Break Bad, Detonate the Economy, Blame the Narrator, Tap Bessent, and Watch the Rally Skip Leg Day – Letter #26

“No more half-measures.” — Mike Ehrmantraut

There’s a scene in Breaking Bad that marks the moment Walter White becomes Heisenberg.

It’s quiet at first. He walks into a dusty auto shop on the edge of Albuquerque—Tuco Salamanca’s headquarters. Tuco is unhinged, violent, flanked by two men with guns. He doesn’t do negotiations.

Walter walks in alone. No backup. No weapon. Just a bag of what looks like crystal meth.

Tuco asks his name.

“Heisenberg,” Walter says.

He sits down. Calm. Steady.

Then he names his price: fifty thousand dollars.

Thirty-five for the meth Tuco stole.

Fifteen for Jesse’s pain and suffering.

Tuco bursts into laughter. “Let me get this straight,” he says. “I steal your dope, I beat the piss outta your partner… and now you’re bringing me more?”

He can’t believe it. The stupidity.

Walter waits for the laughter to die down. Then, without blinking, he pulls a crystal from the bag and tosses it to the floor.

The room detonates.

Windows blow out. Debris rains from the ceiling. Smoke fills the air. Tuco and his crew hit the ground.

Walter doesn’t move.

When the dust settles, he steps forward through the smoke and says the line that rewires the power dynamic in an instant:

“This… is not meth.”

The whole act is a demonstration.

Walter is there to show Tuco what he’s made of.

He’s there to make a declaration: that the rules of engagement have changed.

He isn’t there to plead—he’s there to be feared.

He wants respect. He wants control.

And this, ladies and gentlemen, is how Trump imagines his last week went…

Trump Tariff Tango

“Delusion detests facts the way a vampire detests sunlight.” – David Mitchell

Let’s take a closer look.

Since “Liberation Day,” the administration’s tariff policy has veered between chest-thumping aggression and sudden retreat—often within the span of a single news cycle.

We’ve had universal tariffs. Then reciprocal tariffs. Then selective exemptions. Then a 90-day pause. Then an un-pause, but only for China. Then a redefinition of the pause as something that never actually happened.

At one point this week, the effective U.S. tariff on Chinese imports hit 145%. China responded with 125% tariffs of its own—while simultaneously stating it would cap future increases at that level, in an apparent effort to preserve the illusion of proportionality.

Meanwhile, the universal 10% tariff remains in place across nearly all imports. The 25% surcharge on steel, aluminum, and imported autos is also still standing. The reciprocal tariffs on 57 countries? Only “paused.” For now.

What began as a sweeping trade overhaul has rapidly devolved into a live-action policy whiplash—chaotic in intent, erratic in execution, and nearly impossible to model.

And then came the weekend.

Saturday began with “tariff exemptions” for electronics and semiconductors.

That became refunds on all such tariffs dating back to April 5th.

Then it was delays—”a month or two.”

Then recategorisation.

Now? They’re “just moving to a different tariff bucket,” per President Trump.

“The fake news knows this,” he added, “but they refuse to report it.”

Markets, businesses, and allies are left second-guessing not just the direction of policy, but whether there is a policy at all.

And yet, somehow, this is all proceeding according to plan…

The MAGA Spin Machine

At least, according to the MAGA brigade.

From David Sacks and Chamath Palihapitiya to Bill Ackman, there's no shortage of voices ready to rationalize every twist and turn in the tariff saga—no matter how self-contradictory it might be.

One day it’s “strategic strength.” 🤭

The next, it’s “tactical restraint.” 😆

Then it’s “we meant to do that.” 🤣

The memes captured the vibe better than any economic commentary could. In one, a man paints bullseyes around randomly fired arrows—a perfect visual for the shifting goalposts of Trumpian trade logic.

In another, Chamath is called out for defending tariffs one day and their removal the next.

Even Bill Ackman chimed in, insisting that a tariff pause isn’t a retreat—it’s leverage. It’s negotiation.

It’s all part of the plan.

Of course it is.

Shock Therapy or Self Harm?

But, in my view, Scott Bessent’s claim that the administration’s tariff spiral was always part of a deliberate strategy is absurd—and only serves to further erode the credibility of this White House.

You’d think that, as a macro hedge fund manager, he’d have anticipated the administration to roll out a policy with more structure—something deliberate, less erratic, not detonating a grenade inside the economy and then calling in a medic.

Let’s face it. Markets don’t reward chaos dressed up as strategy. They penalise it. And the penalty came swiftly. Goldman Sachs had already pegged 2025 recession risk at 45% before Wednesday’s reversal. That number has now risen to 54%.

The yield on the 10-year treasury jumped 50 bps last week, its steepest weekly jump since 2001. The yield on the 30-year treasury saw its steepest weekly climb since the 1980s, reaching levels not seen since the GFC. Liquidity is fragile. Risk appetite has thinned, and the global uncertainty premium is now doing the tightening.

Meanwhile, economic activity is slowing because businesses and consumers are in freeze mode. Fear of what comes next has become the transmission mechanism. No boardroom in Europe or Asia sees the U.S. as a stable negotiating partner. And domestically, few executives are signing off on hiring, investment, or expansion in an environment where the rules can be rewritten overnight.

The tariff shocks have likely deepened the slowdown. What could have been a mild deceleration now risks tipping into something worse. I wouldn’t rule out a technical recession, with negative GDP growth in both Q1 and Q2.

When Ray Dalio gets nervous, it’s worth paying attention.

Even Jason is now sounding the recession alarm. Looks like he didn’t get the same memo as Chamath and David Sacks.

The China Standoff

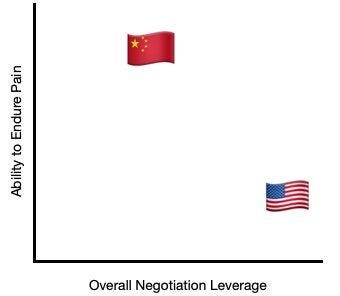

The other thing is that America now finds itself in a full-blown trade war with China.

This rift between the world’s two largest economic powers has become a central uncertainty hanging over the global economy. And this chart captures the standoff with particular clarity.

The counterview is that we may already be at peak tension. That we’re now entering a phase where serious negotiations can take place—talks that could ultimately lead to lower tariffs and the removal of non-tariff barriers. Neither of which, you could argue, would’ve been possible without the shock therapy President Trump just administered.

Scott Bessent’s recent trip to Japan and South Korea, where he met with leaders to begin shaping new trade deals, is held up as evidence of that shift.

But let’s not overstate it. These countries didn’t need to be shocked into cooperation—the U.S. funds the bulk of their defense. They were always going to take the meeting.

What the administration is really trying to do now is use these bilateral talks to co-opt allies into isolating China.

The question is how many will be willing to take sides—especially when Trump is just as capable of flipping and cutting a deal with Xi Jinping tomorrow. That volatility has a cost—most visibly, in the erosion of America’s standing as a reliable, good-faith partner.

Can American Reshoring Even Work?

The other question is whether all this is even going to be worth it for America.

We know the goal: to reshore critical industries, secure supply chains, and reduce dependency on strategic rivals. The U.S. wants to make more things at home—semiconductors, EV batteries, pharmaceuticals, steel. It wants to create jobs, build capacity, and reclaim control.

But whether that’s possible—let alone profitable—is another matter.

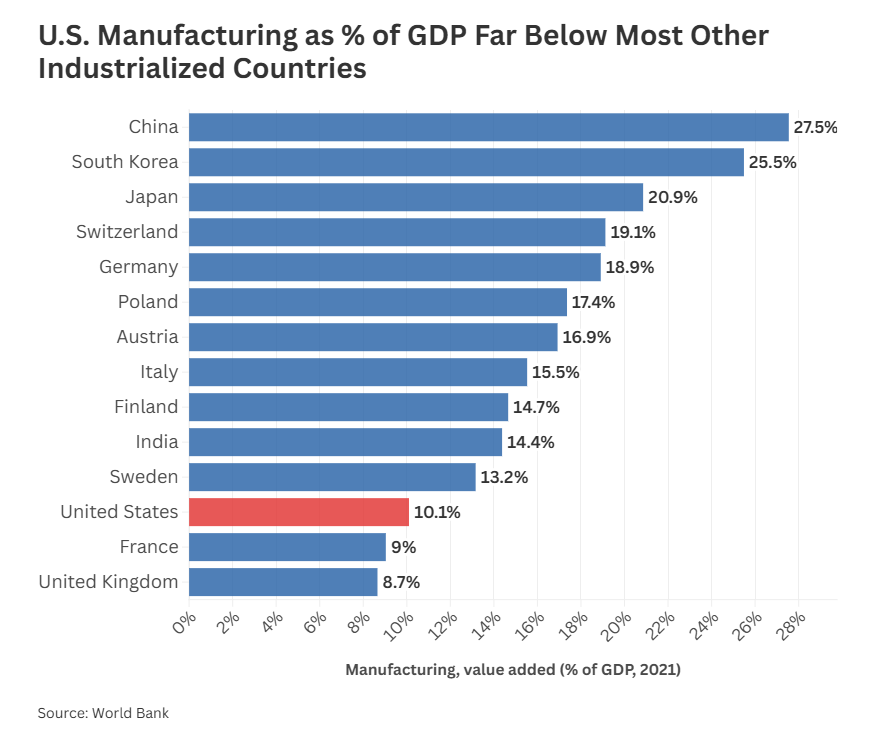

U.S. manufacturing has been in structural decline for decades. There are 12.7 million manufacturing workers today, down from nearly 20 million at the sector’s peak in 1979. Manufacturing’s share of GDP has fallen from 25% in the 1950s to 10% today.

By comparison, China accounts for 35% of global manufacturing output—more than the U.S., Japan, Germany, India, and South Korea combined.

This didn’t happen by accident. China built a manufacturing base that is now world-class in both scale and sophistication. Over two decades, it has developed supply chain ecosystems so dense and integrated that they are almost impossible to replicate. In sectors like EVs, batteries, and advanced electronics, Chinese capacity now outpaces global demand. And thanks to massive state-backed financing, it continues to build faster than anyone else.

And yet, there are signs of progress.

Since January 2021, the U.S. has added roughly 775,000 manufacturing jobs to the economy. Construction spending on new factories hit a record $235 billion in 2024. Reshoring mentions on S&P 500 earnings calls are up 128%. Foreign companies have pledged $1.6 trillion in U.S. investments since the start of the year.

Supporters argue the benefits go far beyond jobs. Every dollar in manufacturing output adds $2.79 to the broader economy. Every new manufacturing job creates between seven and twelve jobs downstream. The sector accounts for 70% of U.S. R&D spending, 55% of new patents, and a third of productivity growth.

So the case for reshoring isn’t weak. But it is complicated.

One problem is that policy volatility cuts against long-term investment. When trade rules change on a whim, capital stays on the sidelines. Ironically, the uncertainty introduced by the White House is making the U.S. a harder place to invest, not an easier one.

There’s also the question of inputs. Nearly half of U.S. imports are intermediate goods—things American manufacturers need to produce finished products. Blanket tariffs don’t just hurt foreign competitors—they raise costs for domestic producers too. And now, the stakes are even higher: over the weekend, China halted rare earth exports to the U.S.—a direct blow to critical input supply chains for advanced manufacturing and defense.

Then, there’s the issue of time. You can’t relocate industrial ecosystems overnight. These aren’t software teams or data centres. Advanced manufacturing takes years—sometimes decades—to rebuild. And the U.S. is trying to do it under compressed timelines and with unclear rules.

Nevertheless, the logic for reshoring is strong—especially in strategic sectors. The pandemic revealed just how brittle global supply chains are. The geopolitics of today only reinforce that lesson.

So, can American reshoring be successful? Yes—but only if the politics start to look more like strategy than spectacle.

Markets Be Like 🤷♂️

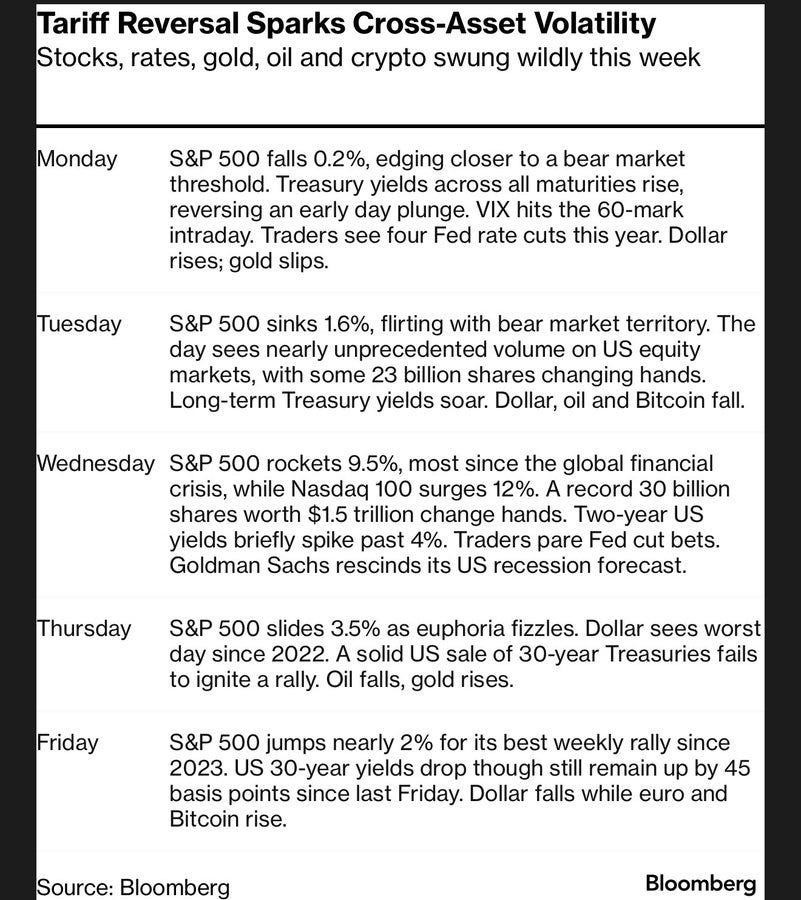

Shifting gears now to markets last week.

This will go down as one of those rare moments traders remember for decades. A week of chaos, volatility, and headlines... yet markets ripped higher.

U.S. stocks added more than $2.5 trillion in value. The S&P 500 logged its best week since October 2023. The Nasdaq? Its best week since November.

And beneath the pump 🤣

Here are some of my favourite data points from the week:

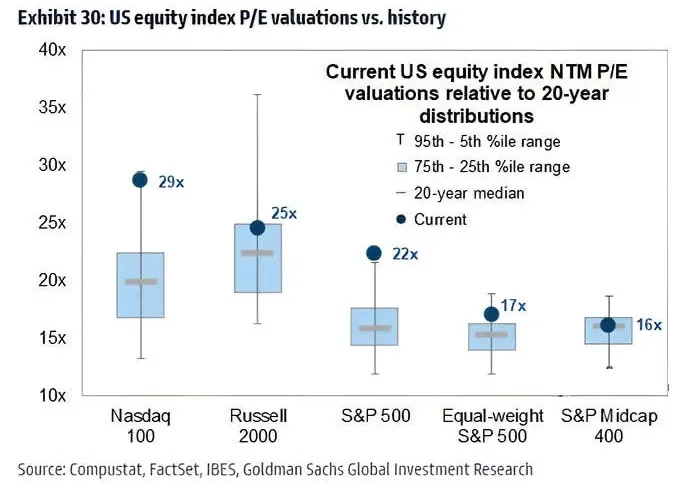

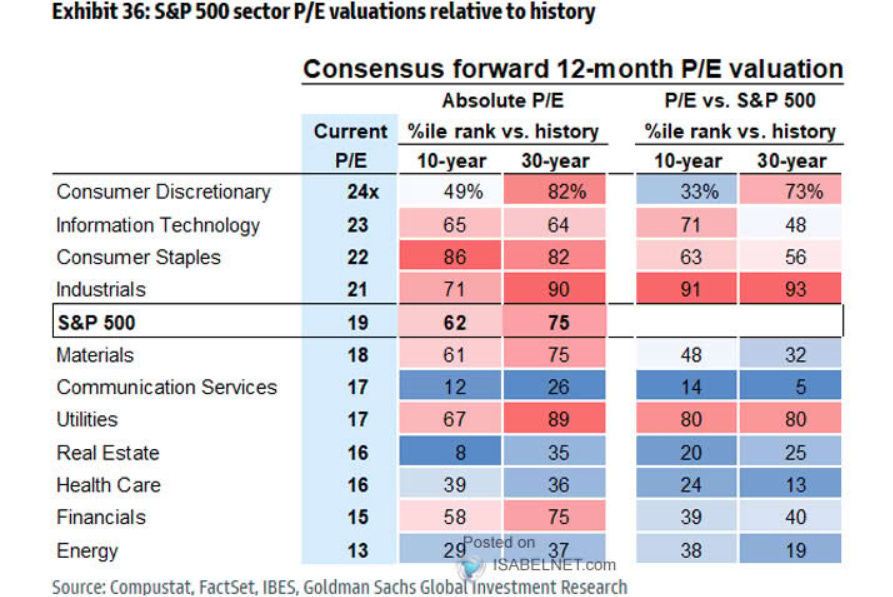

The Mag 7 are now the cheapest they’ve been in over two years, on a P/E basis.

Google at sub 12x EV/EBITDA is near the cheapest it’s been in the past half-decade.

U.S. mid-caps are now trading at a 13x forward P/E — levels typically not seen unless we’re in recessions or bear markets.

S&P 500 sector P/E valuations are down, yes – but they’re still elevated by historical standards.

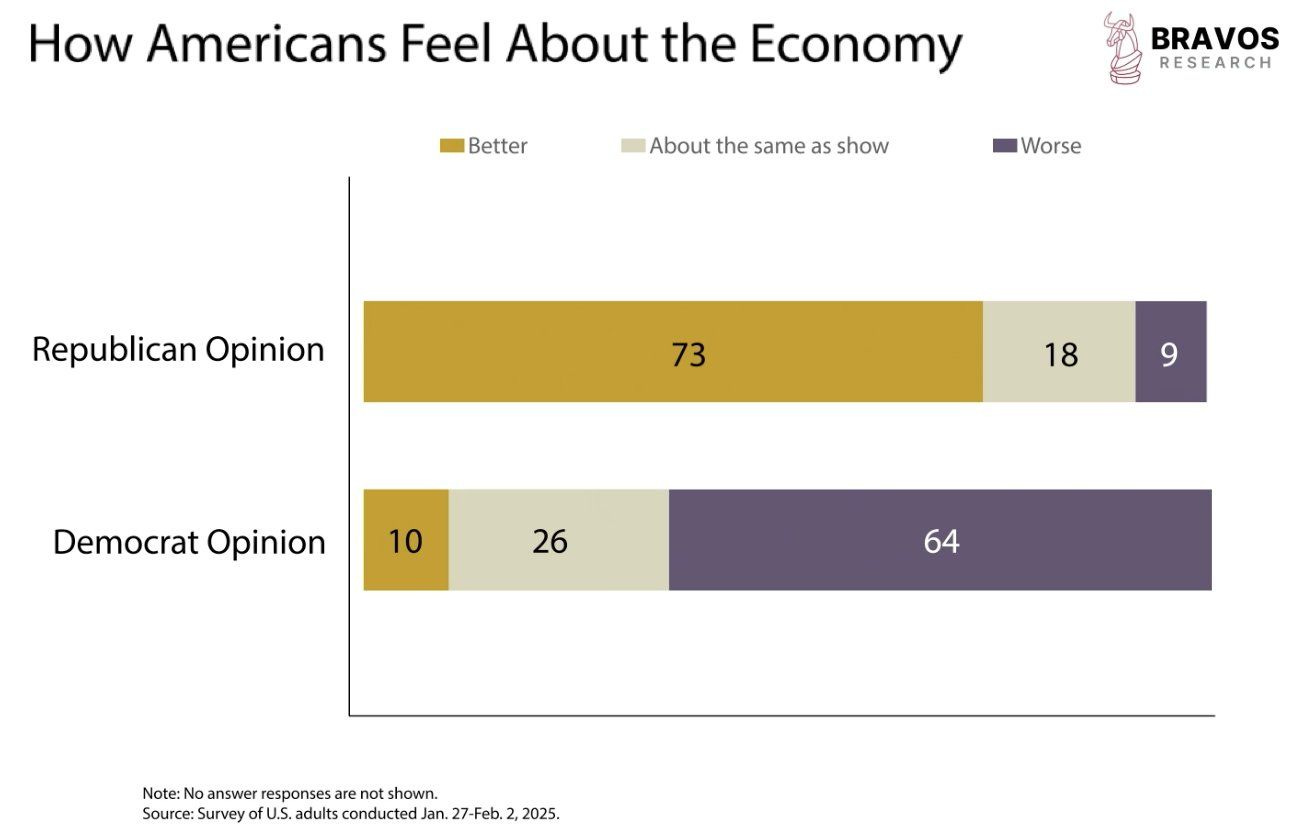

We have political perception diverging fast:

Republicans still expect a strong economy.

Democrats? The complete opposite.

The future’s unclear, but the hindsight will be perfect.

Feel the pulse, stay ahead.

Rahul Bhushan.

Nice one! Unhinged and unbiased, rare to find neutrals in today’s polarised world.

These are so good. Keep 'em coming!