Resilient at 99: Dick Van Dyke, Markets, and the Year Ahead – Letter #14

“I’m gonna keep singing and dancing as long as I can.” – Dick Van Dyke

In 2013, a Jaguar burst into flames on a Los Angeles freeway. Inside, an 87-year-old man wrestled with his seatbelt as smoke curled around him. The fire spread fast, devouring the car’s interior. Just when it seemed too late, a group of strangers rushed in, dragging him to safety. He stumbled out, disoriented, the wreckage behind him crackling and hissing.

The man was Dick Van Dyke — the Hollywood legend who danced with chimney sweeps in Mary Poppins, tinkered with flying cars in Chitty Chitty Bang Bang, and solved crimes in Diagnosis Murder, alongside his real-life son Barry Van Dyke playing a police officer. I still remember coming home from school, dropping my bag, and watching them unravel mysteries with effortless charm.

Fast forward to last Friday: Dick Van Dyke turned 99 years old. And in true Van Dyke fashion, he didn’t celebrate with quiet reflection. Instead, he starred in Coldplay’s new video, “All My Love”. The song — heartfelt and brilliant — feels like it was made for him. He’s still there, on screen, dancing and moving. Still singing. Still radiating joy and resilience.

His oldest son is 74. Let that sink in.

Van Dyke’s longevity isn’t just a marvel — it’s a testament to what’s possible when life, health, and happiness align in harmony.

But here’s the catch: we live in a world where achieving that kind of vitality feels increasingly like an uphill battle. The U.S. healthcare system — the very foundation that’s supposed to support our pursuit of health — is buckling under its own weight. The frustration is boiling over, the cracks are widening, and for all the advancements in medicine, nobody seems satisfied.

And that’s where we’re headed next.

Let’s begin.

The Man Who Ages Backward

Imagine blowing out birthday candles every 19 months instead of once a year. That’s not the plot of a sci-fi movie — it’s the reality of Bryan Johnson, a tech entrepreneur running the world’s most documented longevity experiment. On January 1, 2025, Netflix will release a documentary chronicling his quest to slow — and even reverse — the aging process. The title? It practically writes itself: “Don’t Die”. You can follow his journey here.

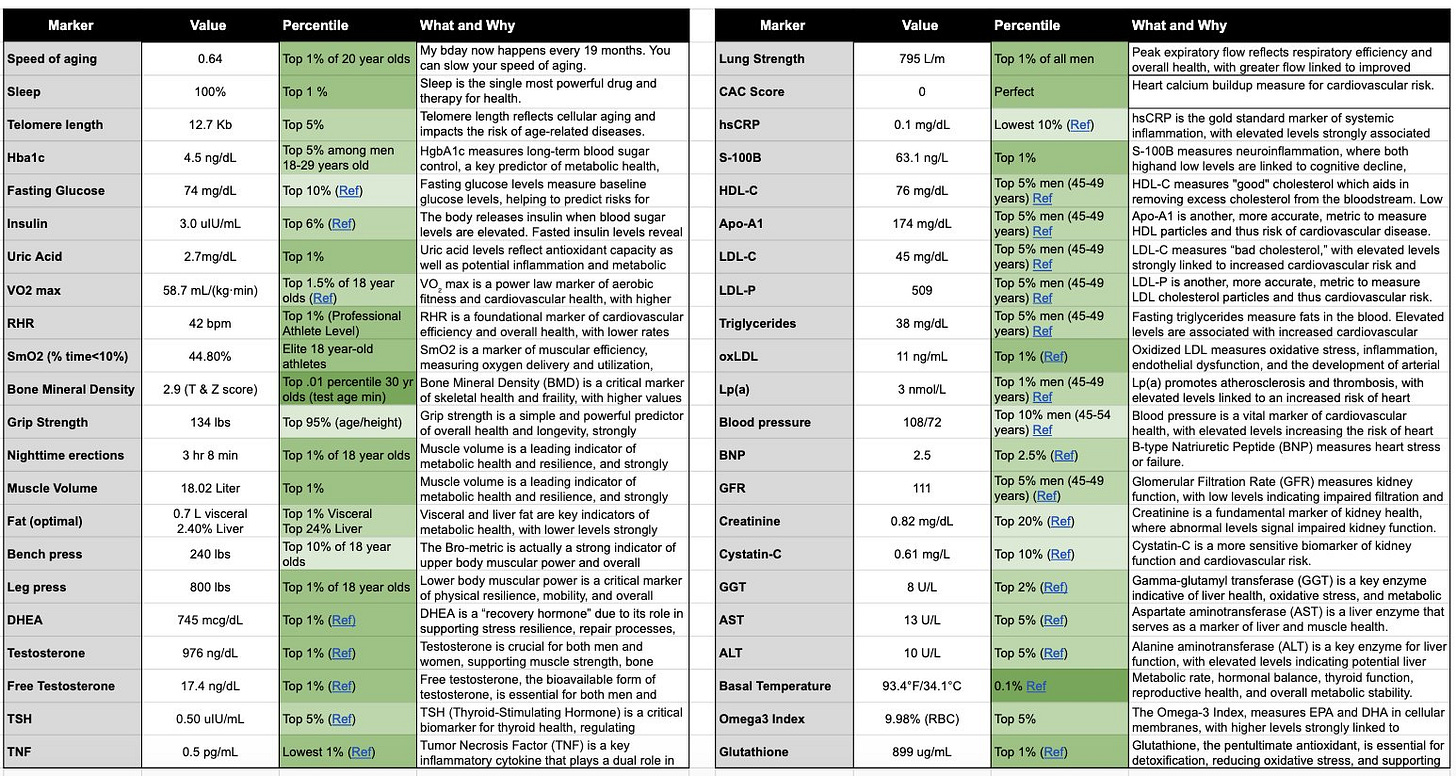

Johnson’s latest health results are as remarkable as they are obsessive. His biomarkers are pristine, his biological age is reversing, and his dedication to data-driven living is relentless. His summary tweet is part flex, part manifesto, and completely fascinating. Number 1 on the left-hand side? “I have a birthday every 19 months”. Talk about turning back the clock.

But his mission isn’t just about personal optimisation. Johnson believes we’re on the brink of a radical evolutionary leap, one that demands a complete rethink of our systems — from healthcare to politics to technology. While individuals like him are pushing the boundaries of longevity, the current medical establishment is groaning under the weight of inefficiency, frustration, and dysfunction.

In a CNBC interview last week, the Dean of Valuation, Aswath Damodaran, put it bluntly: a bad business is one where nobody is happy — not the producers, not the consumers, and not the government. By that definition, U.S. healthcare is in deep trouble.

UnitedHealth Group epitomises this complexity. No longer just a health insurer, it’s a sprawling platform covering insurance, physician employment, pharmacy benefit management, home health care, software, and even banking. This consolidation creates conflicts of interest, blurring the lines between care delivery and profit motives.

The recent murder of UnitedHealthcare CEO Brian Thompson shocked the industry and the public alike, exposing deep-seated anger toward insurers. The backlash is intense and growing. From accusations of Kafkaesque bureaucracy to outrage over executive paychecks, public frustration is boiling over.

Yet, as The Atlantic points out, the blame doesn’t lie solely with insurers. The real culprits? Skyrocketing administrative costs, overprescribed treatments, opaque pricing, and a shortage of doctors. It’s a system where 20% of U.S. GDP is spent on healthcare, yet outcomes fall far short of expectations. A 2023 KFF survey found that while 80% of Americans rate their personal plans as “good” or “excellent,” nearly 60% reported problems with coverage in the past year.

Heading into 2025, both Democrats and Republicans seem to recognise that something needs to change. That rare consensus could spell turmoil for pharmaceutical giants and insurers, who may soon find themselves at the center of the storm.

Physical Health

The market agrees. In 2024, healthcare was the worst-performing sector in the S&P 500. But in markets, as in life, what falls behind can sometimes leap ahead. While traditional healthcare finds itself under a microscope, burdened by inefficiency and backlash, the sector’s underperformance could set the stage for a breakout year in 2025.

The catalyst? Not the entrenched giants, but the pioneers pushing the frontiers of medicine. Genomic therapies, personalised diagnostics, and AI-driven drug discovery are poised to lead the charge. Companies like Twist Bioscience, Recursion Pharmaceuticals, and Adaptive Biotechnologies represent a new breed of healthcare innovators. Their focus is clear: precision over generalisation, efficiency over bureaucracy, and data-driven breakthroughs over legacy systems.

For these disruptors, the winds of political change could provide an unexpected tailwind. The incoming Trump administration’s appointments suggest a tilt toward deregulation and systemic overhaul. Dr. Mehmet Oz as CMS Administrator and Robert F. Kennedy Jr. as Secretary of Health and Human Services are controversial choices, but they signal a willingness to rethink the status quo.

Deregulation, especially at the FDA, could accelerate pathways for novel therapies, breaking the logjam that slows medical innovation. For companies on the cutting edge, this means faster approvals, clearer guidelines, and fewer barriers to market entry. The removal of regulatory capture—where entrenched interests stifle competition—could also open the door for smaller, agile players to thrive.

Financial Health

Let’s pivot from physical health to the financial health of the economy—which, despite some storm clouds, looks surprisingly resilient. With Republicans set to control the White House, Senate, and House, Trump 2.0 could unleash a potent mix of fiscal and deregulatory policies to reshape America’s economic path.

The S&P 500, currently trading at 22.4X forward earnings, sits notably above its 10-year average of 18.4X. But investors aren’t hitting the brakes. Since Election Day, optimism has turbocharged sectors like tech and financials, and the Mag-7 have ridden this wave higher. AI remains the standout story, with AI software companies are increasingly soaking up the spotlight.

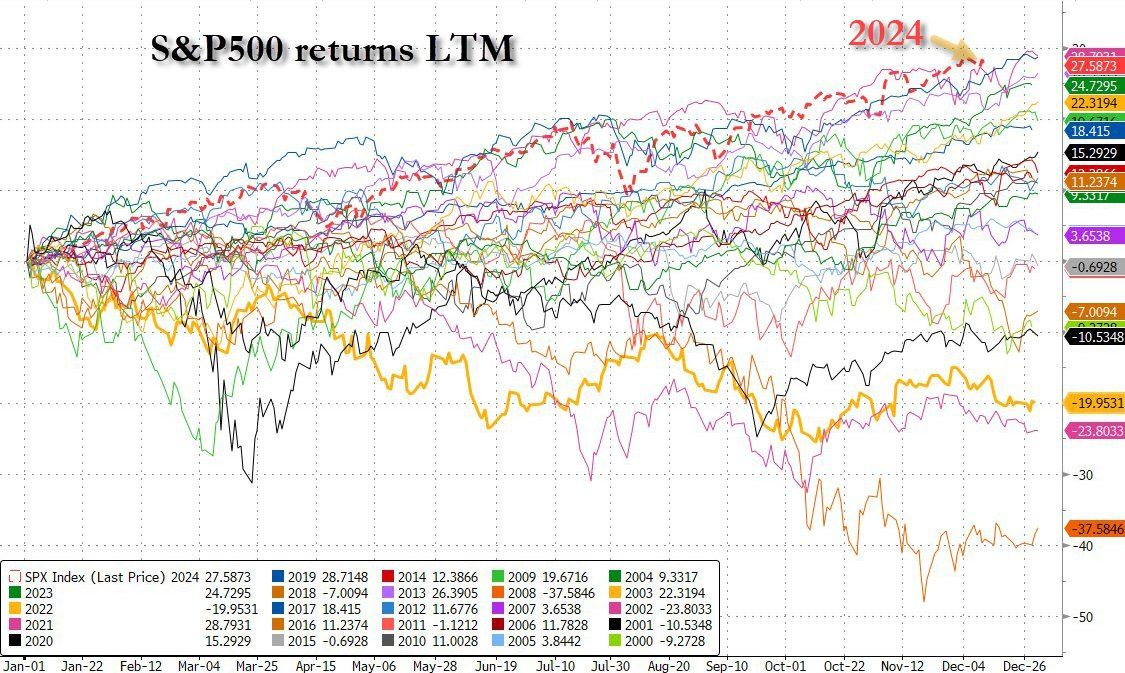

This week saw the Nasdaq Composite shatter the 20,000-point barrier for the first time. Adding to the stock market party, Donald Trump rang the opening bell at the NYSE, a symbolic nod to the bullish energy sweeping the market. With just 10 trading days left in the year, the S&P 500 is up an impressive 27%—on pace for best full-year return this century!

Retail investors are all-in…

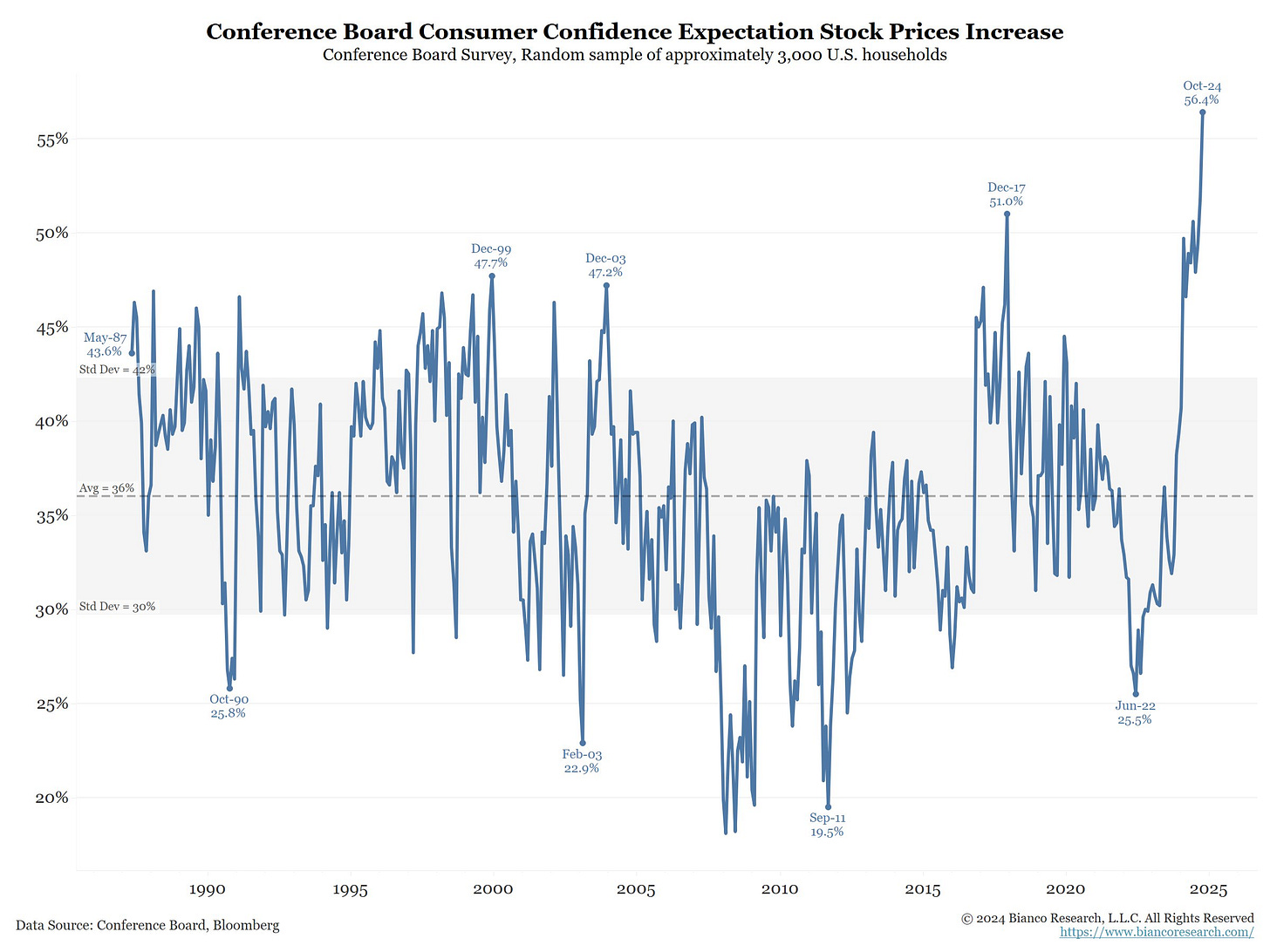

A University of Michigan survey reveals that 56% of households expect stocks to climb in the next year—on optimism surpassing even the dotcom era.

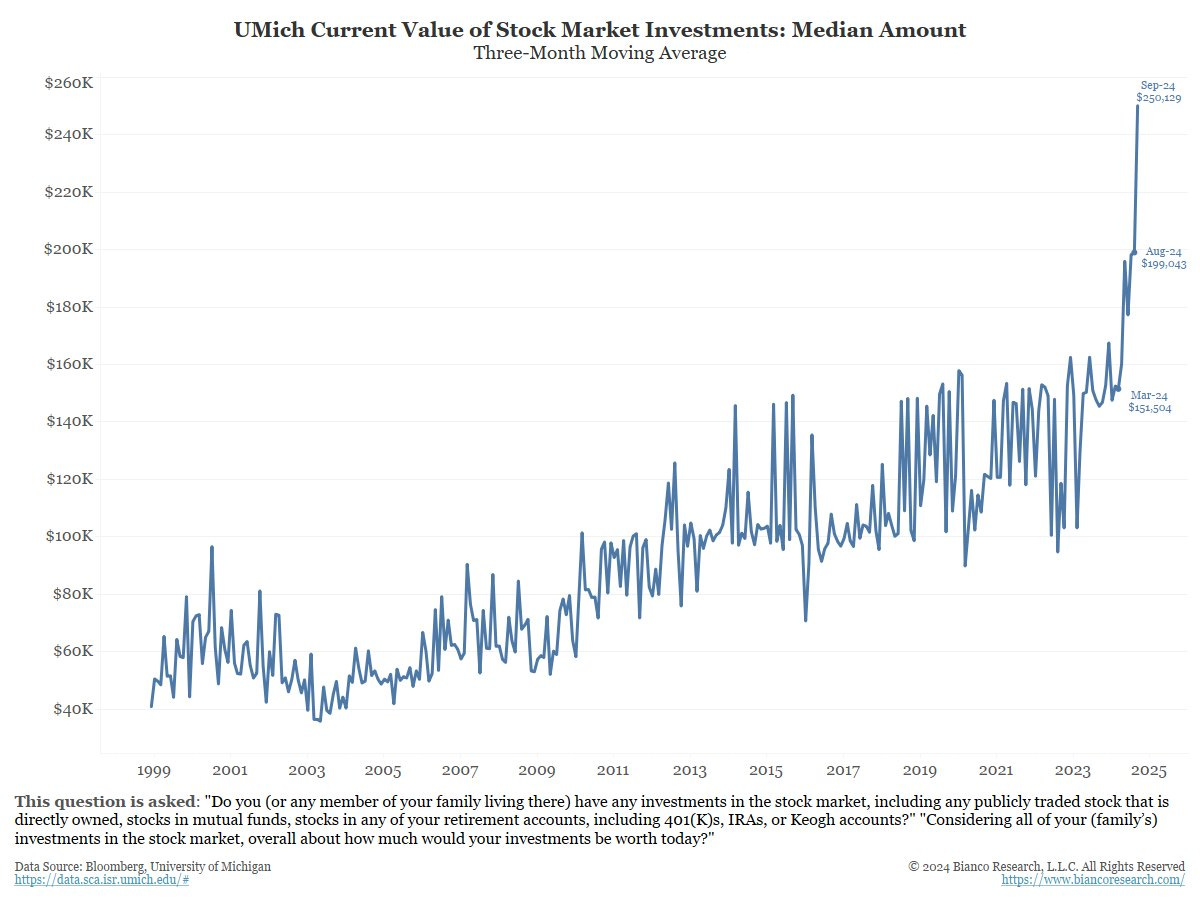

The median household now holds $250,000 in stocks, up $100,000 in just six months.

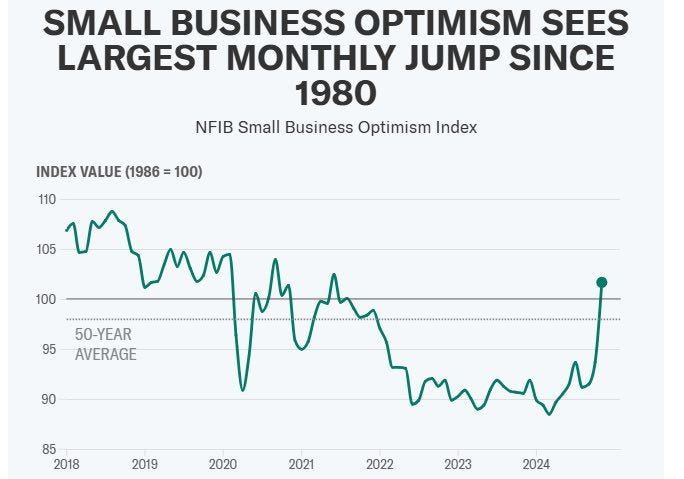

Small business optimism has recorded its largest monthly increase since 1980!

According to Ned Davis Research, daily ETF inflows have reached record highs, with equity ETFs averaging $4.7 billion in inflows per day over the past 50 days!

IPO Revival?

With such robust risk appetite, the tech IPO market appears poised for a potential resurgence in 2025, returning to pre-pandemic levels of activity. A wave of high-potential companies is preparing to go public, offering investors new opportunities at a time when public stock options are increasingly scarce. Top IPO candidates for 2025 include Wiz, Ramp, Rippling, Deel, Databricks, Grafana Labs, Snyk, Figma, Gusto, Notion, Addepar, Canva, Verkada, Navan, Brex, and Celonis.

In total, $303 billion in venture capital is invested across 270 U.S.-based companies with a combined valuation of $1.9 trillion. While some ventures may fall short, a few successful IPOs could deliver tens of billions in returns.

This resurgence comes as the number of public companies has shrunk significantly since 2000. With fewer stocks to choose from, investors may be willing to pay a premium for quality IPOs. The return of tech IPOs could inject fresh dynamism into public markets, expanding the investment landscape and renewing optimism for equities in 2025.

Inflation and Interest Rates

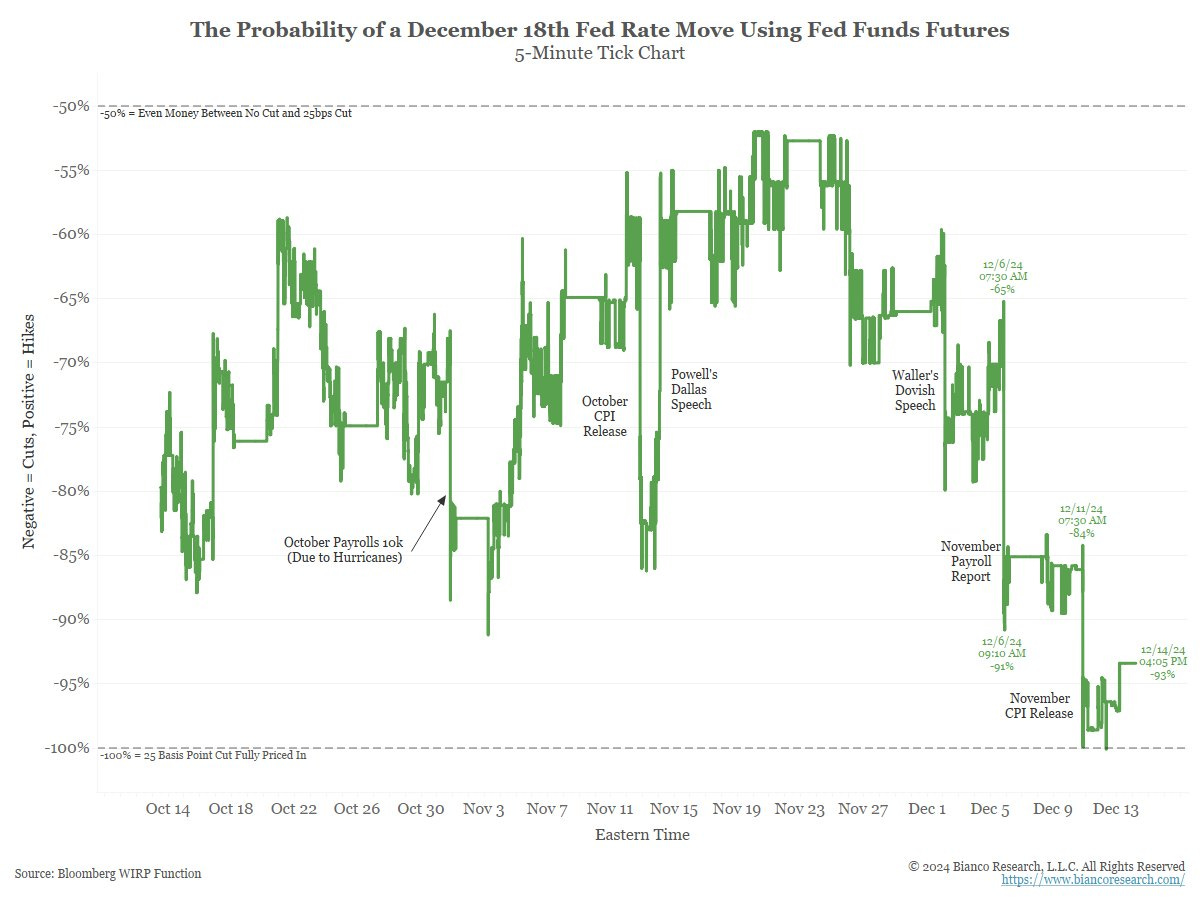

The November inflation numbers in the U.S. came in as expected, highlighting a mixed picture where inflation remains sticky at best and rising at worst. Encouragingly, Supercore CPI is trending downward, falling to 4.2% year-over-year in November from 4.4% in October. Headline inflation rose to 2.7%, aligning with forecasts, while core inflation held steady at 3.3%. These figures should give the Federal Reserve enough confidence to proceed with a rate cut in December. The probability of a 25-basis point cut next week stands at 93%, making it a near certainty.

Still, “sticky inflation” could be a challenge in Q1 2025, gaining more credibility with each report. Much of this persistence in CPI is due to lagging components, particularly shelter costs, which make up 34.4% of CPI and nearly 60% of services inflation. Shelter inflation tends to trail home prices by 15 months, meaning recent declines in home prices should translate into lower shelter inflation in 2025. Additionally, home prices themselves lag the supply of new homes by about seven months, suggesting more downward pressure ahead.

Broader inflation measures, like Flexible CPI for goods such as household supplies and clothing, have already normalised, falling from 19.7% in February 2022 to near-zero levels. This normalisation indicates that much of the inflationary pressure in goods has dissipated. In short, current inflation readings are influenced by delayed effects that are likely to ease in the coming months.

The stage is set. The year ahead looks anything but dull.

Feel the pulse, stay ahead.

Rahul Bhushan.

Absolutely love this weeks Dick Van Dyke opener!