Burn the Boats, Raise the Tariffs, Watch the VIX, Blame the Penguins, and Ride the Robot Horse – Letter #25

“If you want to take the island, then burn your boats.” — Tony Robbins

In 1519, Hernán Cortés, a minor Spanish nobleman turned conquistador, landed on the shores of Mexico with just over 600 men. His mission, sanctioned but not fully supported by the Spanish Crown, was to explore and secure vast new territories rumoured to be rich in gold and empire. But the terrain was unknown, the enemy powerful, and his men uncertain.

Shortly after arriving, Cortés made a shocking decision. He ordered that all his ships be scuttled and burned. The aim was that there would be no turning back. No retreat to Cuba. No pathway home. The message was brutal and clear. The only way forward was through conquest.

Some see this as an act of desperation. Others believe it was a cold-blooded move. As long as the ships remained, so too did the mental tether to an old reality, one defined by trade routes, retreat options, and imperial half-measures. By destroying his own exit route, Cortés aimed to create a new one: a high-risk, high-conviction path intended to redefine Spain’s place in the world. He wanted to increase Spain’s respect on the global stage. He wanted Spain to hold all the cards.

The destruction itself wasn’t the point. It was a deliberate rupture, designed to force strategic realignment.

Did it work?

Yes. The conquest succeeded. Within two years, Cortés had overthrown Montezuma’s regime, and Spain’s power grew dramatically as a result. But it also triggered centuries of colonisation, violence, and upheaval. Cortés eventually died largely estranged from power, recalled to Spain and sidelined in an Andalusian town called Castilleja de la Cuesta.

Will it work for Trump?

Well, he hasn’t yet been banished to Mar-a-Lago 😁. So it might be too early to tell.

In this week’s newsletter, we dive into last week’s crazy events.

No Warning Shot

Let’s start with the numbers.

Last week was the worst week for global equities since the March 2020 COVID collapse. U.S. markets saw similar devastation: the Nasdaq 100 officially joined the Russell 2000 in bear market territory, both down more than 20% from their peaks. The Dow Jones Industrial Average dropped more than 2,200 points on Friday alone—the largest single-day point decline on record.

YTD Returns:

Dow Jones Industrial Average | -10%

S&P 500 | -13%

Nasdaq 100 | -17%

Russell 2000 | -18%

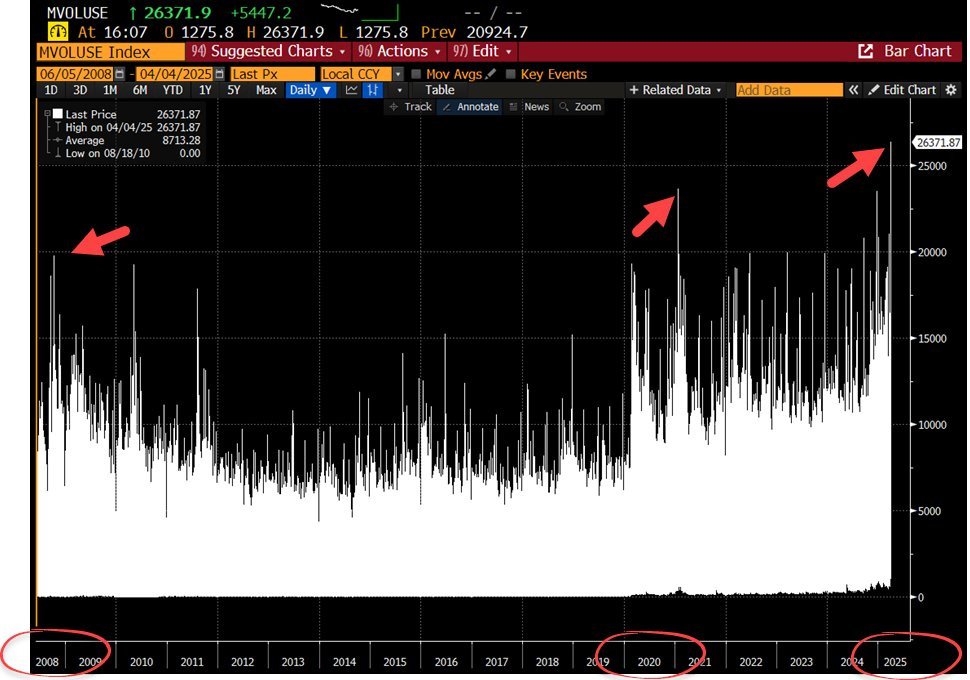

Black Friday — April 4th, 2025. Total trading volume across U.S. exchanges hit an all-time high on Friday and indeed marked the HIGHEST volume trading day of ALL-TIME!

Volatility surged. The VIX index posted its sharpest weekly increase since February 2020, echoing early-pandemic panic. Credit markets were hit hard too—posting their worst performance since the COVID crash and even worse than the SVB banking crisis earlier this year.

Commodities didn’t escape the carnage. Crude oil prices tumbled 11%, the steepest weekly drop since the March 2023 growth scare. Copper plunged by the most since October 2008, and gold had its worst day since November 2024. The only sliver of resilience? Bitcoin, which eked out modest weekly gains.

The weekly sell-off in sector ETFs was broad and brutal. Semiconductors ($SOXX) dropped nearly 19%, Energy ($XLE) fell almost 15%, and Technology ($XLK) shed over 13%. Defensive sectors offered little protection: Consumer Staples ($XLP) and Utilities ($XLU) were down 3% and 4%, respectively.

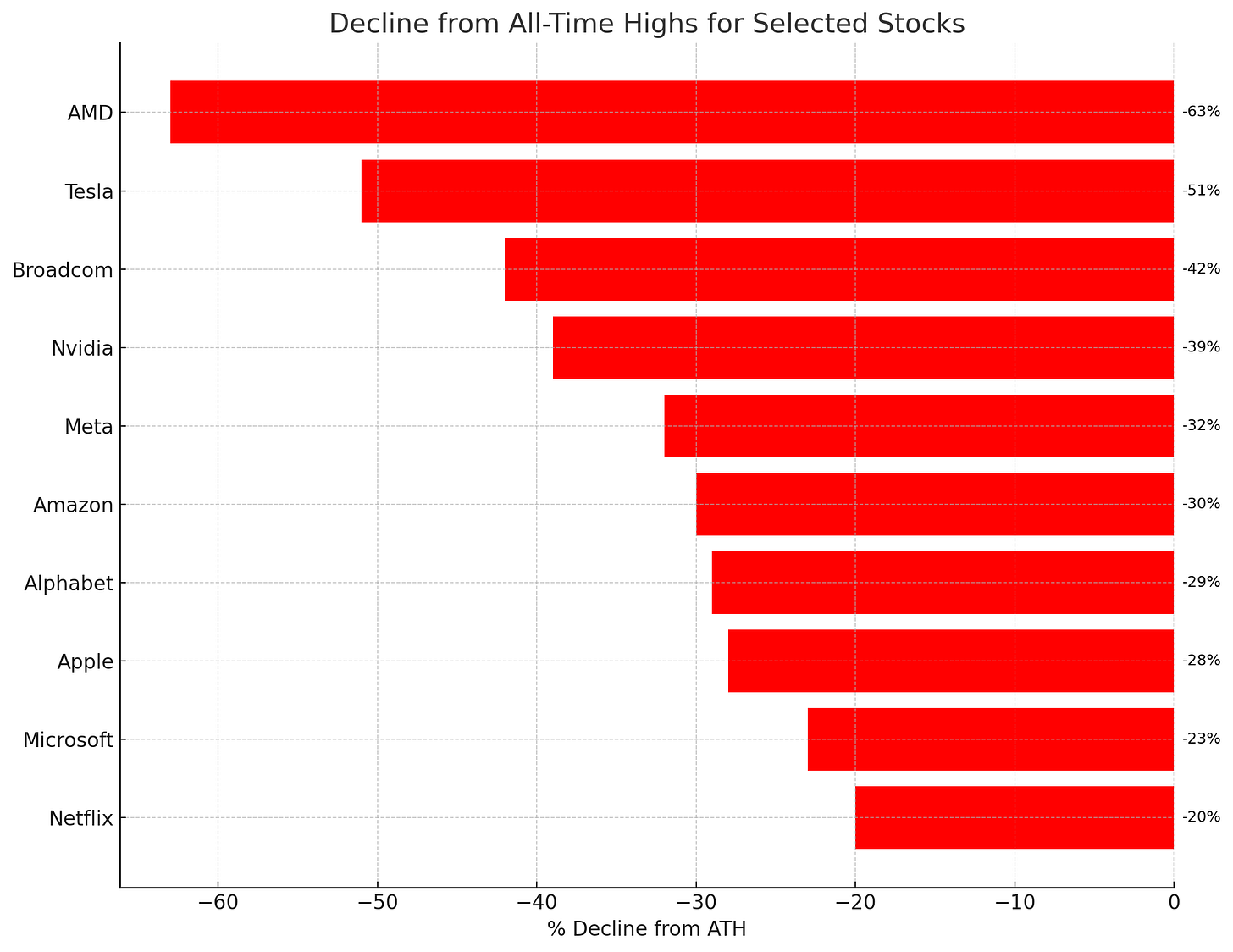

Meanwhile, the Mag 7 tech stocks collectively lost $1.4 trillion in market capitalisation over the week—an all-time record.

What Markets Missed

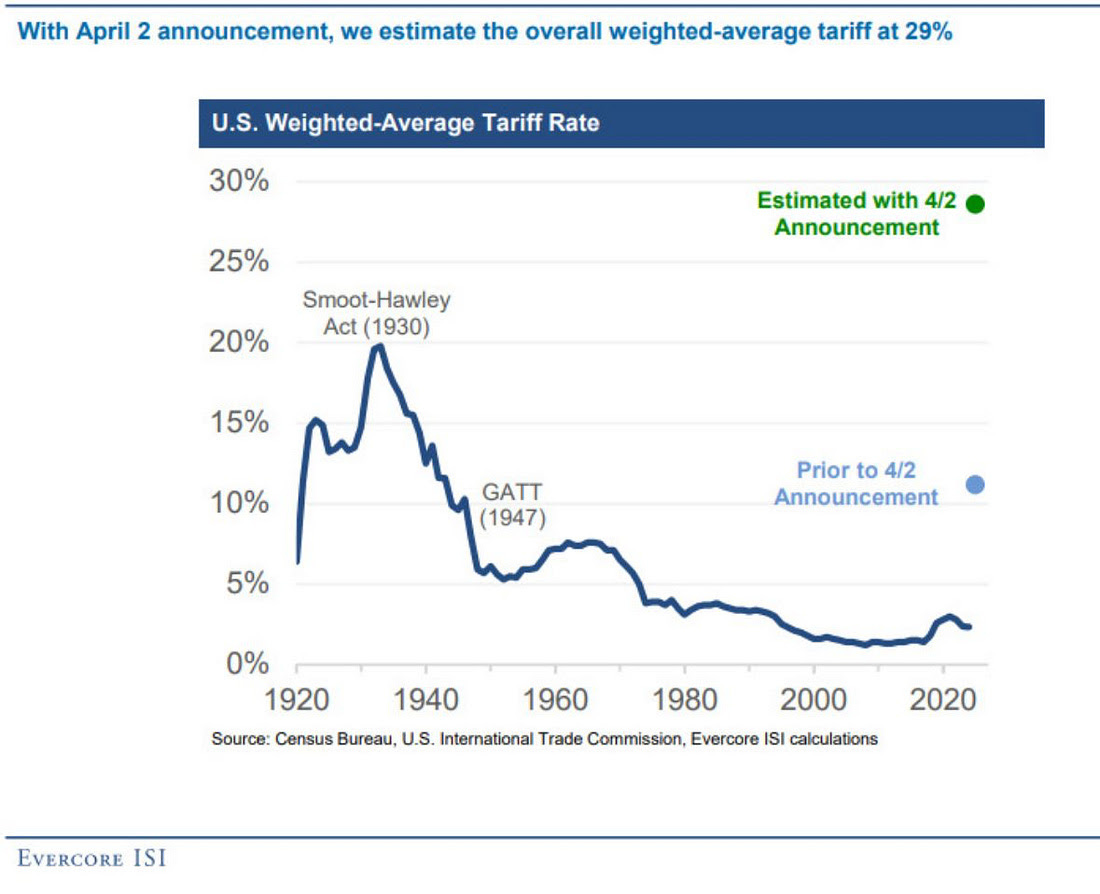

For months, markets assumed the tariff rhetoric was mostly posturing. A negotiation tool. A chip to be traded later. The baseline expectation was 10-20% tariffs—symbolic but manageable. But the numbers now being floated are in the 25-30% range (far above the 20% level that it reached in the 1930s following the introduction of the now-infamous Smoot-Hawley tariffs). That’s not tactical. That’s structural.

What we’re seeing however is increasingly hard to dismiss as a bluff. The Trump administration appears to be pursuing a hard economic reset—one aimed not just at reshoring supply chains or trimming the deficit, but at breaking from a decades-old global order. This order, forged in the aftermath of World War II and launched with the GATT (which later evolved into the WTO), established a basic rule: countries should treat all trading partners the same. It became the foundation of the postwar global economy. The U.S. has effectively abandoned the principle of equal treatment by imposing tariffs that vary dramatically between allies and rivals, from a baseline of 10% to as high as 54% on Chinese imports.

And these tariffs, well, they don’t tweak this order. They take a sledgehammer to it. What Azeem Azhar this week called “a backlash against the ‘flat world’ vision popularised by Thomas Friedman—where geography faded thanks to global supply chains, logistics and telecoms. That model prioritised efficiency but also brought deindustrialisation, inequality and fragility, laid bare by the pandemic and rising geopolitical tension.”

As U.S. Treasury Secretary Scott Bessent said before the 2024 election: “In the next few years, we are going to have some kind of grand economic reordering. Something equivalent to a new Bretton Woods.”

That reordering appears to be underway.

And it comes with a striking political asymmetry. This past week, Bessent again drew attention to this:

“The top 10% of Americans own 88% of equities—88% of the stock market. The next 40% owns 12%. The bottom 50% has debt. They have credit card bills, they rent their homes, they have auto loans, and we’ve got to give them some relief.”

If the administration is targeting a reset that serves those left out of the system, then market fragility may not be a constraint—it may be part of the cost of transition.

When asked about the ongoing market rout, Bessent put it bluntly:

“It’s a Mag 7 problem, not a MAGA problem.”

No Delay, No Doubt

Over the weekend, we received further confirmation of the Trump administration’s commitment to its sweeping tariff plan. Tariffs will go live at 12:01 AM ET on April 9th.

Commerce Secretary Howard Lutnick, speaking on Face the Nation, confirmed postponement is out of the question:

“The tariffs are coming. He announced it, and he wasn’t kidding... Everybody has a trade surplus and we have a trade deficit.”

Treasury Secretary Scott Bessent echoed the same on Meet the Press: the administration will “hold the course.”

In response, Wall Street banks called traders back to their desks ahead of Sunday evening’s market open.

With global equities already shedding over $7 trillion since the April 2nd announcement, tensions are running high. It would take a lot not to see some form of short-term capitulation this week.

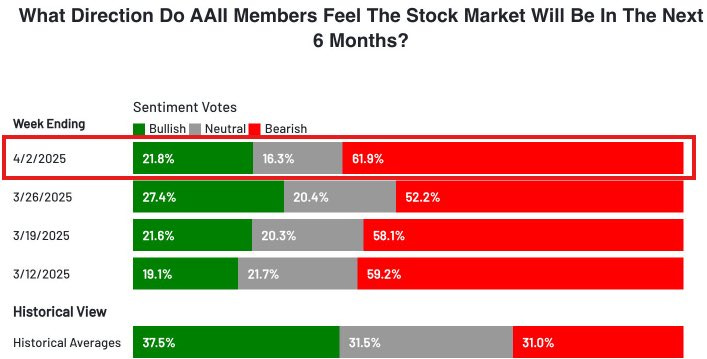

Bearish sentiment is near record highs:

And so we arrive at the question on everyone’s mind: Will tomorrow be Black Monday, or a market bounce?

The coin is in the air.

Call it.

The Bear Case: End of the Order

So, the bear case is really quite bearish — not just about tariffs, but about something deeper: that investors are still coming to grips with America’s abdication of economic, diplomatic, and cultural leadership. That the damage will take years to repair — if it’s even repairable.

On Polymarket, the probability of a U.S. recession in 2025 has jumped from 20% at the start of the year to 65% today.

Can Congress Hit Undo?

Let’s not forget: Congress, not the President, has the constitutional authority to levy tariffs. Trump’s new slate of duties arguably violates both the spirit and, in some cases, the letter of the law. Lawsuits are underway.

But after decades of delegating power to the executive branch, Congress has set itself up for a procedural trap. To override a veto, it needs a two-thirds majority in both chambers. That’s not happening anytime soon.

Still, a crack in the façade appeared this week: Four Republican senators joined Democrats in a symbolic Senate resolution rejecting Trump’s tariffs on Canada.

Symbolic, sure. But it might also suggest dissent could be brewing…?

The Bull Case: Don’t Fight the Flow

As dramatic as all this sounds, the economy is still resilient.

People forget: U.S. GDP fell nearly $2 trillion in a single quarter during COVID — and yet the economy quickly returned to trend. That same economic backbone remains in play. And some of the most important shifts this week were buried beneath the noise of the market crash.

“The little publicised story this week: everyone wants to look at the stock market going down, and do you know what else went down? Oil prices went down almost 15% in two days, which impact working Americans much more than the stock market does.” — U.S. Treasury Secretary Scott Bessent, NBC interview

In fact, just hours after the tariff announcement, a separate bombshell dropped: Eight OPEC+ countries unexpectedly agreed to accelerate their plan to phase out output cuts, increasing supply by 411,000 barrels per day starting in May.

Oil, already reeling from Trump’s trade declaration, has since fallen off a cliff:

Brent crude dropped more than 6%, falling below $70

Oil is now down nearly 15% in just two days

We’ve also seen the dollar weaker...

...and U.S. 10-year yields fall below 4.0% — the first time since last October. And, lower yields are needed. A wall of corporate and government debt comes due this year, much of it issued during the near-zero rate era. Rolling that over into higher-yielding debt means higher costs, weaker balance sheets, and further strain on the U.S. fiscal position.

What many are still missing — as Real Vision founder Raoul Pal noted this week — is that the U.S. Treasury isn’t being run by a central banker. It’s being run by a macro hedge fund manager.

Scott Bessent understands liquidity, financial plumbing, and how to move markets. His playbook is becoming clear:

Lower oil prices

Lower the dollar

Lower interest rates

This is about driving financial conditions lower across all three levers — to revive the business cycle and reaccelerate growth (read: ISM).

Everyone Wants A Deal

Other developments over the weekend...

Trump’s tariffs have indeed triggered a global rush to the negotiating table.

White House Economic Council Director Kevin Hassett announced that over 50 countries have already contacted the administration to begin trade negotiations following the tariff rollout.

Several countries have already made their positions clear:

Singapore: Has opted against immediately retaliatory measures.

UK: Has opted against immediately retaliatory measures.

Indonesia: Has opted against immediately retaliatory measures.

Israel: Has agreed to drop all tariffs on the U.S.

Vietnam: Has agreed to drop all tariffs on the U.S.

Cambodia: Has agreed to drop all tariffs on the U.S.

India: Has agreed to drop all tariffs on the U.S.

Argentina: Negotiations for zero tariffs are underway.

Taiwan: Negotiations for zero tariffs are underway.

So yes—countries are showing up to negotiate. This is some good news, at least for markets.

The Market Has Logged On

But back home, the noise is starting to sound more like an alarm bell.

Over the weekend and into Monday morning, some of the most influential voices in finance began openly questioning both the logic and execution of Trump’s tariff strategy — not because they oppose tariffs in principle, but because the rollout has been chaotic, inconsistent, and deeply unsettling to investor confidence.

Bill Ackman (Pershing Square): “We are in the process of destroying confidence in our country as a trading partner... The president has an opportunity on Monday to call a time out... Otherwise, we are heading for a self-induced, economic nuclear winter.”

Dan Ives (Wedbush): “If these tariffs (in current form/rates) hold... it would set the US tech world back a decade... The US tech supply chain turned upside down overnight and the cost structure will be untenable. Investors know math and the sad reality.”

Stan Druckenmiller (Duquesne): “I do not support tariffs exceeding 10%, which I made abundantly clear in the interview you cite.”

A direct rebuke from probably the most respected mind in macro — and exactly the kind of signal markets don’t ignore.

Penguin Diplomacy

So when all is said and done, yes, the policy outcome may still change. The executive order includes provisions for tariffs to be raised or lowered depending on how other countries respond—either through retaliation or cooperation. But it remains unclear what “reciprocal trade” actually means in this context.

Trump’s tariff formula applies a calculation that divides America’s trade deficit with a country by its total imports. It’s such a rudimentary approach that no one really knows what a country is supposed to do to “earn” a lower rate.

Take the tariffs applied on the Heard and McDonald Islands as an example. They are uninhabited. There is no economy, no trade, just penguins. And yet, they now face a 10% tariff on their exports to the U.S.

Why? No one can say. But at least His Royal Iceness showed up in a tuxedo.

Beyond the flawed math, it is the belligerence that may do the most lasting damage. Even if the U.S. walks back most of these measures, the reputational cost will linger. Nations are unlikely to rely on a partner that can wield power this carelessly. A full recovery of trust and trade relations may therefore take time.

As Ackman put it, confidence, once shaken, is not easily repriced.

Literal Horsepower

If you’ve read this far, here’s your reward: a video you absolutely don’t want to miss this week.

Kawasaki has unveiled CORLEO, a robotic horse powered by a hydrogen engine and equipped with artificial intelligence. It constantly analyses the position of both itself and its rider to ensure you're securely held in the saddle — presumably even during high-speed firmware updates.

Yes, we’ve officially entered the era of robotic equestrianism.

Feel the pulse, stay ahead.

Rahul Bhushan.