The Frenchman’s Ledger, Dire Straits in Iran, Circle Tops $240, Stablecoins Go Federal, The Dollar Becomes a Technology, A Man Draws His Sword – Letter #32

“Sound money is an instrument for freedom.” — Friedrich Hayek

In 1878, in the heart of Paris, a man named Aristide Boucicaut was quietly revolutionising modern life. He wasn’t a politician or a banker. He didn’t command armies or empires. He sold fabric.

Born to a modest hatmaker in Normandy, Boucicaut arrived in Paris as a young man and took a job at a dry goods shop. But he was restless. He believed commerce could be more imaginative. More democratic. In 1852, he became co-founder of a small draper’s store that he would eventually turn into Le Bon Marché, the world’s first true department store, and a prototype for modern retail.

Boucicaut didn’t just change how people shopped. He changed who got to shop. In an era when shopping was an elite activity and credit was reserved for the wealthy, he saw potential in the working classes — especially women, who handled the household budget but had little access to financial tools.

So he did something radical. He created prepaid purchase certificates that could be bought, gifted, and redeemed later. They weren’t coins or banknotes. But inside Le Bon Marché, they worked like money.

They were backed by trust. And by inventory. Customers planned with them. Families used them to smooth spending across time.

Other retailers followed. The idea spread. Over the decades, these instruments evolved into store accounts, charge cards, and eventually financial infrastructure we take for granted today.

But it all began with one merchant asking a simple, visionary question:

What if we created our own money — tailored to how our customers actually live?

The Trust Layer Gets an Upgrade

Today, a similar question is being asked. Not by retailers, but by stablecoin issuers, software developers, and policymakers. And this week, the U.S. responded.

On Tuesday, the Senate passed the GENIUS Act— short for Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025. The vote passed 68-30, marking the first time either chamber of Congress has approved serious federal legislation for crypto.

The bill introduces a full regulatory framework for what it calls “payment stablecoins” — cryptocurrencies that are pegged to the U.S. dollar and designed for everyday use. These tokens are not classified as legal tender, nor as securities or commodities. Instead, they are treated as a new category of digital asset, with strict requirements.

Issuers must back every token with cash or ultra-safe liquid assets such as short-dated Treasuries. One-to-one. No rehypothecation. No funny business. Monthly audited reserve disclosures are mandatory.

I recently caught up with the founders of tokenisation platform Backed Finance, who framed it well: if Bitcoin was crypto’s first product-market fit, stablecoins are shaping up to be the second. Where Bitcoin was designed to be hard money, stablecoins are trying to be better money.

Fast, digital, and globally accessible.

America’s official crypto and AI czar, David Sacks, summed it up cleanly in his reshare:

My only disappointment with GENIUS: Stablecoin issuers will not be permitted to pass on yield from the T-bills they hold to token holders. This was a key precondition for gaining the support of U.S. community banks, which viewed yield-sharing as a threat to deposits. It’s a protectionist measure, and I understand the politics. But it does feel a bit like buying a Tesla and being told you can’t use Autopilot unless you’re wearing a Ford baseball cap.

Wall Street Hugs a Stablecoin

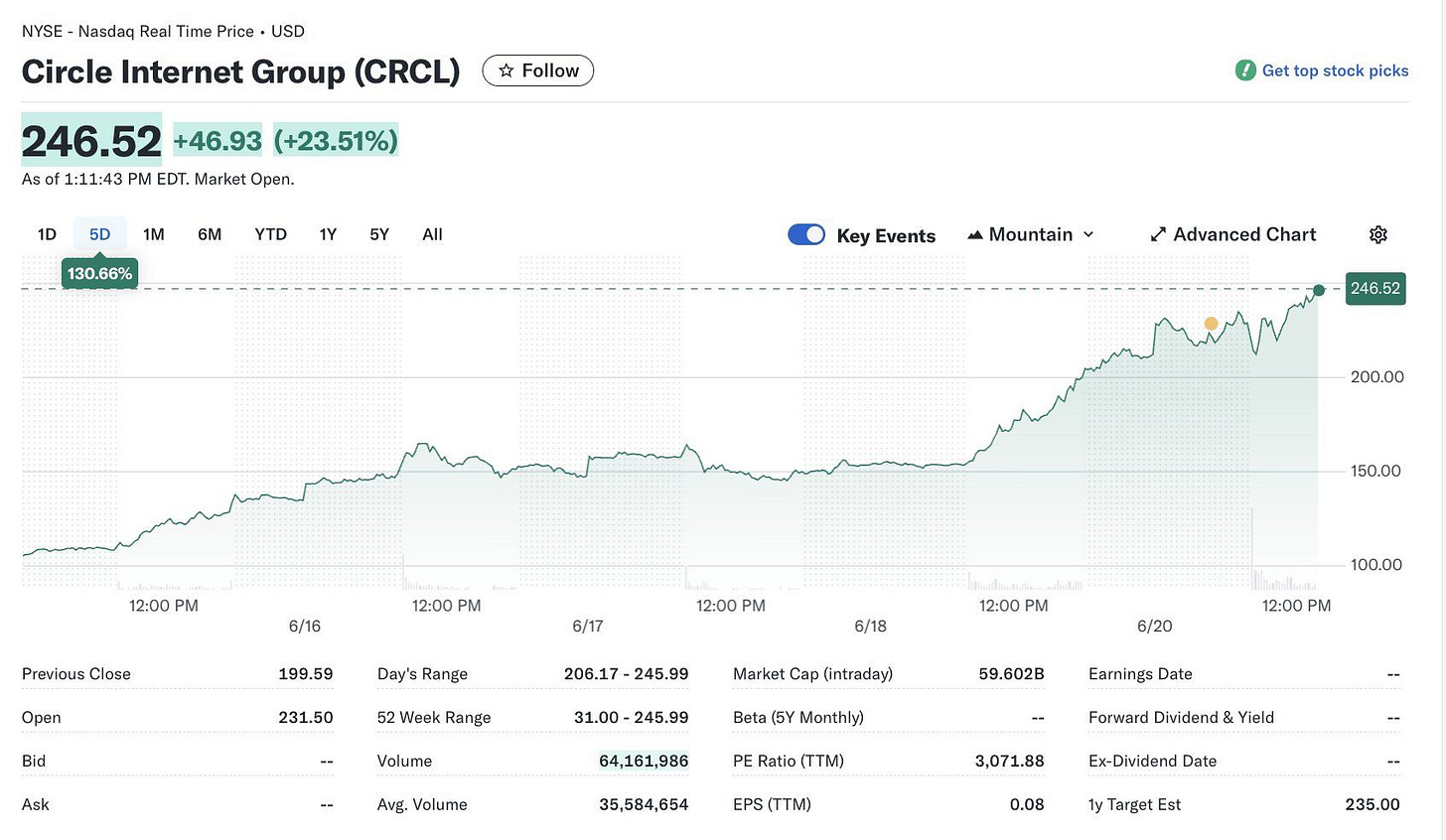

Markets got the message. Circle, the second-largest stablecoin issuer after Tether, went public just weeks ago at $31 per share. Since the Senate vote, the stock closed above $240 on Friday. Up over 670%. At a market cap north of $53 billion, Circle is now worth more than many European banks, including Société Générale and Commerzbank. It might end up being the IPO of the year.

Brief Detour: According to SEC filings, Circle’s chief legal officer, Heath Tarbert, holds over 839,000 restricted shares and nearly 940,000 stock options priced at $25.09. At last week’s price of $240, that’s a $243 million payday. He joined Circle two years ago. Not a founder. Just a well-placed lawyer. By our math, that works out to around $60,000 an hour. Slightly above market rate. Must be all that billable alpha.

Behind the scenes, several major firms are now said to be exploring stablecoin issuance, including Amazon, Walmart, and the DTCC. Others like Apple, X, Google, and Airbnb are reportedly considering how to integrate stablecoin-based payments into their platforms.

The appeal is obvious. Stablecoins settle instantly. They operate on weekends. They reduce frictions in remittances, merchant payments, and B2B flows. For large companies, they offer programmable financial infrastructure without needing to reinvent the banking system.

And perhaps most importantly, they are overwhelmingly denominated in U.S. dollars.

Roughly 97% of the global stablecoin market is dollar-based. Each new user is effectively opting into a dollar-native financial system, even if their local currency is something else entirely.

The Dollar Becomes a Protocol

In the past, dollar dominance was enforced through treaties, trade, and trust. A global reserve currency, yes. A global reserve asset, yes. But also a political instrument, backed by the U.S. banking system, SWIFT, and the Treasury market.

But something subtler is happening now.

The dollar is becoming a technology.

If we define a technology as a scalable system that extends human capability, then stablecoins are doing just that for the dollar. They’re making it programmable, composable, and interoperable — embedding it into APIs, wallets, fintech apps, and smart contracts.

In this sense, the dollar is no longer just the dollar. It’s software.

That’s what makes the “de-dollarisation” discourse — complete with BRICS currency speculation and headlines about the dollar’s supposed decline — feel so untethered (pun intended) from reality. You could argue the opposite: with the rise of stablecoins, the dollar hasn’t merely retained its reserve role — it’s expanded it. It has become a reserve protocol, powering a new financial layer that’s harder to sanction, easier to build on, and far more difficult to recreate overnight. A financial layer that is user-based, not confidence-based.

Traditional reserve assets rely on trust between governments. Stablecoins bypass that, going straight to the end user. Citizens in countries actively trying to opt out of the dollar system often end up pulling the dollar in through the back door. Dollar exposure is now accruing from the bottom up, not the top down. Citizens, not states, are pulling the dollar deeper into the global economy.

Of course, critics will argue: look at the DXY. The dollar is losing its strength and appeal.

True — the index has softened in 2025. But zoom out. The dollar has merely reverted toward its long-term average after an extended period of strength. No secular collapse. Just mean reversion.

Others will say: look at the flows: we’ve seen a pullback from U.S. assets.

Also true. We have seen some exodus. But as Robin J. Brooks noted in his Substack last week, the narrative of the scale of global flight from the dollar doesn’t match the data. April’s tariff-driven volatility didn’t trigger shock levels of capital flight. Long-term outflows out of U.S. assets weren’t even close to where they were during COVID, for example.

Finally, some will point to the declining appetite for Treasuries. And yes, foreign demand for long-term Treasuries has cooled, forcing the Treasury to learn more on short-term issuance. But even if long-term Treasuries lose appeal as a foreign reserve, the dollar might not.

One reason: dollar use is systemic. The eurodollar system, repo markets, and global shadow banking channels all run on dollar collateral and liquidity. And as I’ve argued before, liquidity is the game.

And stablecoins are digital eurodollars for the internet age.

Second reason: stablecoin adoption is proving self-reinforcing. As usage grows, so does demand for short-term Treasuries from stablecoin issuers. Circle and Tether now hold more than $250 billion combined in short-dated Treasuries, putting them just outside the top 10 foreign holders. This is an excellent chart from Brad Setser published June 18th showcasing this shifting replacement dynamic.

So in a world fragmenting politically and economically, the dollar, in my view, appears to be quietly becoming more entrenched.

Not through diplomacy, but through distribution.

It doesn’t need to be a symbol of empire. It can just be an open-source financial operating system.

Remind You Of…. Bitcoin?

Perhaps the net result of stablecoin proliferation is that the dollar, to stay relevant long-term, must adopt some of Bitcoin’s best attributes: decentralised issuance, permissionless settlement, borderless reach.

Bitcoin’s Use Case, in One Chart

Shifting gears for a moment — especially in light of Bitcoin’s recent sideways price action — it’s worth addressing the growing chorus of voices wanting to once again question Bitcoin’s real-world utility and they’ll be louder yet again tomorrow as the Bitcoin price has dipped to $100,000 as I write this on Sunday.

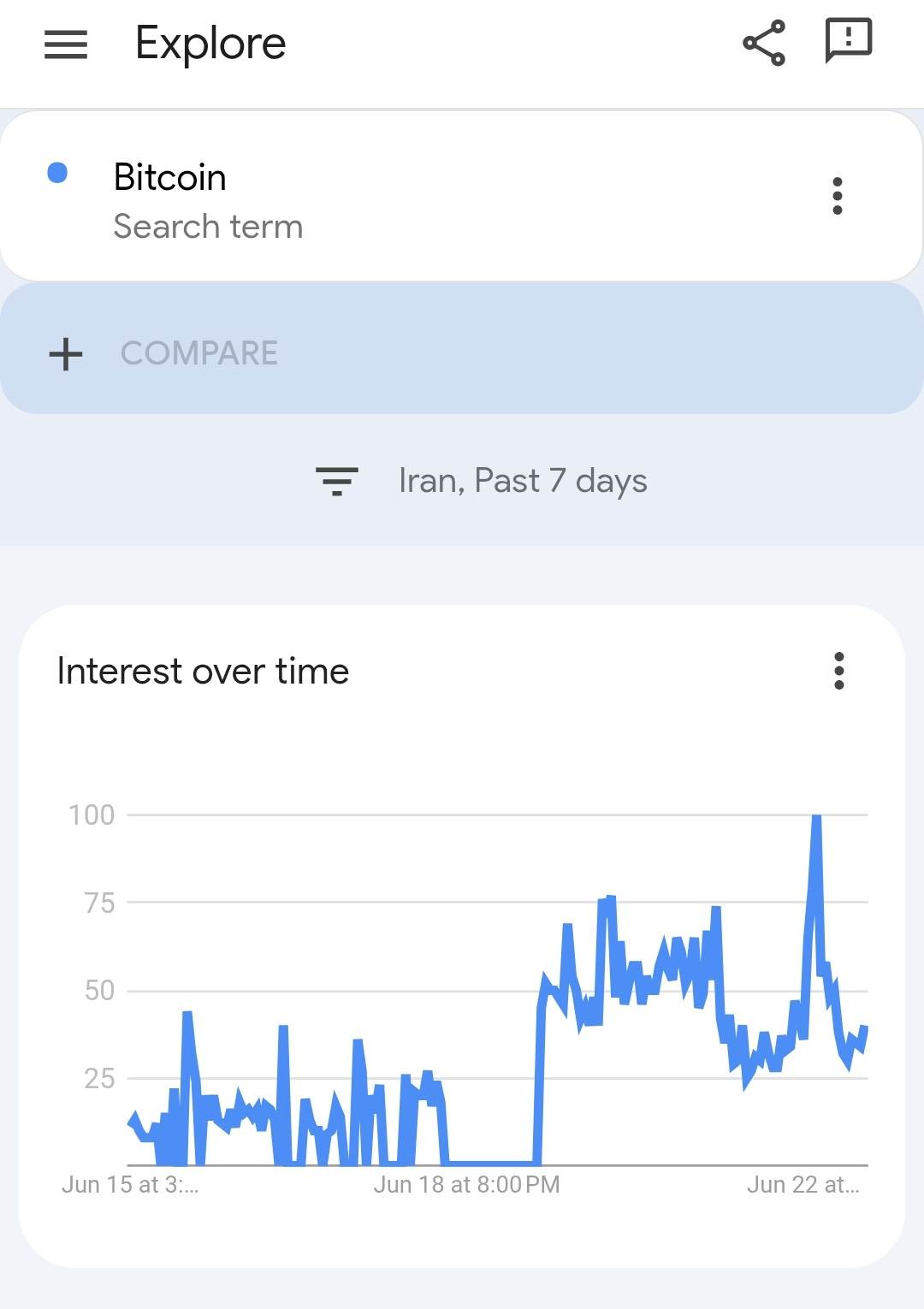

This chart:

What this chart shows is the June 22 spike in Bitcoin interest across Iran, following the U.S. airstrikes. Iranians appear to understand Bitcoin’s utility. In moments of crisis, accessibility and autonomy matter. Many ATMs across the country are offline and no longer dispensing cash.

Some helpful context: In December 2024, Iran officially embraced Bitcoin mining and reserves. In a twist of irony, the regime may have legitimised, then, the very tool citizens are turning to, now, as a financial lifeline.

But while citizens turn to digital tools, markets so far seem less concerned.

Pricing the Unthinkable

Markets have taken a surprisingly calm view of this weekend’s escalation.

Over the past 72 hours, the U.S. launched targeted strikes on suspected Iranian nuclear sites. Russia publicly raised the possibility of nuclear cooperation with Iran. And Tehran’s parliament voted to close the Strait of Hormuz — a key conduit for nearly 20% of global oil shipments.

And yet: as of Sunday night, S&P futures are down just -0.5%. Brent crude is up less than +2.5%. Not exactly the response one would expect if markets were pricing in a multi-week disruption to global energy supply chains.

For context, Deutsche Bank notes that a meaningful closure of the Strait could push oil to $120 or higher. The fact we’re not even close suggests that markets are, for now, discounting the possibility of sustained escalation.

This is a tough call, of course, because we’ve never had a noise-to-signal ratio quite like this: tariffs, wars, central banks, recession chatter, and macro prints — it’s all noise, all the time.

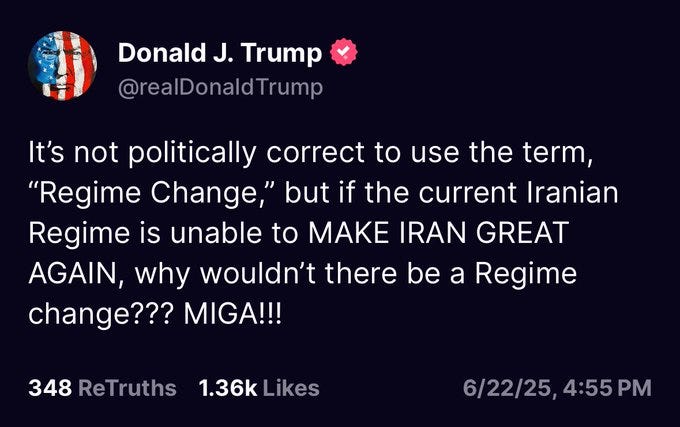

Example:

Another:

Maybe not:

GaveKal notes, however, that Iran has threatened the Strait before — including during the 1980s “Tanker War” — and failed. Moreover, most of the oil flowing through Hormuz goes to Asia, particularly China. And with China now Iran’s most powerful strategic partner, any disruption would carry internal costs. Blocking Chinese-bound crude is hardly a “winning” move.

Still, the situation bears watching.

Goldman Sachs estimates that the recent 15% rise in oil since May would add about +0.4pp to headline inflation in Europe, while shaving 0.1-0.2pp off GDP growth. But if the Strait were meaningfully disrupted, those numbers jump: inflation could rise by 1.8pp and growth could take a larger hit.

Historically, the S&P 500 has dropped by an average of 6% in the three weeks following geopolitical shocks, then recovered in the three weeks after. Whether this moment follows that pattern remains to be seen.

Everyone Knows That Everyone Knows

Brent Donnelly commented in Spectra Markets this week that “Everyone knows that everyone knows that geopolitics don’t matter for MAG7 earnings.”

I’d extend that to MAG7 and select innovation-focused equities. Here are the top 15 growth stocks of 2025 so far:

These companies cut across sectors. From energy ($OKLO), telehealth ($HIMS), and rare earths ($MP), to space ($ASTS), quantum computing ($QBTS), and cybersecurity ($ZS).

All while the dominant narratives are pulling in other directions.

Take the latest BofA Fund Manager Survey:

“Long international stocks” is the consensus pick for best-performing asset over the next five years.

At the same time, ‘long gold’ is now the most crowded trade (for the third month running), followed by ‘long Mag7’ and ‘short U.S. dollar’:

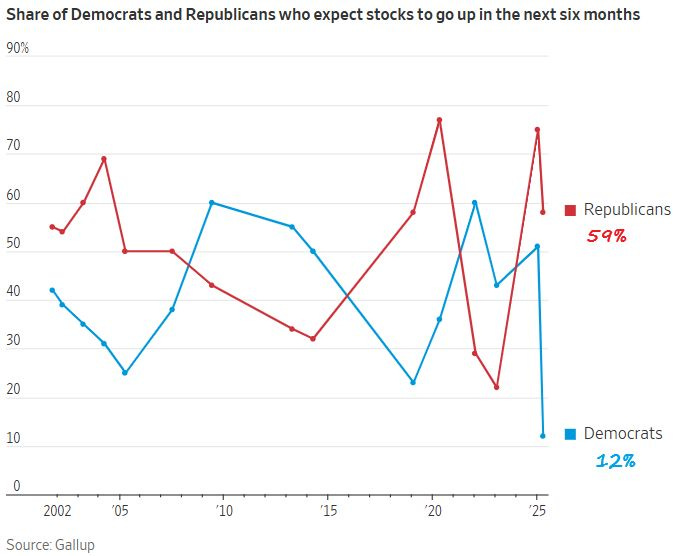

And then there’s this: 59% of Republicans expect market gains over the next 6 months, compared to just 12% of Democrats — the widest gap ever recorded.

Meanwhile, innovation-focused $ARKK has quietly posted one of the smoothest runs since the April lows:

And the Atlanta Fed’s GDPNow model is tracking Q2 growth at 3.4%. That makes the Fed’s 1.4% full-year estimate look unnecessarily gloomy.

In the end, conviction matters more than consensus. 😃

Feel the pulse, stay ahead.

Rahul Bhushan.