All That Glitters Isn’t Gold, It’s $TRUMP – Letter #17

“I am constant as the northern star.” – Julius Caesar (Shakespeare)

For those who know their history, Julius Caesar had a knack for turning even the mundane into something spectacularly self-serving. During a public triumph celebrating his military victories, he decided that ordinary applause simply wasn’t enough. He paid men to line the parade route and chant his praises until the crowd caught on and joined in. It worked so well that people genuinely started to believe Caesar was touched by the gods.

And, in a way, they weren’t wrong. Julius Caesar became the first Roman to be officially deified. After his assassination in 44 BCE, a comet appeared in the sky during public games held in his honor. This “Comet of Caesar” was proclaimed as a sign of his soul ascending to the heavens. The Senate, ever attuned to public sentiment and political opportunity, made it official by declaring him Divus Iulius (the Divine Julius). His adopted heir, Octavian (later Augustus), seized on this cosmic PR stunt to strengthen his own claim to power, branding himself Divi Filius—the “Son of the Divine.”

This moment launched a Roman tradition of elevating emperors to divine status after their deaths. It wasn’t automatic; it required Senate approval, making deification a mix of religious ceremony and political theater.

And today? Well, if Trump were to cheat death, get shot in the year, and somehow be immortalised on a Trump meme coin, we’d essentially be witnessing the modern version of this absurd ritual.

But of course, that could never happen…

The Deification of Trumpius Caesar

It started, fittingly, on a Friday night. As America unwound for the weekend, Donald Trump took to Truth Social with an announcement that could only come from him:

Within two hours, the memecoin reached a staggering $8 billion in market value. By midnight, the Trump Meme Coin ($TRUMP) had skyrocketed even further. Devoted supporters rushed to buy, while skeptics couldn’t resist the sheer absurdity of owning a piece of internet history. Late-night Twitter exploded with memes, hashtags, and commentary as the coin became an instant cultural phenomenon.

By Saturday morning, financial analysts were baffled. Crypto enthusiasts were frenzied, and Trump supporters were giddy. Equal parts satire, speculation, and loyalty, it dominated weekend conversations across social media and beyond.

Patron Saint of the Meme

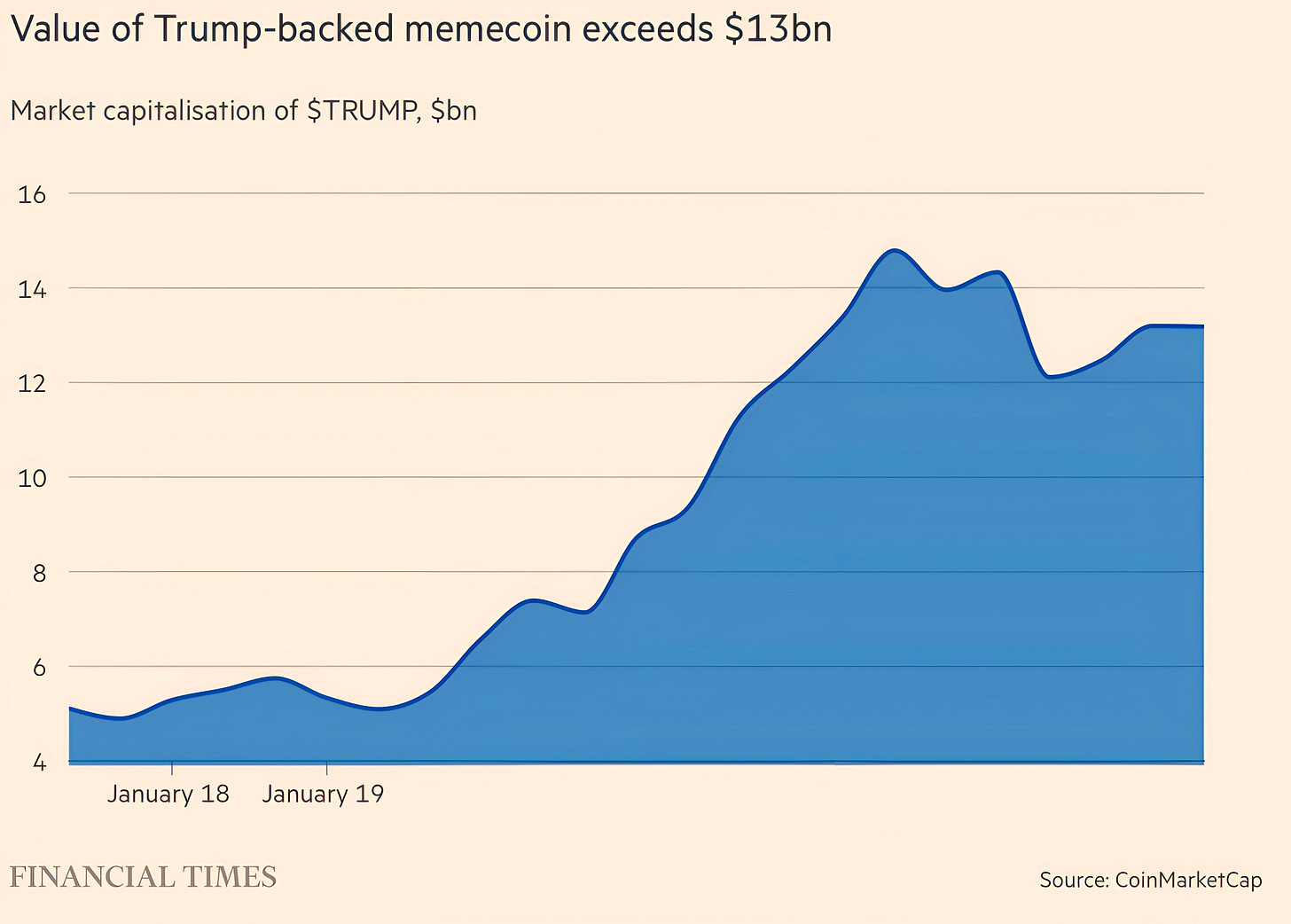

As of Sunday, at the time of writing, the TRUMP meme coin ($TRUMP) is trading at $60, with a free-float market capitalisation of approximately $13 billion.

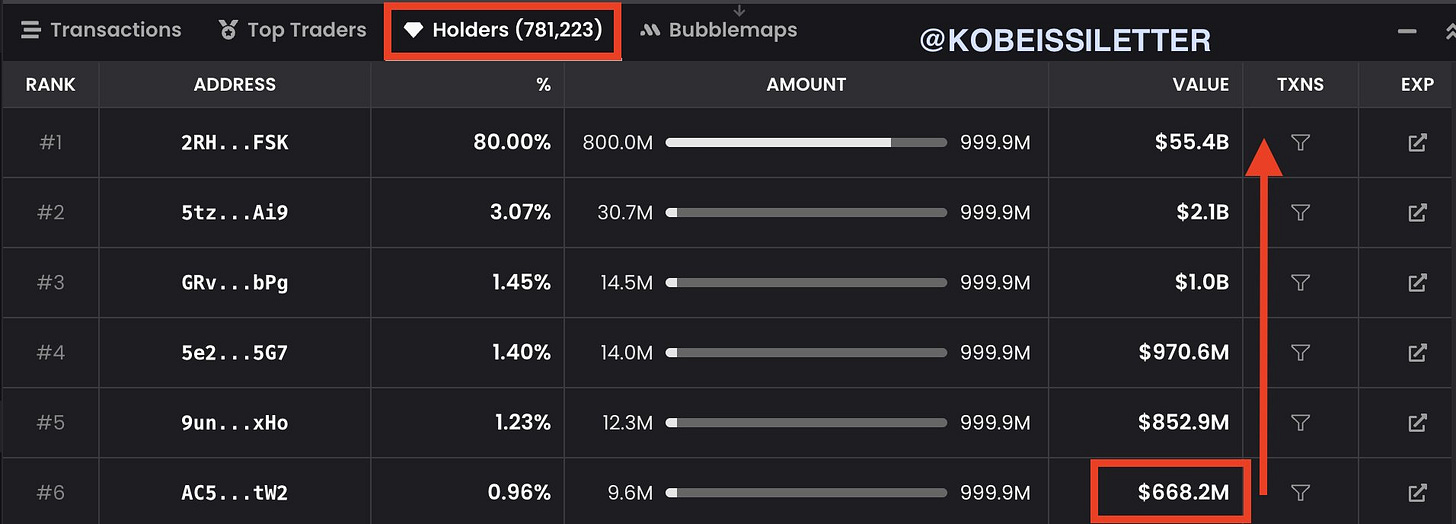

Stories of early investors striking it rich have added fuel to the frenzy. One investor reportedly turned $800 into $300,000, while another turned $1 million into $90 million. Currently, there are 6 wallets holding balances worth over $600 million. Trump himself is believed to own 800 million tokens out of the total maximum supply of 1 billion, leaving 200 million tokens currently in circulation.

[Morning Edit – 20 January 2025]

Just when I thought I’d seen it all… late Sunday night, the Trump family announced the release of a second memecoin: $MELANIA. Why stop at one when you can have two?

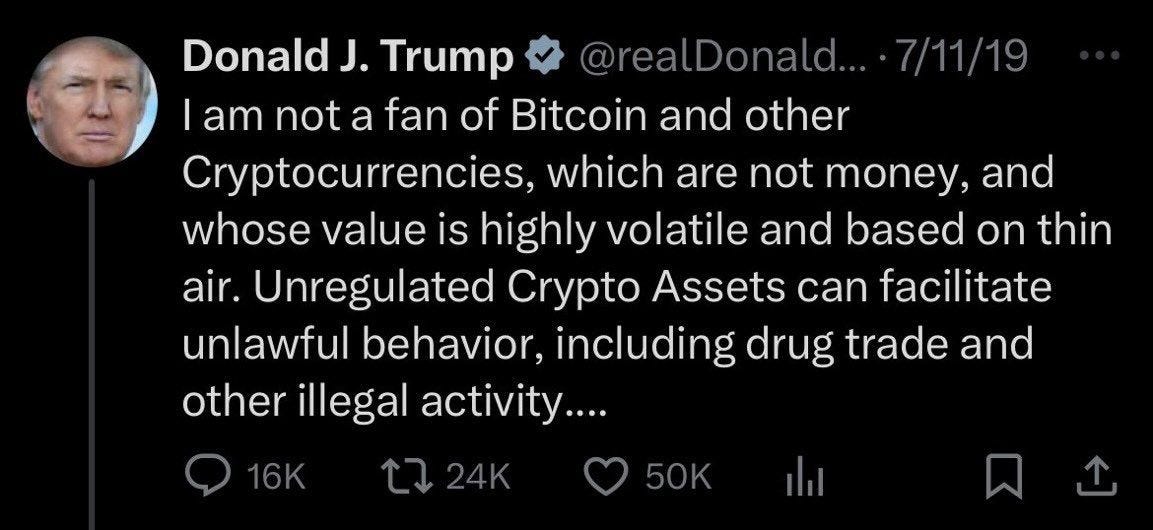

How times have changed…

Strategic Bitcoin Reserve

And now, betting markets are also buzzing with speculation that Trump will establish a strategic bitcoin reserve, with odds reaching as high as 60% on Kalshi.

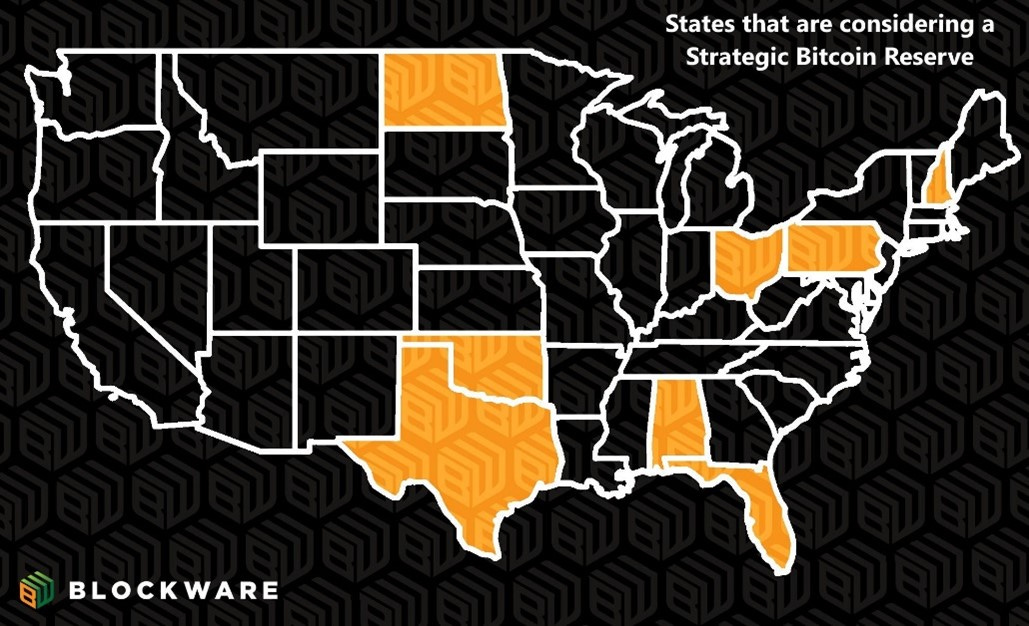

We can see in this chart that 8 out of 50 U.S. states already are exploring the possibility of establishing their own strategic bitcoin reserve.

With the resignation of SEC Chair Gary Gensler, effective today, coinciding with President Trump’s inauguration, the regulatory landscape for crypto is poised for significant change.

Inauguration Day

Today marks the formal inauguration of President Donald Trump, kicking off what promises to be a transformative chapter in U.S. policy. In addition to a pivot toward crypto-friendly initiatives, reports suggest that Trump’s team has prepared over 100 executive orders addressing key issues such as U.S.-Mexico border policy, energy development, federal workforce regulations, and vaccine mandates. These orders are set to roll back significant portions of President Biden’s policies, signaling a sharp ideological shift.

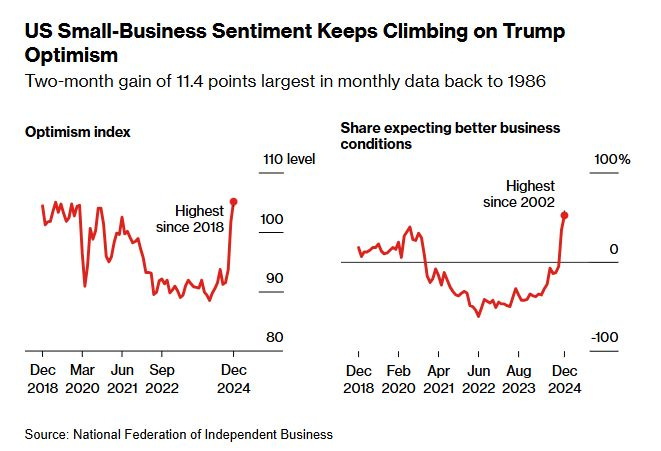

Markets have already priced in optimism about Trump’s pro-business stance, with consumer and business sentiment buoyed since his campaign gained traction. Yet, Trump’s ambitious agenda has raised critical questions about the economy’s capacity to absorb accelerated growth. The U.S. economy, currently operating near full capacity, could see growth rise to 4% or more if Trump’s policies take full effect. However, this poses risks of overheating, and imbalances might trigger a strong response from the Fed.

Two key narratives will dominate the macroeconomic landscape this week. First, the financial markets will scrutinise the details of Trump’s executive orders to assess their feasibility and potential economic impact. Second, the ongoing earnings season will provide a lens into how corporations are positioned to navigate this new era of economic policy. Notably, with inflation holding steady around 3% and the U.S. 10-year yield yet to breach the critical 5% threshold, markets appear stable for now.

Tariffs

Early reports suggest a plan aimed at shielding domestic industries and bolstering America’s leverage in global negotiations. While details are unknown, Alfonso Peccatiello, writing on his Substack The Macro Compass (link), outlines a likely strategy: targeting countries and sectors most vulnerable to economic pressure, including China, Canada, and Europe.

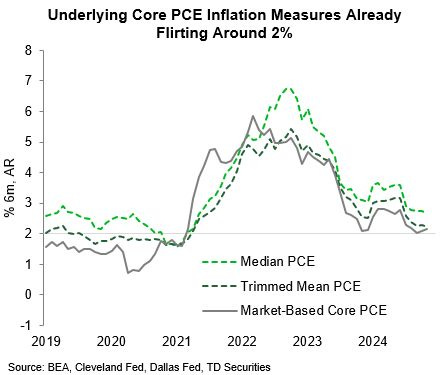

Economic conditions appear to support such an approach. Core PCE inflation is holding steady at a manageable 2.3%, and consumer spending remains strong, giving Trump some latitude to act aggressively without sparking immediate fears of overheating the economy. However, heavy tariffs on China could directly impact U.S. consumers if the yuan is not allowed to devalue, leading to higher import prices. This risk might prompt Trump to initially focus on Canada and Europe, where currencies are less likely to be defended and political instability offers additional leverage.

The tariff strategy could involve a 10% global flat tariff. Such a move would likely disrupt markets, sparking bond rallies, weakening the euro and Canadian dollar, and triggering initial volatility in equities. The true impact, however, will hinge on the scale and timing of Trump’s announcements.

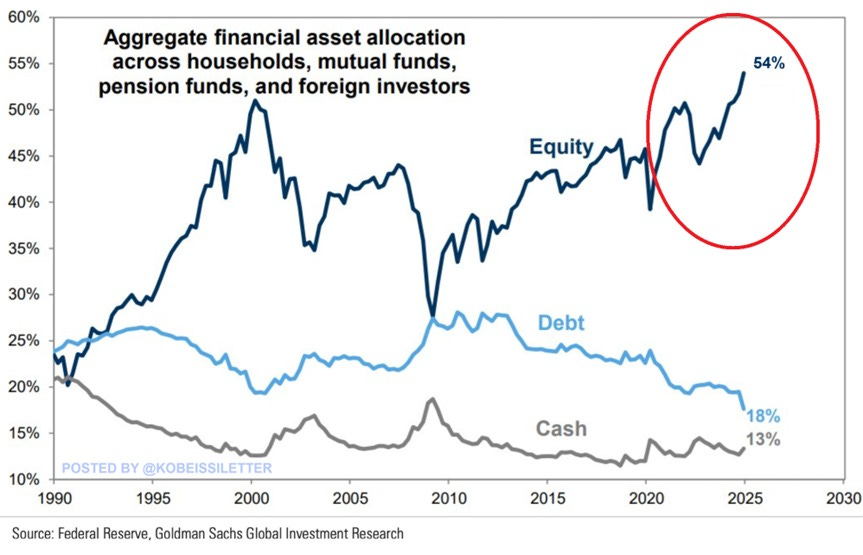

While Trump’s tariff strategy and regulatory shifts raise some uncertainty, investor sentiment remains buoyant, as reflected in the surging allocations to U.S. equities.

Exuberance

At the same time, allocations to U.S. equities across various investor groups—including households, mutual funds, and pension funds—have climbed to an unprecedented 54%. This figure is twice the level observed at the 2009 market bottom and even exceeds the previous high of 51% set during the peak of the Dot-Com Bubble in 2000. Meanwhile, allocations to cash and bonds—traditional safeguards against market volatility—have dropped to just 18% and 9%, respectively.

And it’s hard to see why investors wouldn’t be exuberant. Just consider this past week:

Blue Origin Milestone: Jeff Bezos’ space company celebrated another successful launch.

TSMC: TSMC reported a 57% rise in net income, driven by AI demand, and projected Q1 revenue of $25-25.8 billion with 2025 capital expenditures of $38-42 billion.

Goldman Sachs: CEO David Solomon says AI can draft 95% of an S1 IPO prospectus “in minutes” (a job that used to require a 6-person team multiple weeks).

CES 2025: Jensen Huang highlighted advancements in AI, robotics, and autonomous vehicles, unveiling the GeForce RTX 50 series GPUs built on the Blackwell architecture.

Nvidia’s Project DIGITS: Nvidia also announced Project DIGITS, a personal AI supercomputer starting at $3,000, to empower researchers and data scientists.

Macro

This week’s final S&P 500 heatmap shows the market firing on all cylinders:

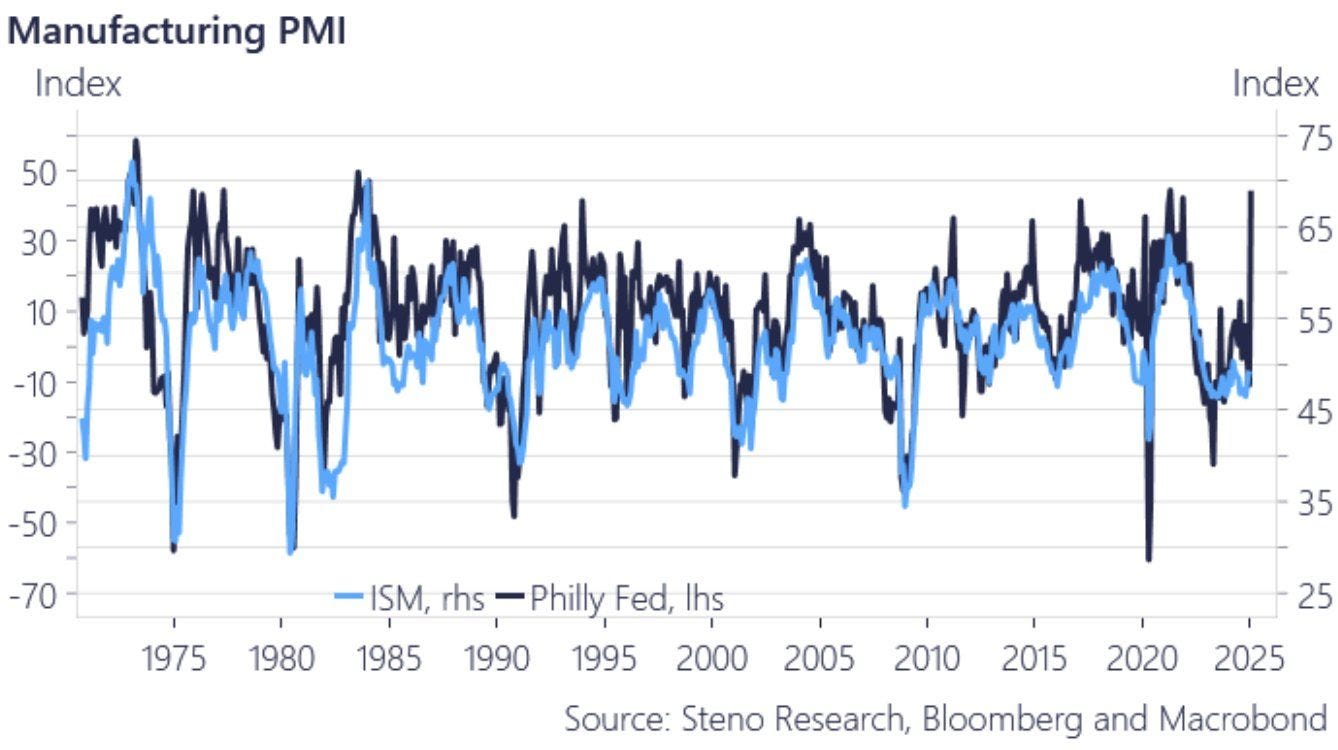

Whilst the business cycle is re-accelerating again…

And growth data is surprising to the upside, with the Atlanta Fed GDPNow model projecting 3% growth for Q4. Corporate earnings are poised for another bumper quarter, fueling optimism across sectors.

And, last week, Fed Governor Christopher Waller delivered unexpectedly dovish remarks, surprising given his hawkish reputation. Markets are now pricing in a 55% chance of a second rate cut this year, up from 30% just a week ago. After 44 months of inflation above target, it seems the Fed may simply be willing to tolerate inflation in the 2-4% range. As Mohamed El-Erian aptly put it, ”the Fed doesn’t want to be blamed.”

Therefore, if growth surprises to the upside and dovish Fed signals persist, the stage is set for continued market momentum—if external shocks remain at bay.

Final Thought

From the echoes of Roman deification to modern market exuberance, this week has underscored one truth: sentiment drives narratives, and narratives drive markets. As we navigate 2025, the policies we set this week will shape this year’s outcomes.

Feel the pulse, stay ahead.

Rahul Bhushan.