Sustainable Investing 2.0: Scarcity To Abundance – The Essays #3

"Earth is abundant with plentiful resources. Our practice of rationing resources through monetary control is no longer relevant and is counterproductive to our survival." – Jacque Fresco

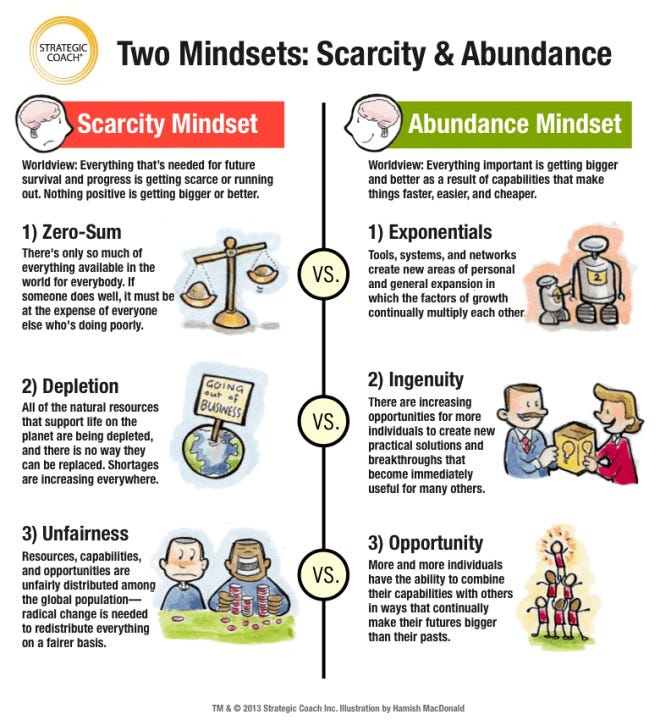

Sustainable Investing 1.0 was rooted in a scarcity mindset—an inherently flawed and counterproductive starting point. This mindset, fixated on limitations and constraints, viewed sustainability as an endpoint rather than an ongoing journey, treating resources as finite and humanity as a burden on the planet. This narrow thinking ultimately clashed with the true purpose of investing: creating the future we desire. It took Jerome Powell’s 25-fold interest rate hike for the world to realise that an approach fundamentally short on innovation, human ingenuity, and prosperity would neither succeed nor attract long-term capital commitments.

Sustainable Investing 2.0, however, is now gaining momentum. In contrast to its predecessor, this new era embraces an abundance mindset—centred on optimism and a deep belief in human potential. This essay delves into how this newer, stigma-challenging approach has the potential to reshape sustainable investing into what it was always meant to be, expanding its appeal across the investment community, particularly in the U.S., where capital markets are the largest. Ultimately, it offers the promise of unlocking long-term value for society.

The Scarcity Mindset

The scarcity mindset of traditional environmentalism is rooted in the belief that the planet operates as a closed system with fixed, inviolable boundaries. It suggests that human activity inherently disrupts these natural systems and that the solution to environmental problems is to limit growth, restrict development and impose regulatory constraints. This perspective, while once useful in addressing specific pollution problems, is no longer adequate for the scale and nature of the climate crisis we face today, nor with the potential of human ingenuity to overcome them.

The challenge of climate change is not simply an air pollution problem that can be solved by regulating or taxing emissions. Carbon dioxide is not a trace pollutant but a fundamental byproduct of virtually every aspect of modern life. Addressing climate change requires not just reducing emissions but transforming the entire energy economy. This means building new infrastructure, developing new technologies and reimagining how human society interacts with the natural world.

The Abundance Mindset

An abundance mindset recognises that solving climate change and other environmental challenges is not about doing less, but about doing more—building more, innovating more and creating more opportunities for sustainable growth. This shift in perspective is crucial for the sustainable investing community, which has often been guided by the same scarcity-driven logic as the environmental movement. Sustainable investing has traditionally focused on divestment, limiting exposure to harmful industries and reducing environmental footprints. While these are important steps, they are only part of the solution.

The next era of sustainable investing must go beyond merely minimising harm. It must actively create value by investing in the technologies and industries that will drive the transition to a sustainable future—embracing an abundance mindset that is long on human progress. This means supporting innovation in clean energy, nuclear power, advanced materials, and other fields with the potential to decouple economic growth not only from emissions but also from environmental harm. We must also remain open to solutions like carbon capture and sequestration, geological hydrogen, nuclear fusion, and even geoengineering, recognising the pivotal role these innovations can play in reshaping our environmental impact. Instead of focusing solely on what must be restricted or scaled back, Sustainable Investing 2.0 must champion what can be built, expanded, and improved to ensure it stands the test of time.

Rethinking Policy

The abundance mindset also requires a reassessment of the regulatory frameworks that have historically guided environmental policy. Many of the environmental regulations developed in the 1960s and 70s were designed to address the specific challenges of that era—pollution, deforestation, and habitat destruction. However, these regulations can sometimes impede the rapid deployment of technologies and infrastructure needed to address today’s climate crisis. For example, nuclear energy, which offers a powerful, low-carbon solution to decarbonisation, is often hamstrung by outdated regulatory hurdles. Permitting reform, both for nuclear and clean energy projects, is critical to enabling the construction and scaling of solutions at the speed necessary to mitigate climate change.

Sustainable Investing 2.0 must align with this new vision of environmentalism—one that embraces human ingenuity as part of the solution, rather than viewing it as a threat to the natural world. The narrative must shift from one of scarcity and restraint to one of abundance and possibility. This does not mean abandoning concern for the environment; on the contrary, it means acknowledging that human creativity and technological progress are essential to protecting the planet.

Conclusion

As the world looks for solutions to climate change, it is clear that the abundance movement offers a promising path forward. This movement rejects the notion that growth and sustainability are mutually exclusive. Instead, it recognises that through innovation, we can create a world where both humans and nature thrive. Sustainable Investing 2.0 must embrace this ethos by channeling capital into the industries and technologies that will make this future possible.