Bolivian Smugglers, Apple’s UK Battle, Microsoft’s Quantum Leap, and MI6’s Investor Handbook – Letter #21

“The urge to save humanity is almost always only a false-face for the urge to rule it.” – H. L. Mencken

Ricardo Guillén had waited months for this moment. After coordinating with a contact in Peru, a courier finally arrived with his contraband delivery—a package so coveted that some Bolivians were paying triple the price to obtain it. Guillén, a YouTuber from a remote village deep in Bolivia’s jungle, eagerly unboxed the equipment, knowing it could change his entire livelihood.

He wasn’t unboxing drugs. He was unboxing Starlink.

Bolivia has the slowest internet in Latin America. Large parts of the country rely on Túpac Katari 1, a Chinese-built, $300 million telecommunications satellite, launched in 2013 with funding from the China Development Bank. The idea was simple: connect rural Bolivia. But over a decade later, the system is failing. Only 10% of the country has mobile coverage, and in rural areas, people climb hills just to find a signal.

So when Bolivia’s government banned Starlink last year, claiming regulatory concerns, it was seen for what it really was: a desperate attempt to control the country’s crumbling digital infrastructure.

But where the state fails, the market finds a way. A booming black market for Starlink kits has emerged. Smugglers transport the devices from Peru and Chile, slipping them across porous borders. Facebook pages now act as underground Starlink dealers, catering to those who refuse to be held hostage by Bolivia’s state-run internet. Guillén estimates there are now 10,000 Starlink kits in Bolivia, a country of 12 million.

Governments blocking Starlink isn’t new—Russia, Iran, and China have tried to limit access too. But Bolivia’s crackdown highlights a larger reality: when governments try to control technology, people will always find a way around it.

And Bolivia’s leaders aren’t alone in trying to tighten their grip on technology. Even in Western democracies, governments are making moves to reassert control over data and communication—this time, under the banner of national security.

The UK Wants a Backdoor to Your Data

Take the UK, for example.

Over the weekend, the UK government strong-armed Apple into weakening its encryption, effectively handing officials a master key to user data stored in iCloud. The tech giant reportedly received a secret government request for this backdoor entry.

At the heart of this decision is end-to-end encryption or E2EE—one of the most fundamental safeguards in modern digital security. With it, only the sender and recipient can access their data. Without it, third parties—including hackers, corporations, and governments—can pry open private communications.

Now, thanks to the UK’s particularly aggressive surveillance laws, Apple is scrapping E2EE in Britain entirely. The law is also extraterritorial, meaning UK law enforcement could demand access to encrypted iCloud data from users anywhere in the world.

The problem? Backdoors don’t come with an owner’s manual. Once a vulnerability is introduced, it’s open season—for friendly intelligence agencies, hostile nation-states, cybercriminals, and anyone willing to exploit the weakness.

Readers will recall the SaltTyphoon breach, where Chinese agents exploited a government-mandated backdoor in U.S. telecom networks, siphoning call records, location data, and even private conversations.

Once encryption is compromised, so is everything built on top of it. Meredith Whittaker, president of Signal—a secure messaging app renowned for its robust encryption—put it bluntly:

“You can’t be tech-friendly while eroding the foundation of cybersecurity on which robust tech depends. Encryption is not a luxury—it is a fundamental human right essential to a free society that also happens to underpin the global economy.”

The irony is that Britain’s own intelligence services invented modern public-key cryptography in the early 1970s, years before it was independently developed elsewhere. Now, the UK government is leading the charge to dismantle the very security architecture it helped create.

Fear of Losing Control?

I personally find the decision baffling.

And I do believe it’s just one front in what’s becoming a much larger battle.

Look around, and the pattern is unmistakable: governments everywhere are tightening their grip—on technology, on data, on financial systems. The question is why.

Why are individual governments today so determined to assert more control?

Perhaps they feel overreach will go unnoticed in an era where rules are being rewritten. Or maybe, deep down, they fear they’re losing control altogether.

I think it’s the latter. And I don’t think the U.S. asserting itself on the global stage—often in defiance of “the international rulebook”—is helping.

MI6 on the New World Order

One of the most fascinating interviews released three days ago was with former MI6 chief Sir Alex Younger, who appeared on BBC Newsnight to share his thoughts on the state of global power.

As he puts it:

“We are in a new era where, by and large, international relations aren’t going to be determined by rules and multilateral institutions—they’re going to be determined by strongmen and deals.”

This sounds like a signal of a fraying of the old order—an erosion of the post-war global framework in favour of a world where the economically most powerful strongmen set the terms.

The UK doesn’t really have a seat at that table.

The Americans do…

The Quantum Power Play

Especially in a time when hard power is dictated almost exclusively by the preponderance of your technological dominance.

In a week already packed with AI agent breakthroughs out of America, tech giant Microsoft also just happened to announce unlocking a new state of matter.

You’ve heard of solids, liquids, and gases. Maybe you even remember plasma from high school physics. Now, Microsoft says we need to add one more to the list: the topological qubit.

That’s the claim behind their latest quantum computing breakthrough, which suggests that this exotic quantum state could be the foundation for fault-tolerant quantum computing. And, as with every quantum computing breakthrough, the magic word is error reduction.

In this short video, Microsoft CEO Satya Nadella discusses this quantum breakthrough and what it means:

Microsoft’s Gambit

So what exactly did Microsoft do?

The company’s research team successfully measured the state of Majorana Zero Modes (MZMs)—bizarre quantum particles that act as their own antimatter. The significance? MZMs are theoretically capable of storing information in a way that’s far more resistant to errors than conventional qubits.

To do this, Microsoft used a superconducting nanowire and quantum capacitance measurements, detecting these states with just a 1% error rate. Even more impressively, the measured states remained stable for over a millisecond—a blink in human time, but a lifetime in quantum computing.

In theory, this is a big step forward in the race to build practical quantum computers. A system based on topological qubits could be much more stable than anything built so far, reducing the need for complex error-correction methods that have historically held back quantum progress.

And if you didn’t understand any of that, you’re not alone 😂

A New Market Order? Small Caps, Europe, and the AI Trade

What stood out most for me from Nadella’s interview was his belief that 10% GDP growth is possible—and that AGI will be a net positive for humanity.

If he’s even partially correct, it could mean we’re overlooking just how transformative the upside might be.

This chart last week, for example, made me pause and reflect:

Source: ISABELNET

Over the past 50 years, five bull markets have lasted over two years, averaging 8 years and a 288% gain. At 28 months old and up 71%, the current bull market appears to be in its early stages, with potential for continued growth. The market is also broadening out.

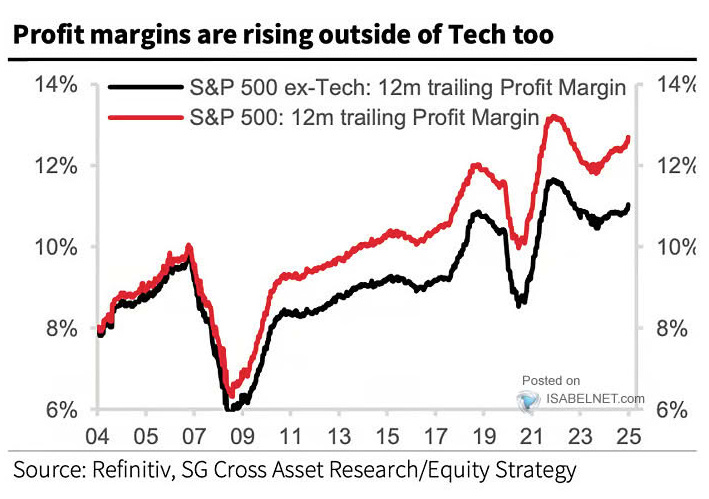

Source: ISABELNET

So far in 2025, the S&P 500’s winning sectors include energy, healthcare, communication services, materials and financials, which have been leading the market’s gains.

Source: FactSet

It also helps that CEOs remain optimistic. Perhaps the allure of deregulation still outweighs worries about potential tariffs.

Source: Charles Schwab

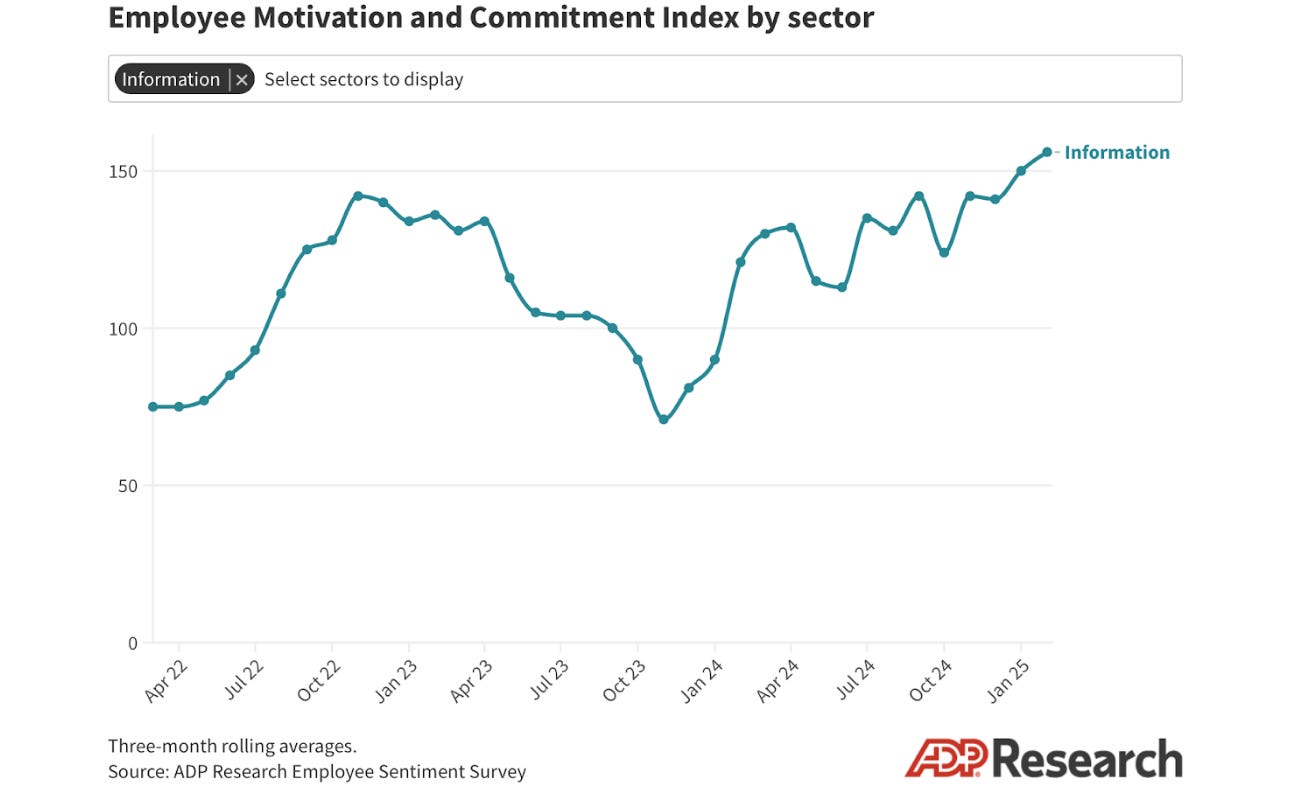

What about workers? A recent ADP survey revealed that employee motivation reached its highest level on record this February.

Source: ADP Research

What’s fascinating to me is that these numbers don’t align with the prevailing macroeconomic narrative from major financial institutions—many of which argue that the small-cap rally is fading and that we’re about to see a renewed shift in favour of large caps. Yet, contrary to this thesis, historical patterns, attractive valuations, and positive earnings growth forecasts point to U.S. small caps being well-positioned for continued outperformance in the near future.

Source: ISABELNET

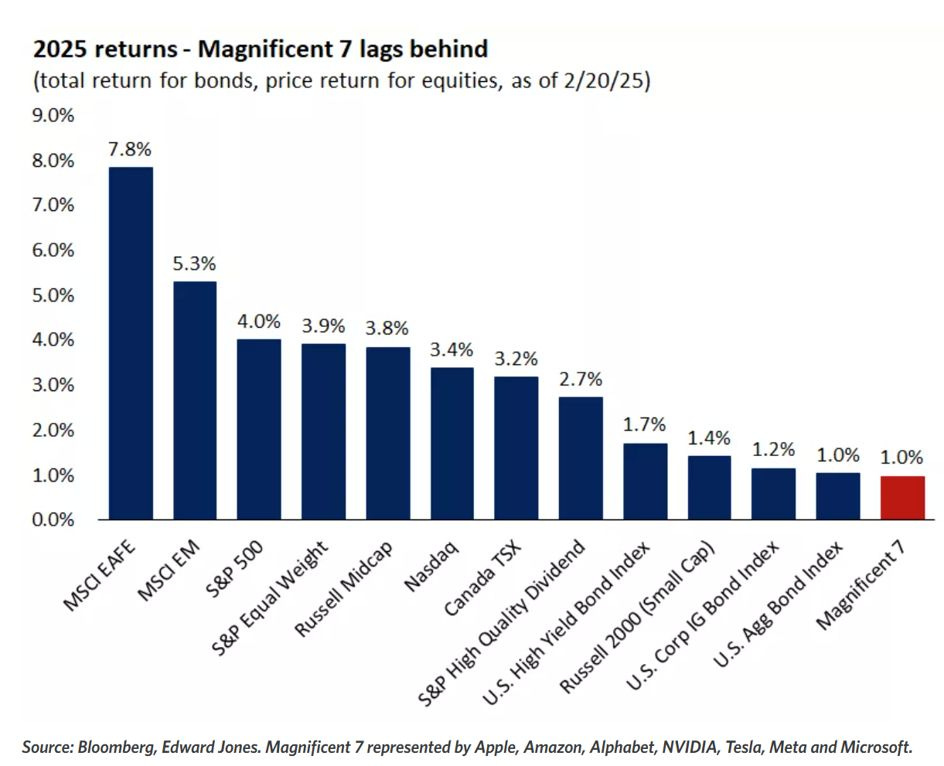

Diversification seems to be paying off in 2025 so far.

Source: Charles-Henry Monchau via Mike Zaccardi

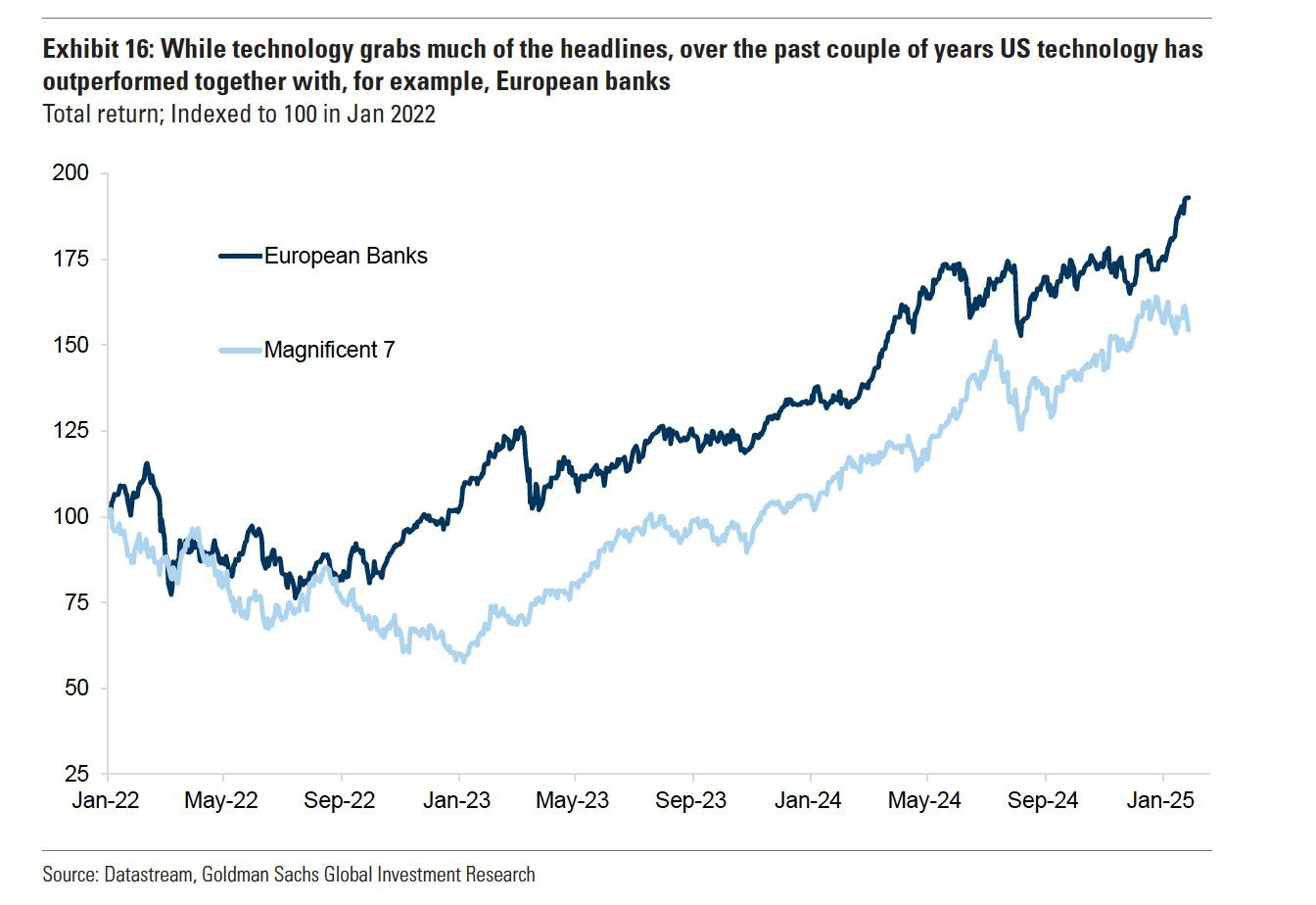

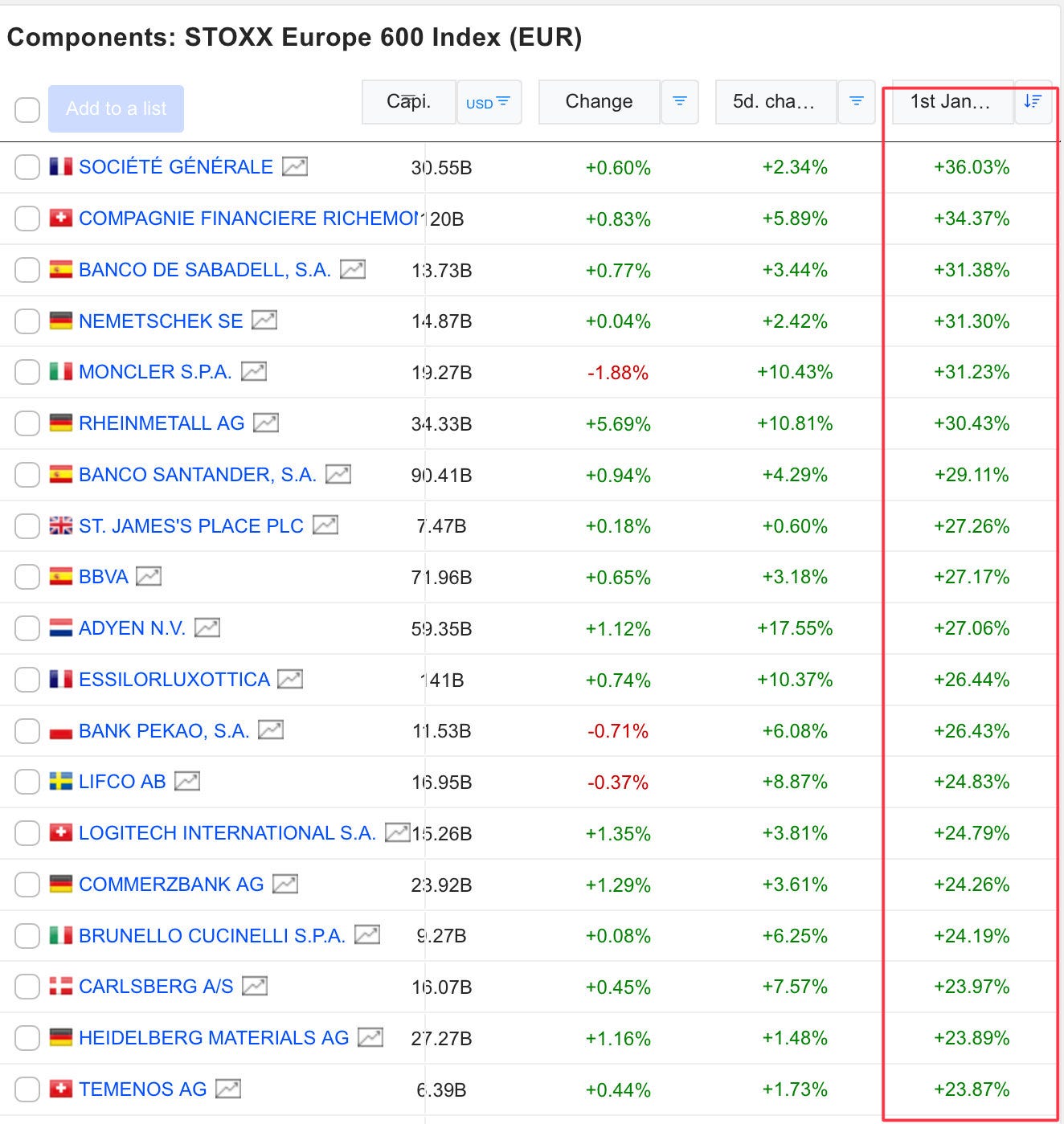

Let’s not forget Europe. Euro area GDP ended 2024 with a weak +0.1% growth, the worst globally. Yet, European stocks are off to their best start in years. Why? European banks—a major part of Euro indices—have rallied sharply, driven by rate cuts that made their 7-8% yields more attractive as risks declined.

Source: Goldman Sachs

Investor flows have tilted toward undervalued European stocks, pulling capital from stretched U.S. markets. A continued rally seems plausible—especially if Ukraine peace talks progress, boosting European companies and consumer confidence, alongside cheap valuations, a more dovish ECB, and expectations of a strategic shift toward greater AI and security investment.

Source: Wasteland Capital

Germany’s DAX is one of the most crowded trades in the world right now:

Source: Brett Donnelly

Zooming out, here’s how everything outside of the U.S. and Canada (as measured by the MSCI EAFE) is performing so far in 2025. Funny how every chart now just bows to the Mag7.

Source: Bloomberg

Chinese stocks are still cheap. Even after Alibaba’s big rally, it’s trading at just 10x cash flows. Oh, and Jack Ma is back.

Source: Trading View

The global equity picture so far in 2025 reflects a market that is broadening beyond the U.S. mega-cap dominance of the past few years. Small caps are still holding firm despite skepticism, European stocks are seeing renewed strength, and even China—despite its well-documented struggles—is flashing signs of value.

As macro conditions evolve, capital is shifting toward undervalued opportunities. And in a world where control is everything, investors seem to be betting on the next wave of economic power—wherever it emerges.

Feel the pulse, stay ahead.

Rahul Bhushan.