Europe’s Innovation Crisis and American Exceptionalism – Letter #10

“Houston, we have a problem.” – Jack Swigert

Nestled in the heart of the Free State of Bavaria lies the Technische Universität München (TUM), one of Europe’s leading engineering and technology institutions. It’s a place where the hum of discovery is constant, from labs dedicated to aerodynamics to classrooms filled with aspiring engineers sketching bold visions of the future. Among these dreamers, Daniel Wiegand stood out—a young aerospace engineer captivated by the idea of reimagining air travel. Inspired by Otto Lilienthal, the 19th century German aviation pioneer, Wiegand envisioned a world where electric vertical take-off and landing (eVTOL) aircraft could redefine urban and regional mobility.

In 2015, Wiegand and a group of TUM graduates co-founded Lilium, a startup aimed at turning this vision into reality. The idea was audacious: a sleek, all-electric aircraft capable of carrying passengers across cities and countries with zero emissions. Early prototypes like the Lilium Eagle and later the five-seater Lilium Jet dazzled with their ingenuity, capturing headlines and investor interest worldwide.

Wiegand spoke passionately about his dream. “We are on a mission: to create a sustainable and accessible mode of high-speed, regional transportation at a lower cost for society,” he said in an interview with Deutsche Bank. Backed by substantial funding rounds, including nearly $400 million from investors, Lilium quickly became a poster child for European innovation. With ambitious plans to revolutionise transportation, it secured deals for service rollouts in Florida and Germany, aiming to lead the charge in the burgeoning eVTOL market.

But the skies darkened. Despite raising over $1 billion since its inception, Lilium’s financial runway shortened precipitously. Building an eVTOL company was inherently capital-intensive, demanding both significant investment and the ability to scale rapidly within Europe’s fragmented and heavily regulated markets. Facing escalating costs and slipping timelines, Lilium sought a €50 million state guarantee from the German government—a modest ask for what had been lauded as one of Europe’s most promising startups. Their refusal, citing financial risks, was a significant blow, underscoring the continent’s limited appetite for bold, high-stakes innovation. Efforts to secure support from the Bavarian state government also failed, leaving Lilium without the critical lifeline it needed. By October 2024, the company filed for insolvency for its German subsidiaries and on November 15, it announced a structured M&A process as a last-ditch effort to survive.

Europe’s Innovation Problem

Lilium’s rise and fall serve as a microcosm of Europe’s struggle to foster and sustain innovation. While the continent boasts world-class engineering talent and academic institutions like TUM, it lacks a cohesive ecosystem to nurture groundbreaking ideas into sustainable businesses. Capital constraints, fragmented markets and heavy regulatory burdens mean that visionary concepts often falter before they can take off.

Lilium’s story is not unique. Northvolt, heralded as a cornerstone of Europe’s green tech future, is now teetering on the brink of bankruptcy. Its factory in Skellefteå, northern Sweden, remains underutilised, emblematic of a broader funding crisis that could cripple Europe’s battery ambitions.

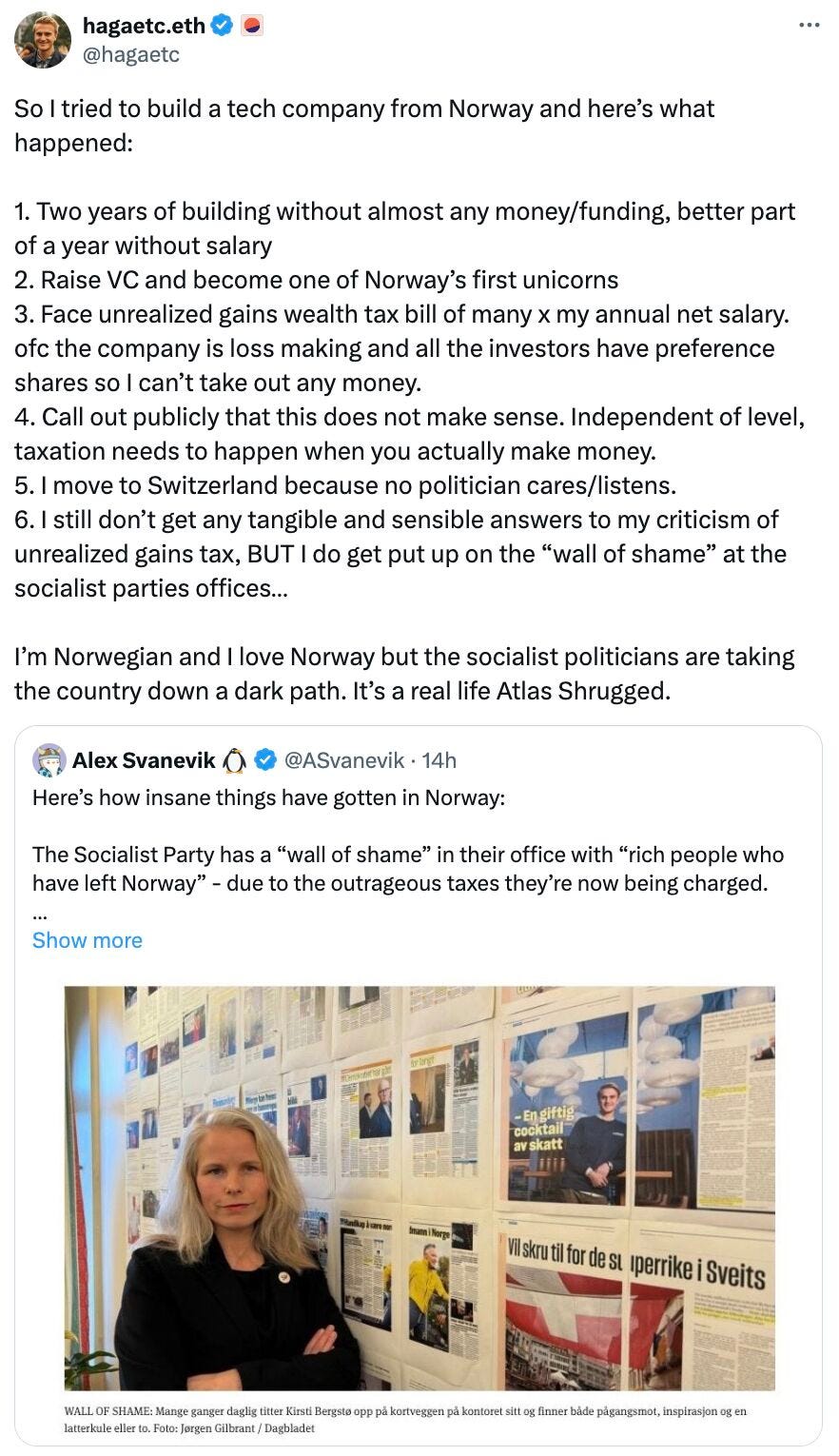

The challenges extend beyond financial struggles. Over the weekend, I came across this startling post:

This thread highlights a recurring frustration among European entrepreneurs: systemic obstacles that stifle ambition. High taxation, restrictive policies and fragmented markets are driving talent and innovation away. Is Europe losing its ability to compete in a world increasingly defined by fast-moving, risk-tolerant ecosystems like those in the U.S.?

American Exceptionalism

While Europe’s innovation struggles highlight systemic obstacles, the U.S. offers a contrasting narrative—one of bold investments and rapid progress. Just in the past week, advancements across AI, life sciences and alternative energy have been nothing short of staggering.

Start with artificial intelligence. Sam Altman, CEO of OpenAI, suggested last week that AGI could arrive as soon as 2025. Dario Amodei, CEO of Anthropic, offered a similar prediction, placing AGI within reach by 2026 or 2027. Amodei has previously posited a thesis that feels almost unimaginable: AGI could compress 100 years of medical progress into a single decade, unlocking a new era of advancements in diagnostics, therapeutics and healthcare at large.

This potential is already evident. Last week, Google DeepMind open-sourced AlphaFold 3, a tool predicting protein structures with unparalleled accuracy. It is already revolutionising research timelines. For instance, researchers at the University of Colorado Boulder have leveraged AlphaFold to map proteins in antibiotic-resistant bacteria in mere hours—a task that traditionally spanned years. By democratising this technology, DeepMind is accelerating efforts to combat diseases like cancer and tuberculosis.

In alternative energy, the Biden administration announced plans to triple U.S. nuclear power capacity by 2050. Meanwhile, a fusion breakthrough in New Zealand last week demonstrated the growing feasibility of this transformative energy source. Helion Energy, a U.S. fusion startup, recently signed the world’s first commercial agreement to provide fusion-generated electricity by 2028. If successful, this could mark the dawn of a new energy paradigm: virtually limitless, carbon-free power with unprecedented scalability.

This is just one week in the U.S.

Implications For Investors…

Economist Ed Yardeni forecasted last week that the U.S. is poised for an exceptional surge in productivity and economic growth—potentially one of the most significant in history—projecting the S&P 500 to reach 10,000 (!!!) by 2030.

👀 👀

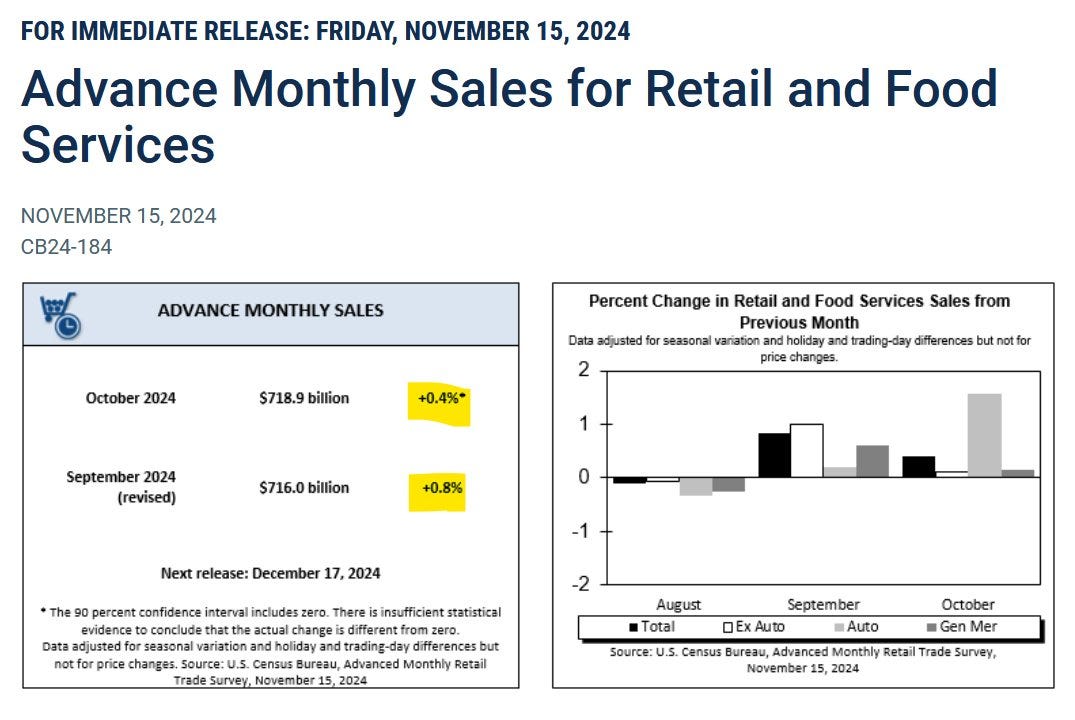

Federal Reserve Chairman Jerome Powell reinforced this optimism, describing U.S. economic growth as “by far the best of any major economy in the world.“ Despite some headwinds in October—like slower job growth attributed to storm damage and labour strikes—the labour market remains robust, with historically low unemployment. Retail sales data added to this positive narrative, showing strong October growth alongside upward revisions to September figures.

Inflation presents a mixed picture. While supercore inflation (which excludes volatile categories like food, energy and housing) remains above 4% y/y, there are signs of cooling m/m. Middle-income homeowners, meanwhile, have experienced cost-of-living inflation below 2% for six consecutive months, highlighting disparities between headline inflation metrics and lived realities.

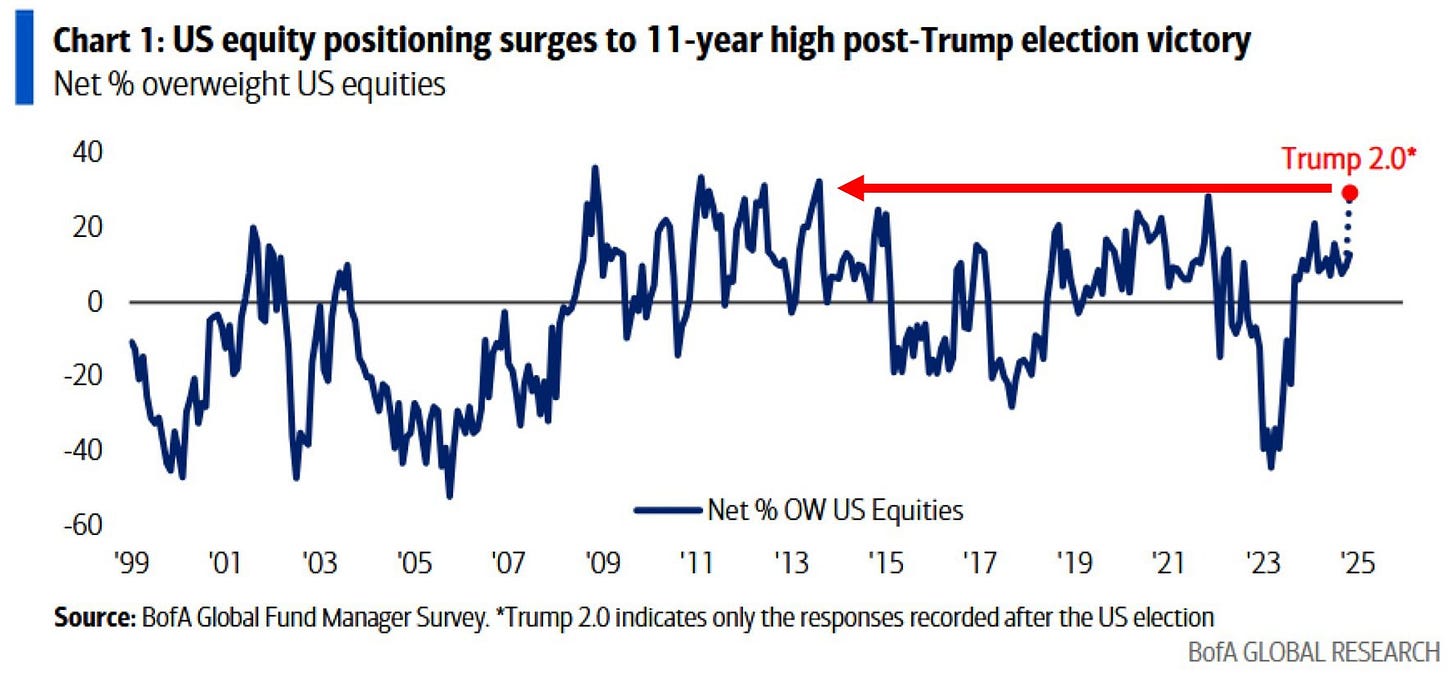

Investor positioning reflects confidence in the U.S. economy. Both institutional and retail investors have increased their exposure to equities, with global allocations to U.S. stocks reaching their highest levels since August 2013, according to BofA:

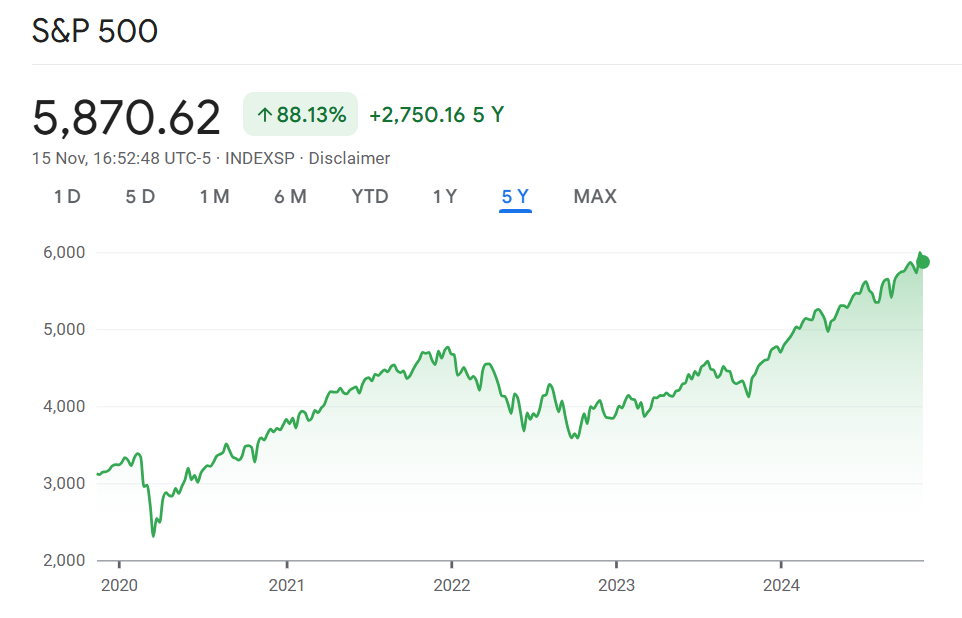

U.S. innovation remains a key driver of this optimism. Since 2011, U.S. equities, represented by the S&P 500, have soared by +377%, far outpacing global equities ex-U.S. (MSCI ACWI ex-USA), which have gained just +38%. Much of this outperformance has come in the past five years, fueled by technological breakthroughs, sound economic policies and resilient consumer spending.

The strength of the U.S. equity market reflects its unique ability to adapt and thrive amid challenges. For investors, the question becomes: in a world shaped by U.S. resilience and innovation, where else would you allocate capital?

Fiscal Exceptionalism: The Missing Piece?

Building on this, the D.O.G.E. initiative, spearheaded by Elon Musk and Vivek Ramaswamy, seeks to address the ballooning $36 trillion U.S. national debt—an issue that demands urgent attention. With federal interest expenses now exceeding $1.1 trillion annually, the need for innovative fiscal strategies is clear.

But what if the U.S. applied the same ingenuity that has driven its market and technological leadership to its fiscal strategy? The idea may seem ambitious, but bold initiatives have always been a hallmark of the American economic playbook.

At its core, D.O.G.E. focuses on both sides of the government’s balance sheet. On the cost side, it proposes cutting $2 trillion in government spending—exceeding current discretionary limits—while enhancing efficiency and unlocking productivity gains. A key target is the sprawling federal workforce of 8-9 million employees and contractors, a politically sensitive but substantial opportunity for reform. Yet, as Musk has often emphasised, efficiency alone is not enough. True transformation demands resourcefulness.

On the revenue side, Howard Lutnick, who was endorsed over the weekend by Musk for Treasury Secretary, envisions leveraging untapped U.S. assets—including land, natural capital and critical resources like lithium—to boost the government’s revenue capacity. By strategically monetising these assets, the U.S. could simultaneously stimulate economic growth and strengthen fiscal sustainability.

For investors, the potential impact is significant. Narrowing the deficit—or even balancing the budget—could magnify optimism around U.S. markets, driving GDP growth and reinforcing market confidence. It’s a “what if” scenario worth exploring.

Indeed, we are living in fascinating times.

Feel the pulse, stay ahead.

Rahul Bhushan.