Trump’s Return and the Promise of America's Golden Age – Letter #9

“Let them eat cake.” – Marie Antoinette

Maria Antonia Josepha Johanna was born on November 2, 1755, to Empress Maria Theresa of Austria and Emperor Francis I. Raised in the lavish courts of Vienna, Maria Antonia spent her days strolling through manicured gardens, surrounded by grand tapestries, towering chandeliers, and ornate statues. Her life was defined by ceremonial grandeur and carefully orchestrated routines, all preparing her for a future among royalty.

In 1770, Maria Antonia married Louis-Auguste, the future King Louis XVI of France, and became Marie Antoinette. Her world shifted to the glittering halls of Versailles. Known for her charm and elegance, Marie Antoinette embodied the grace of French royalty. Her life was steeped in galas, gilded mirrors, and exquisite silks. Yet, over time, her lavish lifestyle became a point of contention, and her distance from the struggles of ordinary citizens grew.

Upon hearing that the peasants had no bread, she supposedly remarked, “Let them eat cake,” a phrase that came to symbolise her detachment—an almost casual obliviousness to the hunger and hardship faced by people who couldn’t even afford the most basic food. To the citizens of France, she represented a monarchy insulated in its own reality.

When the French Revolution finally came, it arrived as sudden and unrelenting as the tide. The very people Marie had once symbolised turned against her. Her story endures as a powerful reminder of the dangers of losing sight of the realities faced by those one is meant to serve.

A Modern-Day Political Guillotine

In many ways, last Tuesday’s election was a modern-day guillotine for the Democratic Party. Trump’s landslide victory served as a sharp rebuke to the incumbency and revealed a fundamental shift in American politics. Exit polls from Gallup highlighted a key divide: while Republicans focused primarily on economic concerns, Democrats centered their campaign on democracy itself. But economic realities loomed large for voters. Squeezed by inflation and rising costs, many Americans found Trump’s direct economic message more relevant than abstract appeals to protect democracy, delivering him a decisive mandate.

For Democrats, the shock will run deep—and it’s not just because top aides to Vice President Harris were still telling senior staff and former President Obama’s aides past 9 p.m. on Tuesday that she was about to win. This defeat goes to the core of their conception of the party. Traditional polls, which had presented a 50/50 race, proved flat out wrong, while Polymarket turned out to be far more accurate in forecasting the outcome. The party’s core assumptions—that shifting demographics and a stronghold among working-class whites, blue-collar Latinos and Black men would secure its base—came undone. Instead, these voters swung toward Trump. Surprisingly, Senator Bernie Sanders remarked after his reelection, “A Democratic Party that has abandoned working-class people should not be surprised when the working class abandons them.” Brutal.

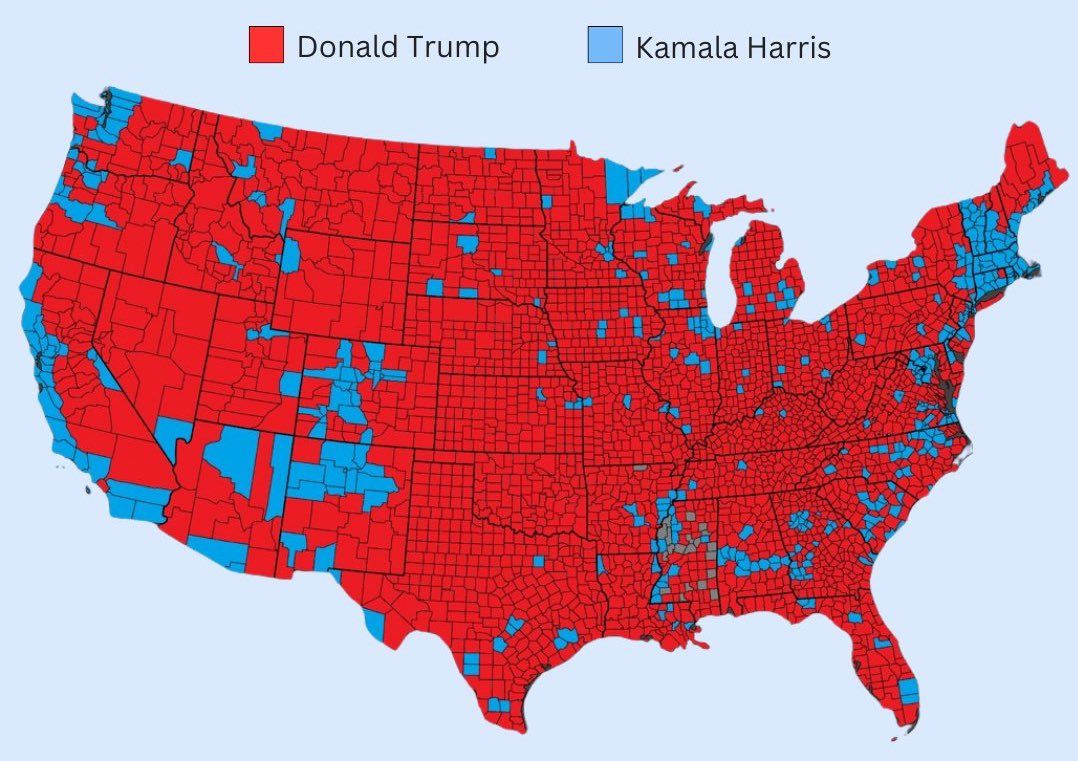

Red sweep: Trump win over Harris in one map

Biden’s Farewell

In his post-election address, President Biden struck a tone of resolve, promising a “peaceful and orderly transition” and reassuring voters of the integrity of U.S. elections. Yet, the gap between the Democratic platform and the electorate’s concerns has never looked starker. When your main endorsements come from Hollywood’s finest—Ben Stiller, J.Lo and Cardi B—it says something about your platform (not that I have anything against celebrities…). Meanwhile, the other side pulls in the backing of tech giants and financial heavyweights like Marc Andreessen, Bill Ackman, and Elon Musk (and say what you will about Musk, but he’s no Zoolander).

Interestingly, this anti-incumbency wave hasn’t been unique to the U.S.—it’s been global. As the Financial Times reported this week, 2024 has revealed a clear and unprecedented pattern: incumbents across 10 major countries—including America’s Democrats, Britain’s Tories, Macron’s Ensemble coalition in France, and Japan’s Liberal Democrats—have faced sweeping defeats. According to the ParlGov research project, this marks the first time in 120 years that every governing party up for reelection has lost support. Globally, it seems, the status quo is no longer enough to satisfy an increasingly frustrated electorate.

Every governing party lost vote share in this year’s elections, for the first time since WW2.

Market Reaction: Rallying on Pro-Growth Promises

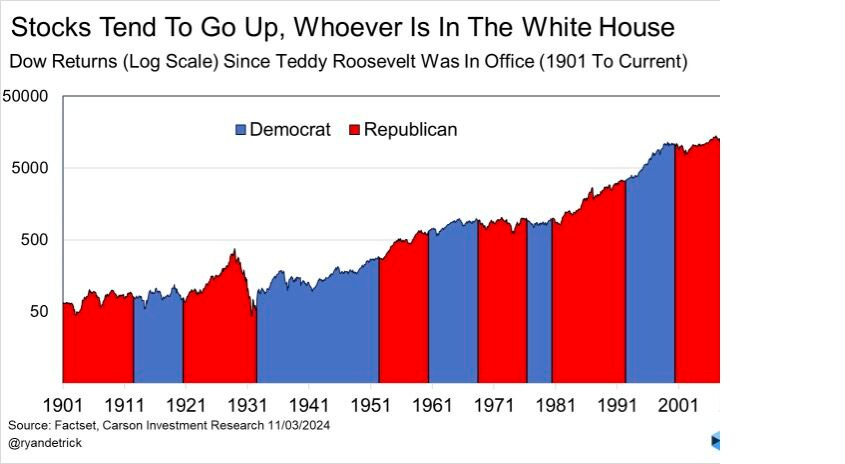

The impact of last week’s political shifts extended well beyond the ballot box, energising financial markets as investors welcomed Trump’s victory and the Republican sweep. Stocks and bonds rallied sharply once the election was called for President-elect Donald Trump, with optimism holding strong throughout the week. Investors responded positively to Trump’s agenda of tax cuts, deregulation, and support for business—which drove the markets similarly in 2016.

The “Trump trades” made a comeback, with sectors like financials, crypto, oil & gas and reshoring industries leading the charge. By week’s end, U.S. stocks had gained 5%, fueled by the promise of a business-friendly agenda. If Trump’s first term offers any guidance, this momentum may signal the beginning of a sustained equity rally.

In a boost to sentiment, the Fed cut rates by 25 bps on Thursday, with Chair Powell expressing confidence in a soft landing. Asked if he’d step down if Trump requested, Powell bluntly replied “No,” with all the charm of a rate hike.

Here’s a look at how various sectors and asset classes responded in the wake of this historic election:

Record post-election gain: U.S. stocks added $1.62 trillion in value on Wednesday (last week), marking the largest-ever post-election gain and the 5th largest single-day gain in history.

U.S. equities surge: The S&P 500 surged past the 6,000 mark for the first time, closing at a record high, while the Dow crossed 44,000. The S&P 500 is now up 25% in 2024, the best start to a year since 1997 and 12th best in history.

S&P 500 milestones: It took just 9 months for the S&P 500 to climb from 5,000 to 6,000—compared to nearly 3 years for the previous 1,000-point gain.

Bitcoin milestone: Bitcoin set 2 milestones, crossing $75,000 during the week, and reaching $80,000 over the weekend, bringing its YTD gain to ~90%.

Tesla milestone: Tesla continued its post-election rally, surpassing a $1 trillion market cap.

U.S. household equity allocation: U.S. households’ stock allocation has reached 49%. Americans have never held more stocks in modern history.

Post-election performance: According to Carson Research, the S&P 500 has gained an average of +15.2% in the year, following 9 of the last 10 elections, adding optimism for further upside in 2025.

Interest Rates, Inflation, and a New Growth Era?

Since mid-September, the yield on the 10-year Treasury bond has climbed by 70 bps to 4.305%, reaching levels not seen since spring. This rise underscores growing concerns around fiscal policy and persistent inflation. But looking ahead to 2025, I see strong reasons to expect a different, more dynamic economic path, driven by potential policy shifts and technological advancements.

A Trump administration, coupled with Republican-led tax reforms, could set the stage for a growth trajectory reminiscent of the boom years of the 1980s and 1990s. Proposed corporate tax cuts, regulatory easing and targeted tariffs may drive the U.S. economy from deficit towards sustained growth. Then, as now, tax cuts paired with a supportive monetary stance helped ease inflationary pressures while igniting productivity growth. Today, these tax reforms could lower the corporate tax rate from 21% to 15%, potentially lifting EPS estimates by around 4%, according to Goldman Sachs—a game changer for corporate America.

Productivity growth remains a crucial factor and recent data shows signs of strengthening. With the U.S. dollar likely to rise—applying downward pressure on commodity prices—sustained productivity gains could help counter inflationary risks, fostering stable growth across essential sectors. Together, a stronger dollar and rising productivity create a stabilising effect on prices and pave the way for an investment-friendly environment.

In the near term, interest rates may face downward pressure as businesses hold off on major capital investments until lower tax rates are realised. Expected regulatory shifts at the SEC and FTC could open the door to greater capital flows into high-growth sectors, while reductions in government inefficiencies and targeted incentives might kickstart a powerful cycle of economic expansion.

Altogether, these factors set the U.S. economy up for a period of robust growth that attracts global capital and strengthens the dollar. With productivity gains, pro-growth policies and innovation flourishing, I believe we may well be on the brink of a new golden age for American markets—one defined by resilience, breakthroughs, and unprecedented growth across U.S. stocks and key sectors. It’s an exciting prospect and one that promises extraordinary opportunities ahead.

Feel the pulse, stay ahead.

Rahul Bhushan.