Beyond the Noise: Tesla, China, and the Power of Patience – Letter #5

“Patience is bitter, but its fruit is sweet.” – Jean-Jacques Rousseau

This week, we focus on the market’s impatience, which has recently been on full display. Instead of appreciating long-term trends (many, now set in motion) and the transformative progress humanity is making across sectors, the focus is on immediate, short-term deliverables. As we explore key developments from Tesla, China and the macro environment, the Fed and Google, it becomes clear that this obsession with instant gratification often blinds investors to the incredible innovation and opportunities being built for the future. Hell, SpaceX’s metal chopsticks just snatched a rocket out of mid-air!

Tesla: Man Meets Machine

Last week, Elon Musk’s presentation of Tesla’s long-awaited Robocab may not have made the immediate splash investors were looking for, but the bigger picture reveals a company that continues to push the boundaries of what is humanly possible. The Robocab, while lacking short-term specifics, is yet another leap forward in Tesla’s vision of a fully autonomous, electric future.

Tesla is no stranger to skepticism over its timelines. As Musk himself said on X over the weekend, “For my time-based predictions, I generally aim for the 50% percentile date, which means that half my predictions will be late and half will be early. The press never mentions the predictions that were early, so it seems like I’m always late. However, it is very rare that a prediction I make does not come true over time.”

This is a company that led the world to electric mobility, stands far ahead of every automaker combined in the realm of full self-driving and now is unveiling a fully electric, autonomous humanoid robot. The market’s reaction misses the monumental long-term vision being built here. Yes, timelines may shift, but when pushing the limits of innovation, this should be expected. No one questioned Neil Armstrong for not landing on the moon five years earlier.

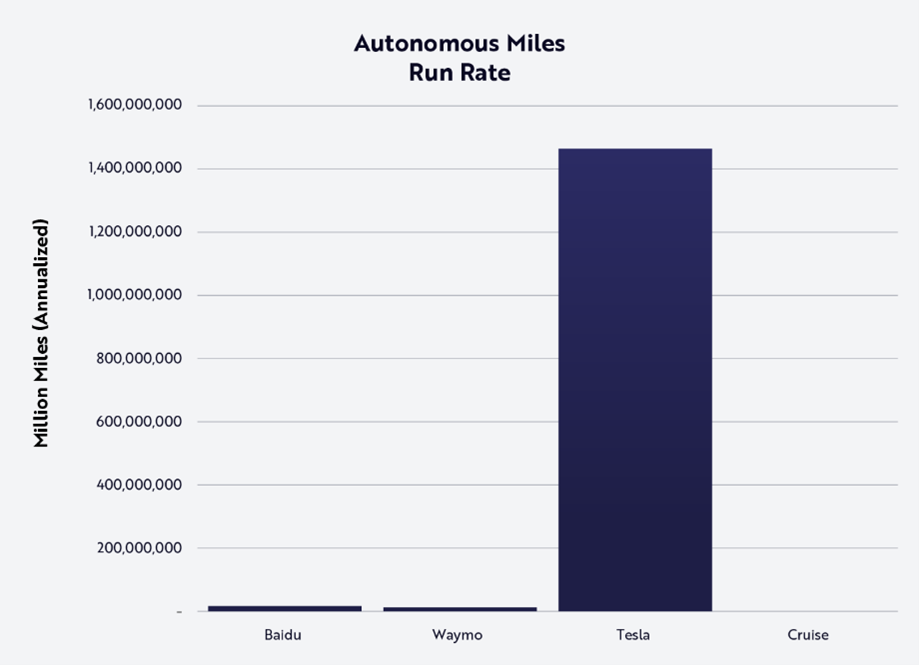

It’s important to zoom out and recognise that Tesla remains a Western crown jewel. While robotaxis like Waymo are already on the streets with ~700 vehicles, Tesla’s full self-driving advantage is staggering, with 1.3 billion cumulative FSD miles—110 times more than its nearest competitor, Waymo, which has racked up only ~4.9 million cumulative FSD miles in 2023. What’s being built at Tesla is not just a disruption in automobiles, but a transformational change in how society will interact with transportation and technology.

The Market vs. China’s Mahjong Strategy

China’s latest fiscal package, announced on Saturday, may not be the $1 trillion stimulus the market had hoped for, but it’s still the largest aid program the country has rolled out since the global financial crisis. The $325 billion in fiscal support available over the next 3 months is designed to support banks, stabilise the property market and boost consumer spending.

While the market was disappointed with the scale of the package, it’s important to recognise that China’s primary objectives have already been met: currency stabilisation and support for the domestic equity market.

Unlike Western economies where markets often dictate policy, China’s Politburo isn’t primarily concerned with foreign investor sentiment. Domestic retail participation in Chinese equities is a mere 10%, compared to 70% in the US. And China’s leadership is focused on achieving its internal goals. The key to understanding China lies in recognising that the broader policy shift is to support the RMB, regardless of whether this weekend’s fiscal firecracker hit immediate market expectations.

It’s also important to remember that China runs an $80 billion monthly trade surplus, and there’s currently $1.2 trillion sitting in Hong Kong bank deposits, mostly held by exporters. It’s unnatural for a country with such a large surplus not to see its currency strengthen, but the RMB weakness reflects a broader lack of confidence stemming from economic policy missteps. What’s important to remember, however, is that China’s policy stance has definitively shifted—they’ve committed to being supportive, and it will take more to derail them. Hence, more fiscal stimulus cannot be ruled out for now, but as with all things China, patience is key.

Macro Environment: Seeing Beyond Gold and Utilities

Friday marked the 45th all-time high for the S&P 500 this year. The index is now trading above 5,800 for the first time in history, up 23% year-to-date, with nearly $14 trillion of market cap added since October 2023.

Markets truly terrible last week 😊

Despite these strong gains, investors have raised concerns as gold and utilities continue to rally—assets typically associated with defensive markets. But there may be more nuanced reasons behind both these trends.

One contributing factor to the rally in utilities is the growing demand from AI data centres. We have about $1 trillion dollars’ worth of data centres that need to be modernised with Nvidia GPUs for accelerated computing, and so far, we’ve only seen about $150 billion of this investment. This doesn’t even account for the wave of new data centres expected to be built. Utilities providing stable, predictable energy to these data centres are positioned to be major beneficiaries of this increasing demand for energy.

Meanwhile, gold’s rally can be partially attributed to Chinese demand—China remains the 800-pound gorilla in the gold market. Following the freezing of Putin’s $600 billion offshore war chest in the wake of Russia’s invasion of Ukraine, China has been gradually shifting portions of its $3 trillion in dollar reserves into gold.

This suggests that underlying market conditions may be healthier than they appear, with growth still underpinned by strong fundamentals rather than the traditional flight to safety.

Fed Up Or Full Steam Ahead?

The market’s fixation on September’s CPI miss—2.4% vs. the expected 2.3%—seems to have overshadowed the broader trend of disinflation seen last Thursday. While inflation slowed from 2.5% to 2.4% month-over-month, marking the sixth consecutive month of decline, the focus remained on this slight miss. A similar pattern emerged with initial jobless claims, which came in higher than expected at 258,000 (vs. the forecasted 231,000). However, much of this spike was attributed to temporary hurricane-related disruptions.

Despite these headline-grabbing details, in our view, the broader path for the Fed remains clear. Powell and his team are steadily moving towards a rate target of 3-3.5%.

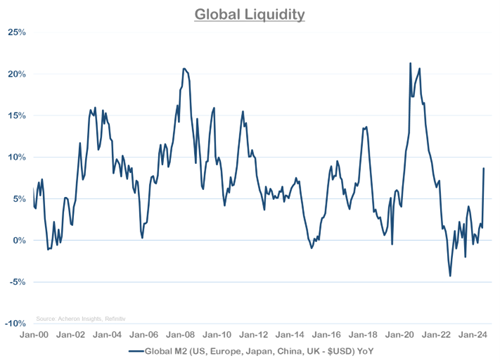

Accordingly, the overall trend is one of stabilisation. The global economy is expected to benefit from liquidity injections from both the PBoC and the Fed. In China, the fiscal support measures announced on Saturday signal more aid, with increased consumer spending and manufacturing expected to follow. In the US, the Fed has already started cutting rates and plans to increase liquidity through bond issuance and credit lines in Q4.

Therefore, the outlook remains positive. The broader trend points towards continued economic support and stable financial conditions.

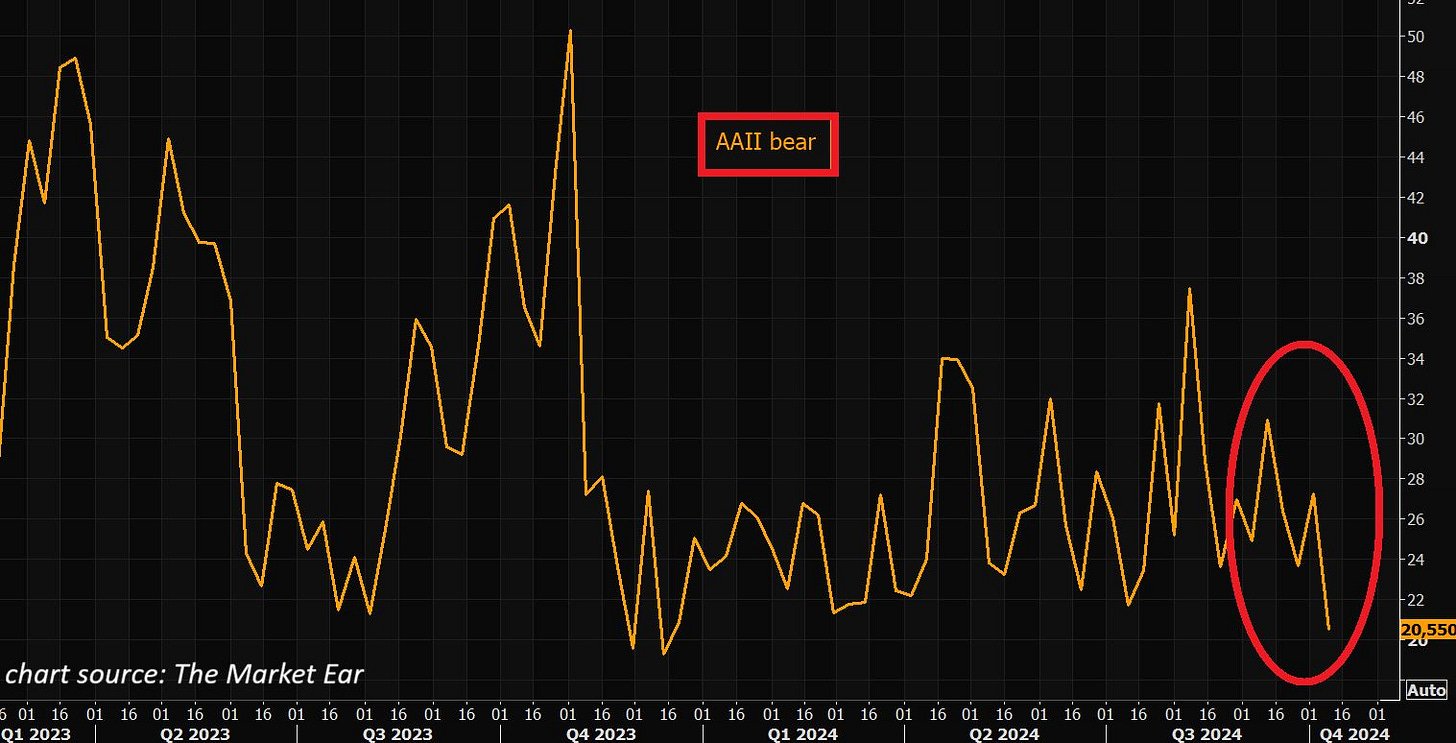

We’re also beginning to see the bears throw in the towel. According to the AAII Investor Sentiment Survey, which has tracked individual investors’ 6-month outlook for the U.S. stock market since 1987, bearish sentiment has now fallen to its lowest level since Q4 2023.

Maybe things aren’t so dire, after all?

Google’s Nobel Victory Lap: Proof That Patience Pays

Last week, three researchers affiliated with Google were awarded Nobel Prizes for their breakthroughs in AI and protein decoding. Demis Hassabis and John Jumper from DeepMind were recognised for their groundbreaking work in protein folding, which is revolutionising drug and vaccine development. Geoffrey Hinton, a pioneer in neural networks, was also honored for his foundational contributions to AI.

Let’s be clear: these achievements were the result of years of sustained investment and, more importantly, Google’s “patient capital,” which enabled long-term research. As Hassabis mentioned in his acceptance speech, Google’s long-term vision and financial support empowered his team to push the boundaries of what’s possible.

It would seem patient capital is alive and well in certain parts of the market after all.

“Our favorite holding period is forever.” – Warren Buffett

Feel the pulse, stay ahead.

Rahul Bhushan.