Ed Sheeran, Fentanyl Diplomacy, AI Capex, Pope Trump, 200 Trade Deals and the Resurrection of Risk-On – Letter #28

“The obvious is obviously wrong.” — Howard Marks

Recently, Ed Sheeran released a new song, Azizam—a vibrant, Persian-inspired track that’s become a staple on our family car rides. My kids can’t get enough of it. Of course, I now get scolded for “letting” the satnav disrespect Ed Sheeran.🙄

The song, whose title means “my dear” in Farsi, was co-written with Iranian-Swedish producer Ilya Salmanzadeh and blends Sheeran’s signature pop sound with traditional Persian instruments like the daf and santoor. A daf and santoor are, respectively, a large hand-played frame drum and a trapezoidal string instrument played with mallets.

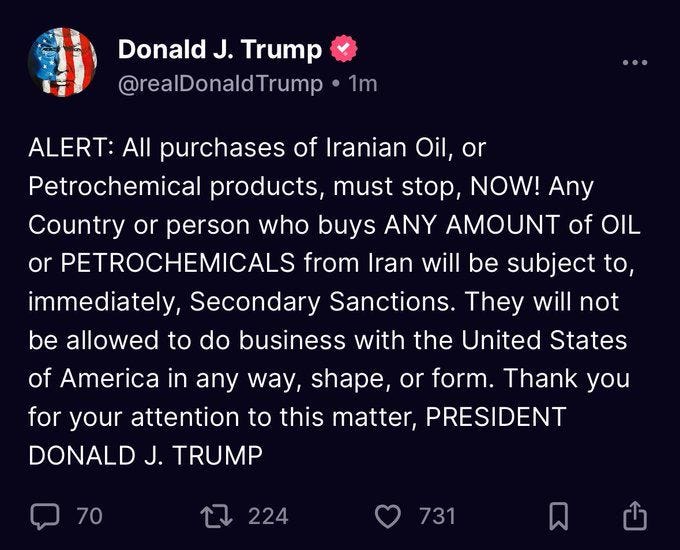

Meanwhile, this week, Donald Trump announced that any country trading with Iran “must stop, NOW!!” and that “they will not be allowed to do business with the United States of America”—a stark reminder of ongoing geopolitical tensions.

One moment. Two completely opposing forces. One, a cultural bridge. The other, a geopolitical wall.

That contrast stuck with me. Because markets often move the same way: narratives harden in one direction, but suddenly, a real move begins somewhere else—quietly, perhaps, and often in the opposite direction.

It reminded me of another curious moment in time: 1998.

If you’re like me, you’ll remember 1998 as the year Seinfeld aired its final episode, the iMac G3 made computers look like jellybeans, and a strange little search engine called Google started asking us to “just search it.”

But you might also remember 1998 as the year:

The Asian Financial Crisis deepened, culminating in Indonesia’s economic meltdown and the fall of Suharto in May.

Russia defaulted on its debt (On August 17th, it devalued the Ruble, defaulted on domestic obligations, and paused payments to foreign creditors).

LTCM collapsed, nearly triggering a full-blown financial crisis (the near-collapse became public around September 23).

It was a year where, by mid-summer, sentiment was bleak. Economists braced for global contagion.

And yet, the S&P 500 didn’t just pick back up. It ripped higher into 1999—as shown by the black line in the chart below. The current path, including April’s sell-off, is shown in red. A striking parallel.

Of course, no two periods are exactly alike. But the point isn’t perfect symmetry.

What matters is this: when narratives become one-sided—when the headlines all scream in one direction—markets often find the cracks, the nuance, the surprise.

And right now, that surprise could well be upside—the breakout scenario that remains underappreciated.

The AI Capex Obituary Was Premature

I love this chart from Brent Donnelly.

It speaks to this theme of narrative overreach.

We’ve seen it play out in AI—most visibly during the DeepSeek moment. When the Chinese startup claimed it had built a GPT-4-class model with just $6 million, it sent a shockwave through the sector. It raised uncomfortable questions about Big Tech’s massive AI infrastructure spend. Suddenly, billions poured into compute looked wasteful and obsolete. AI capex had peaked.

But that conclusion now looks premature.

What seemed like the end of the AI capex boom now appears to have been just a pause—if not a full misread.

The last few weeks have brought a sharp reversal.

Two weeks ago, Google reported higher-than-expected revenue growth of 12%, with 1.5 billion people now using its AI Overviews feature—up from 1 billion in October.

Then came last week. Amazon, Microsoft, and Meta—torchbearers of AI investment—reported earnings.

Amazon, reporting after the bell, beat on both the top and bottom line, and reminded investors that its cloud business is not just an AI engine, but a money-printing machine.

Microsoft’s cloud business grew 33% yoy, with half of that growth attributed directly to AI. The company’s stock jumped more than +10%, making it once again the largest public company in the world.

Meta also beat Q1 expectations and raised its full-year capex guidance to $64-72 billion, up from a prior range of $60-65 billion. Its stock rose more than +5% on the news.

We saw the Nasdaq surge, as Microsoft and Meta recovered lost ground.

Back From the Brink

The Nasdaq has now fully recovered from the drawdown it suffered post–Liberation Day. It’s really quite remarkable.

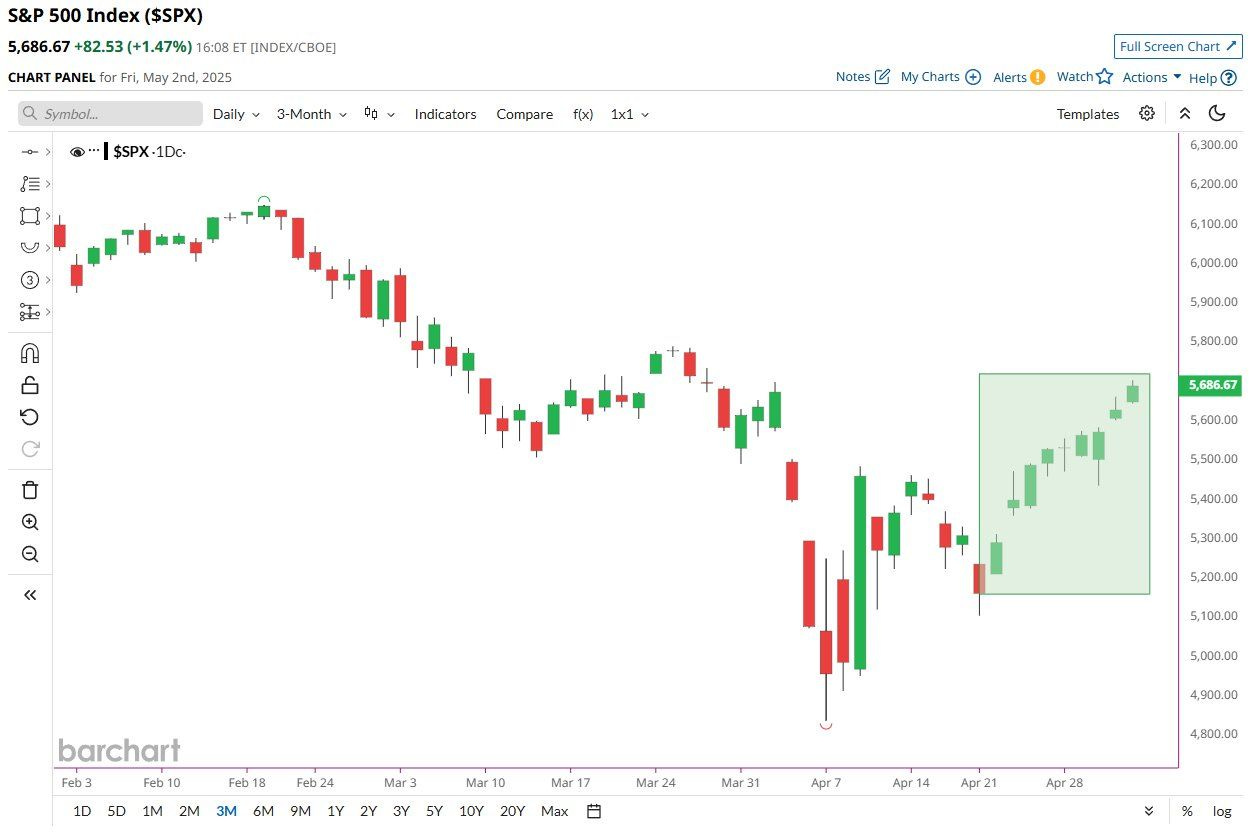

Turning to the S&P 500—last month’s surprisingly strong jobs numbers, combined with signals that China may be open to renewed trade discussions, helped push the index into its longest winning streak in over two decades (more on this later), fully unwinding the losses sparked by recent tariff headlines.

Here are last week’s numbers:

Nasdaq +3.4%

S&P 500 +2.9%

Russell 2000 +3.1%

Dow Jones +3.0%

US 10-year Treasury yield +6 bps

Bitcoin +2.4%

VIX -9%, front month VIX futures -4%

U.S. Dollar Index +0.5%

Gold -1.7%

Silver -3.3%

WTI Crude Oil -7.1%

Meanwhile, I’m not sure any clear trend has emerged yet among the biggest stock winners and losers during Trump’s first 100 days—but for those interested, here they are:

Trump’s First 100 Days

🚀 Biggest Winners:

Palantir +57%

Philip Morris +39%

Dollar General +36%

Verisign +31%

Newmont +30%

Netflix +29%

😨 Biggest Losers:

Deckers Outdoor -48%

Teradyne -44%

Zebra -40%

Albemarle -40%

Delta Airlines -36%

United Airlines -36%

The Simulation Gets Weird

We really are living through one of the most interesting times in recent market history.

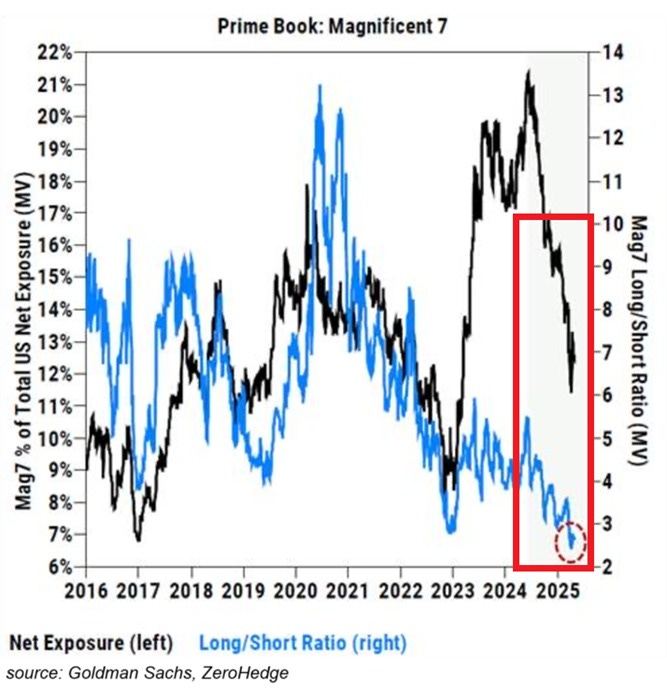

On the one hand, hedge funds are max bearish: their long/short ratio on the Magnificent 7 stocks has fallen to ~2.5x—the lowest level ever recorded. Not even the 2022 bear market saw this metric drop that far.

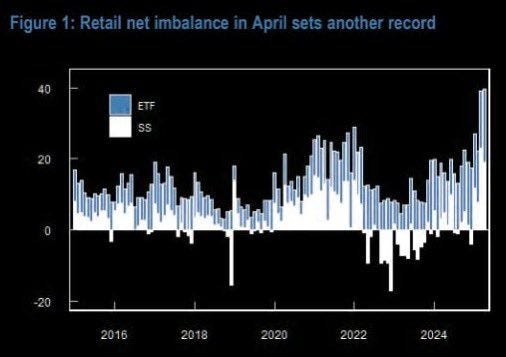

On the other hand? Retail traders just bought $40 billion worth of stocks and ETFs in April—the fastest monthly buying spree in history. 🚨

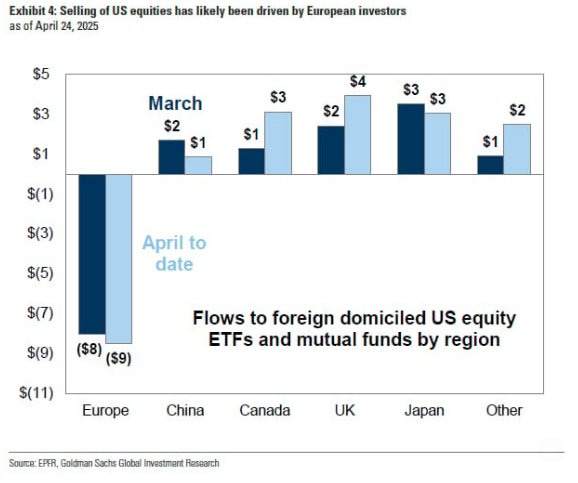

Internationally, this excellent chart from Goldman Sachs shows an interesting pattern: it is only European investors who have been selling US stocks. 🚨 The rest of the world, including China (!), are buying. 📈

And while all this was happening, over the weekend, Trump tweeted an image of himself dressed as the pope. Because of course he did.

At this point, you’d be forgiven for thinking we’re all living in a simulation.

Three Reports That Mattered

Three critical economic reports dropped last week: the first read on Q1 GDP, the latest core PCE inflation print, and the April non-farm payrolls report.

So far? The data still paints a picture of a US economy that’s resilient—at least on the surface—as we await any delayed fallout from the April 2nd tariff announcements.

GDP: Negative but noisy

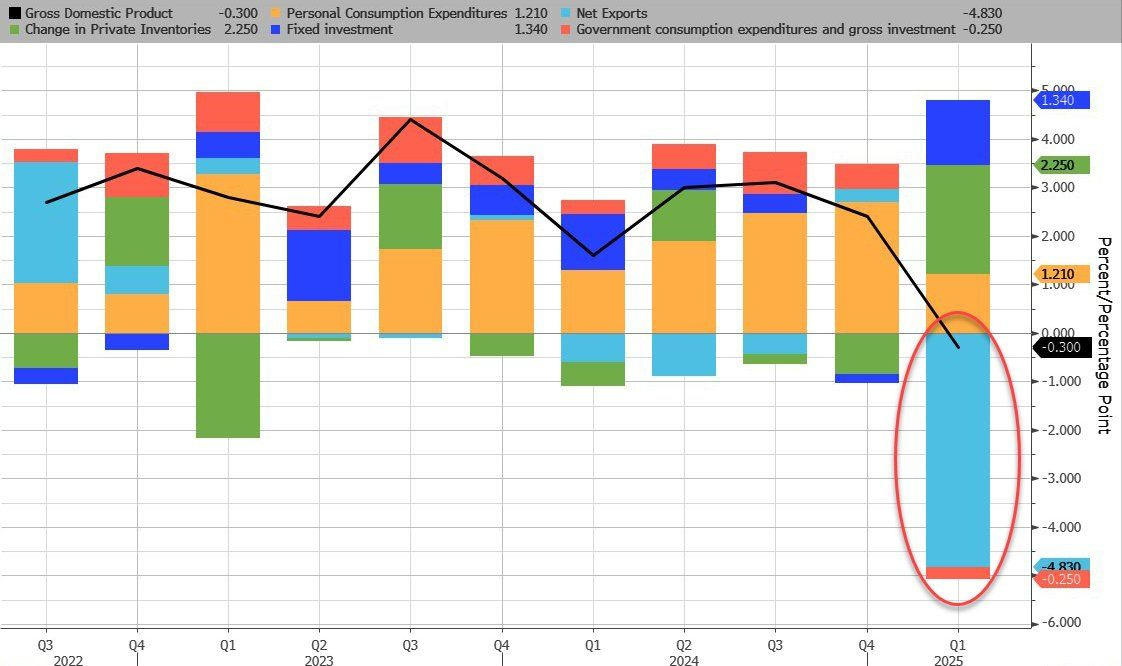

The headline print was negative. US GDP shrank by 0.3% annualised in Q1—well below expectations of +0.3%. That’s the worst quarterly performance since Q2 2022.

But it’s probably too early to panic.

Much of the weakness was due to front-loaded imports, as businesses rushed to stockpile inventory ahead of tariffs. Imports alone subtracted 4.83 percentage points from GDP. The only other drag? A small decline in government spending.

🔴 Q1 GDP: -0.3% vs. +0.3% expected

😱 Lowest reading since 2022

📉 Trade and government spending were the only two negative contributors

One weak quarter doesn’t make a recession. It didn’t in 2022. But it does put the spotlight on future quarters. Especially as tariffs begin to bite. Chances of a technical recession? High.

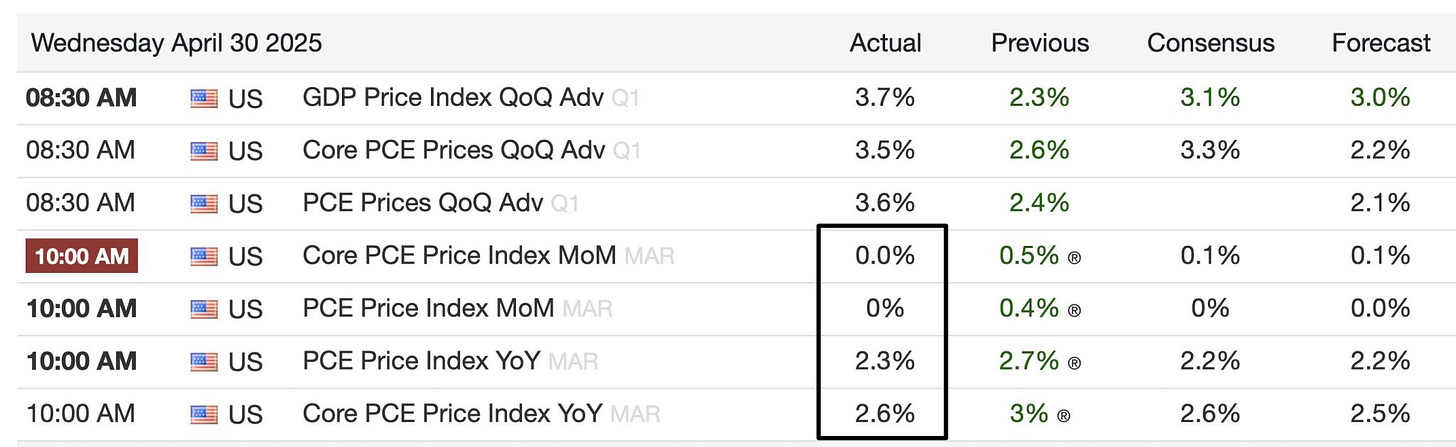

PCE: Inflation not misbehaving (yet)

March core PCE came in at +2.6% yoy—matching recent lows and suggesting inflation isn’t reaccelerating.

The Fed is likely to look through this one and wait for May, June, and July data to judge tariff effects.

✅ Core PCE steady at 2.6%

⏳ No immediate inflation breakout, but it’s early

Payrolls: Still sturdy

April’s payrolls report showed 177,000 jobs added, above expectations of 138,000. The unemployment rate held steady at 4.2%, and wage growth moderated slightly.

There’s no sign yet of any labour market fallout from Trump’s tariff push.

👷♂️ NFP: +177k vs. +138k expected

📉 Wage growth cooled: +0.2% MoM vs. +0.3% expected

🔁 Unemployment steady at 4.2%

The labour market remains the economy’s firewall. But as Mark Zandi warns, that firewall could be tested soon:

“Unless the trade war de-escalates in the next few weeks, the firewall will come down, and a recession will ensue.”

So far, the data’s holding up. But the lag between shock and slowdown may still be ahead of us.

A Break to the Upside?

We’re approaching a pivotal moment for markets. Most of the hard data so far only captures the pre-tariff world—through March. Trump’s Liberation Day tariff spree on April 2nd changed the calculus, but the true impact hasn’t shown up in the numbers yet. What we’ve had instead is a drip-feed of anecdotal evidence, soft data deterioration, and renewed fears that consumers may soon be forced to pull back spending as price pressures mount.

Economists remain hesitant to call a recession. Goldman puts the probability at 45%, while one analyst sees it closer to 34%. Whether that proves right depends largely on Trump’s ability to defuse his own tariff threats—the president says he’s already inked 200 trade deals, though there are no details on with whom.

So, it’s worth asking: what if markets break the other way?

As far as I can tell, there are four key catalysts that could fuel an upside surprise. All of which seem underappreciated by the consensus narrative:

1) Earnings

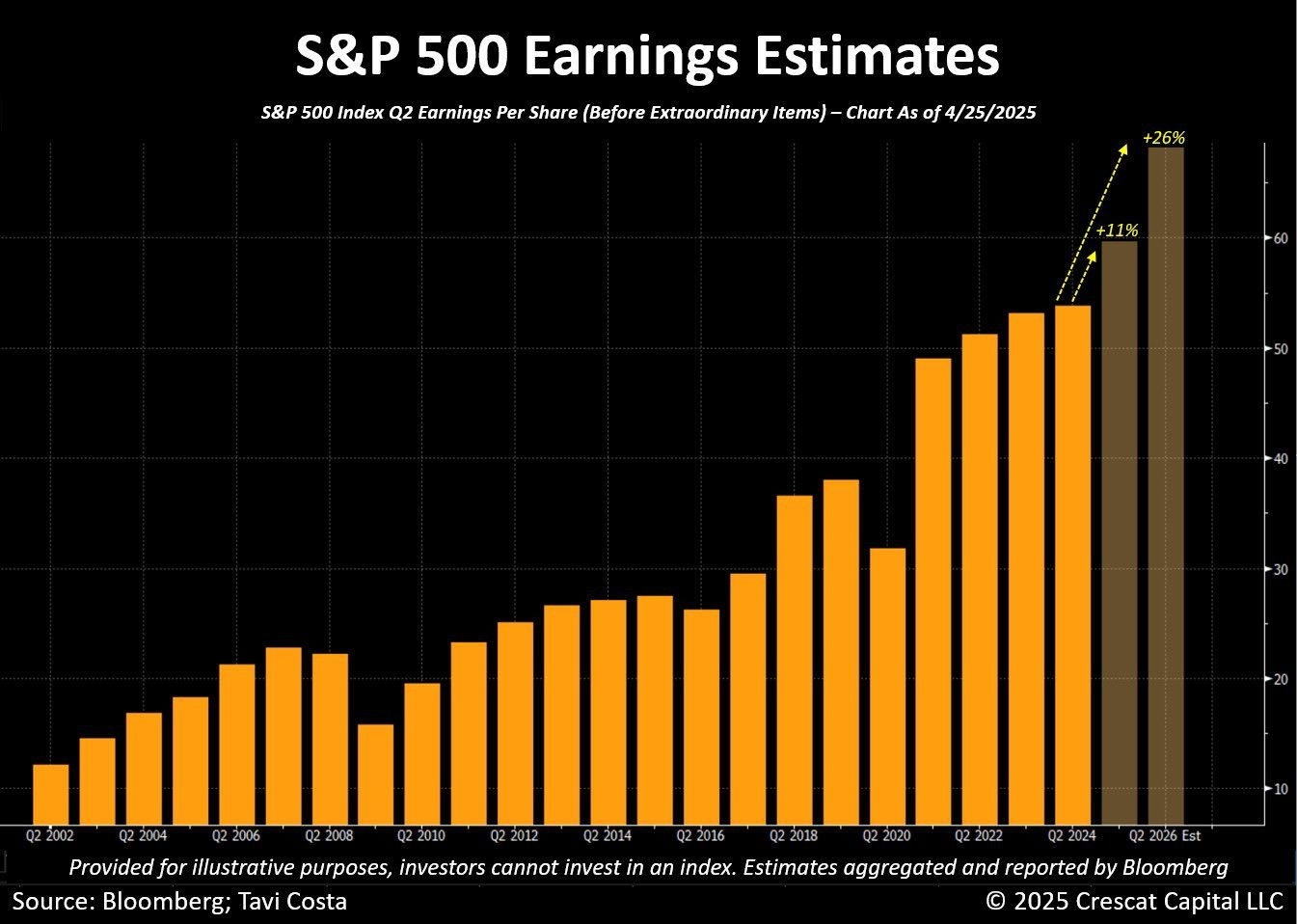

S&P 500 earnings growth is tracking +10% YoY—above what analysts expected at the start of earnings season (6%), primarily driven by positive margin surprises. Earnings revisions have remained surprisingly resilient even as macro expectations soften. indeed, the S&P 500 EPS growth (expected) continues to lead Europe (strong euro, tariffs) and China (tariffs, domestic economy not doing so well).

Markets may be pricing in a recession, but earnings don’t appear to be.

Per Crescat Capital, S&P 500 earnings for 2026 are expected to grow by as much as 26% (!). Maybe US exceptionalism isn’t dead.

2) Fed Dovishness

The May 6-7th FOMC meeting could prove a sentiment inflection point. Powell isn’t committing to rate cuts yet, citing uncertainty and trade risks, but with growth slowing and inflation flatlining, the door remains open. The market is already leaning dovish: 2-year yields are near their lowest since September, and the Fed funds curve is pricing five cuts by April 2026.

If Powell even slightly softens his tone, the combination of dovish guidance and strong tech/consumer earnings could reignite risk appetite.

3) Deregulation + Tax Cuts

Trump is now openly touting what he calls the One Big Beautiful Bill—a sweeping package that would eliminate taxes on tips, Social Security, and overtime, slash regulations, and potentially deepen corporate tax cuts. He claims it will be “the biggest bill ever passed in U.S. history,” combining tax relief, deregulation, military investment, and more into a single legislative push.

It’s unscored and highly ambitious. But if even parts of it pass, it would mark a significant return to the pro-growth, pro-business posture of Trump’s first term.

4) Trade De-escalation

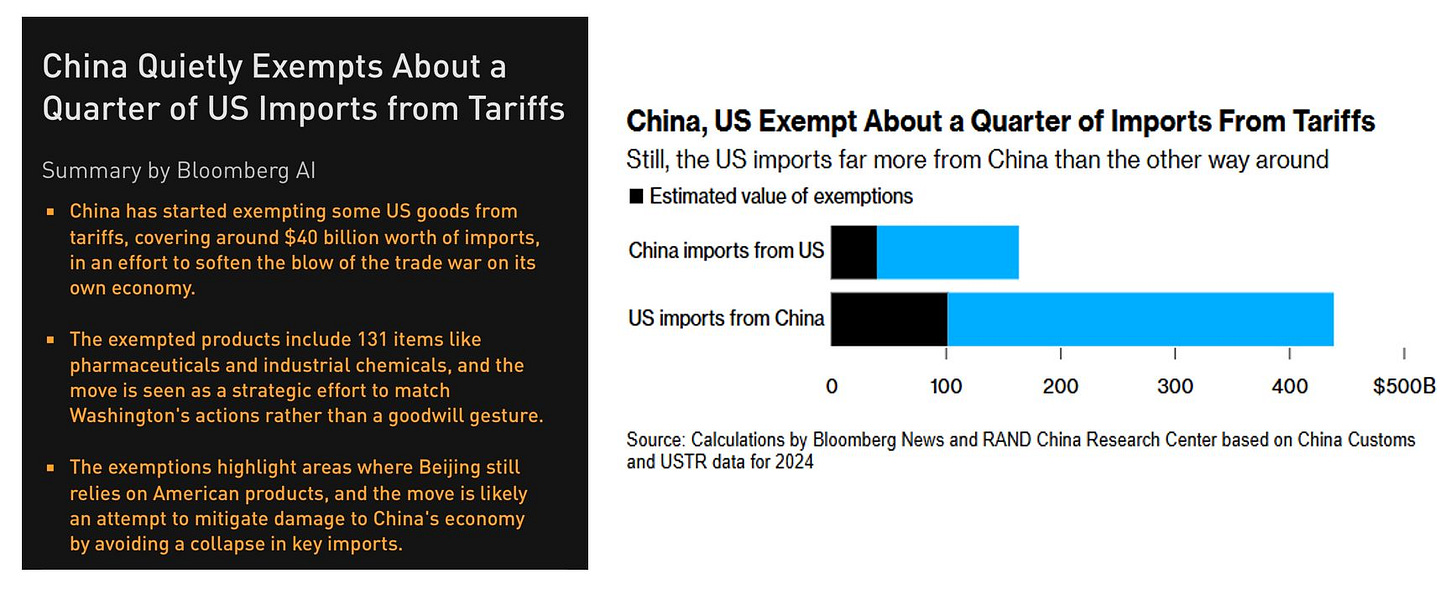

The White House has started to walk back parts of its tariff policy, introducing partial exemptions for U.S. automakers that rely on imported parts. Talks with India also appear close, hinting that other deals may not be far behind. Meanwhile, China says it is “evaluating the possibility of trade talks with the U.S.”—a notable shift in tone.

At the same time, signs of economic stress are mounting in China. Factory activity contracted in April, and exports have fallen 10% yoy—the sharpest drop in over 15 years.

Purchasing managers’ indices are back below 50, and Goldman Sachs estimates that up to 16 million Chinese jobs could be at risk if tariffs remain in place. Growth expectations have already been revised down to ~4%, well below the official 5% target.

In response, Beijing is readying exemptions on select U.S. goods and considering concessions on fentanyl precursor chemicals to help restart trade talks. These may seem like marginal moves, but they signal a broader willingness to de-escalate.

If even a few of these gestures lead to partial tariff rollbacks, one of the biggest overhangs on global markets could quickly become a tailwind.

Final Thoughts

All four upside catalysts are entirely plausible: strong earnings, a dovish Fed pivot, Trump’s proposed deregulation and tax cuts, and a possible trade thaw. And yet sentiment remains anchored in downside obsession.

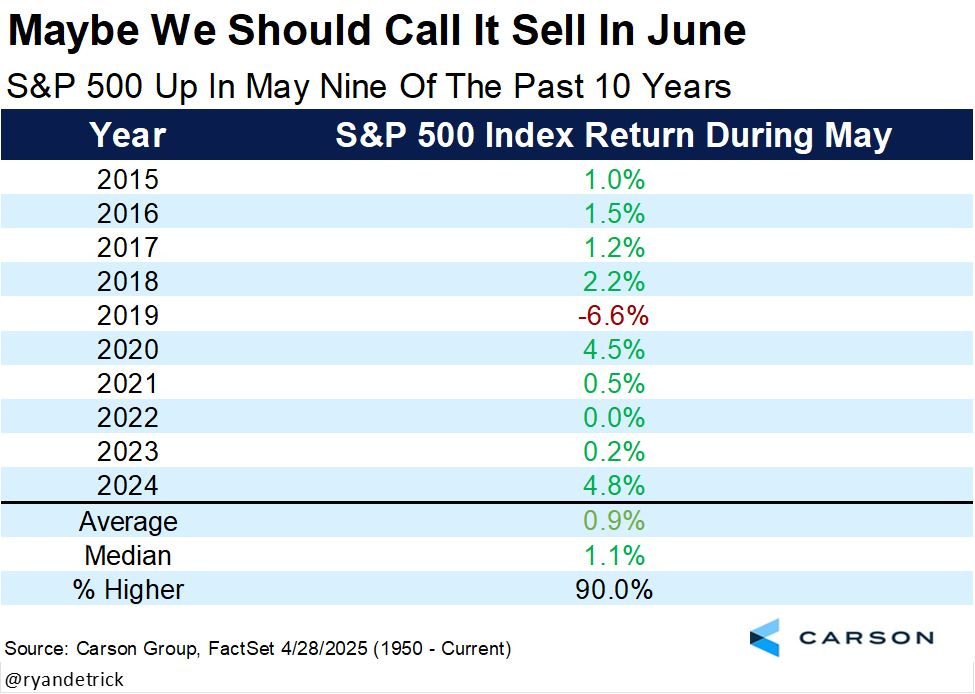

Markets may not be irrational. They may simply be underestimating how many things could go right. Thankfully, it’s still May—a month that’s defied the old adage 9 of the past 10 years. 😃

Feel the pulse, stay ahead.

Rahul Bhushan.