Larry David’s Guide to AI, Trade Wars, and Unintended Consequences – Letter #18

“A good compromise is when both parties are dissatisfied. That’s when you know you have a deal.” – Larry David (Curb Your Enthusiasm)

A warm welcome to all new subscribers. Your support is hugely appreciated. I look forward to your comments and feedback on this week’s newsletter.

This week’s events made me recall one of my favourite episodes of Curb Your Enthusiasm. In this episode, Larry David, fuelled by equal parts indignation and delusion, embarks on a completely unnecessary but deeply personal crusade against the most sinister of foes—coffee.

It all starts with a seemingly trivial grievance. Larry walks into Mocha Joe’s, a local coffee shop, expecting a decent cup of coffee and a pastry. The coffee is lukewarm. The scones are too soft. The seating is wobbly. He points it out, naturally.

Mocha Joe does not take criticism well. He snaps back, dismisses Larry’s complaints, and then—the ultimate insult—he bans him from the store.

Most people would shrug it off and move on. But Larry isn’t most people.

And so, in a fit of entrepreneurial pettiness, he does what any rational person would: he opens his own coffee shop—directly across the street. Its entire existence is an act of defiance. It is Latte Larry’s, a shrine to perfection, a declaration of war against Mocha Joe.

• The coffee? Piping hot—scalding, even.

• The scones? Crispy.

• The furniture? Ergonomic.

• The floors? So clean, customers are forced to wear protective booties.

And for a while, it works. Latte Larry’s becomes a hit. Mocha Joe seethes. The battle lines are drawn.

But then, slowly, the cracks begin to show.

Larry’s obsession with outdoing Mocha Joe starts to spiral.

• The floors are too clean—so sterile it makes customers uneasy.

• The coffee is too hot—people burn their tongues.

• The atmosphere is too controlled—more laboratory than café.

What started as a battle of wills turns into a self-inflicted catastrophe.

And in the end? It all burns down—literally. Latte Larry’s catches fire, and in the chaos, Mocha Joe’s is destroyed too.

Nobody wins.

The moral of the story?

DeepSeek: Nvidia Killer to GPU’s Best Friend

The LOL of my week:

“If I had a dollar for every DeepSeek ‘expert opinion’ floating around, I could train DeepSeek.”

On Monday last week, Chinese AI firm DeepSeek released an open-source reasoning model (R1) that was both remarkably powerful and incredibly cheap—a combination that sent shockwaves through the AI world.

For geopolitical analysts, this initially looked like a strategic power play: if China wasn’t going to dominate AI, its next best move was to ensure no one else could either. By open sourcing such an advanced model, DeepSeek effectively undermined the competitive advantage of proprietary AI firms like OpenAI, making cutting-edge AI freely available to all and reducing the strategic leverage of U.S. firms.

For Silicon Valley insiders, however, the move was interpreted differently—as a radical push to keep AI in the hands of the public rather than concentrated within a single corporation. In some ways, releasing such an advanced model as open-source sets off a chain reaction of mutually assured destruction for closed-source AI. If a model this powerful is free, it forces competitors to rethink their business models, accelerating the race toward open access whether they like it or not.

Then came the twist.

At first, it seemed like DeepSeek was rewriting the AI playbook:

DeepSeek was quickly crowned the “Nvidia killer”. If AI models could be trained this efficiently, the assumption that Nvidia’s pricey GPUs were the only way to scale AI seemed increasingly uncertain.

But, as is often the case with too-good-to-be-true stories, cracks began to appear.

The first sign of trouble came when Scale AI’s CEO Alexander Wang revealed in Davos that DeepSeek had access to at least 50,000 Nvidia H100 GPUs.

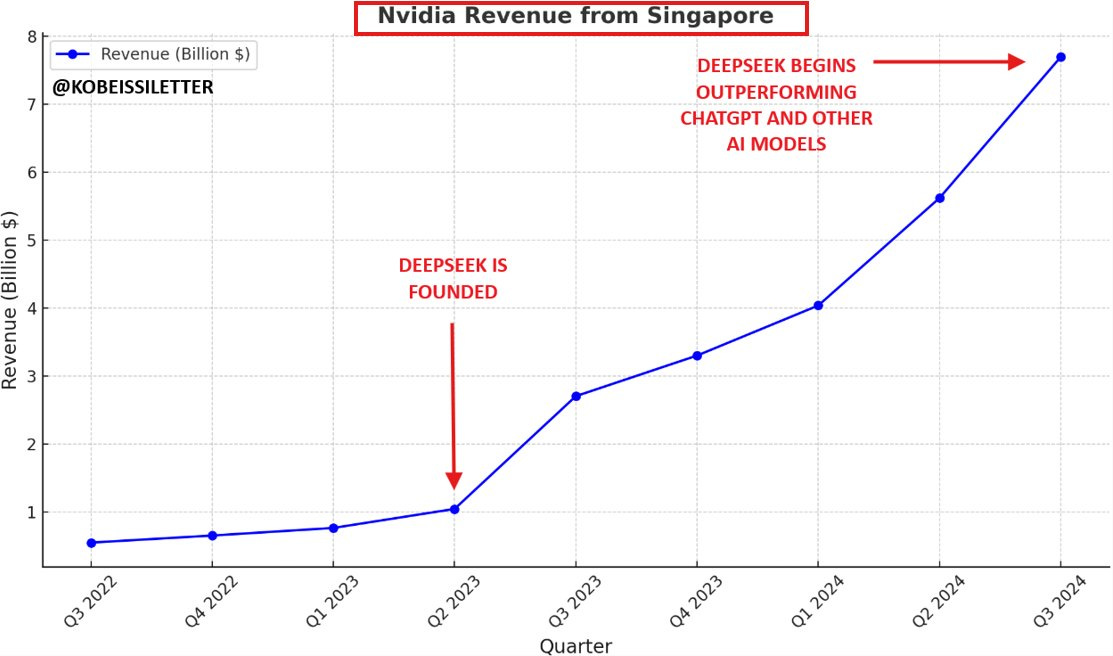

Then, the second blow: The Kobeissi Letter published a chart showing Nvidia’s sales to Singapore had surged a whopping +740%, suggesting that DeepSeek might be sidestepping sanctions through third-party channels.

The third revelation came from SemiAnalysis’ Dylan Patel, who uncovered that DeepSeek’s compute cluster likely cost over $1 billion—far more than the reported $6 million. So much for the “cutting-edge” narrative.

Within days, the story had done a full 180. The only thing certain now? The race for AI supremacy just got a whole lot more interesting.

Bill Jevons and the Paradox of the Bottomless Buffet

One of the discussions percolating on social media this week centers around William Stanley Jevons, a 19th-century British economist and logician, best known for his paradox: when something becomes cheaper and more efficient, demand for it actually increases.

It’s possible this is where we are in the race for AI.

Retail certainly appears to think so:

Consider this chart from Goldman Sachs: Only 6% of U.S. companies currently report using AI. Cheaper AI will mean more AI adoption.

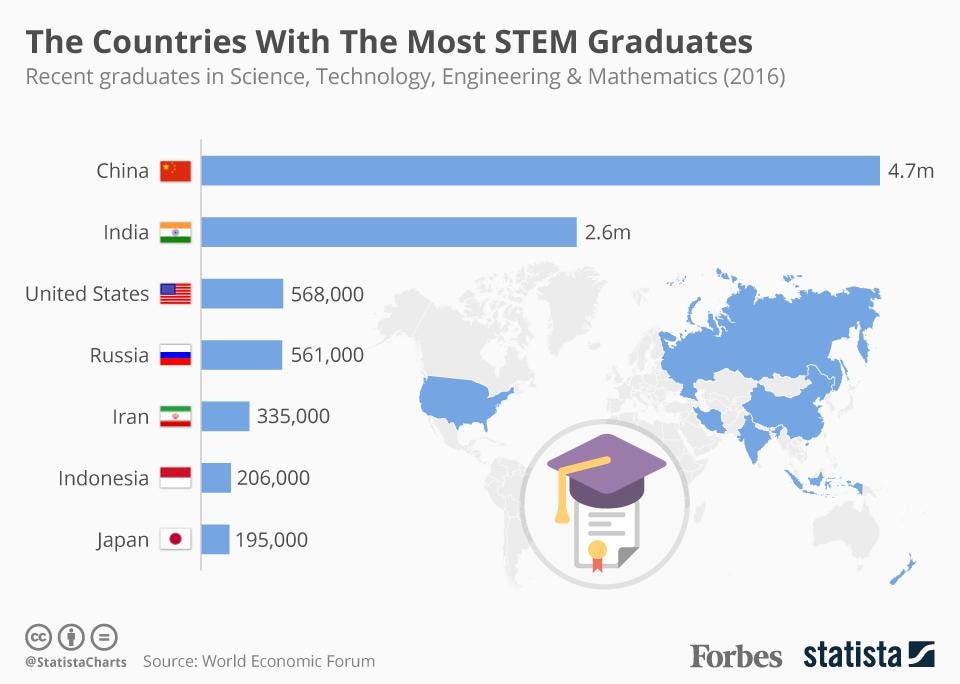

Now, look at this chart from Gavekal, which shows that China produces as many engineering graduates as the next 4 countries combined.

It’s pretty clear to me—if anyone can produce cheaper AI, it’s the Chinese.

Trump’s Tariff War: A Game of Pointless Escalation?

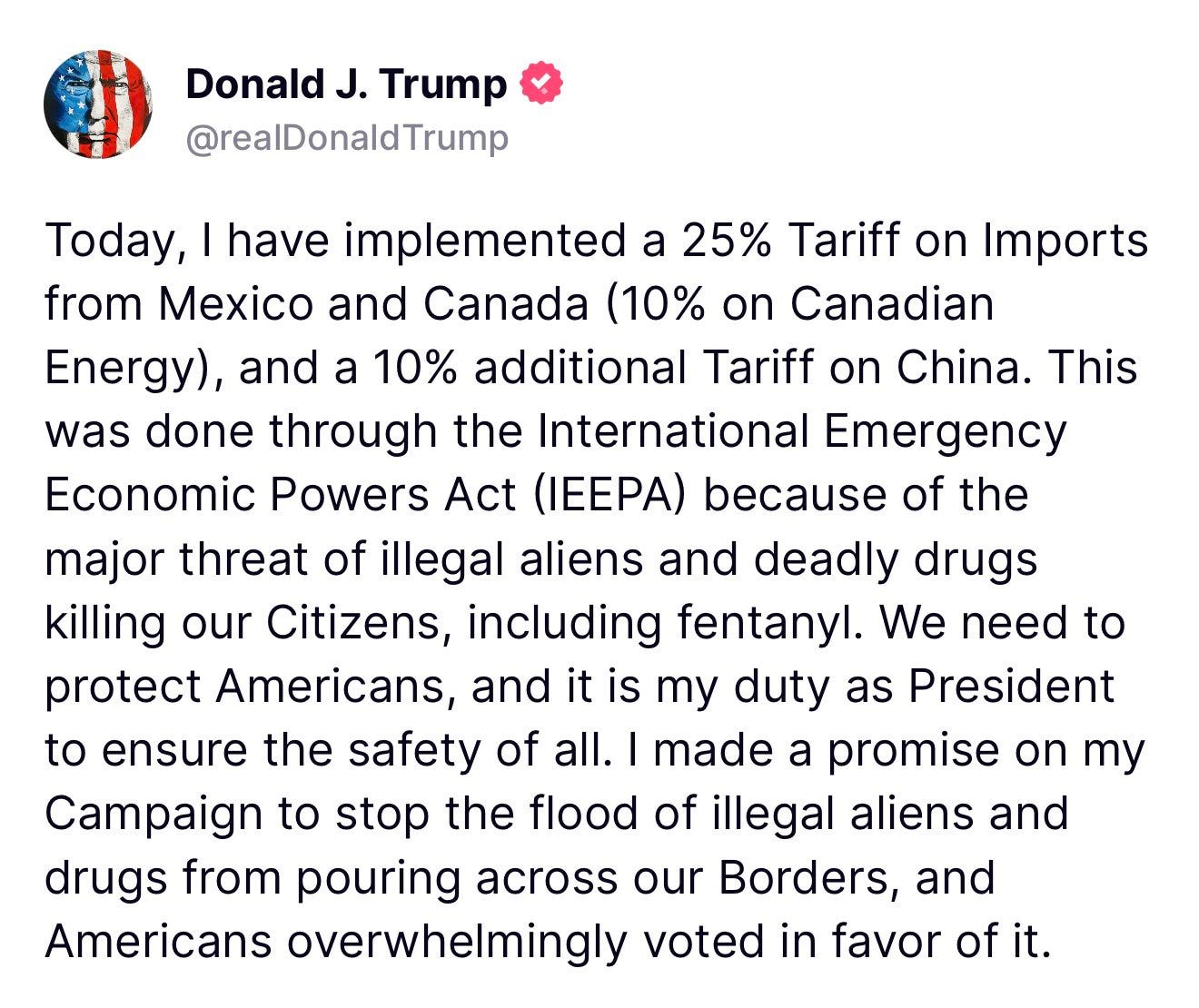

So it begins. On Saturday, Donald Trump signed the executive orders to launch his much-anticipated trade wars, a cornerstone of his second presidency. Canada and Mexico will be hit with immediate 25% tariffs on nearly everything except oil, which will face a 10% tariff. Chinese imports, meanwhile, will face an extra 10%. As the Wall Street Journal pointed out, the scale of these tariffs in dollar terms far exceeds anything Trump imposed in his first term.

Trump claims the tariffs are a response to illegal immigration and the fentanyl crisis flooding across U.S. borders. The tariffs are framed as a negotiating tactic, designed to force action from Mexico and Canada. However, many are sceptical of this reasoning, with Paul Krugman pointing out that calling fentanyl the “real reason” is just as plausible as the WMDs justification for Iraq. For Trump, the underlying motivation might just be the imposition of tariffs themselves—asserting dominance and power.

How have Canada, Mexico and China responded?

Up to now we’ve only seen Canada retaliate with 25% tariffs on approximately $105 billion worth of American goods. Mexico has vowed to respond but has yet to specify its targets. Meanwhile, Beijing has announced plans to challenge the tariffs at the WTO—a largely symbolic move—while also preparing unspecified “countermeasures” in response to the levies.

Lessons from China’s 2018 playbook

Robin Brooks argues that these countermeasures are mistakes, suggesting that Mexico and Canada would be better off avoiding retaliatory tariffs. He points to China’s 2018 response, where it allowed its currency to depreciate, fully offsetting U.S. tariffs without escalating the trade war. This approach, he contends, protected Chinese exporters while minimising broader economic fallout. Brooks implies that instead of engaging in tit-for-tat measures, Mexico and Canada should adopt a similar strategy—letting their currencies depreciate to absorb the tariff impact rather than imposing counter-tariffs that could further escalate tensions.

This is because U.S. exports to Mexico and Canada amount to approximately $320 billion and $360 billion, respectively—less than 2.5% of U.S. GDP. In contrast, these exports represent 20-30% of Canada and Mexico’s GDP, making the trade war inherently lopsided. Moreover, U.S. exports to Mexico and Canada account for approximately 16% and 17% of total U.S. annual exports, respectively. Meanwhile, Mexico and Canada’s exports to the U.S. make up a staggering 78% and 77% of their total annual exports, underscoring their deep trade reliance on the U.S. and the asymmetric risks of escalation.

What are the anticipated impacts? A tale of two perspectives

Mohammed El-Erian has offered a game-theory perspective on Trump’s tariff policy, arguing that the U.S. stands to gain in the short term due to its economic strength. The key question, he notes, is whether these gains materialise immediately or only after resistance from other nations fails.

However, if tariffs become a “repeated game”, the long-term outlook worsens, as countries will seek to reduce reliance on the U.S., accelerating the fragmentation of a global economic order that has historically benefited America. While trade weaponisation may yield short-term advantages, its sustained use risks undermining U.S. economic dominance.

My $0.02?

The U.S. dollar has appreciated amid recent reciprocal tariff actions. Reflecting on the 2017–2018 period, it’s plausible that escalating tariffs may suppress economic growth more than they contribute to inflation. During that time, price increases were mitigated by currency fluctuations and reduced profit margins, resulting in a smaller-than-expected rise in PCE goods inflation. A similar scenario now could lead to a deceleration in growth, and potentially lower long-term bond yields (!).

In Case You Missed It…

On Tuesday, January 28, 2025, the aviation world celebrated a pivotal moment as Boom Supersonic’s XB-1 demonstrator aircraft successfully broke the sound barrier during a test flight at California’s Mojave Air & Space Port. Piloted by Chief Test Pilot Tristan “Geppetto” Brandenburg, the XB-1 ascended to an altitude of 35,290 feet and achieved a speed of Mach 1.122 (750 mph), marking the first time a privately developed civil supersonic jet has reached such speeds.

This achievement not only revives the legacy of the Concorde but also signifies a significant step toward the future of commercial supersonic travel. Boom Supersonic’s ultimate goal is to develop the Overture airliner, designed to carry 64 to 80 passengers at speeds of Mach 1.7 (approximately 1,300 mph). This would drastically reduce flight times, making journeys like New York to London possible in about three and a half hours. The company has already secured 130 orders and pre-orders from major airlines, including American Airlines, United Airlines, and Japan Airlines.

Final Thought

In 1961, two proud nations—France, led by the war hero Charles de Gaulle, and Brazil, under President Jânio Quadros—nearly went to war over something that most of us would consider far less than a matter of national security: lobsters.

The dispute began in the rich, lobster-filled waters between Brazil and France. Brazil claimed that these lobsters, living on its continental shelf, were part of its territorial waters and, therefore, its rightful property. France, however, argued that since lobsters swim, they should be treated like fish—free to be harvested by any nation with a fishing boat and a net.

What followed was a surreal escalation. The diplomatic rows became so heated that both nations deployed warships to the region. Brazil sent warships to assert its control over the disputed waters, while France responded by deploying its own naval forces. In what seemed like a farcical overreaction, both countries even threatened to go to war.

Thankfully, no violence ensued, and the dispute was eventually resolved diplomatically. Today, the Lobster War stands as a symbol of how small, seemingly ridiculous issues can escalate into full-blown diplomatic crises. And, perhaps more importantly, it showed the world that even warships can be mobilised for a fight over dinner.

Feel the pulse, stay ahead.

Rahul Bhushan.