AI, Stimulus, and Goldilocks: A Perfect Macro Setup – Letter #3

“If you’ve got a sentient humanoid robot that is able to navigate reality and do tasks at request, there is no meaningful limit to the size of the economy.” – Elon Musk

Is AI Delivering Productivity Gains?

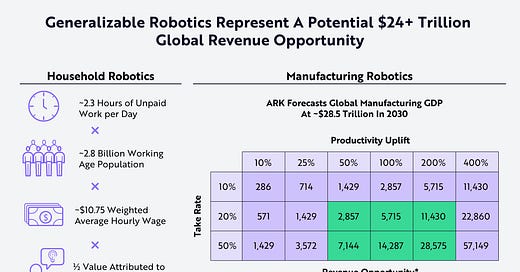

Are we seeing AI’s promised productivity surge in our everyday industries yet? The productivity potential of humanoid robots is immense, and recent developments indicate that AI is making significant strides. During Tesla’s first-quarter earnings call, Elon Musk shared a vision that we believe is driving rapid progress in robotics deployment. During Tesla’s first-quarter earnings call, Elon Musk shared a vision that we believe is driving rapid progress in robotics deployment. With the ability to take on tasks at scale, these robots could transform productivity across both household and industrial sectors. Even before achieving human-level capabilities, large-scale deployment of humanoid robots could generate approximately $24 trillion in revenue, divided almost equally between household and industrial robotics, as illustrated below:

Connected to this, one of the most common questions we’ve received from clients is when we expect to see signs of AI’s impact reflected in productivity statistics.

Here are some of our current observations:

Meta, which has grown its engineering headcount by over 20% annually over the past 5 years, is now indicating plans to keep engineering headcount growth flat or limited to 1-2% in the coming years. This shift suggests an expectation of increased productivity from the existing workforce. Full article: https://www.staffingindustry.com/news/global-daily-news/meta-cfo-says-headcount-could-grow-1-2-next-year-ai-will-be-priority-area

Amazon has reported that developers using Amazon CodeWhisperer tool during its preview phase completed tasks 57% faster and were 27% more likely to complete tasks successfully compared to those who did not use it. CodeWhisperer is an AI-powered tool that provides real-time code suggestions. Full report: https://www.linkedin.com/pulse/aws-codewhisperer-revolutionizing-development-omkar-chaudhari/

This MIT study published on 05 September 2024 sought to assess the impact of Generative AI on software developer productivity using 3 randomised controlled trials at Microsoft, Accenture, and a Fortune 100 electronics manufacturer. Developers provided with Microsoft Copilot (which as it happens is the fastest growing product in Microsoft history) saw a 26% increase in productivity. Notably, less experienced developers had higher adoption rates and greater productivity gains. Full study: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4945566&utm_source=substack&utm_medium=email

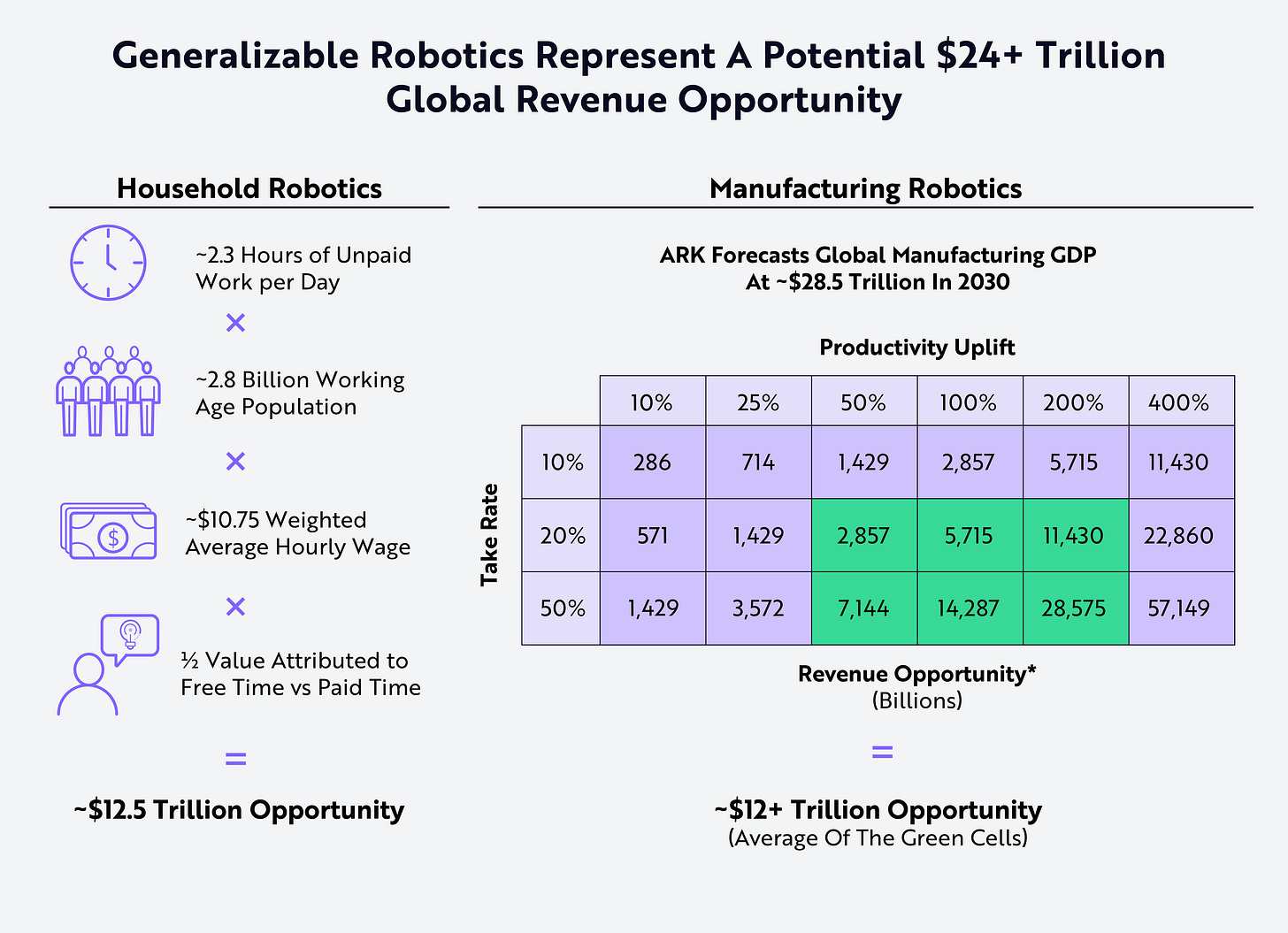

This National Bureau of Economic Research report, also published this month, highlights that Generative AI is being adopted faster than the internet and PCs. Around 39% of Americans aged 18-64 have used Generative AI, with over 24% using it at work weekly. The rapid adoption is remarkable, but the key moment will be when it shows up in productivity statistics. For electricity and PCs, and uptrend began after about 25% household adoption. Could we see the same for generative AI? Full report: https://www.nber.org/papers/w32966?utm_source=substack&utm_medium=email

We’re still early in this process, but we believe we’ll be hearing more of these anecdotes. We see 2023 as the year of testing, with AI trials in call centers, sales teams and engineering teams. 2024 appears to be shaping up as the year of deployment, where we’ll start to see initial productivity gains materialise. By 2025 and beyond, we expect to witness significant transformations.

What’s Going On In Global Macro?

Well, the biggest news last week was China’s decisive economic intervention. Facing risks of a “Japanification” scenario, where high debt levels could lead to a balance sheet recession, Chinese authorities announced a major stimulus package. This included sweeping interest rate cuts to save 50 million households around 150 billion yuan annually, commitments for necessary fiscal spending to meet the 5% growth target, and the issuance of 2 trillion yuan in special sovereign bonds to prevent local councils from defaulting and boost spending. Additionally, an 800-billion-yuan fund was established to support the stock market, partly for share buybacks. These measures led to a significant rally, with the CSI 300 index up 15.7% for the week—its best performance since 2008—while Hong Kong’s Hang Seng index gained 13%, marking its biggest weekly rise since 1998.

Will it be enough? David Tepper of Appaloosa Management appears to think so. Following the stimulus announcements, Tepper stated that he is going “all-in on China” describing it as a “buy everything moment” and expressing confidence in the growth prospects of Chinese companies, particularly given their attractive valuations and the push for stock buybacks. Tepper’s bullish stance suggests optimism that the stimulus could effectively kick-start China’s economic recovery.

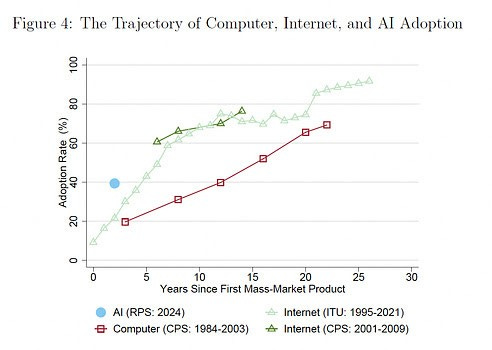

The US Economy Is Growing Faster Than We Thought

We also learned last week that the US economy has been growing faster than we thought. The revised figures showed that the US GDP grew at an annual rate of 3% in the second quarter, up from the previously estimated 2.8%. This upward revision was driven by stronger consumer spending and business investments, which suggests unexpected resilience in the face of tightening monetary conditions. In technology, Micron reassured investors that the global demand for semiconductors remains robust. Together, these data points paint a picture of an economy that is still finding avenues for growth.

Indeed, the US economy is also outgrowing the rest of the developed world. If we look at the revisions to real GDP per capita, from 8.2% to 9.4%, just this 1.2% increase alone is more growth than the UK, Germany, and Canada have seen.

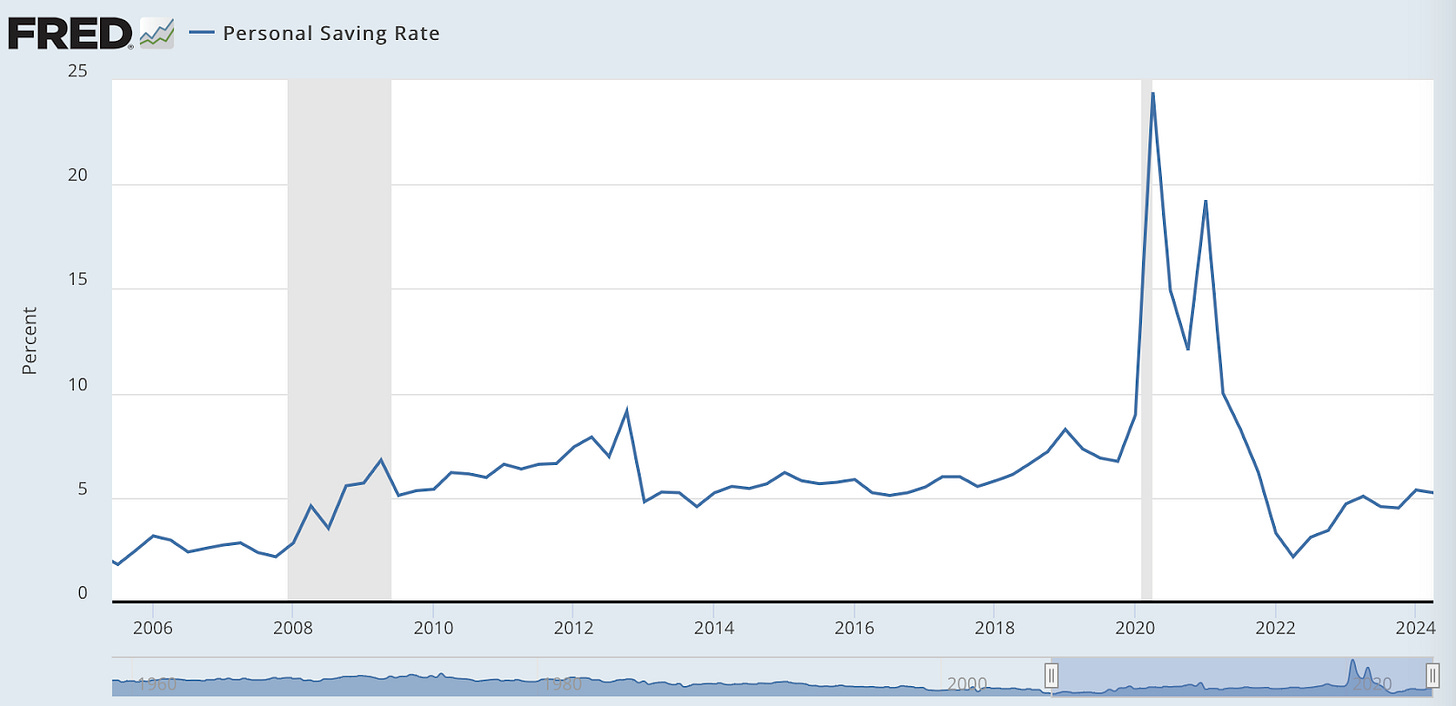

The US personal savings rate was also revised up to 5.2% from 3.3% — higher savings means greater buffer in case of a recession (and generally, lower recession risk).

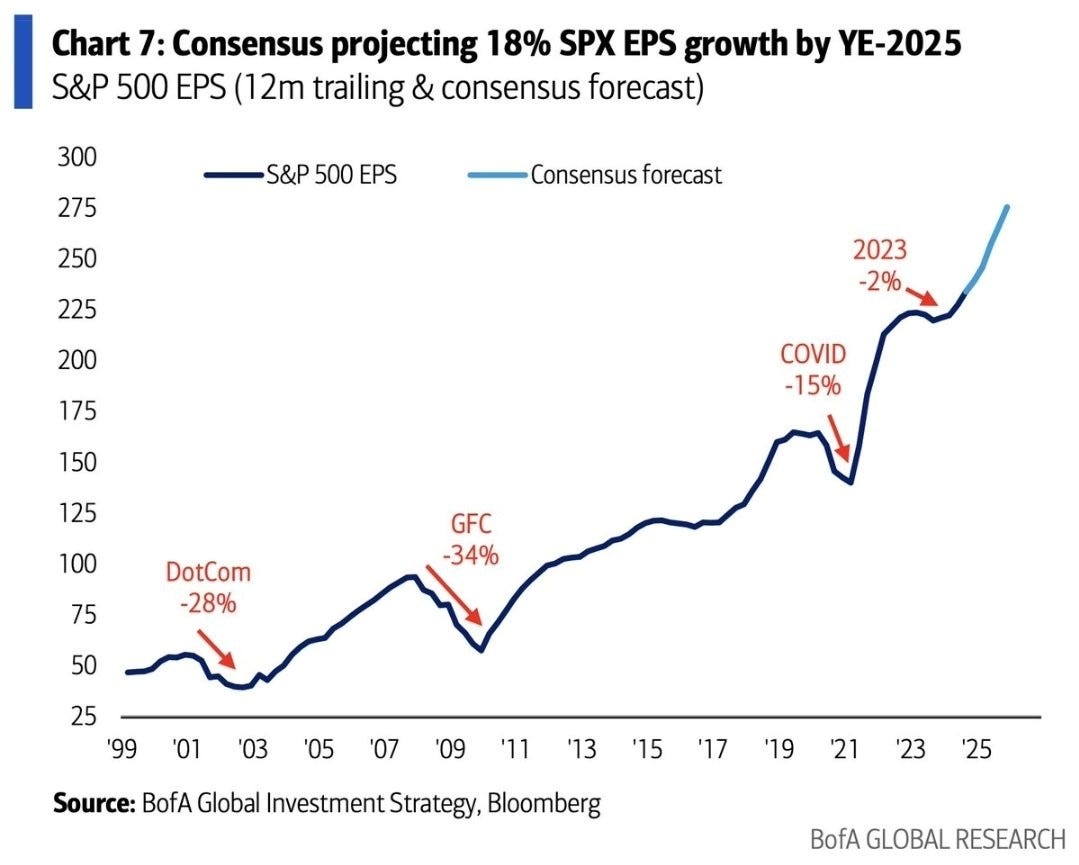

Credit and stock markets are currently pricing in 250 bps of rate cuts and an 18% growth in S&P 500 earnings per share by the end of 2025. It doesn’t get much more favorable for risk, compelling investors to chase opportunities.

With China’s recent stimulus measures and the dovish stance from the Federal Reserve, the macro environment has become far more favourable, making it increasingly challenging for equity bears. Just a few weeks ago, I discussed the possibility of navigating through an economic air pocket, where I leaned towards optimism while recognising potential headwinds like the rolling recession. However, I maintained that any downturn would likely be shorter and less severe, thanks to disinflationary pressures and falling oil prices. Now, with the latest data revisions and additional stimulus, the outlook has improved further, and we are witnessing the emergence of a reflationary ‘Goldilocks’ scenario.

The current setup for equities is rare and highly favourable: inflation is cooling, GDP growth remains steady, the labour market is normalising, and government spending remains elevated. It’s difficult to imagine a more ideal macro backdrop for risk assets.

Base Metals Vs. Crude Oil & Further Disinflation?

Let’s also examine commodity markets. One would think that China’s stimulus package would have a positive effect on copper—and indeed, it has!

If one would assume that it’d also be bullish for oil, anticipating a surge in Chinese consumption and a broader global reflationary effect, then however one would be mistaken!

Indeed, oil prices have remained largely unchanged, currently hovering around $67.

Coupled with Saudi Arabia's landmark decision last Thursday to abandon its goal of pushing oil prices to $100 per barrel, this signals a significant shift in global energy markets. Rather than prioritizing high prices, Saudi Arabia is now willing to accept lower revenues, with plans to increase output to maintain its market share against non-OPEC+ producers like the US, which now accounts for 20% of global hydrocarbon production. This shift should benefit US consumers, resulting in lower diesel and gasoline prices at the pump and easing household energy expenses. Additionally, it is likely to contribute to further disinflation, exerting additional downward pressure on CPI.

Investing In Innovation

The current macro environment is likely to be highly supportive of risk assets, creating a compelling backdrop for investing in innovation and thematic equities. Disinflationary pressures, steady GDP growth, and upward revisions to both GDP and personal savings rates indicate a resilient economic landscape. The dovish stance from the Federal Reserve and the accelerated pace of rate cuts globally are further bolstering financial conditions, while China’s fresh stimulus measures provide additional growth momentum.

This convergence of factors—rising productivity, easing inflation, and supportive monetary policy—lays the foundation for significant opportunities in innovation. As AI, robotics and automation begin to scale, their impact on productivity and value creation is expected to be transformative.

The future is looking bright!

Feel the pulse, stay ahead.

Rahul Bhushan.