Jedi Powell Strikes Again: Balancing Rates, and the Force – Letter #1

“The only constant is change” – Heraclitus

Last week, J. Pow brought balance to the Force and calmed the galaxy like a cane-wielding Jedi.

By announcing that “the time has come for policy to adjust”, he cemented his promise of a September rate cut. How deep remains to be seen – but – we can see that markets are currently pricing in a modest 25 bps. Nevertheless, we shouldn’t yet rule out a half-cut reduction.

Perhaps the most important takeaway remains that Powell – in his comments – referenced the labour market more than he referenced inflation. Until now, the Fed has largely pointed to elevated PCE readings as evidence that more work needs to be done, while stating that the labour market is in good shape. However, last week, Powell appeared to indicate that the labour market might be of greater concern.

The unemployment rate has risen by 0.9% from its low, and last week’s massive downward BLS data revision raises questions about where the labour market is, currently. If Powell sees further downside risk, the rate cutting cycle could be more prolonged than we anticipate. It’s important to remember the Fed hasn’t had to deal with a sustained rise in unemployment since the GFC.

Moreover, if the slowdown in the labour market is here to stay, inflation will invariably take care of itself via a drawdown in demand.

Q2 GDP and Weekly Jobless Claims

Last week finished on a relatively quiet note to an otherwise somewhat turbulent August.

3 Key Highlights

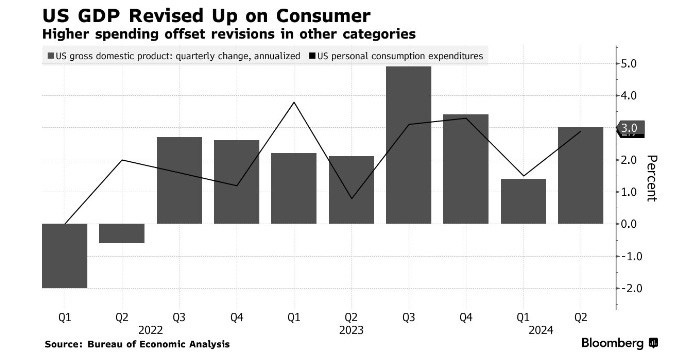

The second estimate of US Q2 GDP growth came in stronger than the initial one (revised upward to 3.0% from the initial read of 2.8% and 1.4% in Q1), due to stronger consumption.

This didn’t feel recessionary.

The GDP data point combined with lower-than-expected weekly jobless claims (231,000 new unemployment claims filed vs 232,000 expected and 233,000 the previous week).

So, less one thousand à No big deal…

Perhaps most importantly, a reassuring PCE inflation measure for July of 2.5% (below expectations of 2.6%) provided markets further reassurance of a soft(er) landing.

The PCE remains the Fed’s favourite gauge.

Our take - A 3% GDP growth rate could prevent the Fed from cutting too much, too fast. Crucially, stronger growth coupled with slower inflation should be cause for greater optimism. This balanced economic outlook could pave the way for more sustainable, long-term market gains.

Nvidia Earnings

The WSJ reported that NYC bars were unusually packed on Wednesday for Nvidia Q2 earnings watch parties (!!).

Despite smashing revenue and earnings by 122% and 168%, the company’s stock finished the week down ~10% lower.

This is what happens when sky high valuations meet sky high expectations.

Nvidia’s exceptional performance has been a key driver for the S&P 500's gains. With Nvidia's momentum losing steam, it might signal a shift in investor focus. We believe the next wave of “AI growth” is poised to come from the broader AI landscape, where innovation is just accelerating. Our dedicated research capabilities and long-term investment process position us to identify and capitalise on these emerging breakout names.

US Equity Market

The S&P 500 remained flat last week, despite notable gains in cyclicals and defensive sectors. This highlights a key issue when just a few stocks dominate the major indices—when a heavyweight like Nvidia drops nearly 10%, it drags down the overall market, even as most S&P sectors are posting gains.

The Mag 7 tech giants have underperformed the other 493 stocks in the S&P 500 by 14% since the weaker than expected US inflation report on July 11.

So, we’re seeing a shift in market dynamics similar to mid-July, when lower-than-expected inflation spurred a rate cut frenzy.

Small Caps are now outperforming Large Caps, as they stand to benefit the most from lower rates.

Additionally, value and low-volatility sectors, including Infrastructure, are gaining renewed attention.

Our take - In this environment, relying on benchmarks becomes increasingly risky, especially as top-heavy names lose steam. Instead, it’s becoming a stock selector’s market—and a right-theme selector’s market—where rotating into sectors and themes that are gaining momentum could be key. Our thematic strategies, such as those focused on Genomics and Cybersecurity, offer exposure to innovative small-cap names that are well-positioned to capitalise on this shift. A strategic rotation into targeted themes, rather than sitting in benchmarks and hoping for the best, could now be the more prudent approach.

Final Thoughts

The outlook remains positive, even amidst typically weaker seasonality. Growth indicators are robust, with strong consumer sentiment and an upward GDP revision. Inflation is continuing to fall, and the Fed’s rate cuts are providing further support to the economy.

Earnings are also showing resilience, which adds to the overall optimism. With the second quarter earnings season nearly concluded (with only 7 companies left to report), average earnings growth reached 13% for the quarter, the strongest since Q4 2021.

Feel the pulse, stay ahead.

Rahul Bhushan.