Tesla, Tech, and the U.S. Deficit: Equities Outshine Bonds – Letter #7

"The difference between something good and something great is attention to detail." – Charles R. Swindoll

This week, my wife and I found ourselves immersed in The Penguin series on HBO. She was genuinely astonished when I told her that Colin Farrell was the actor behind the Penguin’s chilling transformation; she didn’t believe me and had to Google it to be sure. (Trust issues, maybe?) One of the show’s key themes has struck me as deeply relevant: beneath Penguin’s outward swagger lies an insidious blend of fear, greed, and bubbling threats that both the Falconi and Maroni crime families chose to ignore until it was too late. It made me think of another “overlooked threat” lurking in plain sight—the U.S. federal deficit.

The deficit has grown to dangerous levels. The U.S. federal deficit has ballooned to nearly $2 trillion, or 7% of GDP. What’s striking to me is how neither side of the political spectrum—Republicans or Democrats—seems particularly concerned. In the upcoming U.S. election, which increasingly feels like a histrionic popularity contest, both sides’ policy proposals, I’d argue, have been carefully crafted purely to pander to voters. Fiscal austerity isn’t even on the table.

To put this in perspective, the U.S. government currently spends 40% more than it collects—$6.4 trillion against $4.4 trillion in revenue. U.S. debt-to-GDP sits at around 126%, which some argue is manageable by pointing to Japan, which has a debt-to-GDP ratio of 265%. However, the stark difference is that in Japan, this debt is held largely domestically, offering a degree of insulation, whereas in the U.S., around 90% is publicly held, making it highly vulnerable to external market pressures.

We’re already seeing these pressures manifest. The U.S. government has been issuing more debt, but with shorter maturities. Each time, in the past twelve months, where the U.S. Treasury has attempted to issue long-term bonds, such as 10- or 30-year bonds, the market response has been rather tepid. Meanwhile, gold has recently surpassed $2,700 per ounce as foreign governments, particularly China, diversify away from U.S. Treasuries and the dollar. Last week’s BRICS Summit in Kazan, Russia, reinforced this agenda with the Kazan Declaration, emphasising the bloc’s commitment to a financial order less dominated by the United States.

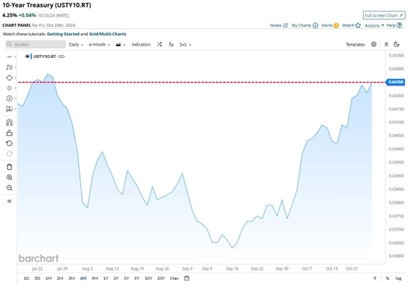

The recent surge in the 10-year Treasury yield, now around 4.25%, signals expectations of further fiscal expansion ahead, as both candidates all but guarantee further deficits. In response, just last week on CNBC, legendary investor Paul Tudor Jones declared fixed income ‘uninvestable’ given the rising debt levels and unsustainable bipartisan policies, favouring gold, bitcoin, and tech equities instead. This environment, I’d argue, continues to tip the balance in favour of equities—especially those positioned around enduring, transformative themes.

“Easy Money, Easy Fiscal”

With federal spending at such high levels, you create a dynamic whereby it’s harder and harder to slip into a recession. Flush with fiscal stimulus, the economy just manages to chug along. Consider that the U.S. economy is today near full employment and achieving 6% nominal growth. The Atlanta Fed’s GDPNow model pegs current growth at a healthy 3.3%, underscoring an economy performing beyond expectations.

This strength is further reflected in jobless claims, which have returned to pre-hurricane levels, alongside stronger-than-expected S&P PMIs for October, released last week. Durable Goods orders came in strong, reinforcing the positive Retail Sales figures seen the week before last. U.S. consumer spending remains strong, even amid concerns about rising delinquencies and cautious insights from the latest Beige Book and corporate earnings calls.

So, where does this leave us? The Fed, currently leaning toward easier monetary policy, is paired with a U.S. government intent on intensive fiscal stimulus. Regardless of the election outcome, additional fiscal support, I’d argue, is a near certainty. With two more Fed meetings on the calendar, anything less than a 50-bps rate cut in November could be surprising. However, factors like developments in the Middle East (e.g. oil surging above $100 per barrel due to Israel-Iran tensions) or promising indications that the Chinese stimulus is real and durable which drive a rally in cyclicals, could prompt the Fed to ease less aggressively in November.

Nevertheless, both the U.S. and China appear committed to “easy money, easy fiscal” policies, which creates an environment supportive of growth. Together, fiscal and monetary conditions should fuel a further boom in risk assets.

S&P 500: 6,000 Before U.S. Election?

Fittingly, U.S. equities are on track for yet another impressive year, having risen 23% since January, with many brokers now forecasting a rally to 6,000 by year-end for the S&P 500—a further 11% gain from today’s levels.

Meanwhile, the Nasdaq hit a record high last week, bolstered by better-than-expected results from Tesla. Tesla’s shares surged approximately 21% on Thursday after the company reported strong third-quarter profitability, bolstered by record-low vehicle costs, additional revenue from FSD software, and significant growth in energy storage and services. Management reaffirmed plans to release a low-cost vehicle in early 2025 to support its 20-30% vehicle growth target and announced the launch of a ride-hailing service in California and Texas next year. Tesla’s position as an AI-driven company extends beyond vehicles; it now includes energy storage and autonomous driving solutions, with non-automotive segments contributing 20% of its revenue—a near doubling year-over-year and a testament to its expansion beyond EVs.

Tesla’s ambitions also include the Cybercab robotaxi and Optimus robot, both of which highlight the company’s commitment to transforming both transportation and automation. Musk’s bold vision, supported by Tesla’s strong cash flow and solid balance sheet, signals a long-term expansion in autonomous vehicles and renewable energy solutions.

Bank of America Global Fund Manager Survey

This week, I was encouraged to read Bank of America’s global fund manager survey, which signaled a notable surge in investor optimism. Conducted between October 4 and 10, 2024, among 195 fund managers overseeing $503 billion in assets, the survey reveals investor sentiment has reached its highest level in more than four years.

Moreover, investors are pulling out of bonds at a breakneck speed, marking the fastest shift out of fixed income in the survey’s 23-year history.

At the same time, equity allocations are rising at their swiftest pace since the end of the global pandemic, indicating revived confidence in risk assets.

About 76% of investors now expect the global economy to experience a “soft landing,” with limited economic slowdown but no recession. An alternative “no landing” scenario, with continued growth, is expected by 14%, up from 7% last month. Meanwhile, just 8% predict a “hard landing” or recession—a four-month low.

Concerns over a U.S. recession have declined from 40% in September to 19% now. However, 33% see geopolitical tensions as the primary tail risk, up from 19% the previous month.

In Closing

The recent Bank of America fund manager survey reveals a shift toward bullishness, with investors pulling out of bonds and moving swiftly into equities, reflecting renewed confidence in risk assets. This appetite underscores a recognition of today’s market dynamics: while fiscal imbalances, like the U.S. deficit, pose challenges to fixed income, sectors positioned for transformative growth present compelling opportunities.

At the core of this letter is the theme of navigating the balance between fiscal risk and economic resilience. Though the U.S. deficit looms large, robust consumer spending and strong corporate earnings reinforce the case for grounded optimism within financial markets. As we look ahead, growth-driven sectors like technology and companies like Tesla are poised to lead, offering significant potential for those focused on forward-looking investments. Recognising these dynamics is key to positioning for future growth amid today’s market complexities.

Feel the pulse, stay ahead.

Rahul Bhushan.