Europe’s Defense Paralysis, Palmer Luckey’s Anduril, and Market Turning Points – Letter #20

“The price of inaction is far greater than the cost of making a mistake.” – Meister Eckhart

Czar Nicholas II of Russia ruled the largest empire on Earth. For years, his authority seemed absolute, upheld by tradition, a vast bureaucracy, and a powerful army. But beneath the surface, the empire was unravelling.

Decades of economic mismanagement had left much of the population impoverished. Rapid industrialisation had created an urban workforce that was restless and radicalised. Military defeats in the Russo-Japanese War exposed Russia’s weakness, while World War I drained its resources and shattered public confidence.

When the 1917 revolution came, Nicholas had no power left to wield. Strikes and mass protests paralysed the country. His advisors abandoned him. His allies did nothing. He was forced to abdicate, and the once-mighty tsar became a helpless prisoner, awaiting his fate.

Instead of confronting Russia’s decline with decisive reforms or strategic alliances, Nicholas dithered. He issued half-hearted concessions that satisfied no one and left critical decisions to a bloated, slow-moving bureaucracy. The Russian aristocracy debated endlessly while the empire burned beneath them.

In July 1918, Nicholas and his family were executed in a basement, their deaths marking the final collapse of a dynasty that had ruled Russia for over 300 years.

Nicholas II didn’t lose his empire because of a single mistake. He lost it because he failed to recognise that power is meaningless if you cannot act.

In this week’s newsletter, we examine Europe’s defense paralysis, the rise of Anduril and Palmer Luckey’s impact on military innovation, and the evolving macro landscape—from liquidity shifts to inflation risks.

Europe’s Moment

The European Union today increasingly resembles Nicholas II’s Russia—bloated with bureaucracy, paralysed by indecision, and unable to defend itself even as threats mount on all sides.

The EU loves to talk about “strategic autonomy”. It drafts long reports on security challenges, holds countless summits on energy independence, defense policy, and economic resilience. But when the moment comes for action? Nothing happens.

Europe’s defense remains dependent on the United States. A new Military Balance report reveals that Russia’s defense spending (in PPP terms) now beats Europe’s combined budget.

Energy policy is reactive, not strategic. European energy prices remain 3-4 times higher than in the U.S., a handicap in industrial competitiveness.

Economic competition is met with regulation, not innovation. We’ve all seen the bottle cap meme.

At least Emmanuel Macron revealed a deepfake of himself ahead of the Paris AI summit, so if nothing else, Europe has a sense of humour!

But in all seriousness, the world is moving fast—China is reordering global trade, Russia is reshaping security dynamics, and the U.S. is prioritising its own interests. Meanwhile, Europe debates itself into irrelevance.

Power that cannot be wielded decisively is no power at all.

And institutions that cannot defend themselves do not survive.

The only question now is whether Europe will act—or wait for history to decide its fate.

Turning the Tide?

And yet, there are signs that Europe may finally be waking up to the urgency of its moment. Mario Draghi, in a hard-hitting piece for the Financial Times, exposed Europe’s economic vulnerabilities, highlighting how internal barriers are strangling competition and that intra-EU trade is half that of U.S. states. Without breaking down these structural obstacles, Europe risks becoming an economic backwater in a world increasingly shaped by industrial and technological power.

From Draghi’s column:

Meanwhile, the reality of Europe’s security dependence is hitting home. In the wake of Trump’s NATO comments and growing fears that U.S. protection is no longer guaranteed, key European states are scrambling to ramp up defense production and procurement:

Germany is reconsidering its rigid debt brake to fund military spending.

France is leading calls for greater EU-wide defense cooperation.

NATO’s European members are accelerating efforts to turn decades of underinvestment into real capability.

Then there’s AI. While the U.S. and China are pouring billions into AI infrastructure, Europe’s instinct has been to constrain. But this week’s Paris AI Summit suggests a realisation that leadership in AI will be determined by those who own the compute, talent, and foundational models.

After years of drift, there are signs of movement in Europe. I’m hopeful.

America’s Fragility

It’s easy to look at Europe’s situation and assume America stands in sharp contrast. But that illusion falls apart when you examine America’s ability to produce, particularly in the context of national defense. This also explains, to some extent, Trump’s Trumponomics.

The mindset that once turned the U.S. into the Arsenal of Democracy during World War II has been replaced by supply chains optimised not for resilience but for cost. Production lines are sluggish, fragmented, and incapable of rapid mobilisation.

Meanwhile, China’s defense-industrial machine operates at warp speed. They have 350 times the shipbuilding capacity of the U.S. In a prolonged conflict, they wouldn’t just match America’s output—they would replace every lost ship, missile, and drone within weeks. The U.S.? Years.

This isn’t the narrative most people want to hear. The prevailing story is that America is strong, its military unmatched, and its technological superiority insurmountable. But strength without industrial depth is an illusion. Ukraine has made this painfully clear—war today isn’t just about having the best weapons, but about the ability to sustain, replace, and scale them under real combat conditions.

The ability to manufacture at speed is power. Without it, everything else is just a matter of time before the cracks show.

Palmer Luckey

I don’t watch Shawn Ryan podcasts often, frankly, because they’re 3 hours long—and I have two kids, so I’d be lucky to get 30 minutes to myself. But this was an episode I watched end to end.

For those unfamiliar with Palmer Luckey, the guy is fascinating. He founded Oculus VR at 16, sold it to Facebook for $2 billion, then got fired. He then decided he wanted to look like the lead singer from System of a Down, before going on to build Anduril Industries—a company that is reshaping U.S. defense with autonomous warfare and AI weapons. He’s basically the modern-day Tony Stark.

During the podcast, Palmer goes deep on America’s inability to build things at scale. According to recent U.S. war games simulating a conflict over Taiwan, America would run out of missiles in less than 8 days. Let that sink in.

In other words, the world’s largest military wouldn’t be able to sustain high-intensity conflict beyond a week.

Which is his key point. This isn’t a defense problem—it’s a manufacturing crisis. The U.S. doesn’t just need better weapons; it needs faster, simpler, scalable production. For decades, the U.S. has fixated on building high-end, exquisite military hardware that takes years to produce, while China has figured out how to crank out ships, missiles, and drones at the speed of Shein dupe hitting the market.

Anduril Industries

I had the pleasure of talking to someone at the European Defense Agency last week. It was a fascinating conversation, and they were, of course, familiar with Anduril Industries. They noted Europe’s urgent need to coalesce private investment into defense start-ups and build a dedicated investor ecosystem. It was also acknowledged that this kind of innovation is unlikely to come from Europe’s incumbent giants.

Consider how Anduril is applying Tesla-style manufacturing to weapons production, using automation and modular design to build missiles in weeks, not years.

In this clip, Palmer describes running a sub 8-minute mile in an exoskeleton, a speed he normally can’t hit, thanks to AI-driven motion prediction that applies force to match his movements—like full-body power steering. He’s built a system that bypasses the body’s natural nerve conduction delays, letting him fire a trigger faster than his brain could send the signal down his arm. Instead of the command traveling through his spinal cord, he flexes a muscle on his face, which wirelessly fires a patch on his arm, instantly pulling the trigger. The implications are staggering—reaction times faster than humanly possible, more accurate shooting, and a future where weapons fire at the literal speed of thought.

In this clip, Palmer describes IVAS, a next-gen battlefield system that gives soldiers superhuman perception—essentially turning them into real-world versions of Superman. With augmented vision, they can see at night, through fog, and even detect thermal and hyperspectral signatures. It’s not just about vision—superhuman hearing, real-time target marking, and a fully integrated heads-up display mean that every soldier can instantly see where their teammates, enemies, and non-combatants are, seamlessly overlaid in their field of view.

If you want to understand what’s happening in the defense space in America—and how things can still turn around—this is the podcast to watch.

The Trump Effect

President Donald Trump made waves this week by announcing his intent to broker a nuclear arms deal with China and Russia—one that would ultimately see all 3 nations cut their military spending in half. It’s a bold proposition, and the odds of securing such an agreement are slim. But that didn’t stop markets from reacting.

Shares in Lockheed Martin, the largest U.S. defense contractor, tumbled nearly 5% in the wake of Trump’s comments.

RTX and Northrop Grumman—two other Pentagon heavyweights—dropped 4% and 7%, respectively.

But the bigger story isn’t just about whether this deal ever materialises. The Department of Defense, which commands an $849 billion budget, may be looking at belt-tightening long before Trump sits down with Xi Jinping or Vladimir Putin.

DOGE at the Pentagon

Trump has reportedly directed DOGE to turn its focus to the Pentagon, with officials bracing for an 8% budget reduction as Musk’s team conducts its audit.

Defense Secretary Pete Hegseth has already hinted at potential job cuts.

Some military branches are now preemptively reviewing their procurement plans, with certain equipment orders reportedly on the chopping block.

For years, both parties have criticised bloated defense programs plagued by cost overruns and underwhelming results. Even Elon Musk has publicly taken shots at the F-35, questioning whether its massive price tag is justified.

The Debt Dilemma

Despite the headlines about Pentagon audits and mass government layoffs, even aggressive spending cuts would barely make a dent in the U.S. fiscal trajectory. The Congressional Budget Office projects a $2 trillion deficit in 2024—roughly 7% of GDP.

The push for spending cuts might have a noble aim—to rein in deficits and bring fiscal discipline back to Washington—but the reality is far more complicated. Even if Trump’s administration follows through on reductions, the scale of the challenge remains overwhelming.

Meanwhile, the real issue isn’t spending cuts—it’s the sheer volume of debt that needs to be refinanced.

That’s where the real pressure lies. The U.S. must refinance 33% of its outstanding debt this year, meaning trillions in new bonds need to find buyers. And that brings us to the next question: where will the money come from?

The Liquidity Puzzle

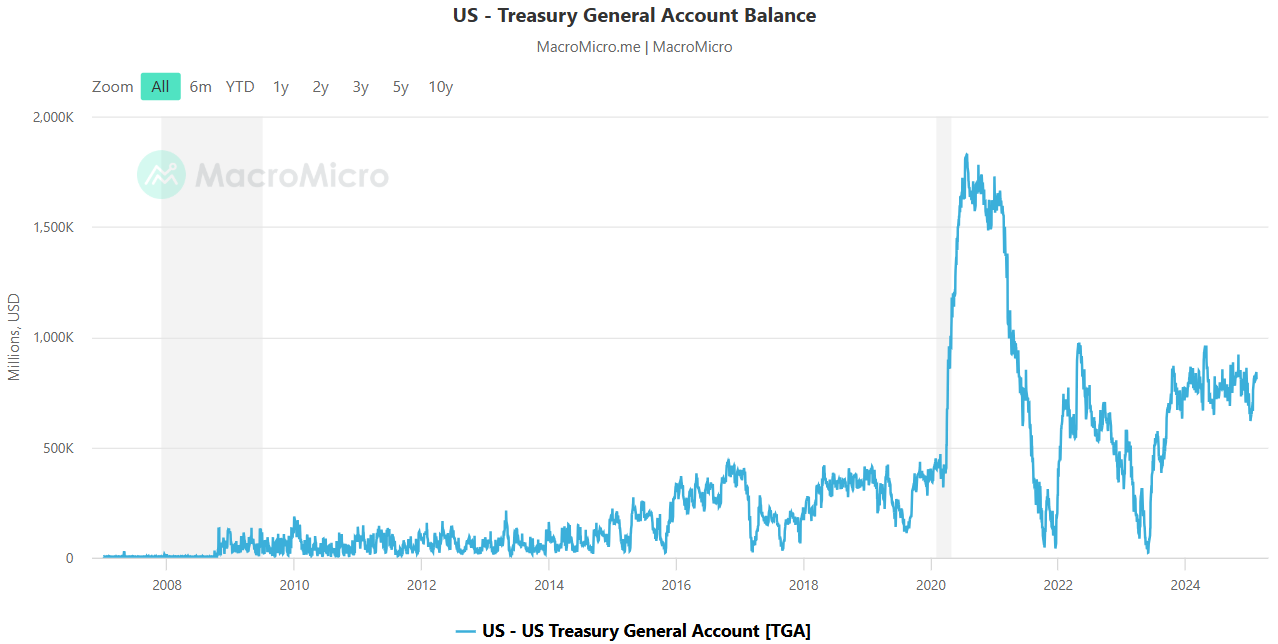

Markets have been fixated on AI and defense stocks, but another force has been quietly reshaping financial conditions: liquidity.

Michael Howell tracks the global liquidity cycle which, despite the Fed’s hawkish rhetoric, continues to expand.

In the U.S., quantitative tightening is now running on fumes. The reverse repo facility—which has been absorbing excess cash—is nearly drained. Once that buffer is gone, QT effectively ends. The Treasury General Account is also being drawn down, further injecting liquidity into the system.

And then there’s Scott Bessent, the man tasked with refinancing 33% of America’s outstanding debt in 2025. If foreign buyers don’t step up—and hedge funds remain unreliable long-term holders—the Fed may face a difficult choice:

Allow bond yields to spike, tightening financial conditions sharply.

Or quietly ease, providing enough liquidity to keep markets stable.

Meanwhile, in Canada, the Bank of Canada is running backdoor QE. In China, the PBOC is draining liquidity to prop up the yuan. Central banks talk tough, but in reality, they might increasingly resort to financial repression—forcing institutions to absorb government debt.

But liquidity won’t fix everything.

Inflation: A Stubborn Guest

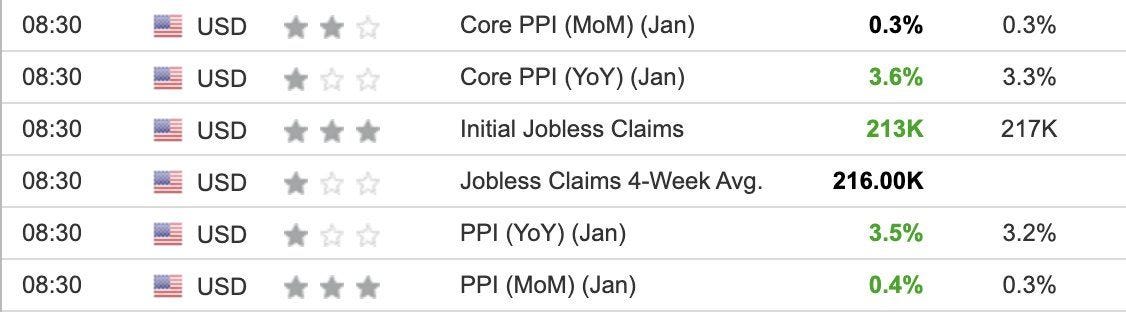

The real risk remains inflation. In the January CPI report, headline inflation rose 0.5% month-over-month, pushing the annualised rate back up to 3%—the highest since June.

Core inflation remains at 3.3%, suggesting that while food and energy are the main drivers, broader price pressures haven’t disappeared. And if historical patterns hold, inflation could reaccelerate into the summer.

This puts the Federal Reserve in a tight spot. Markets have priced in multiple rate cuts this year. But if inflation remains sticky—or worse, starts rising again—the Fed may be forced to push back on easing expectations.

The Markets vs. Reality

Despite all this, the S&P 500 continues to trade near all-time highs. A paradox? Maybe. But markets are forward-looking, and right now, they seem to be pricing in AI-fueled productivity gains, an eventual Fed pivot, and the resilience of corporate earnings rather than the structural risks building underneath.

Yet the divergence between financial markets and economic fundamentals is growing. New tariffs on aluminum and steel are set to fragment global trade and squeeze U.S. manufacturers. A tightening labour market, fueled by mass deportations, could trigger unexpected inflationary shocks. And an economy running on deficit spending means the Treasury will need to sell a staggering amount of debt into a bond market already struggling with weak demand.

So far, markets have taken all of this in stride. Inflation surged to 9% two years ago, and investors stayed trusted the Fed to manage it. That trust paid off—disinflation followed without a recession. But can they be so sure this time?

One indicator flashing red: two-year inflation expectations have detached from oil prices, drifting higher. That’s not what you want to see if you believe inflation is under control. Meanwhile, gold, the quintessential uncertainty hedge, is at all-time highs, and demand is so strong that banks are reportedly flying gold bars on commercial airlines to exploit pricing mismatches between New York and London.

If this is what smooth sailing looks like, what happens when the tide turns?

Feel the pulse, stay ahead.

Rahul Bhushan.