Bitcoin in an Age of Entropy – The Essays #5

“Bitcoin is a hedge against bad governance.” – Unknown

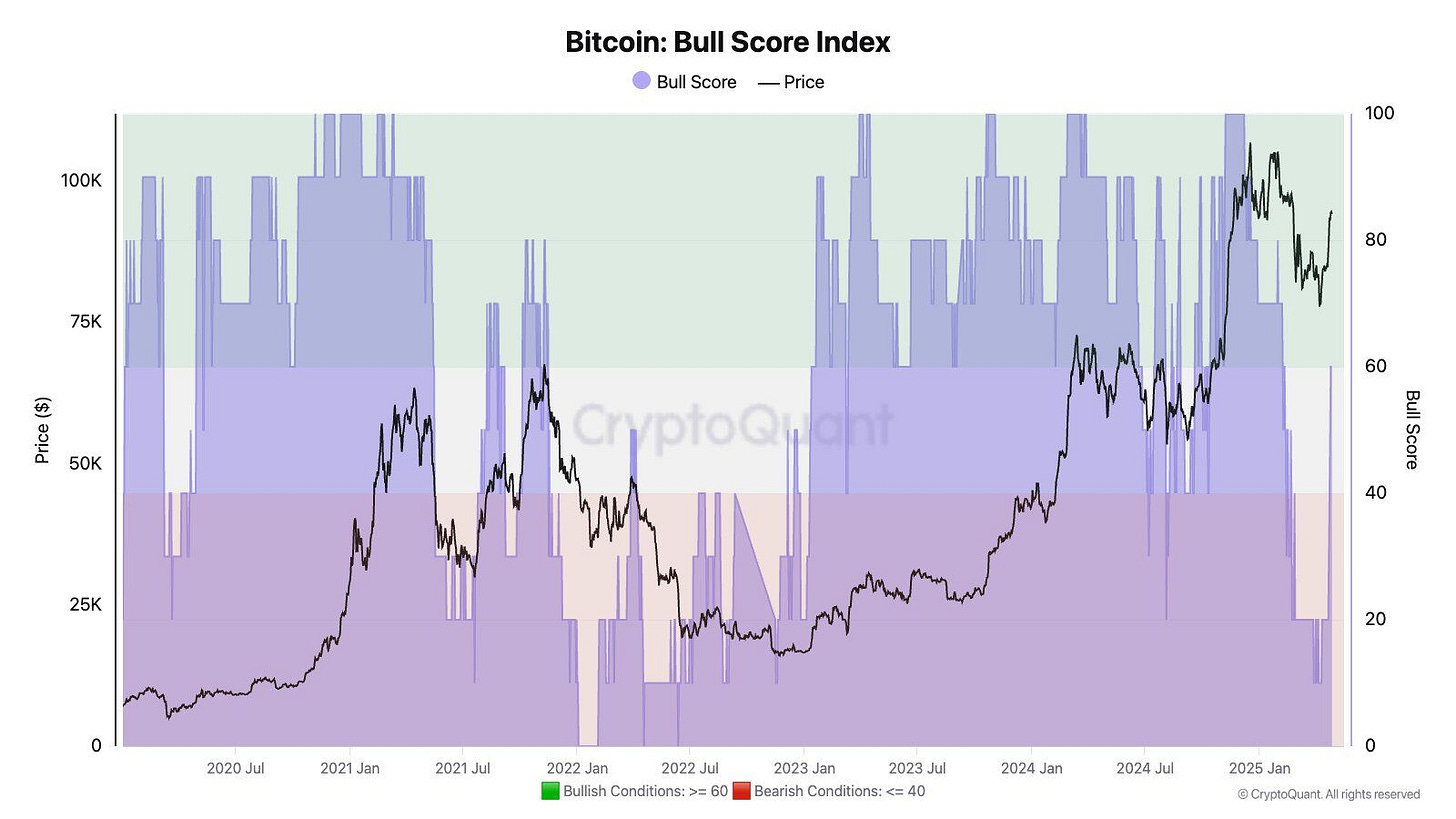

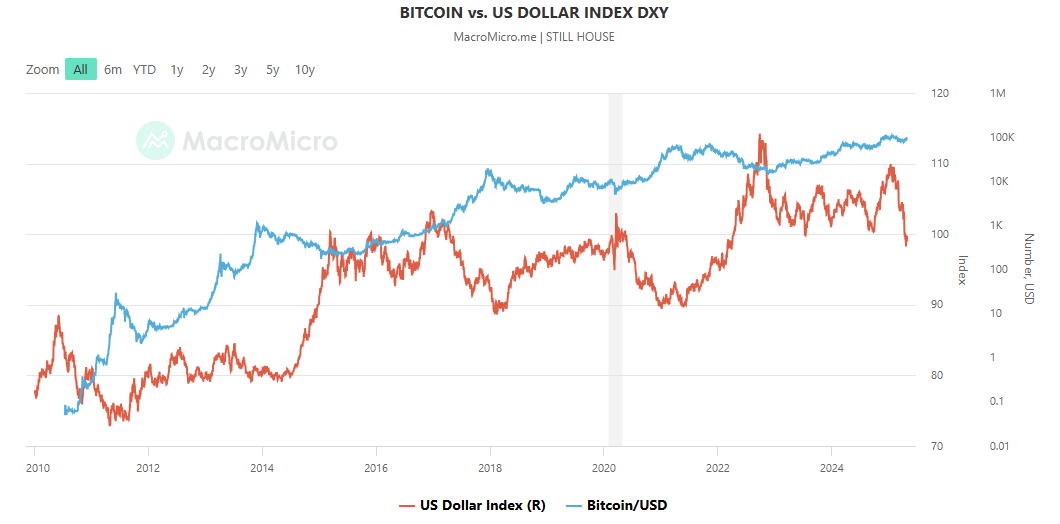

In recent months, financial markets have witnessed the reemergence of a deep, underlying instability. The warning signs are everywhere: global M2 is surging again, yet the DXY continues to slip. 10-year Treasury yields have decoupled from the dollar’s direction, rising even as the dollar weakens—a rare and ominous signal. Trump’s return to the political stage, crowned by aggressive new tariff proposals, has reignited fears of deglobalisation. Meanwhile, political risk premiums are quietly creeping back into U.S. assets, no longer isolated to emerging markets.

The broader picture is unmistakable: geopolitical fragmentation is accelerating. Supply chains are unwinding, former allies are bracing against each other, and friends and foes alike are subjected to tariff threats. Trade wars appear to no longer be episodic, but structural. Investors are no longer just navigating inflation or recession risks, but having to price in the risk of systemic disorder.

Amidst this backdrop, Bitcoin’s behavior is evolving—and telling a new story.

The Bitcoin Price

Just A Chaos Barometer?

Historically, Bitcoin has oscillated between narratives: an inflation hedge, a speculative tech proxy, a risk-on high beta asset, “digital gold,”…

But recently, something has changed.

Over recent months, Bitcoin has:

Held firm even as equities and bonds corrected.

Decoupled from Ethereum and broader altcoins.

Diverged meaningfully from tech proxies like the QQQ.

Tracked global M2 expansion with almost surgical precision.

In other words, Bitcoin is behaving less like “tech” or “crypto,” and more like an emergent macro asset—a live market gauge of geopolitical entropy.

Where equities waver with growth expectations, and bonds move with inflation data, Bitcoin appears to be reacting to something deeper: a slow-motion rupture of global financial cohesion.

In the past, calling Bitcoin “digital gold” felt premature and aspirational. But today, with political risk premiums rising, capital controls tightening, and financial alliances fraying, Bitcoin is earning that label.

And yet, it is simultaneously becoming something more.

Bitcoin as Stateless Sovereignty

Gold, for all its enduring appeal, is inert. It stores value but cannot move itself. It offers protection but requires intermediaries for transport, custody, and liquidation. In an age of rising sanctions, capital controls, and surveillance, gold’s physicality becomes both a strength and a weakness.

Bitcoin transcends these limitations.

Bitcoin is:

Borderless: Transferable across jurisdictions without reliance on any sovereign infrastructure.

Programmable: Able to integrate into decentralised financial architectures.

Self-custodial: Accessible and secure without institutional permission.

Bitcoin doesn’t just store value; it enables sovereign mobility of wealth. It allows capital to exit broken systems in real time. It offers an opt-out, not merely a hedge.

In this sense, Bitcoin is not merely “digital gold.” It is the financial system’s first stateless insurance policy against a breakdown in global cohesion. It reflects individual sovereignty in an era where institutional sovereignty is fragmenting.

Skeptics will argue that Bitcoin remains too volatile, too untested. But in a world where fiat currencies are increasingly subject to politics and gold is increasingly constrained by logistics, Bitcoin’s volatility may be a feature, not a bug.

As the macro landscape shifts from managing economic cycles to navigating structural disorder, Bitcoin is quietly stepping into its role: not just as a speculative asset, but as a monetary asset for the age of entropy.

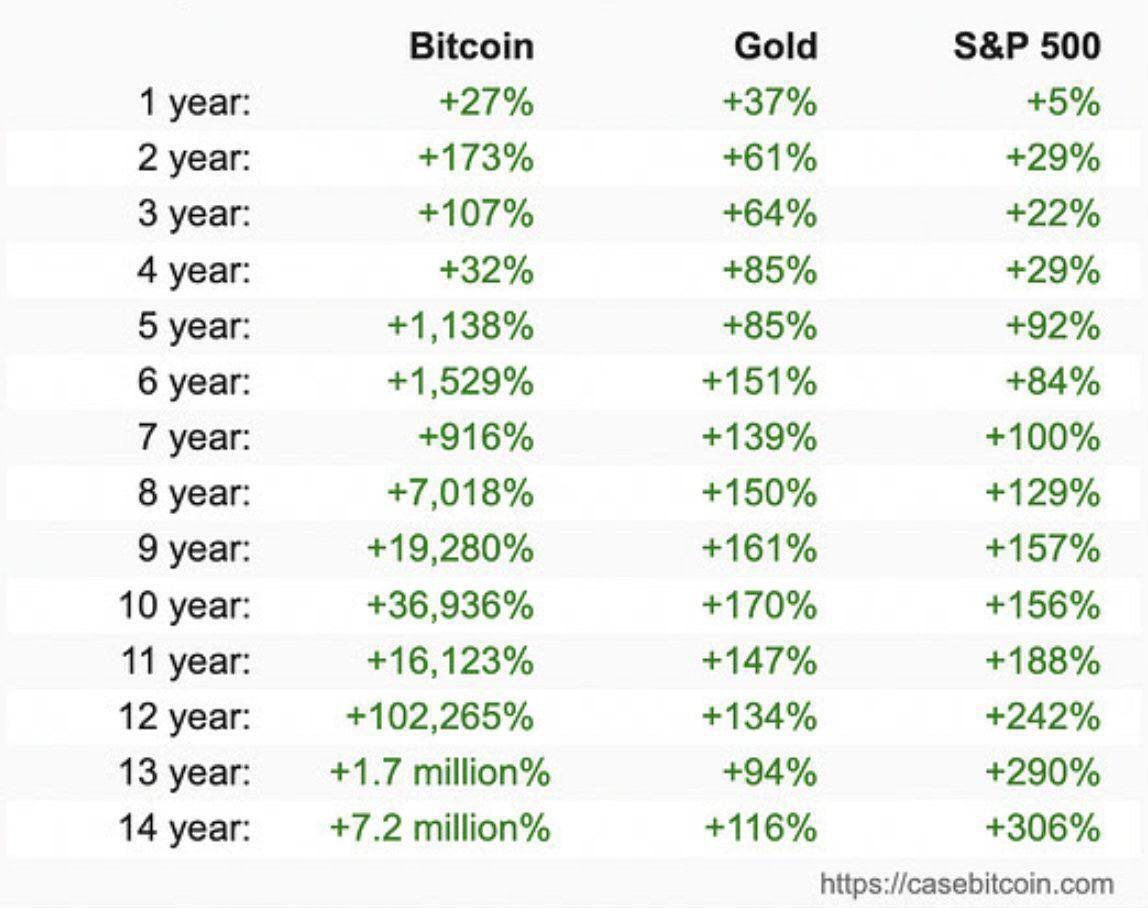

Bitcoin has crushed the S&P 500 every single year since launching

Final Thought

Bitcoin isn’t replacing gold. It is evolving the concept of a chaos hedge for a digital, decentralised world. In the coming years, it may not be the most volatile asset. It may become the most revealing.

People who have both gold and Bitcoin

A live signal. A sovereign shield. A barometer for a world increasingly priced for disorder.

The real question isn’t whether Bitcoin will survive. It’s whether investors will recognise the shift before the next systemic shock forces them to.

Very well explained!

Can you go deeper into your meaning of entropy?