Paw Patrol, DOGE Casualties, Nvidia GTC, OpenAI Voice, xAI vs Hollywood, A $1.4 Trillion Bet, and Powell's Poker Face – Letter #24

"Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria." — Sir John Templeton

Do you know what Paw Patrol is? If you don’t, consider yourself one of the blessed few. For the rest of us, it’s the soundtrack to our slow descent into madness…

My son has decided that playing Paw Patrol is a full-time occupation, and there’s no such thing as an off day. Whether it’s a daring rescue mission or just running around pretending to be Chase, it’s non-stop action from the moment he wakes up to the moment he’s reluctantly dragged to bed.

And it’s not just my son. It feels like every parent I talk to is stuck in the same doom loop. These fearless little pups and their endless supply of gadgets have kids everywhere hooked. Maybe it’s the way they make every problem seem solvable, even if it’s just rescuing a runaway chicken. I must’ve clocked so many pretend rescue missions by this point that I’m pretty sure I deserve a lifetime achievement award. (“No job is too big, no problem too small!”)

This week, I discovered that the writers have introduced a Robo-Dog. Just when I thought I had the Paw Patrol universe figured out. It turns out they’ve been a step ahead all along—bringing in autonomous rescue while the rest of us are still debating the future of AI. Makes you wonder—are they low-key preparing our kids for the world they’ll be living in?

Either way, it got me thinking about the big themes in AI and robotics that unfolded last week—a week unlike any I’ve yet seen—themes that might just be as transformative as a four-wheeled, bionic Jack Russell joining a viral kid’s cartoon.

Let’s dive in, as Zuma would say. (Oh God, I really need help.)

Just A Casual $1.4 Trillion U.S. Dollars

On Friday, the UAE announced that it would be investing a jaw-dropping $1.4 trillion in the U.S. over the next decade. The commitment came after a meeting between President Donald Trump and UAE’s national security adviser Sheikh Tahnoon Bin Zayed Al Nahyan. According to the White House, the pledge will significantly boost the UAE’s existing investments in key areas of the U.S. economy, including AI infrastructure, semiconductors, energy, and manufacturing.

It’s a colossal bet on America’s economic resilience and technological leadership—essentially doubling down on the sectors expected to shape the future. At a time when geopolitical alliances feel increasingly fluid and economic uncertainty looms large, this kind of long-term commitment stands out. Whether it proves to be a masterstroke or just another diplomatic headline remains to be seen, but for now, it’s one of the boldest statements of confidence in U.S. innovation we’ve seen in a while. Guess bold moves don’t need a suit—just a solid pair of sunglasses 😎

Are We Ready for the Robotic Revolution?

But that’s not all—last week felt like the future crashing into the present with a tidal wave of innovation from every corner of the AI and robotics landscape. Nvidia, Baidu, OpenAI, xAI, and even Boston Dynamics all seemed to have synchronised their product drops. The message is clear: we’ve already crossed the threshold into the robotic era.

Nvidia’s AI Dominance

Jensen Huang took the stage at GTC 2025—leather armour on, radiating calm authority—with a declaration of intent. Nvidia is positioning itself as the AI infrastructure juggernaut. Huang’s message was clear: The global buildout of AI infrastructure will benefit every company and country striving for economic growth. He emphasised that the pace at which AI is becoming useful is accelerating rapidly, with breakthroughs emerging at a rate that even the most optimistic forecasts couldn’t predict.

“This is where almost the entire world got it wrong… the scaling law of AI, is more resilient, and in fact, hyper accelerated. The amount of computation we need, at this point, as a result of agentic AI… is easily 100 times more than we thought we needed, this time last year.” – Jensen Huang

To punctuate this message, Huang introduced Blue—a nimble, Star Wars-inspired robot developed by Disney Research and powered by Newton, an open-source physics engine created in collaboration with Nvidia and Google DeepMind. Blue captivated the audience by performing a series of complex tasks, including navigating the stage autonomously, interacting with objects, and responding to Huang’s commands with precise movements. The aim is to teach robots to think about how they move—not just moving efficiently, but moving intelligently.

Nvidia also unveiled GR00T N1, an open foundation model designed to advance humanoid robot development. GR00T N1 is a blueprint for creating robots capable of interpreting their environment, reasoning, and taking purposeful actions—setting the stage for a new generation of intelligent machines. At the conference, the humanoid robot NEO Gamma, developed by 1X Technologies, showcased its abilities by vacuuming the floors with impressive precision, demonstrating GR00T N1’s real-world application. Let’s just hope these robots won’t hold a grudge about all the vacuuming…

Of course, Nvidia being Nvidia, they flexed some hardware muscle too. Huang revealed DGX Spark, the world’s smallest AI computer with 128GB of memory, and DGX Station, a 20-petaflop powerhouse with 72 CPU cores. Looking ahead, Nvidia unveiled a roadmap featuring Blackwell Ultra (2025), Rubin (2026-27), and Feynman (2028), cementing its intent to remain the dominant force in AI compute.

The new Blackwell GPUs are set to deliver a staggering 68-fold performance boost over Hopper, all while cutting costs by 87%. Further down the line, the Rubin chip is expected to take performance to another level, offering a 900-fold improvement with a 99.97% reduction in cost.

These kinds of leaps are critical, given that single agent tasks are now consuming around 1,500 times more tokens than standard chat applications.

DeepSeek Pioneers, Baidu Accelerates

Baidu unveiled ERNIE 4.5, a multimodal model that achieved performance on par with GPT-4.5 at just 1% of the cost, along with ERNIE X1, a reasoning AI that rivals DeepSeek’s R1 at half the price. This move has underscored China’s focus on efficiency and affordability—an approach aimed at democratising access to powerful AI rather than solely chasing breakthrough performance.

Renowned AI investor and entrepreneur Kai-Fu Lee, a leading voice on the future of technology, weighed in on the debate between closed and open source. He asserted that open source had won, emphasising its pivotal role in driving innovation. Lee noted that DeepSeek had an operating cost in 2024 that was roughly 2% of OpenAI’s, managed by a lean team of just 160 employees compared to OpenAI’s 2,000.

Meanwhile, DeepSeek’s billionaire founder, Liang Wenfeng, is reportedly deliberately limiting commercial activities. Content with breaking even, his strategy focuses on cutting-edge research rather than rapid productisation—a model that appears to be defining the competitive landscape in AI.

OpenAI’s Voice Revolution

OpenAI made inroads into humanising machine communication with its latest release of three API-based models for audio agents. At the forefront was GPT-4o-mini-tts, an advanced text-to-speech model that adapts its speaking style based on prompts. Whether delivering a news report with gravitas or recounting a story with warmth and enthusiasm, this model blurs the line between synthetic and human voice. We’re now moving beyond AI’s just reading text.

Accompanying this model were GPT-4o-transcribe and GPT-4o-mini-transcribe, which set a new benchmark in speech-to-text performance. Both models outperformed Whisper—a leading voice recognition tool—on accuracy and robustness benchmarks, paving the way for digital assistants that can converse. It’s hard not to wonder whether OpenAI is quietly building the most lifelike voice assistant yet—one that feels less like a machine and more like a companion. And suddenly, the future feels a bit more... personal.

xAI’s Video Vision

Over at xAI, they’re pushing the boundaries of AI-generated content to make it more immersive than ever. Last week, they acquired generative AI video startup Hotshot. The plan? Integrate Hotshot’s models into Colossus—xAI’s supercluster built with 200,000 H100 GPUs (set to scale to over 1 million)—to deliver video synthesis that’s faster, more lifelike, and—dare we say—indistinguishable from human-made media.

Curious how good Hotshot’s AI footage already is? Take a look:

Rise of the Machines

Last week, the robotics world also witnessed some jaw-dropping advancement.

China’s Deep Robotics stole the spotlight with a new “one-touch navigation” capability for its robot dogs. In the demonstration, multiple robot dogs map their surroundings in real time, effortlessly navigating difficult terrain and avoiding obstacles.

Meanwhile, Noetix Robotics unveiled the N2, an AI-powered humanoid priced at just $7,999. Standing 3’7” tall and weighing 20 kg (44 lbs), it boasts 18 degrees of freedom for full-body motion, powered by Nvidia’s Jetson platform. Ideal if you’re in the market for a toddler-sized robotic butler.

California-based Dexterity released Mech, an AI Demogorgon to a soundtrack that feels straight out of Stranger Things. Mech is a robot designed for industrial-specific use cases, featuring an 8-ft reach, 130+ lbs lifting capacity, and advanced AI to help teams move faster, reach farther, and lift heavier than humans.

Finally, Boston Dynamics gave us a glimpse of Atlas crawling, breakdancing, and cartwheeling. I’ve covered Atlas before, but the breakdancing at 0:45 shows just how natural the movements have become—it’s sometimes easy to forget the immense effort that went into figuring all of that out.

And while tech continues racing toward tomorrow, politics has a way of pulling us back to today. Often abruptly.

Creativeng Destruction

Last week, President Trump declared that April 2nd will be Liberation Day in the U.S.

Before thumping the $TRUMP meme coin over the weekend.

Liberating indeed. Yet, so far, it seems the main beneficiaries of this newfound “freedom” have been former public sector employees. What I’ve been paying attention to are the public companies that might become corporate casualties of the DOGE purge.

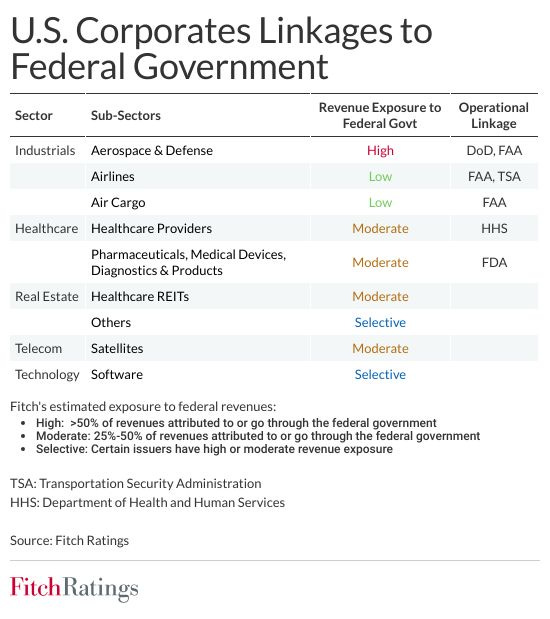

Fitch recently underscored the gravity of the issue, pointing out that about 10-20% of Fitch-rated corporate issuers rely significantly on federal funding, meaning DOGE-driven cuts could trigger meaningful credit downgrades.

Already, consulting giant Accenture looks like it might be among the earliest corporate victims, with its stock down 12.5% year-to-date. CEO Julie Sweet explicitly cited DOGE-driven federal spending cuts as a drag on sales. Accenture isn’t alone—other consultancies including Deloitte, IBM, and Booz Allen Hamilton have similarly come under pressure as federal agencies pause or cancel contracts.

Booz Allen Hamilton, which depends on the government for 98% of its revenue, is particularly exposed. CEO Horacio Rozanski openly acknowledged short-term challenges from DOGE’s efficiency drive, though he remains optimistic that opportunities will eventually surface once the government stabilises in its leaner form.

IBM has seen federal consulting contracts freeze, prompting CFO James Kavanaugh to signal a forthcoming workforce “rebalancing.” Investor unease over declining government revenues sent IBM’s stock lower alongside Accenture’s, despite IBM’s attempts to diversify into less vulnerable markets.

Leidos Holdings has already experienced abrupt cancellations of projects deemed “non-essential.” CEO Thomas Bell described rapid internal reshaping to align with DOGE’s efficiency demands—essentially racing to avoid deeper revenue impacts.

Airlines are feeling the pinch as well. Southwest Airlines specifically attributed its lowered revenue guidance to reduced government travel. Meanwhile, United Airlines CFO Mike Leskinen openly acknowledged a 50% drop in government-related travel bookings since DOGE’s measures began, cautioning investors to expect weaker-than-anticipated results.

Even software providers aren’t immune. Workday, initially optimistic about opportunities from government IT modernisation, now faces uncertainty. CEO Carl Eschenbach recently conceded that federal clients have grown hesitant amid the chaos, tempering his earlier enthusiasm.

Are Blue Chips Turning Fragile?

Taken individually, these stories might seem like isolated setbacks—typical friction as governments trim spending. But collectively, they hint at something deeper and perhaps more troubling. Investors may be underestimating how swiftly this wave of revenue disruption could ripple through even the bluest of Blue Chips.

Even before DOGE, earnings outside the so-called “Magnificent 7” were stagnating, with powerful disruptive trends—AI, robotics, blockchain, gene sequencing, and energy storage—already poised to reshape industries and render many legacy businesses obsolete. Now, with the public sector being rapidly transformed into “USA Corp.”, longstanding government contracts and entrenched business relationships are being abruptly dismantled.

This acceleration introduces a new layer of fragility that many companies—and investors—might not fully appreciate. Businesses previously considered stable or resilient could soon find themselves facing unprecedented revenue erosion, margin pressures, or competitive displacement. For investors, it’s a timely reminder: even giants can become vulnerable when disruption arrives swiftly and without warning.

When Central Banks Play Poker

While companies grapple with disruption, policymakers across the globe are locked in their own high-stakes poker game. Last week, central bankers at the U.S. Federal Reserve, Bank of Japan, Bank of England, People’s Bank of China, and Sweden’s Riksbank all held interest rates steady. Amid economic uncertainty, nobody seems ready to reveal their cards quite yet—although Fed Chair Jerome Powell hinted he’s still got some room to manoeuvre if needed.

But not every central bank has been dealt the same hand.

China, facing sluggish consumer spending and outright deflation (-0.7% CPI last month), hinted at fresh stimulus to achieve its ambitious 5% growth target. Sweden’s Riksbank opted for caution, betting that a jump in EU defense spending might offset growing trade tensions.

Japan, meanwhile, remained guarded, signaling possible rate hikes this year amid slowly rising prices—but avoided specifics on trade turmoil. The Bank of England is stuck between stubborn inflation (a recent peak of 3%) and barely-there economic growth, openly admitting it must remain restrictive “for sufficiently long.”

Then there was Switzerland, never afraid to break ranks, cutting rates by another quarter-point to 0.25%—the fifth straight cut since last year—in its relentless pursuit of the world’s lowest interest rate. With inflation at just 0.3%, the Swiss remain cautiously accommodative.

And finally, the U.S. Fed revised its growth forecast down (now 1.7%) while nudging its inflation expectation up slightly (to 2.7%), partly driven by tariff uncertainty—which Powell amusingly suggested might be “transitory” (where have we heard that before?). Yet the Fed Chair calmly indicated he still expects two rate cuts later this year.

Market Pulse Check

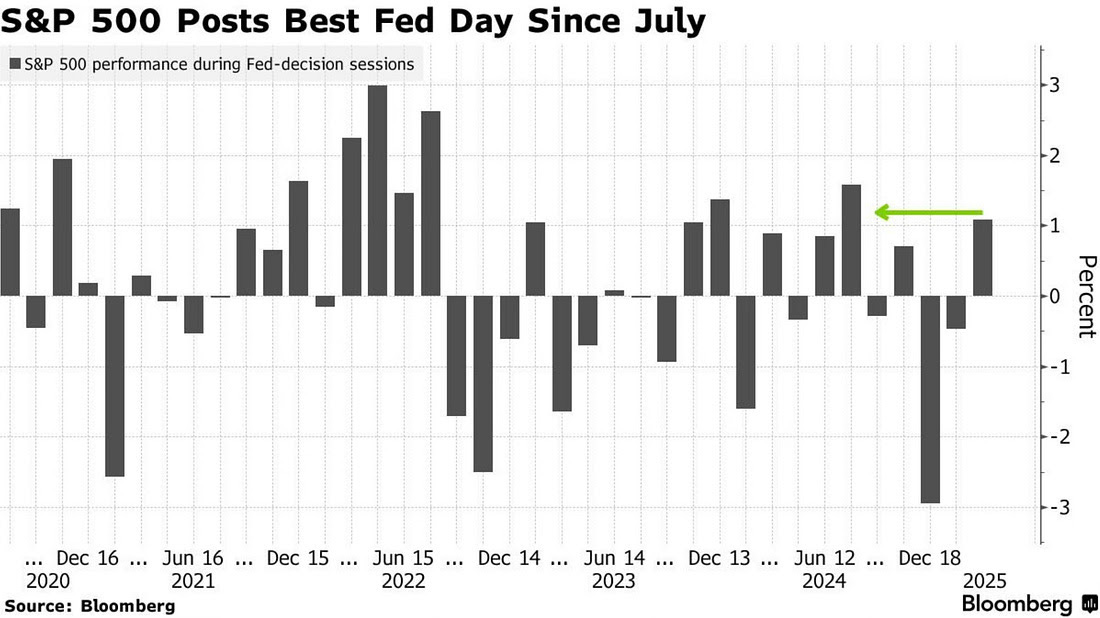

Rates on hold and a clear hint of easier policy ahead gave the S&P 500 its strongest single-day rally since July.

Markets dialed back their cautious stance last week, shifting toward a more balanced near-term outlook, helping stocks wrap up the week firmly in the green.

Even Tesla snapped back:

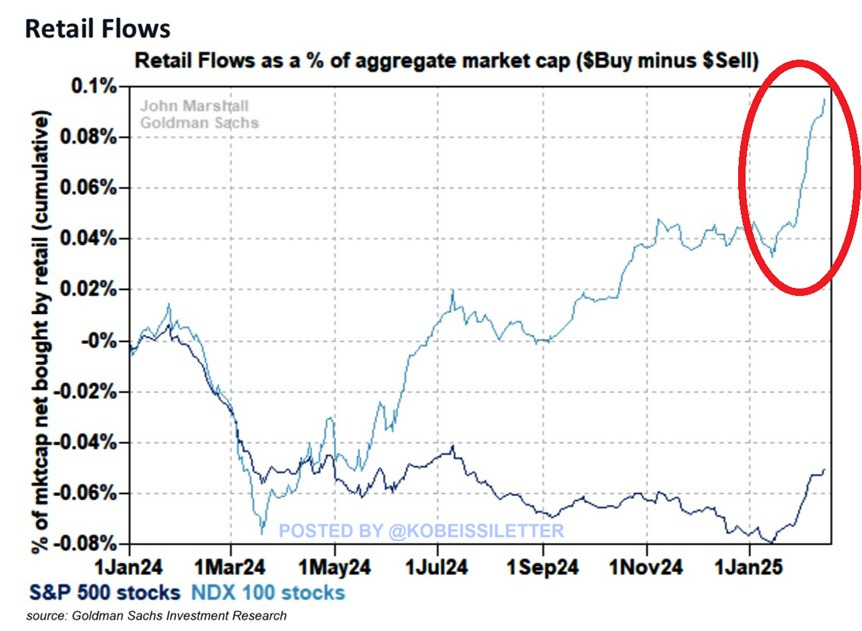

That breaks a four-week run of losses for both the S&P 500 and the Nasdaq, as retail investors flood back into equities at an accelerating clip. Retail investors have pushed net inflows into Nasdaq 100 stocks up to 0.1% of market cap—the strongest pace in over a year.

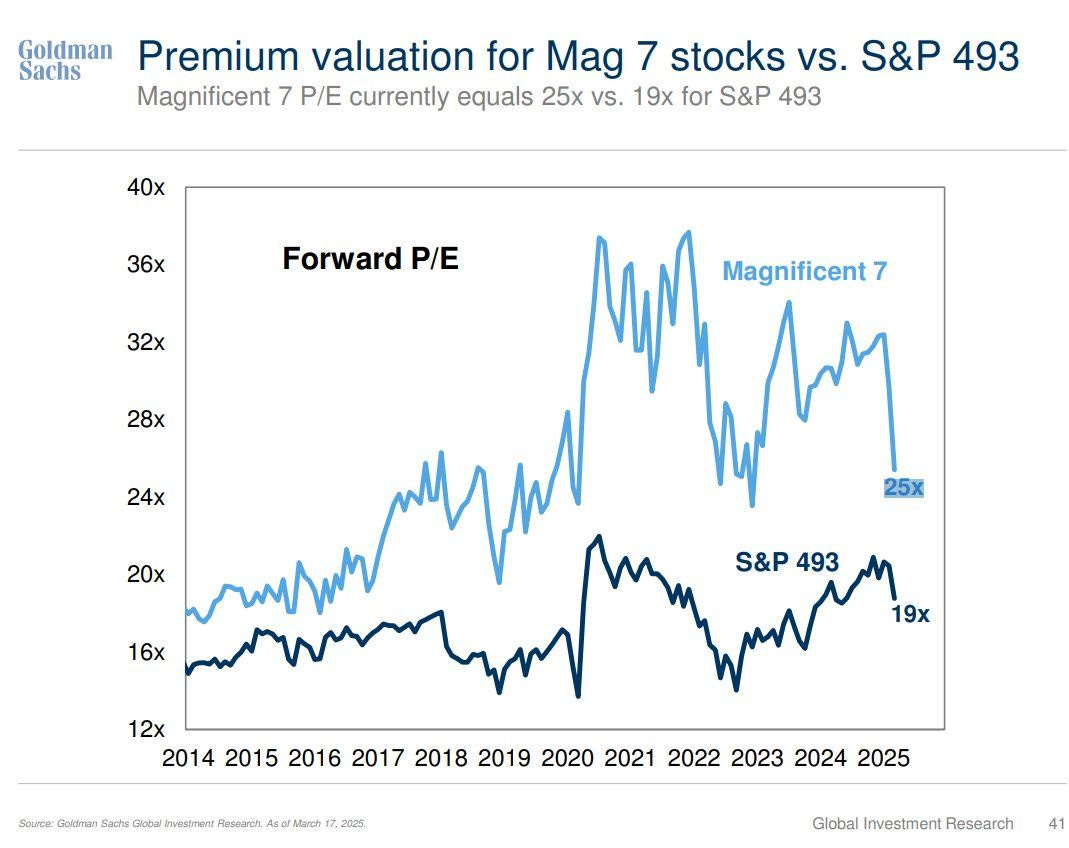

The Magnificent 7’s P/E ratio is down to just 25x—the narrowest spread compared to the other 493 S&P 500 stocks in years.

Maybe retail investors are starting to bargain hunt?

Finance Twitter is certainly buzzing:

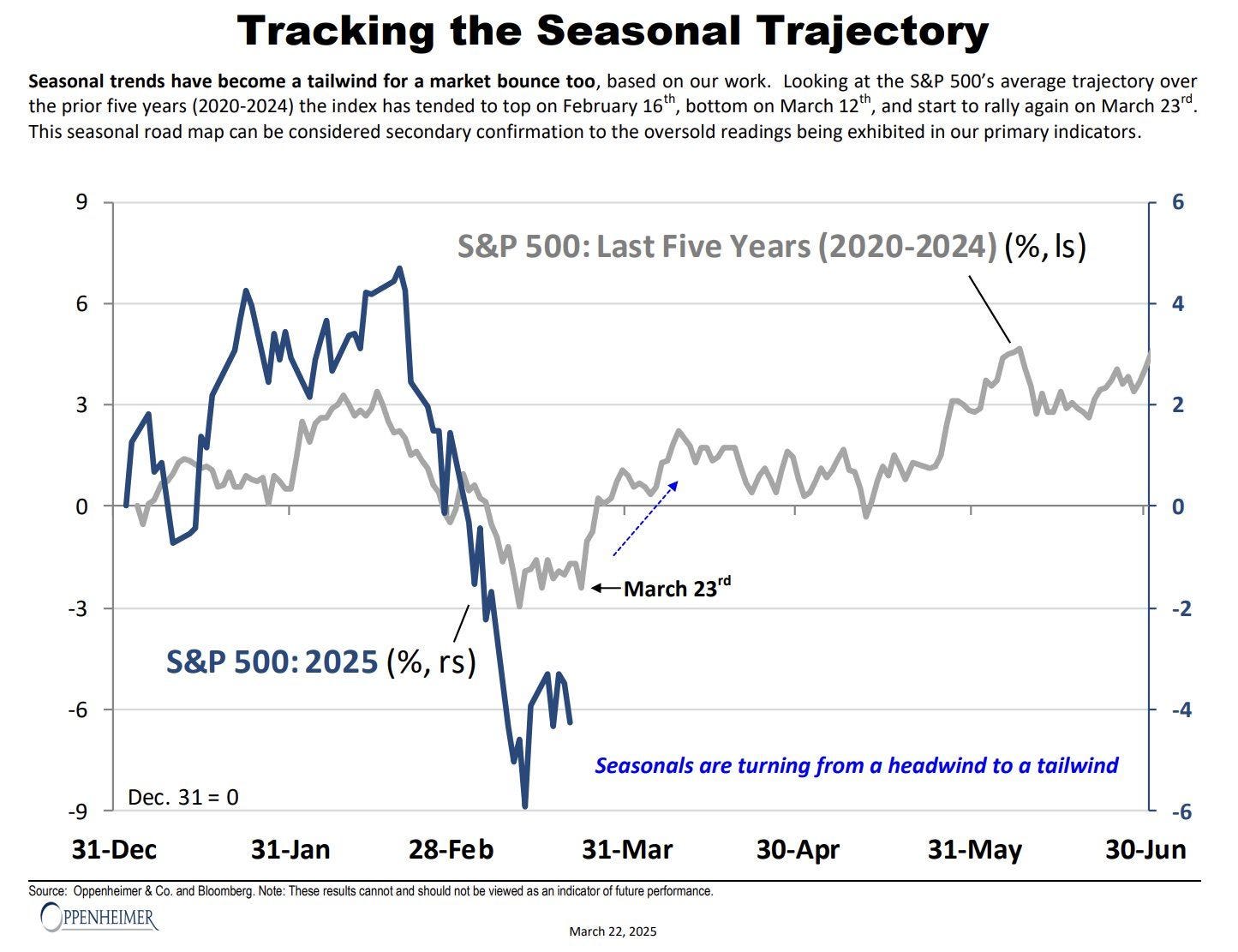

I really like this chart from Oppenheimer. It highlights the S&P 500’s average path over the past five years (2020-2024), showing that the index typically peaks on February 16th, bottoms on March 12th, and starts to rally again on March 23rd. If history repeats itself…

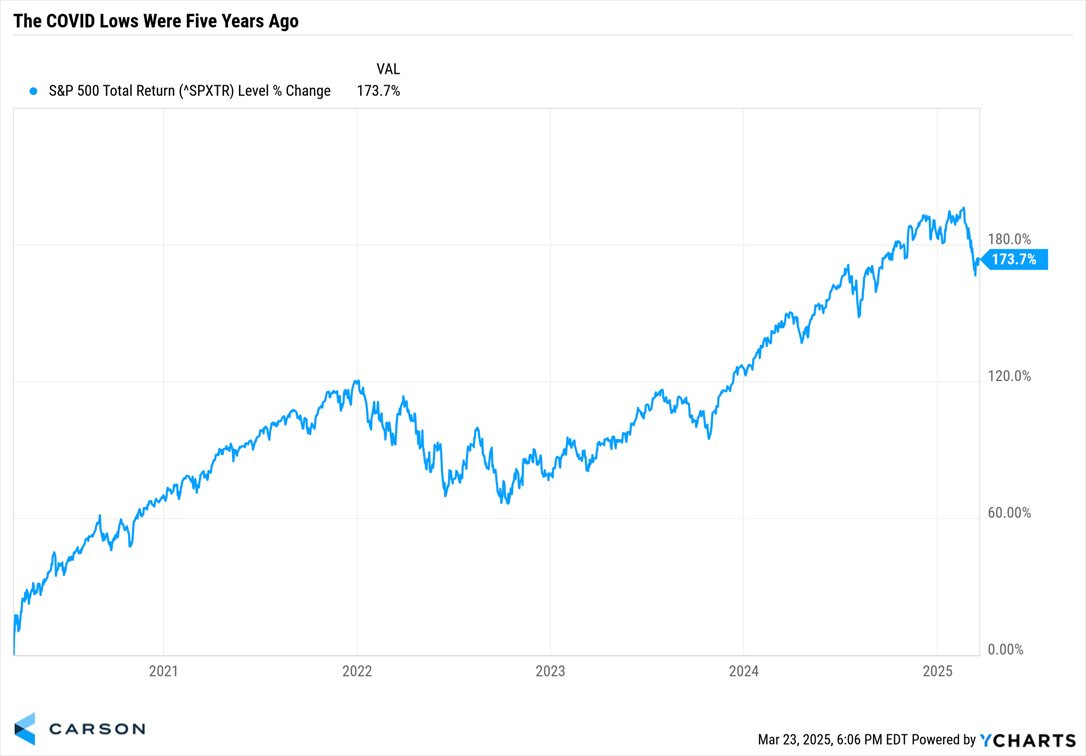

Fun Fact: Five years ago today, the S&P 500 hit rock bottom after a 34% bear market triggered by the COVID shutdown. Earlier this year, the index was up nearly 200% (total return) from those lows. Just something to keep in mind when reading spooky headlines.

Feel the pulse, stay ahead.

Rahul Bhushan.

This lineup is wild! Can't wait to see how the markets play out with all this buzz. Templeton's quote hits hard—feels like we’re in that optimism phase right now.