Vatican Diplomacy, Bitcoin Breaks Free, Trump’s Protection Racket, Xi’s Ghosting, and Bald Dolls Signal Recession – Letter #27

“He who wishes to be obeyed must know how to command.” — Niccolò Machiavelli

Giovanni di Lorenzo de’ Medici was born in 1475 into a family that needed no introduction in Florence. The Medici name was synonymous with power—not through swords or crowns, but through ledgers, loans, and the quiet authority of finance.

Raised amid the grandeur of Florentine palaces, Giovanni’s path was set early. As the second son of Lorenzo de’ Medici, known as Lorenzo the Magnificent, Giovanni was destined for a life in the Church—a place where Medici influence could extend beyond commerce and politics. Surrounded by scholars, artists, and statesmen, his education blended theology with the art of governance.

By the age of thirteen, Giovanni was appointed cardinal, a position secured not by piety alone, but by the influence his family wielded across Europe.

In 1513, at just thirty-seven years old, Giovanni ascended to the highest spiritual office in Christendom, becoming Pope Leo X. With the papacy came not only spiritual authority, but control over one of the most significant political and financial institutions of the time.

Leo X embraced his role with characteristic Medici flair. He became a patron of Renaissance art and architecture, commissioning grand works—including the rebuilding of St. Peter’s Basilica. His approach to leadership was perhaps best captured in a remark to his brother:

“God has given us the papacy, let us enjoy it.”

By the time of his death, the Vatican had evolved into more than a seat of spiritual guidance. It stood as a testament to how wealth, culture, and influence could converge within the walls of a sovereign city-state.

Over the Weekend in Vatican City

Over the weekend, the smallest country in the world once again became the stage for a gathering of presidents, prime ministers, and dignitaries. The funeral of Pope Francis drew more than 200,000 people and 130 heads of state to St. Peter’s Square, alongside hundreds of thousands of mourners. A sovereign city-state spanning less than half a square kilometre had, as it has for centuries, convened the powerful—not through force or wealth, but through tradition, symbolism, and legacy.

Among those in attendance were Javier Milei (where Francis was from), Donald Trump, Volodymyr Zelensky, Emmanuel Macron, and Keir Starmer—leaders who, for a moment, set aside rivalries and competing agendas to stand together within the walls of Vatican City.

The ceremony was a reminder that few institutions embody soft power as completely as Vatican City. Without armies, without economic leverage, the Vatican continues to draw the world’s most powerful figures—not because it must be obeyed, but because it cannot be ignored. Its influence rests not on coercion, but on its ability to project values, history, and moral authority across borders and generations.

When Diplomacy Meets A Blunt Instrument

The irony was unmistakable. President Trump—whose approach to global affairs has been defined not by persuasion or tradition, but by the blunt instruments of hard power— stood as a symbol of stark contrast. Where the Vatican influences through attraction, legitimacy, and identity, Trump’s recent policies reflect a worldview where outcomes are driven by force, economic leverage, and confrontation.

This weekend’s gathering was a stark reminder that enduring influence doesn’t always require coercion. Sometimes, it is rooted in the quiet power of being a place—an idea—that the world cannot ignore.

The U.S. has long been defined by its ideals: democracy, freedom and opportunity, and the rule of law. For much of modern history, this was the allure of what America represented.

However, this president’s recent actions risk marking a departure—whether unintended or not. The pattern is familiar: bold assertions followed by tactical retreats. First, sweeping tariffs threatened on friends and foes, only to be delayed with a 90-day pause. Then, targeted tariffs on China—announced with characteristic force, but quickly moderated. Finally, as recently as last week, the threat to fire “Mr. Too Late / Loco / Major Loser“ Jerome Powell, only to walk it back days later—crossing a line largely untouched since the Reagan-Thatcher era.

From Tough Talk to Truce Talk

Confidence isn’t helped when, within 48 hours, messaging swings from bravado to diplomacy. On Tuesday, the president told Time magazine that President Xi had called him seeking a deal on tariffs. By Wednesday, Treasury Secretary Scott Bessent was echoing the sentiment, suggesting “there is an opportunity for a big deal“ with China.

De-escalation talk is welcome—but when it comes wrapped in political theatre, markets don’t take it at face value. Especially when China quickly responded, repeatedly confirming that no negotiations on tariffs have taken place!

If Trump and Xi Jinping can’t agree on whether they’ve even spoken to each other, how can they ever agree to a trade deal? 🤣

I worry that the ongoing geopolitical convulsions of Trump’s protection-racket diplomacy have unnerved markets and risk leaving a reputational scar—one whose tissue may not heal as quickly as the administration would like.

A Pause for Thought

It would seem President Trump has begun to recognise the side effects of his own strategy. Was it the stock market correction that got his attention? The drop in sentiment surveys? Slipping approval ratings? Maybe someone in his inner circle finally managed to get through. Or perhaps Howard Lutnick convinced him to take the Ice Bucket Challenge. Who knows.

Then again, with 75 countries queuing up to “kiss your ass“, even the most iron-cheeked negotiator knows when to step back.

Whatever the cause, the shift in tone from the White House over recent weeks has been clear. The latest U-turn feels substantial enough to explain why markets finally caught a bid.

After nearly a month of volatility, investors were given a breather.

Hopes for imminent trade deals—or at least a pause in hostilities—sent U.S. equities sharply higher. The Nasdaq posted its second-best week since November 2023, while gold retreated as risk appetite cautiously returned.

Weekly Market Moves

Long-term yields have retreated from their recent highs reached after the sweeping tariffs announced on Liberation Day—a move that triggered a sharp rise in Treasury yields (see below) as China and Japan began reducing their U.S. debt holdings.

The VIX has eased to around 25—which doesn’t signal calm waters, but is a notable improvement from the panic levels seen just a few weeks ago, and its lowest point since Liberation Day.

And in central bank news, Cleveland Fed President Hammack offered markets a small lifeline, suggesting that a June cut is possible if conditions worsen quickly enough and the ECB delivers another rate cut.

So, on the surface, good news..

The question, as always, is one of durability. Rhetoric has shifted rapidly throughout 2025, and there’s little reason to believe it won’t again. Equity markets may have enjoyed a reprieve, but—as usual—the bond market is showing greater scepticism, refusing to chase a full-blown rally.

For now, investors may welcome the pause.

Recession Roulette

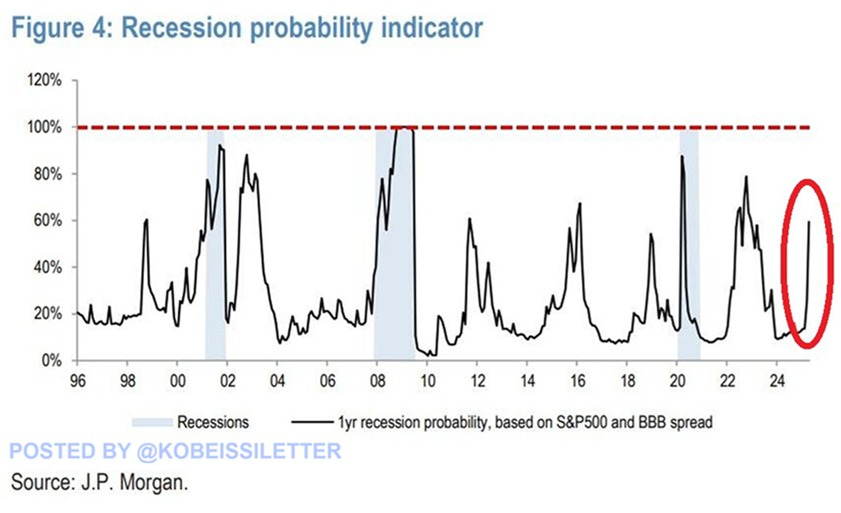

If you’re looking for clarity on where the economy is headed, it depends entirely on whose crystal ball you prefer.

J.P. Morgan has now placed the odds of a U.S. recession at 60%. Over at Bank of America, they’re holding the line at 35%. Ed Yardeni is calling it 45%, hedging his bets with a mix of “stagflation/recession.” And if you’re feeling particularly gloomy, Torsten Slok offers a 90% chance of what he diplomatically terms a “Voluntary Trade Reset Recession.”

Adding to the unease, the IMF cut its global growth forecast this week to 2.8%, down 0.5 percentage points from January’s outlook. Even then, these figures are, at best, tentative.

Meanwhile, on Main Street, American consumers are signalling concern. The University of Michigan’s closely-watched sentiment survey dropped 8% from March to April, driven by renewed fears over inflation and economic uncertainty.

For households, consumer confidence is hovering at record lows. Spending has been pulled forward, with many rushing to make purchases ahead of tariff hikes. Even tourism, particularly international travel, is feeling the strain.

For businesses, new orders are falling. Capex plans are being shelved. Inventories swelled in anticipation of tariffs, and now companies are quietly revising down earnings expectations.

The CEO of MGA Entertainment—maker of Bratz and L.O.L. Surprise!—recently admitted that without Chinese manufacturing, they’re not quite sure how to keep putting hair on their dolls’ heads.

We can debate recession odds all day, but bald dolls feel like a leading indicator. 🤣

Soft Worries, Hard Realities

All this said, as recently as a week ago, the biggest concern in markets was that foreign investors had lost faith in the US dollar and would start dumping US assets. But TIC data shows foreign selling of US equities has been moderate. Not much has happened — yet.

Coming back to the theme of soft vs hard:

As Augur Infinity pointed out this week, “The softness in US soft data — like sentiment surveys — still hasn’t spilled over into hard data. Based on our calculations, hard data continues to indicate above-trend growth.”

In other words, while sentiment sulks, the real economy hasn’t cracked. And when everyone is focused on the same risk, pricing in worst-case scenarios, markets have a habit of disappointing the pessimists.

So maybe — just maybe — this holds together longer than many expect.

It certainly seems that way if you ask retail investors. After every major pullback this year, including the most recent drop, retail has done what it does best: buy the dip.

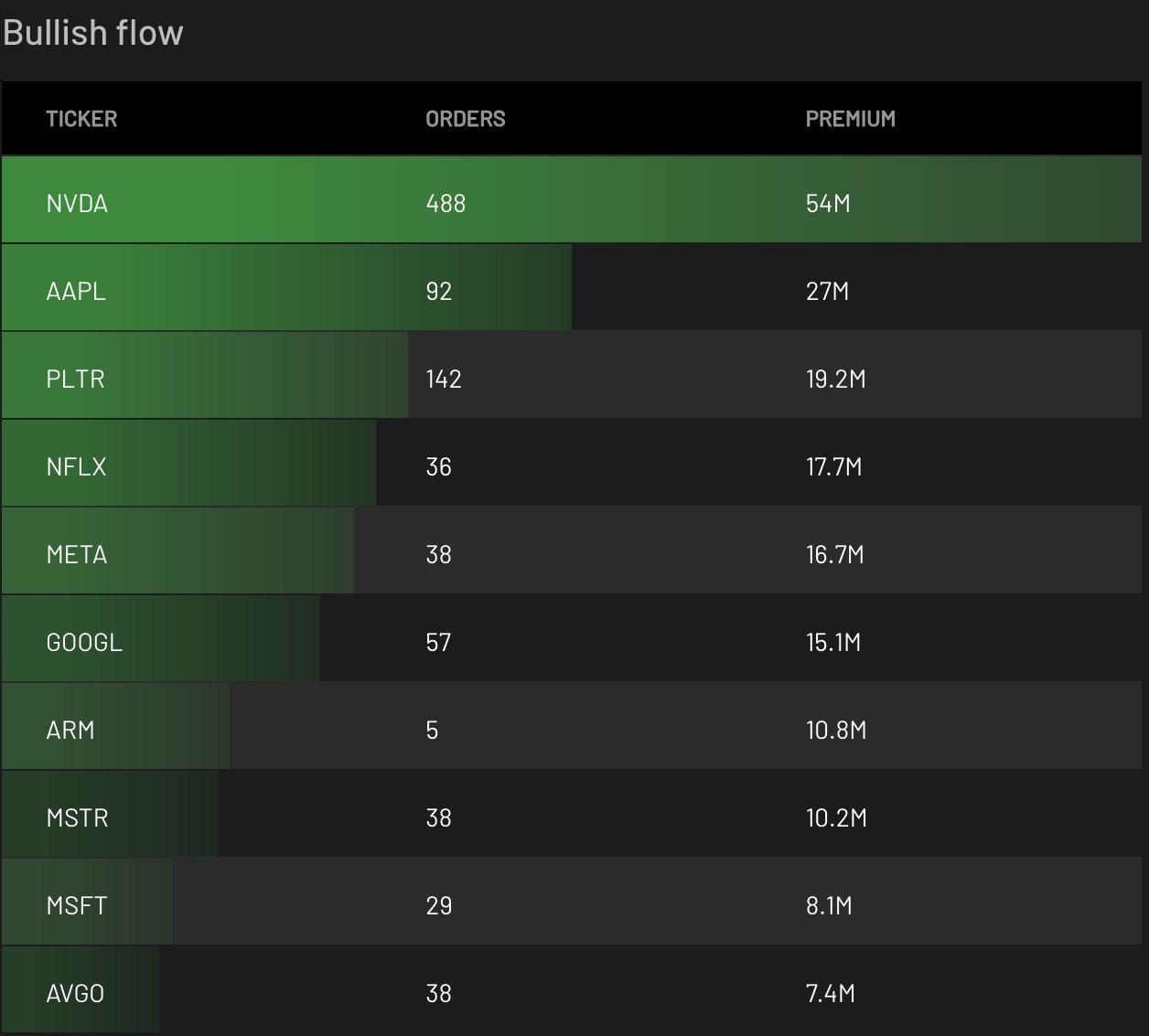

Here are the stocks that saw the strongest bullish flows last Thursday — with Google in the top 10 last week after reporting a 46% surge in first-quarter profit, fuelled by continued strength in its search business and soaring AI-driven demand for cloud computing.

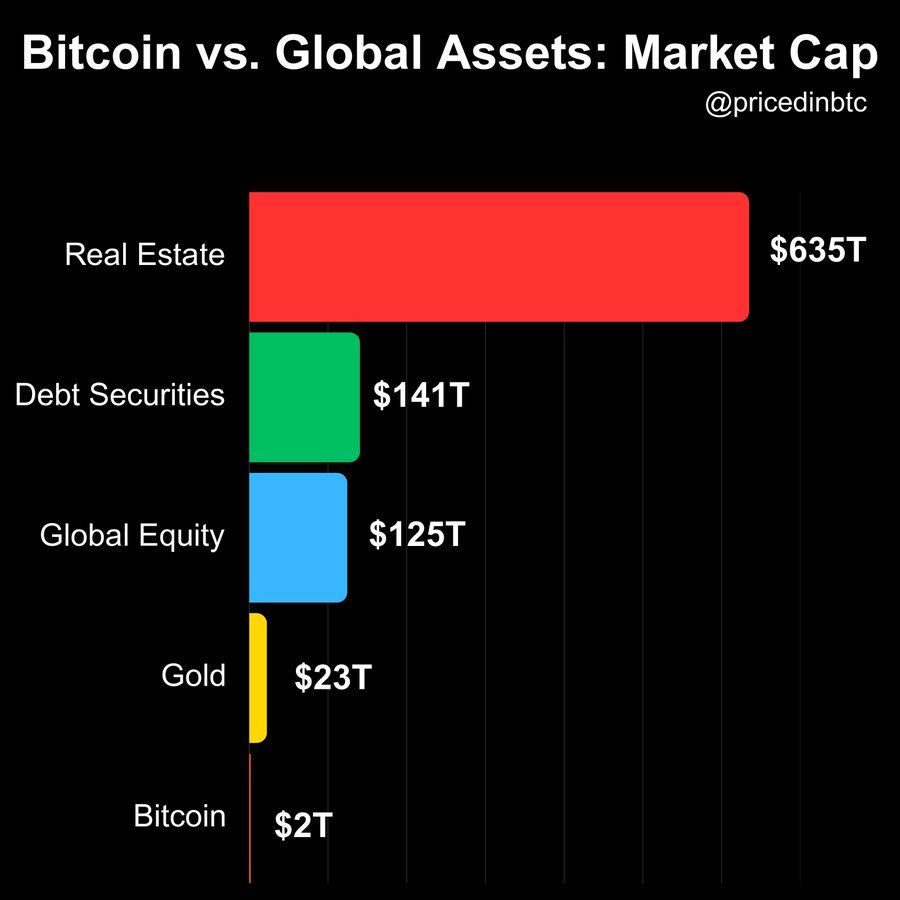

But this didn’t stop Bitcoin from flipping Google in market cap last week:

Bitcoin’s Graduation

I’ve only written about Bitcoin once before in this newsletter. But as a long-term HODLer, it feels worth highlighting five developments that have quietly redefined Bitcoin’s role in markets over recent months..

Bitcoin (BTC) has surged to over $90,000, not in a risk-on frenzy, but against a backdrop of falling equity markets, declining bonds, a weakening U.S. dollar, and underperformance across other cryptocurrencies. BTC is the OG.

Bitcoin is decoupling from tech and other cryptocurrencies. Here are two charts (courtesy of Brent Donnelly) showing Bitcoin’s divergence from TQQQ (3x long Nasdaq) and ETH (Ethereum).

Global M2 growth remains the ultimate driver, and Bitcoin is proving to be its cleanest expression. This chart from Raoul Pal shows Bitcoin lagging M2 by 12 weeks—almost to perfection.

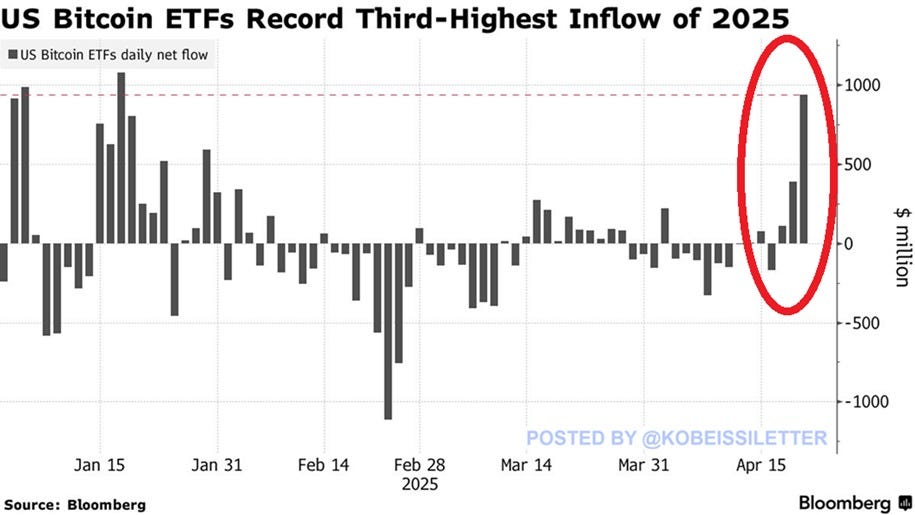

Institutional adoption is rising. Not because Bitcoin is trendy, but because it’s being recognised as what it truly represents: The market’s only stateless insurance policy against a breakdown in global cohesion. In a world of tariffs, controls, and political dysfunction, Bitcoin offers something no other asset can: A chaos hedge for a fragmenting world.

And finally… this is still how I feel at dinner parties my wife drags me to:

Feel the pulse, stay ahead.

Rahul Bhushan.