Cynicism vs. Reality: The U.S. Economy Defies Odds – Letter #6

“Progress is impossible without change, and those who cannot change their minds cannot change anything.” – George Bernard Shaw

I want to start this week’s newsletter by exploring why humans are naturally hardwired for pessimism and whether today’s appetite for optimism is large enough to counterbalance the pervasive marketplace for pessimism. We question whether the widespread cynicism we see today is truly reflective of economic reality.

Your brain is a neural network, much like a LLM. With its 100 billion neurons and 100 trillion synaptic connections, it absorbs and is shaped by what it consumes. Feed it a steady diet of negative news, much of what makes up today’s media landscape and it will develop a cynical and gloomy outlook. Focus on positive developments and you’re more likely to view the world as full of possibility rather than decline.

As humans, we’ve evolved with a “fight or flight” mindset—perfect for surviving on the African savannah, but less useful in today’s information-rich world. Our brains are optimised to detect threats and scarcity, which was vital for avoiding predators but now often misleads us in modern life.

This survival-driven mindset frequently distorts our perception of reality. For instance, while global poverty has been on a steady decline for two centuries, many people still believe it’s on the rise. Similarly, infectious diseases like malaria and tuberculosis have seen significant reductions in mortality rates, but this progress is overshadowed by lingering fears of health crises. And in terms of energy, we are closer than ever to achieving abundance—solar power costs have plummeted by over 80% in the last decade, signaling a major leap forward in sustainable energy. Yet, many remain unaware of how rapidly we are approaching a clean energy future.

A Pew Research study found that 58% of Americans believe life was better 50 years ago. This nostalgia often blinds us to the incredible advancements made over time. Consider air and space travel, for example. In 1901, the esteemed astronomer and mathematician Simon Newcomb, who served at the U.S. Naval Observatory, dismissed manned flight as nothing more than an idle daydream. The New York Times even predicted that it would take a million years before humans could fly—just weeks before the Wright brothers took to the skies. The Apollo program was derided as a waste of taxpayer money. Yet, the 1969 Moon landing captivated the world and unleashed a wave of technological innovation that transformed industries.

Today, SpaceX is making history, shattering barriers in space exploration and redefining what was once considered impossible. From dismissing manned flight as fantasy to routinely landing rockets back on Earth, the journey from cynicism to progress continues.

The U.S. Economy Defies Expectations

After months of doom-and-gloom predictions, the U.S. economy has been surprising on the upside. Recent data suggests the economy grew at an annualised rate of nearly 3.5% in the third quarter.

U.S. stocks posting another winning week last week. The S&P 500 hit an all-time high on Friday, closing out its 6th consecutive week of gains for its longest streak of 2024. The Dow and Nasdaq also closed in the green.

Risk asset prices still appear to be enjoying a ‘Goldilocks’ period—healthy economic growth, coupled with a global central bank easing cycle. A solid start to the Q3 earnings season adds to the mix. Big banks are off to a strong start, and improved investment banking activity suggests financial institutions may finally be loosening the reins and returning to deal-making. Netflix, while only a single anecdote, showed solid subscriber growth, indicating consumers are willing to continue spending on discretionary items. The resilience of the U.S. economy in terms of growth, sales, and earnings has been impressive, defying a barrage of negative sentiment.

Last week’s September retail sales also beat consensus, rising 0.4% MoM versus the expected 0.3% and above August’s 0.1%. These data points, despite including inflation effects, show the ongoing strength of the consumer.

As illustrated in the chart below, economic data points have consistently surprised on the upside, following summer fears of a slowdown. The sudden reversal in expectations highlights the economy’s underlying resilience.

The U.S. data remind us of the wisdom of never underestimating the hedonism of the U.S. consumer. Many may doubt the data, but U.S. retail sales have climbed over 25% since 2021, while goods inflation is up just over 17%—indicating an improving standard of living, at least when measured by material consumption.

The CME Fed Watch now prices a 92% chance of a 25-bps rate cut at the November 7th FOMC meeting, thanks to resilient payroll, CPI and retail sales data.

Are Markets Pricing in a Trump Win?

What’s interesting is how markets seem convinced that Trump will win the upcoming election. You can see it in bank stocks, crypto and even DJT, his social media company. Across the board, industries expected to benefit from deregulation or tax cuts under a Trump administration are performing strongly. The market appears wildly optimistic heading into the election, which is rare.

This BofA chart highlights times in history when the market raised cash (red circles).

Yet, this election bucks the trend—fear of missing out on a Trump tax cut and an MMT fiscal deficit-induced stock market rally seems stronger than concerns over tariffs, Middle East unrest, China softness, or deflationary pressures in oil and commodities.

The Fed Put

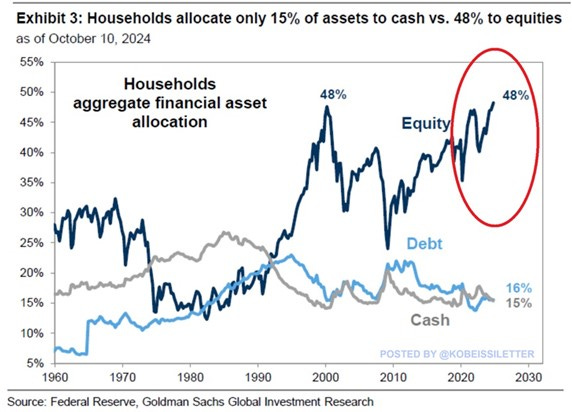

Finally, let’s not forget that U.S. households now hold 48% of their assets in equities, the highest since the 2000 Dot-Com bubble peak. Since the 2020 crash, this share has risen by ~13 percentage points as the stock market has surged 160%. Over the last 15 years, this percentage has doubled.

Meanwhile, Americans’ allocation to bonds and cash sits at just 16% and 15%, respectively—well below long-term averages. In other words, households are all-in on this stock market rally.

Closing Reflections

What do you do when data continues to tell a different story? As we look ahead, the resilience of consumer spending, corporate earnings and the stock market suggests that the optimism within financial markets may be more grounded in reality than many believe.

Perhaps the real question is not whether the economy can continue to defy the odds, but whether we are willing to adjust our thinking to match this new reality. The future rarely unfolds as expected and those who can embrace uncertainty, recognising opportunity in disruption, may find themselves better positioned to thrive. In the end, it’s not just about predicting the future, but about positioning ourselves to thrive within its unfolding.

Feel the pulse, stay ahead.

Rahul Bhushan.