War and Carnage, Main Street vs. Wall Street, China AI, Tariff Boomerangs and Trump Austerity – Letter #22

“All war is a symptom of man’s failure as a thinking animal.” – John Steinbeck

I’ve been thinking a lot about wars these days. Not just the ones that dominate the headlines—Ukraine, Gaza, the AI war, the tariff skirmishes—but war as a concept. Once upon a time, wars had endings. They were fought for conquest, for resources, for ideology. And when they ended, maps were redrawn, empires expanded or collapsed, and victors imposed their will on the defeated. The Peloponnesian War left Athens in ruins, Rome salted the earth of Carthage, the Napoleonic Wars reshaped Europe, and World War II redrew the entire geopolitical order. War was brutal, but it was, at least in theory, decisive.

But when was the last time a war was won? Not just declared over, but truly resolved? Korea ended in an armistice. Vietnam ended with helicopters fleeing rooftops. The War on Terror sprawled endlessly, each “victory” birthing a new conflict hydra-headed. Today, even economic and technological wars—the battles fought with sanctions, tariffs, and semiconductor embargoes—seem to have no clear winners. The U.S. restricts China’s access to AI chips, and yet, within months, China unveils a frontier model. It slaps tariffs on European goods, only for Europe to retaliate. The pattern repeats, escalating rather than resolving.

If war was once about conquest, now it feels more like entropy. A slow, grinding stalemate where everyone loses, but no one knows how to stop playing.

Let’s dive into this week’s events.

Chinese AI: The War That Was Never Theirs to Lose

Consider the sheer extent of U.S. efforts to block China’s AI progress. Export bans on Nvidia GPUs, restrictions on semiconductor manufacturing tools, blacklists for Chinese tech firms, and investment restrictions—each move designed to slow China down. And yet, not only has China refused to fall behind, but it is now emerging as a serious competitor at the AI frontier.

Take DeepSeek, which seemingly came out of nowhere to briefly dethrone ChatGPT as the most downloaded app on the U.S. App Store. Then there’s Manus AI, an AI agent—or a cream for an itch you’d rather not Google. Released last week, it showcased a general AI agent capable of managing 50 tasks simultaneously, setting a new benchmark in autonomous multitasking.

ByteDance, which built TikTok’s AI recommendation engine years before its Western counterparts understood the power of large-scale AI-driven content optimisation, is now expanding its AI ambitions across new domains. Meanwhile, Alibaba, Huawei, and SMIC are quietly constructing an AI chip stack to reduce China’s reliance on Western hardware altogether.

The irony is hard to ignore: every attempt to contain China’s AI development has seemingly accelerated it. China is now producing AI that is not just powerful, but more cost-effective and scalable.

And now, China’s humanoid robotics sector is flexing. EngineAI’s PM01, a 4’6” bipedal robot, was seen this week running with an unnerving level of confidence. My best guess? This thing was trained on a 24/7 loop of David Goggins rants.

Meanwhile, Unitree’s G1 pulled off a dance routine a few weeks ago, only for BridgeDP Robotics to have its own humanoid, Booster T1, perform the exact same routine last week.

The broader lesson? The pace of technological progress is relentless, talent finds its way to where it is most needed, and adaptation is inevitable. The real question is no longer whether China can develop cutting-edge AI— it’s how much we’re willing to learn from their remarkable progress.

The Tariff Treadmill

Policymakers love to frame tariffs as a tactical manoeuvre—an economic war of attrition where the U.S. turns the screws, waits for the other side to buckle, and claims victory. But in practice? These wars don’t end—they just erode confidence.

We’ve seen this before. The Trump 1.0 era tariffs on China were supposed to protect American manufacturing, but instead, businesses absorbed the higher costs, passed them onto consumers, and moved supply chains to Vietnam and Mexico instead of back to the U.S.

The common response from policymakers? “It’s just a little turbulence.” But this, according to Larry Summers this week, sounds a lot like the “Inflation is transitory” narrative from 2021—which aged about as well as milk left in the sun.

This trade war isn’t just with China—it’s with allies, trading partners, and even the very investors who once saw the U.S. as the most predictable game in town.

This was never a war the U.S. was prepared to win—just one it keeps doubling down on.

This X post caught my attention this week:

A curious stance, given that in his recent speech at the European Parliament, economist Jeffrey Sachs pointed out that China hasn’t fought a war in over 40 years—while the U.S. has been engaged in conflicts almost nonstop. So maybe China isn’t preparing for a war of bullets and bombs—because the real power struggle is happening in AI labs, not war rooms.

Whiplash on Wall Street

Moving on to markets, these tariff rollouts and mounting fears over AI spending have thrown investors into a state of whiplash as March begins. President Trump’s sudden tariffs—25% on imports from Canada and Mexico, and 10% on Chinese goods—sparked immediate volatility, with the Dow plunging more than 5% in a single trading session on Monday last week. Then, midweek reports confirmed certain tariff delays or exemptions. The administration’s unpredictable stance has left markets bracing for further disruptions.

These stop-start-delay-exempt tactics from the White House are wreaking clear havoc on financial markets. Since Trump took office on January 20, the S&P 500 has fallen nearly 4%.

Early days of Trump 2.0 vs. Trump 1.0:

Meanwhile, the Nasdaq 100 has entered correction territory, now down more than 10% from recent highs and breaking below its 200-day moving average.

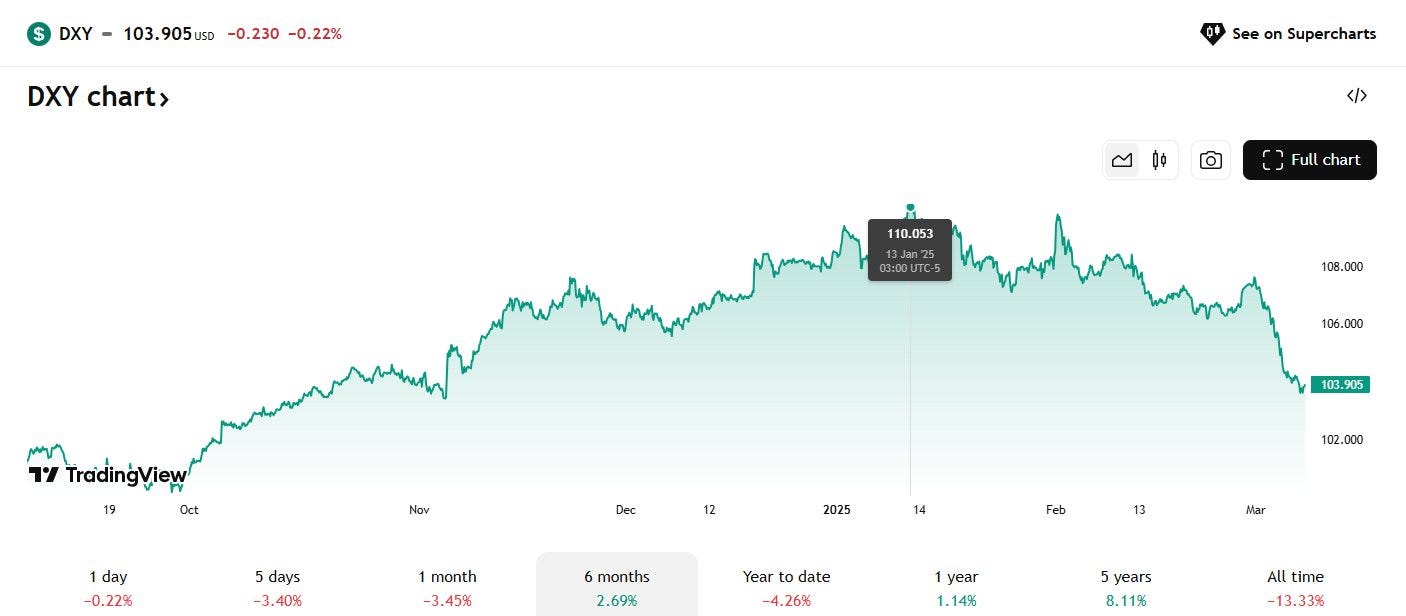

The dollar index has declined over 5%, reaching a four-month low as foreign investors increasingly withdraw funds from U.S. stocks.

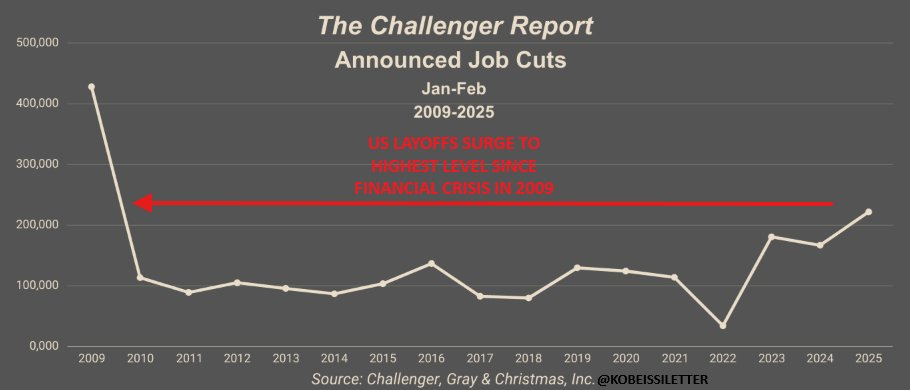

Jobless claims have spiked sharply, overshadowing modest February job growth of 151,000 positions. Most notably, 172,000 layoffs occurred last month alone, driven largely by a surge in federal job cuts linked to DOGE. Year-to-date, layoffs have reached 221,812—the highest total since 2009.

With manufacturing data weakening and the Atlanta Fed’s Q1 GDPNow forecast plunging to more than -2.4% as of March 6th, 2025, markets remain on edge. The longer these economic pressures linger, the greater the potential for further downside.

Amidst all this volatility, it’s worth asking: is this market weakness a structural problem, or just an adjustment phase as the U.S. shifts toward a new economic paradigm?

Main Street vs. Wall Street

While markets remain jittery, my view is that this volatility is more of an adjustment than the start of something structurally damaging. What we may be witnessing is a shift from public-sector-driven growth to private-sector spending—a recalibration that prioritises Main Street over Wall Street. In many ways, this resembles a form of austerity, aimed at bringing the U.S. onto a more sustainable fiscal path. With national debt nearing $40 trillion and annual interest payments exceeding $1 trillion, this pivot might not just be necessary, but inevitable.

The likely play here is to weaken the dollar, lower oil prices, and drive down long-term bond yields—all in service of manufacturing disinflation or even outright deflation. Recent data from the Truflation gauge, now down to 1.40%, suggests that inflationary pressures have already cooled significantly.

The trajectory of oil prices in 2025 will play a crucial role in shaping inflation, given oil’s outsized influence on consumer costs. A sharper decline is likely ahead. OPEC+’s decision to increase supply defies economic logic, particularly when market sentiment is overwhelmingly bearish, as evidenced by the sharp drop in speculative long positions in WTI and Brent futures. The most plausible explanation is political: Saudi Arabia and Russia appear to be responding to pressure from a Trump administration eager to drive down gasoline prices ahead of the Ukraine peace summit in Riyadh. Citigroup expects prices to fall to $60, while JPMorgan projects $50 if restrictions on Russian exports are lifted.

If this trend continues, it could give the Federal Reserve room to cut interest rates—a move that would directly support Main Street by making borrowing cheaper for households and businesses.

Tom Lee of Fundstrat Global Advisors essentially co-signed this thesis last week:

“I think the White House wants the Fed to get off neutral, and I think it’s increasingly looking like the Fed is behind.”

If they realise it in 8 weeks, we’re likely going to get a May rate cut.

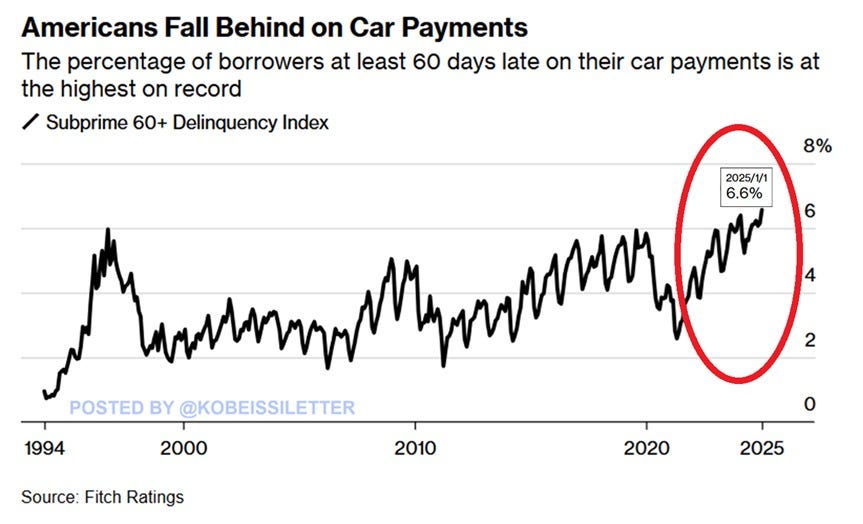

Consider that Americans are falling behind on debt payments at a rate that resembles a recession. In January, for example, 6.6% of subprime car borrowers were at least 60 days past due—the highest level in at least 30 years. This percentage has doubled over the past 3.5 years in a high interest rate environment, now exceeding the peaks of 2020, 2008, and the previous record set in 1996.

But there’s another motivation: with $10 trillion in U.S. debt needing refinancing this year, lower rates would ease the Treasury’s burden. The White House wants cheaper refinancing, and given Trump’s recent comment on the stock market (“I don’t even look at it”), the market volatility appears [somewhat] engineered to push the Fed toward rate cuts.

Accordingly, the bigger picture appears to suggest that the goal is long-term stability. Lower asset prices, falling yields, and a recalibrated fiscal strategy could all help pave the way for a more sustainable expansion—one that better balances the needs of both Main Street and Wall Street.

Smart Money Moves in Chaos

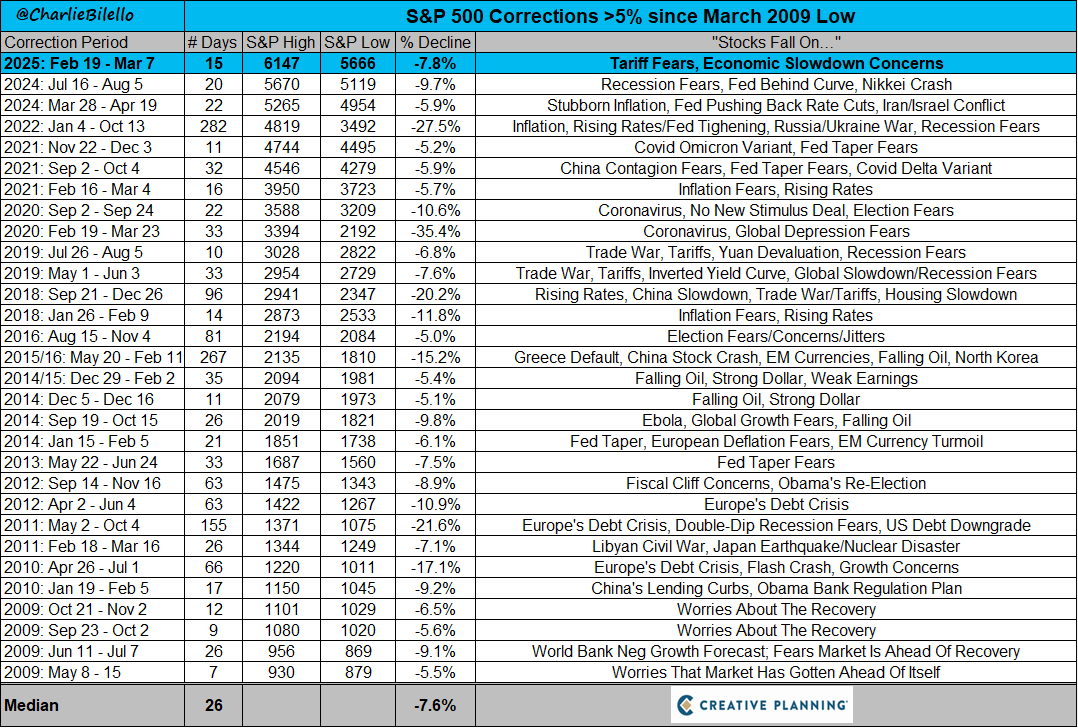

In this context, this recent pullback might be seen as less about economic weakness and more about a necessary transition. Since the March 2009 lows, the S&P 500 has experienced 30 similar 5%+ corrections, each one feeling like the end of the world at the time—only to be followed by recoveries.

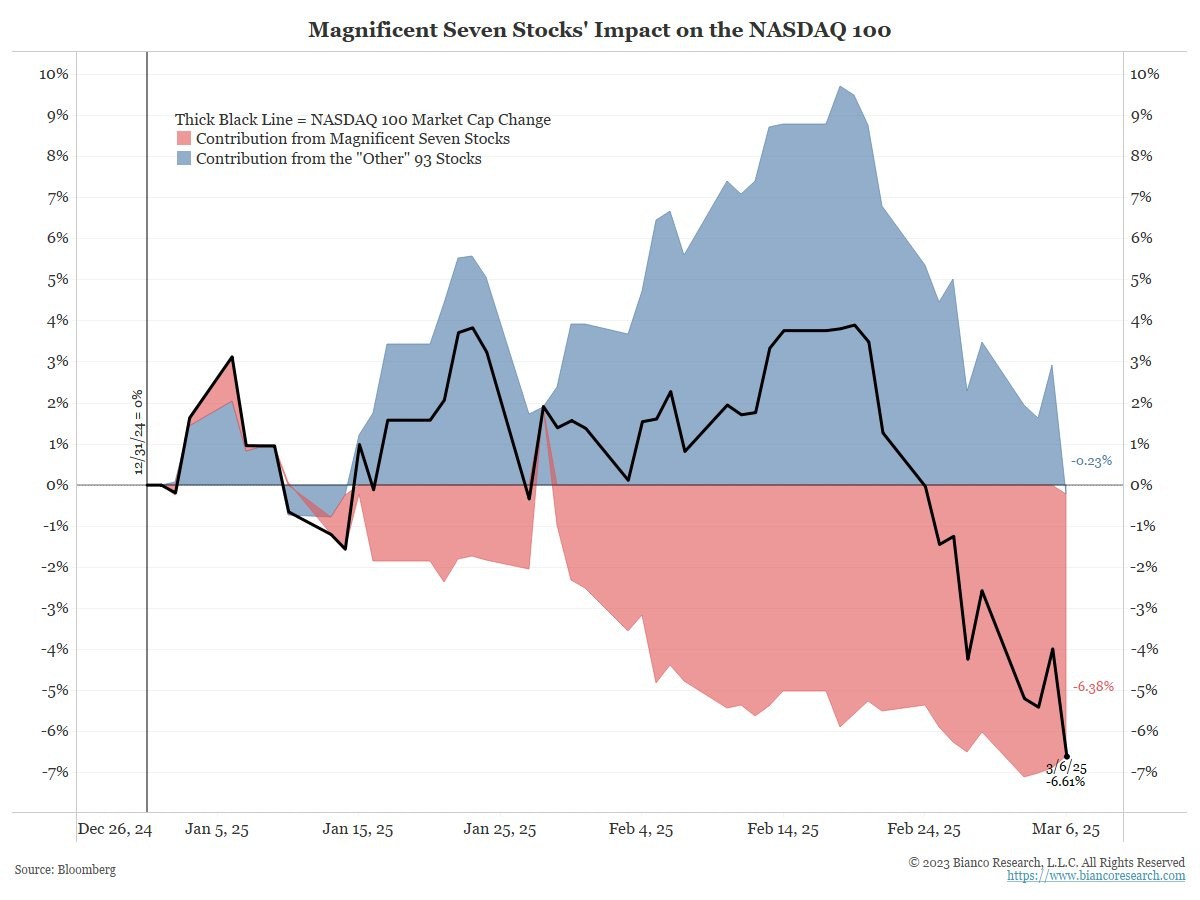

Notably, year-to-date, nearly all of the Nasdaq 100’s decline has come from the Magnificent Seven, highlighting that this downturn is not broad-based.

If we’re reliving 1983 to 2001, but on a larger scale, then we’re setting up for a mega bull run:

According to Goldman’s David Solomon, the likelihood of a U.S. recession remains “very small” despite ongoing trade uncertainty.

Opportunities in the Market?

Wedbush analyst Dan Ives remains highly optimistic about Tesla’s long-term value proposition:

“I think 90% of the value is going to be autonomous and Optimus-driven. I think autonomous itself is worth more value than all of Tesla today. And I just think right now we are going into what could be actually the biggest golden path for Musk and Tesla.”

Meanwhile, Amazon is currently trading at an EV/EBITDA multiple of just 12.99x, one of the lowest valuations it has seen in the past decade—arguably a rare opportunity in a market that often overpays for quality.

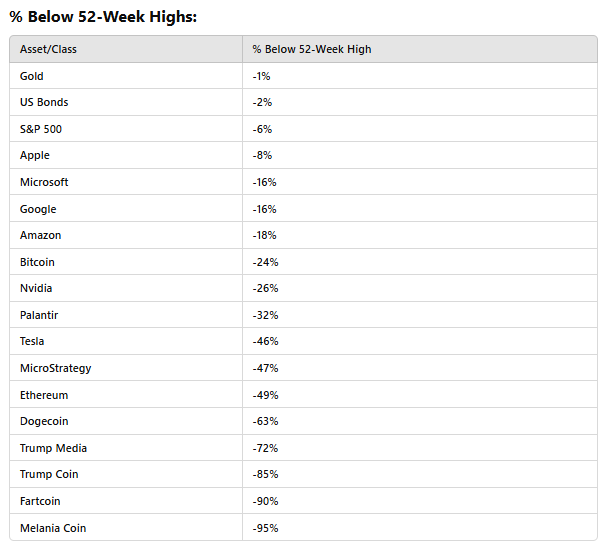

Yet, despite these apparent bargains, market sentiment remains fragile. If you had told investors at the start of the year that Nvidia and Broadcom would be down 16% year-to-date, Tesla down 35%, IonQ down 51%, and RocketLab down 26%, many would have said they were waiting for a dip to buy back in. But now that the pullback has arrived, fear dominates.

Same cycle, every time—investors want a dip, but when it comes, they hesitate. Narrative always follows price action.

What will you do?

Feel the pulse, stay ahead.

Rahul Bhushan.