Probability Playbook: Staying Ahead in Uncertain Markets – Letter #4

“All models are wrong, but some are useful.” – George E. P. Box

The world is rarely what it seems and the only thing certain about the future is that it is unknown and unknowable. While we can’t predict exactly what lies ahead, we still need to make decisions based on what seems most probable versus what is less likely. In this newsletter, we explore some of these “most likely” scenarios, assigning probabilities and staying open to different possibilities.

Natural Gas, Not Just Nuclear, Is Likely to Power AI

While much of the focus has been on AI’s energy needs potentially reviving nuclear power—highlighted by Microsoft’s recent partnership with Constellation Energy to reopen Three Mile Island, Amazon’s collaboration with Talen Energy on nuclear energy and Meta’s deal with Sage Geosystems to supply its data centres with geothermal energy—fewer are paying attention to the natural gas developments.

The world is currently experiencing an oversupply of natural gas. Last week, Oracle announced a $6.5 billion cloud services centre in Malaysia, the fifth-largest LNG exporter, to support AI infrastructure, including Nvidia chips. Earlier this year, Quantiphi partnered with Qatar Free Zones Authority to establish a global AI technology hub, supported by Google Cloud. Even Saudi Arabia, with vast natural gas reserves, saw Amazon Web Services announce $5.3 billion for data centres by 2026. In the US, energy executives see immense growth potential in AI data centres, with some stating that their power demand could be more promising than LNG exports.

Will natural gas be the bridging fuel that carries the AI boom along until a full nuclear renaissance can be realised? All the signs are there. At an exponential rate, the molecule might flip from one that couldn’t be given away to the hottest commodity on the board.

AI May Underwhelm Short-Term, But Is Likely to Overwhelm (in a Good Way) Long-Term

According to a survey conducted by the Federal Reserve Bank of St. Louis, which is the first nationally representative US survey of generative AI adoption (link), generative AI is being adopted at an astonishing rate. By August 2024, nearly 40% of Americans aged 18-64 reported using generative AI and almost one in three used it either daily or weekly. Interestingly, usage at home (32.6%) was more prevalent than at work (28.1%), but daily use was higher at work (10.6%).

This adoption rate surpasses that of earlier technologies such as PCs and the internet, which only reached 20% after several years of their introduction. Industries like financial services, insurance and real estate have led adoption with more than half of their workers using AI tools, while unexpected sectors like agriculture and mining also show notable uptake. The most common uses include writing and administrative tasks, highlighting AI’s broad utility. However, whether the rapid adoption will lead to sustained productivity gains or overinvestment remains uncertain.

The Fed’s Normalised Rate Is Likely Higher Than Expected

Financial markets have been fluctuating between expectations of significant and moderate rate cuts, mainly due to inflation rising too high after COVID-19. Central banks responded with aggressive rate hikes, raising fears of a recession and credit crisis. However, US growth has remained steady while inflation dropped, as the supply side of the economy has largely recovered. Despite this, stable nominal rates and falling inflation have caused real rates to rise, which could eventually slow growth. The Fed is expected to lower rates by mid-2025, potentially to around 3%, but the exact neutral rate remains uncertain.

Recent data shows the US economy growing at 3%, above the estimated potential growth of 2%, which suggests growth needs to slow to prevent inflation from resurging. Adding to the uncertainty, rising geopolitical tensions could trigger sudden spikes in oil prices, complicating the path forward. As a result, the Fed and markets face a dilemma—whether growth will finally slow or if the neutral rate is higher than expected, limiting how much rates can be reduced.

The Fed Is Likely To Remain Data-Dependent, Provided It Doesn’t Hurt Their Credibility

The Bull Case: Recent economic data has painted a resilient picture for the US economy. September’s jobs report significantly exceeded expectations, adding 254,000 jobs compared to the 150,000 predicted, while unemployment dropped to 4.1%. Strong employment gains in sectors like hospitality and construction, coupled with resilient retail sales and a GDP growth expectation of 3%, suggest the economy remains robust. With inflation down to 2.5%, additional stimulus likely and rate cuts already starting, a path toward higher stock prices seems clear for late 2024. Moreover, high-yield credit spreads are still near all-time lows, indicating stable financial conditions. The Fed’s recent rate cuts demonstrate a clear commitment to supporting growth. While rates may not be dropping swiftly, the trajectory is evident, which reduces the risk of a significant credit event or an imminent recession.

The Bear Case: Despite the encouraging data, signs of underlying weaknesses are there in cyclical sectors from housing to commercial real estate to multifamily homes to autos. The three-month moving average of ADP growth has eased to the lowest since 2020, while job hiring rates have dropped to levels not seen since 2013. September’s job cuts were 54% higher than a year ago and the manufacturing sector is showing contraction with fewer companies reporting rising employment. Additionally, the oil price spike driven by geopolitical tensions could add inflationary pressures, complicating the Fed’s path. Even with the Fed cutting rates, Jerome Powell has stressed that they will proceed cautiously and expectations for aggressive cuts are diminishing. A 50 bps cut now could send a signal of unseen risks, potentially damaging the Fed’s credibility. Consequently, the Fed faces a significant challenge: balancing support for growth while preventing an inflation resurgence, managing expectations around the true neutral interest rate, and navigating the economic "air pocket" without causing strain on the labor market.

Judging What We Believe Is Most Likely

Recent data highlights the resilience of the US economy, which continues to perform strongly despite mixed signals.

September’s jobs report showed better-than-expected gains of 254,000, with unemployment falling to 4.1%.

GDP growth remains solid at 3%:

High-yield credit spreads are stable, near historical lows:

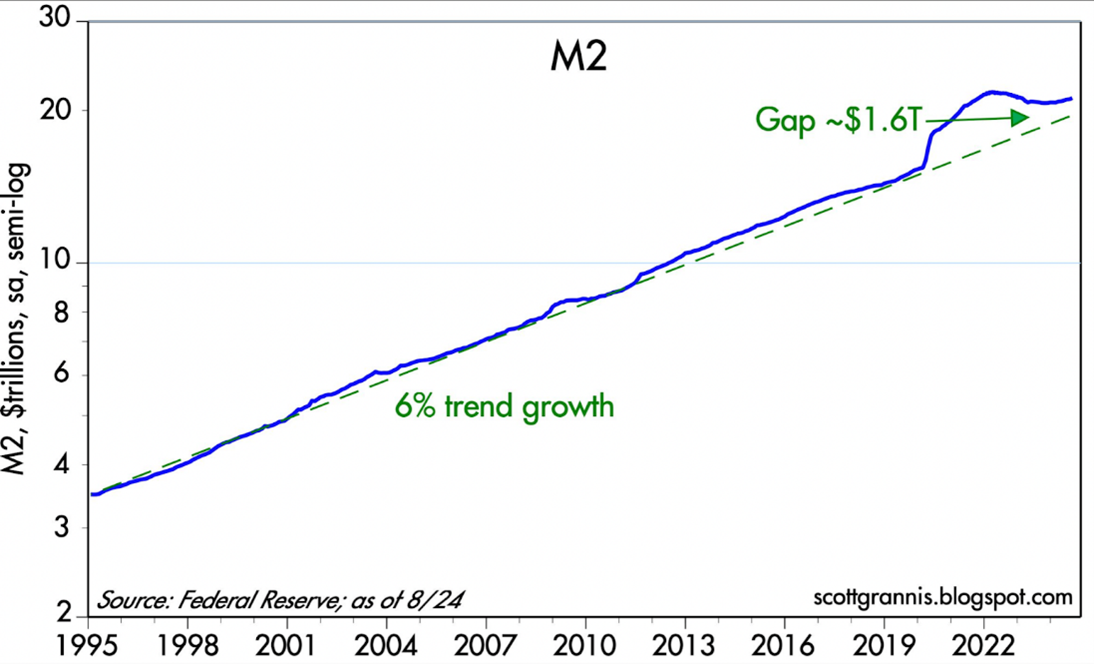

The US money supply is nearly back to trend:

This points to a healthy economic environment, with rate cuts and potential stimulus suggesting a path to higher stock prices into late 2024.

The Risk of Being Under-Allocated

With markets showing resilience and the Fed gradually easing its policy stance, we believe the risk of being under-allocated to equities could be significant. The current economic environment, characterised by normalizing real growth, declining inflation, and a more predictable Fed policy, suggests that increasing exposure to equities is a prudent approach. Missing out on potential growth, especially with the upcoming US election, could prove detrimental as markets often respond positively to policy clarity and improving economic fundamentals.

Positioning for this phase of the cycle means focusing on sectors poised to benefit from these conditions, and staying invested is key to capturing the broader opportunities now emerging.

Feel the pulse, stay ahead.

Rahul Bhushan.