How To Buy Greenland, The Market, and AI Agents – Letter #16

“All great change is preceded by chaos.” – Deepak Chopra

Welcome to the first newsletter of 2025! It’s only mid-January, but the year has already brought plenty to consider. Here’s to an exciting year of discovery and perspective. I hope you enjoy this first edition.

The ship cut through the choppy seas, its wooden hull creaking against the waves as Erik the Red of Iceland steered it toward the distant, snow-capped shore. The air was cold, biting even, but the horizon ahead promised something new. Erik had been exiled for manslaughter and a series of disputes that had forced his banishment. Now, driven by the promise of a fresh start, he sailed westward, seeking a land where he could rebuild his life, away from the grudges of the past.

After weeks of navigating treacherous waters, his eyes finally caught sight of the shore—a vast, icy expanse of untamed wilderness. He anchored his ship in a sheltered cove. As the crew disembarked, Erik took his first steps onto the rocky shore. The land was wild and uninviting, with glaciers hanging off towering cliffs and jagged rocks scattered along the coastline. But Erik, ever the optimist, didn’t see this harshness as a deterrent. He saw potential. He named the land “Greenland”.

A Brief History of Greenland

After Erik the Red’s arrival in the 10th century, Greenland was settled by Norsemen. The settlers established farms and small communities, relying on livestock and fishing for survival. However, the colony struggled with Greenland’s harsh environment, and by the 15th century, the Norse settlements had disappeared.

Greenland remained isolated until 1721, when Dano-Norwegian missionary Hans Egede arrived and founded Godthåb (modern-day Nuuk). His mission to convert the Inuit also marked the beginning of Denmark’s involvement in Greenland, which became part of Denmark’s colonial empire, focused on whaling, fishing, and trading.

Greenland’s strategic importance grew during World War II when the U.S. established military bases there after Denmark was occupied by Nazi Germany. In 1953, Greenland was formally integrated into Denmark as an official county, and over time, Denmark invested in modernising its infrastructure.

In 1979, Denmark granted Greenland Home Rule, giving it more autonomy over internal matters. In 2009, Greenland gained greater self-rule through the Greenland Self-Government Act, gaining control over natural resources and expanding political autonomy. Today, Greenland remains part of Denmark, but its relationship with the Kingdom continues to evolve.

Land of Impermanence

Greenland has always been shaped by change. From its early days as a Norse settlement to its current geopolitical significance, the island has continuously evolved, influenced by both nature’s forces and shifting political interests. Once defined by its vast, unyielding ice sheet, Greenland is now witnessing rapid melting, contributing to rising sea levels. As the Arctic becomes more accessible with warming, Greenland finds itself at the centre of a new geopolitical battle, with nations vying for access to its untapped resources and newly viable shipping routes.

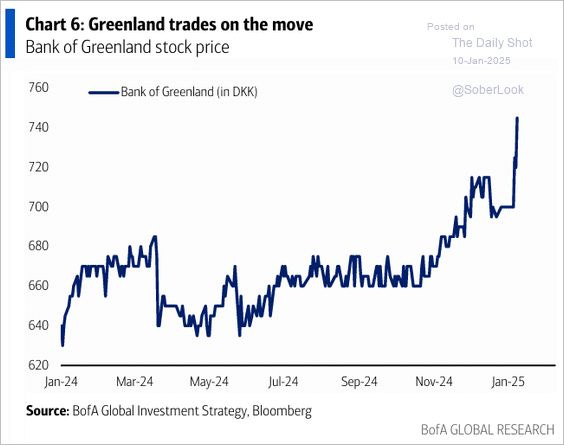

Bank of Greenland’s share price reacts to U.S. interest in the territory:

How To Buy Greenland

Of course, I couldn’t resist researching how President-elect Donald Trump might go about purchasing Greenland, given its strategic value with rare earths, oil, and gas. However, as The Wall Street Journal points out, buying Greenland isn’t as simple as just signing a check.

Here’s the breakdown:

Navigating Danish Diplomacy: Any attempt to purchase the island would require Denmark’s approval before any discussions could even begin.

Greenland’s Independence Movement: Greenland is moving toward greater autonomy, with some even pushing for full independence. Greenland’s government has firmly stated, “It’s not for sale.“

U.S. Congress Approval: Even if Trump could strike a deal with Denmark, it would need to be approved by Congress. Any purchase of foreign territory requires a treaty ratified by two-thirds of Congress. The U.S. paid the Russians $7.2 million for Alaska in 1867.

Economic and Military Coercion: If diplomacy fails, Trump hasn’t ruled out using tariffs on Denmark, or military action to sway the deal. Alternatively, the U.S. may pursue economic or military cooperation with Greenland, rather than outright ownership—which, to me, seems like the most plausible outcome.

While the idea of a U.S. purchase of Greenland seems far-fetched, the notion is not completely out of the realm of possibility. In this age of climate change and geopolitical competition, the island finds itself at the crossroads of history once again.

Greenland’s Armed Forces preparing for annexation:

Flipping the script.

Beyond Forever: The Economics of Impermanence

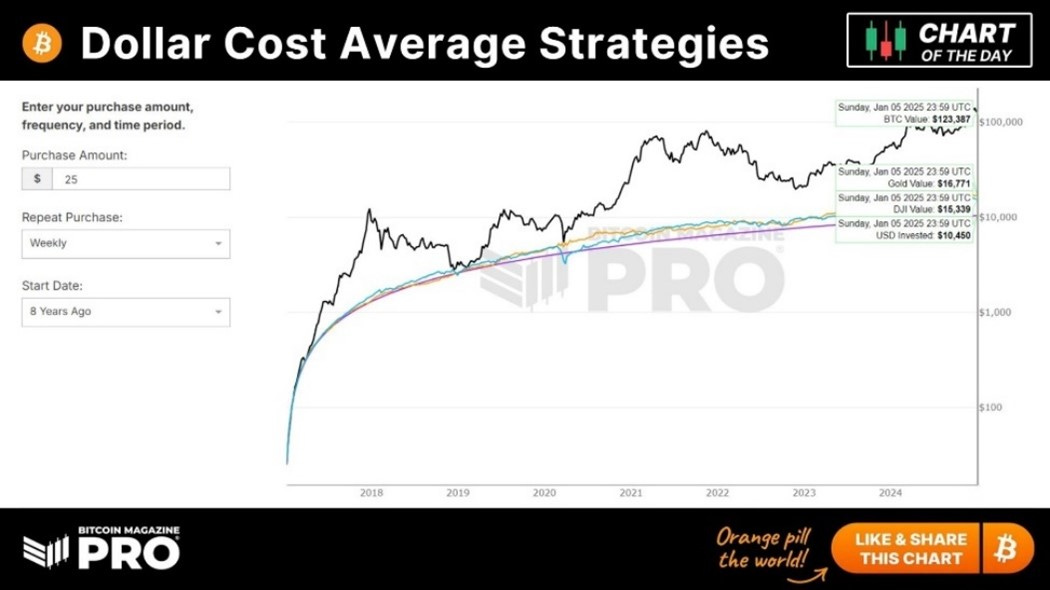

If you had started dollar-cost averaging in 2017 with just $25 a week, your $10,450 investment would have returned:

⛏️ Gold: $16,770.50

🏦 Stocks: $15,339.39

🔥 Bitcoin: $123,386.57

But had you put that same amount into diamonds, your $10,450 would have returned:

💎 Diamonds: Less than $8,000.

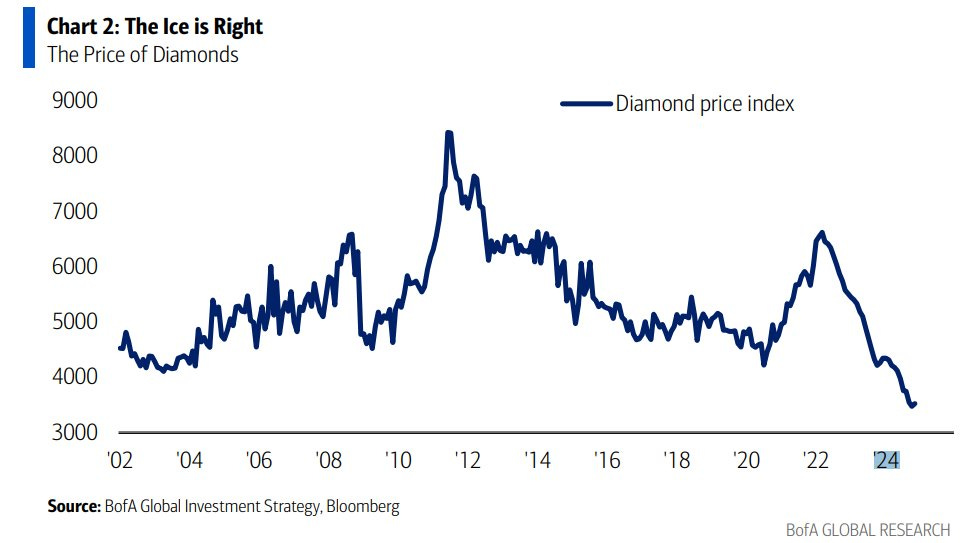

Diamond prices are currently at their lowest level this century, per Bank of America:

So, what happened? Weren’t diamonds supposed to be forever?

On December 14, 1971, Hollywood released Diamonds Are Forever, featuring Sean Connery—undoubtedly the best James Bond in cinematic history (I know this might lose me a few followers, but if Mark Zuckerberg taught us anything this week, it’s that honesty should go beyond what’s conveniently self-serving). The film paints a picture of diamonds as the ultimate symbol of wealth and permanence.

Yet, just three months earlier, on August 15, 1971, President Nixon ended the gold standard, marking the collapse of the Bretton Woods system and triggering far-reaching shifts that continue to shape the global economy. The decision to sever the U.S. dollar’s link to gold sparked seismic economic change that continue to reshape our world today.

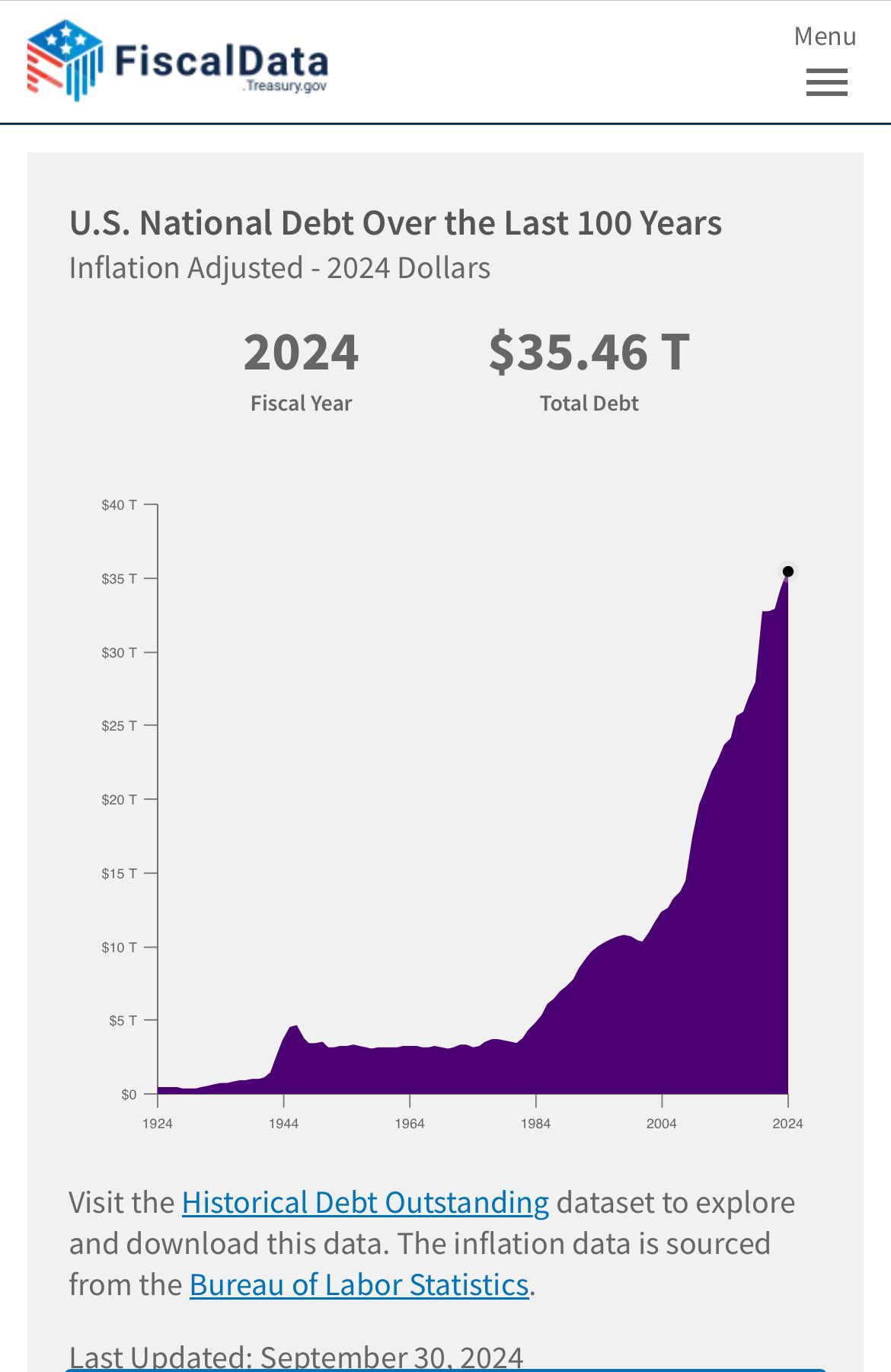

Since then, the money supply has skyrocketed…

Deficits have exploded…

Debt has ballooned…

It turns out, no party can go on forever…

U.S. 10-year Treasury yields hit 4.7% on Friday, their highest levels in 14 months!

Last Tuesday, the U.S. government’s monthly auction of 10-year notes drew the highest yield since 2007 at 4.68%!

Many argue that this underscores the need for the Federal Reserve to slow the pace of its rate cuts.

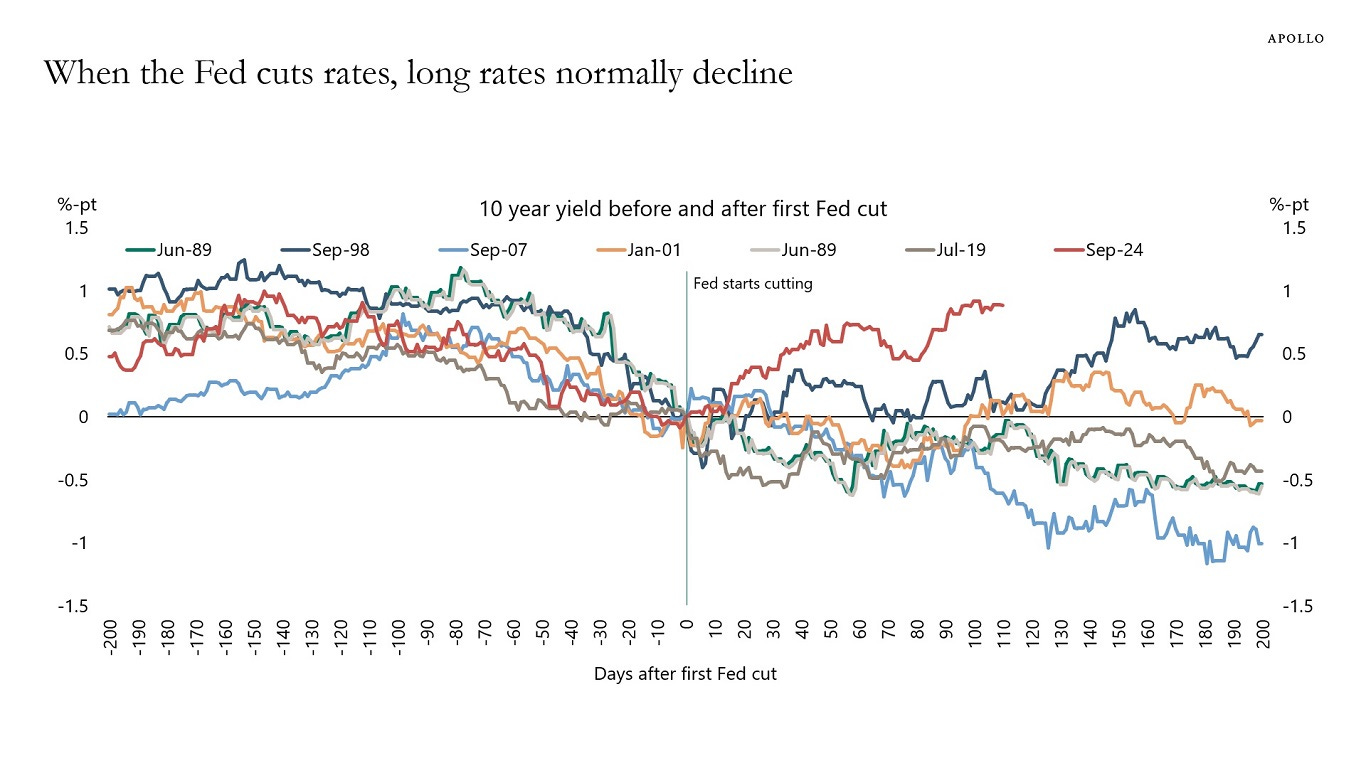

Why? Because historically…

But this time, the opposite is happening, despite the fact that…

We’ve had a stronger-than-expected payrolls report, showcasing unexpected resilience in the U.S. job market. Employers added 256,000 jobs in December 2024, marking the highest gain in nine months and surpassing forecasts of 160,000, while the unemployment rate dipped from 4.2% to 4.1%.

Additionally, U.S. employers were advertising more job openings at the end of November than predicted, while sectors such as finance, retail, and other services experienced faster-than-expected growth in December.

According to the Atlanta Fed, real economic growth stands at 2.7%.

Corporate profits are near all-time highs as a share of GDP.

And, S&P weekly forward profit margins are at record high levels.

Diamonds may not be forever, but America’s ability to sustain excellence is timeless.

The Age of AI Agents

America’s enduring pursuit of excellence is reflected in its pursuit of AI.

Sam Altman set the tone for the future at CES this past week, declaring that OpenAI is “confident in how to build AGI” and is now pushing the boundaries toward superintelligence. His vision speaks to AI entering a new chapter where its capabilities will redefine industries. Nvidia’s Jensen Huang echoed this sentiment, describing this moment as a turning point for robotics and the advent of “agentic AI”—systems designed to act autonomously, adapt to their environments, and solve problems independently.

These systems go beyond today’s co-pilot tools, handling complex tasks with little to no human intervention. Altman envisions a future where a single individual, equipped with a network of intelligent agents, could create billion-dollar ventures. Huang foresees a workforce augmented by digital assistants, with millions of AI systems working in tandem with human employees.

AI agents are also proving their value in enterprise. Microsoft’s Copilot Studio, for example, has allowed McKinsey to slash project intake times from 20 days to just two. In science, researchers at Stanford employed agents to generate 92 potential nanobody designs for COVID-19 treatment.

Altman anticipates that even skeptics will be surprised by the leaps these systems achieve in the coming year. Let’s keep our eyes and ears peeled.

Final Thoughts

In nature, markets, and technology alike, the question isn’t whether things last forever—it’s how we adapt when they invariably change. As investors, embracing this impermanence can help us position not for eternity, but for opportunity.

Feel the pulse, stay ahead.

Rahul Bhushan.

Great read, once again !