Bulls, Bears, and the Yield Curve: What’s Next? – Letter #2

“In the midst of every crisis, lies great opportunity” – Albert Einstein

I would like to begin this week's newsletter with a reminder to the great investors who read it: the economy moves in cycles, alternating between periods of expansion and contraction (see chart below). These cycles affect crucial factors like employment, consumer confidence, and overall market conditions.

Economic Cycles: The economic cycle typically follows four phases: full recession, early recovery (early expansion), full recovery (maturing expansion), and early recession (late expansion). Historically, the market anticipates these shifts.

Bear markets often begin as a recession starts. Meanwhile, bull markets frequently take root in the depths of a recession, signalling brighter days ahead. The market always anticipates the economy. Recognising this forward-looking nature of the market is key.

Rolling Recession: The Current State

We have maintained that we’ve been in a rolling recession for the past 2+ years. What started in housing, moved to autos, capital spending, and most recently consumer spending has started to slow as companies lose pricing power, with consumers resisting higher prices. This sector-by-sector recession has allowed certain parts of the economy to weather the storm better than others.

We anticipate if we see a broader economic downturn, that it is likely to be shorter and less severe than many would anticipate. Here is why:

CPI continues to fall and M2 growth has moved into positive territory (see chart below).

Source: ARK Invest (via Macrobond)

Oil prices are dropping against a sluggish China and their rapid EV revolution, which should contribute to disinflation. Lower oil prices reduce inflationary pressures and act as a tax break for consumers and businesses, preventing the recession from becoming severe.

Brent crude prices recently fell below $72 per barrel (see chart below as of 09 September 2024). OPEC+ delayed production increases to stabilize the market, but softening demand and over-pumping by member countries like Iraq and Kazakhstan have led to lower oil prices.

Source: Trading Economics

OPEC+ is losing relevance as its global market share sank to an all-time low in April due to stiff rival competition in the US, Canada, Brazil, and Guyana. It could be just a matter of time before OPEC opens the floodgates to regain market share, accelerating disinflation precipitously. US gas prices hit a six-month low at $3.31 per gallon, contributing to easing inflation.

Deflation Pressures, Rate Cuts, and Market Rotation

The debate about deflation and the Fed’s next moves is intensifying, with mounting evidence that monetary policy has been far too restrictive for too long. Long-term bond yields, such as the 10-year Treasury, have dropped from a peak of 5% to just above 3.7%, confirming that current conditions are too tight, especially with inflation pressures easing. The Fed appears out of touch with how tight conditions have become, and the lagging impact of their policies suggests that deflation could arrive sooner than expected. Under these circumstances, long-term Treasury yields could drop sharply, possibly into the 2-3% range.

As inflation cools, global growth remains fragile, with economic struggles in Europe and China adding further justification for lower yields. Declining oil prices, which feed directly into inflation, have reinforced the deflationary environment, pushing bond yields lower.

Amid these conditions, we are seeing a significant shift in stock market returns. The "NVIDIA effect" — where sky-high expectations for the tech giant have moderated — has caused a sharp 17% drop in its stock price, more than 20% below its all-time high. Similarly, Broadcom saw a 10% decline after missing Q4 revenue expectations, despite strong Q3 results. This moderation in growth rates has spread across broad market benchmarks, allowing for broader market participation. However, the “broadening out” move has currently been confined to other S&P large-cap sectors, while small caps and longer-duration innovation stocks have yet to benefit from this rotation. The market is increasingly leaning on the recession narrative, expecting a 50-bps rate cut from the Fed, which could alter this dynamic.

Key Themes: Signs of Economic Weakness

Yield Curve: The yield curve has dis-inverted, signalling a potential recession. Historically, dis-inversion precedes recessions, and the current yield curve behaviour suggests a deeper rate-cutting cycle by the Fed than most expect.

Source: Brett Donnelly

Long Bond Yields: Long bond yields have already dropped from 5% to around 3.7%. This suggests that inflation is not the primary concern anymore, and deflationary forces may soon dominate. A drop in long-term yields to 2-3% will be met by more aggressive rate cuts. Lower rates would stimulate cyclical sectors of the economy, particularly housing and consumer spending.

New Home Sales: While housing permits, starts, and existing home sales are nearing 2008-09 lows, new home sales rose by 10.6% in August, as lower mortgage rates (now near 6.5%, down from 8%) drove demand, signalling a strong price elasticity of demand function.

Retail Sales and Industrial Production: August retail sales saw a burst, likely due to retailers (e.g. Amazon, Walmart) aggressively pricing to clear excess inventory, even though consumers’ purchasing power has weakened, as shown by slower income growth and a collapsing savings rate (see chart below). This inventory drawdown may also explain the 0.6% drop in industrial production, and the ISM new orders index hitting a low, aligning with a potential recession signal.

Source: ARK Invest (via Macrobond)

Jobs: August’s BLS non-farm payrolls missed expectations (160,000) but increased to a robust 142,000, following the 89,000 number in July. That said, nonfarm payroll gains for June and July were revised down a net 86,000. These downward revisions bring the three-month average employment gain to 116,000. Despite this, the unemployment rate remained steady at 4.2%. Other labour market indicators raise concern:

Challenger job cuts surged in August.

The JOLTS job openings report showed a sharp decline, indicating job openings are disappearing and companies are just not hiring.

The ADP employment report showed a smaller increase than forecasted.

Household employment which showed near 0% YoY growth compared to NFP’s 2% YoY growth (see chart below). Household employment numbers are considered more reliable than NFP.

The overall picture suggests that the labour market is weakening, which could be the catalyst for a broader economic slowdown.

Source: ARK Invest (via Macrobond)

Productivity Gains and The Role of Technology in a Recession

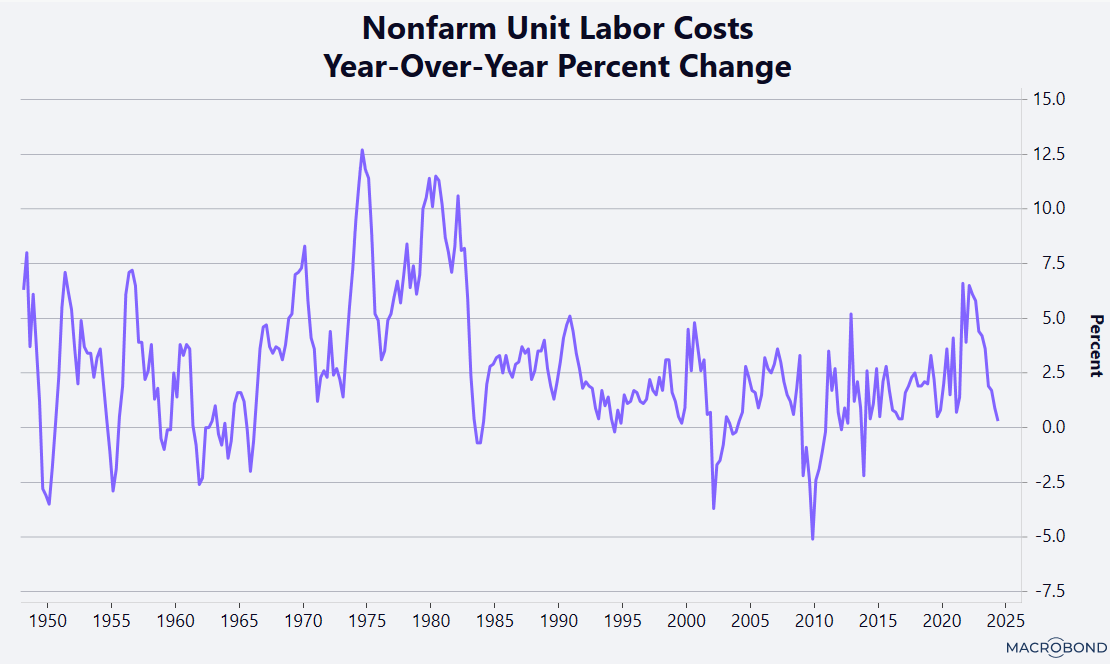

The Federal Reserve has long been concerned that rising wages could drive inflation, but recent data suggests that wage inflation is not a significant risk. To support this conclusion, let’s examine the key data points:

Average hourly earnings have increased, but nonfarm unit labour costs have fallen below zero, indicating that labour cost pressures are easing. This suggests that the recent wage gains have not resulted in inflationary pressures, as productivity gains are offsetting wage increases.

Source: ARK Invest (via Macrobond)

Nonfarm labour productivity has grown by 3% YoY, exceeding expectations. This growth in output per hour reduces the overall cost of labour, further mitigating inflation risks from wage increases.

Source: ARK Invest (via Macrobond)

These data points confirm that wage inflation is being contained. Instead of wage growth driving up prices, companies are responding to weakened pricing power by focusing on productivity gains. As businesses find it harder to raise prices, they are holding back on wage increases and turning to technology investments to enhance productivity.

Historically, recessions have often accelerated technology investments as companies have sought to enhance efficiency and reduce costs. For example, during the 2008 GFC, companies doubled down on automation and digital transformation, which laid the foundation for the rise of cloud computing and global ecommerce. Similarly, the COVID-19 pandemic sparked rapid investments in automation and digital platforms. We would therefore expect companies to accelerate investment once again in technology, including in artificial intelligence, amid new economic uncertainty. These investments will drive productivity growth but also help manage wage inflation by reducing reliance on labour-intensive processes. Therefore, a downturn could unleash a wave of innovation that fuels growth across sectors like tech, healthcare, and industrials, setting the stage for future economic recovery.

Feel the pulse, stay ahead.

Rahul Bhushan.