Big Tech Earnings, AI, the U.S. Election and Fiscal Woes – Letter #8

“The greatest danger in times of turbulence is not the turbulence; it is to act with yesterday’s logic.” – Peter Drucker

Imagine a monkey tapping away on a typewriter for eternity, finally re-creating Shakespeare’s complete works. According to the Infinite Monkey Theorem, it’s possible—but recent research begs to differ. Even with every monkey on Earth typing nonstop, they’d fall short of finishing Hamlet before the universe itself fades into a googol years (a 1 with 100 zeros, for the curious). Some things, it seems, are just too improbable, no matter how much time you give them.

Or are they? Is improbability just a concept we made up to explain the impossible? This weekend’s saga of Peanut, the Instagram-famous squirrel, might make you wonder. Against all odds, Peanut had amassed thousands of followers with his acrobatic antics—only to meet a tragic end when New York officials seized him, citing rabies concerns and euthanised him alongside his raccoon friend, Fred. Peanut’s rise to stardom seemed improbable enough, but his untimely demise and the fact that it made national headlines (with even Elon Musk retweeting the story), left fans and casual onlookers like me scratching their heads. Speaking of improbable twists…

Last week, Russia raised the bar on absurdity by fining Google a whopping 2 undecillion Rubles or about $20.6 decillion—roughly 195 quintillion times the world’s GDP. The Kremlin, fully aware of the impossibility, is using the fine as a symbolic prod to get Google to restore access to Russian broadcasters. For Alphabet, Google’s parent company, it’s more of a surreal distraction than a real threat.

Why? Because, in a world where the improbable sometimes does happen, Google’s earnings report just smashed expectations. In a headline you’d think was plucked from fiction, Sundar Pichai and his team are rewriting the rulebook on Big Tech’s growth, delivering results that would seem impossible—until they aren’t.

Big Tech Earnings

Following Google’s massive earnings beat this quarter, Big Tech has shown just how improbable their growth rates remain at such staggering scale. Google reported quarterly revenue of $88.3 billion, a 15% yoy increase, beating the projected $86.4 billion. EPS reached $2.12 against estimates of $1.84, while net income surged 34% to $26.3 billion, nearly $4 billion above analysts’ expectations. This impressive growth was driven largely by Google Cloud, which posted a 35% yoy revenue increase to $11.35 billion. Such results have eased concerns over the high costs of AI infrastructure, reinforcing Google’s position for now.

Amazon joined in on the strength, with its cloud segment AWS continuing its rapid growth; 2024 revenues are now equivalent to AWS’s entire 2006 revenue every two hours. Amazon’s quarterly capital expenditure reached a record $22.6 billion, marking an 81% yoy increase—higher even than the capital outlays of traditional heavyweights like the oil & gas industry. Meanwhile, Microsoft and Meta reported solid quarterly gains as well, with Microsoft’s revenue rising 16% to $65.6 billion and net income up 11% to $24.7 billion. Meta saw its revenue increase 19% to $40.6 billion and net income jump 35% to $15.7 billion. Although both companies flagged AI-related expenses as a growing challenge, Microsoft notes that demand for its AI capabilities still “continues to exceed available capacity.”

AI Capex

At the heart of Big Tech’s growth narrative this quarter is AI, with companies reporting capital expenditures at an all-time high. Apple, Amazon, Google and Meta alone are projected to collectively invest over $200 billion this year in AI, solidifying it as a cornerstone of their long-term strategy. Leading the charge, Amazon’s $22.6 billion quarterly capex has underscored the immense computational demands of AI as it builds out infrastructure to secure its lead in the cloud market. Google, Microsoft and Meta have likewise invested heavily, pushing their combined AI-related quarterly expenditures past $50 billion.

Looking ahead, these investments are expected to increase significantly, as shown in the Morgan Stanley Research chart below, which tracks the progression of 2025 capex estimates at three points in time: the beginning of 2024, pre-Q3 results and now, post-Q3 results. Initially, the combined capex for Amazon, Microsoft, Google, Meta and Oracle was estimated at $194 billion for 2025. However, pre-Q3 updates raised this projection to $265.4 billion and post-Q3, it has now surged further to an astounding $288.4 billion—representing an overall increase of ~50% since the start of the year. These capex increases highlight not only Big Tech’s confidence in AI as a long-term growth driver but also the extraordinary scale of resources required to support AI at the level they envision.

Cloud Revenue

Cloud revenue remains essential for Big Tech, with Amazon, Google and Microsoft reporting a combined cloud revenue of $62.9 billion this quarter—a 22.2% increase yoy. Microsoft pointed to sustained high demand for its AI capabilities as companies adopt advanced AI tools. Anticipation is also building around the next generation of language models from Google and Anthropic, which are set to bring new levels of AI-driven automation, from managing complex workflows to handling day-to-day tasks like shopping and travel booking.

Investor responses have been broadly positive, though reactions to Apple and Microsoft highlight the market’s ongoing scrutiny of Big Tech’s AI spending. Apple, the most reserved in discussing AI this season, reported robust growth in its services segment, with iCloud and Apple TV+ now comprising a quarter of its revenue. Meta, on the other hand, exceeded earnings expectations, with CEO Mark Zuckerberg emphasising AI’s transformative role for the company’s future growth.

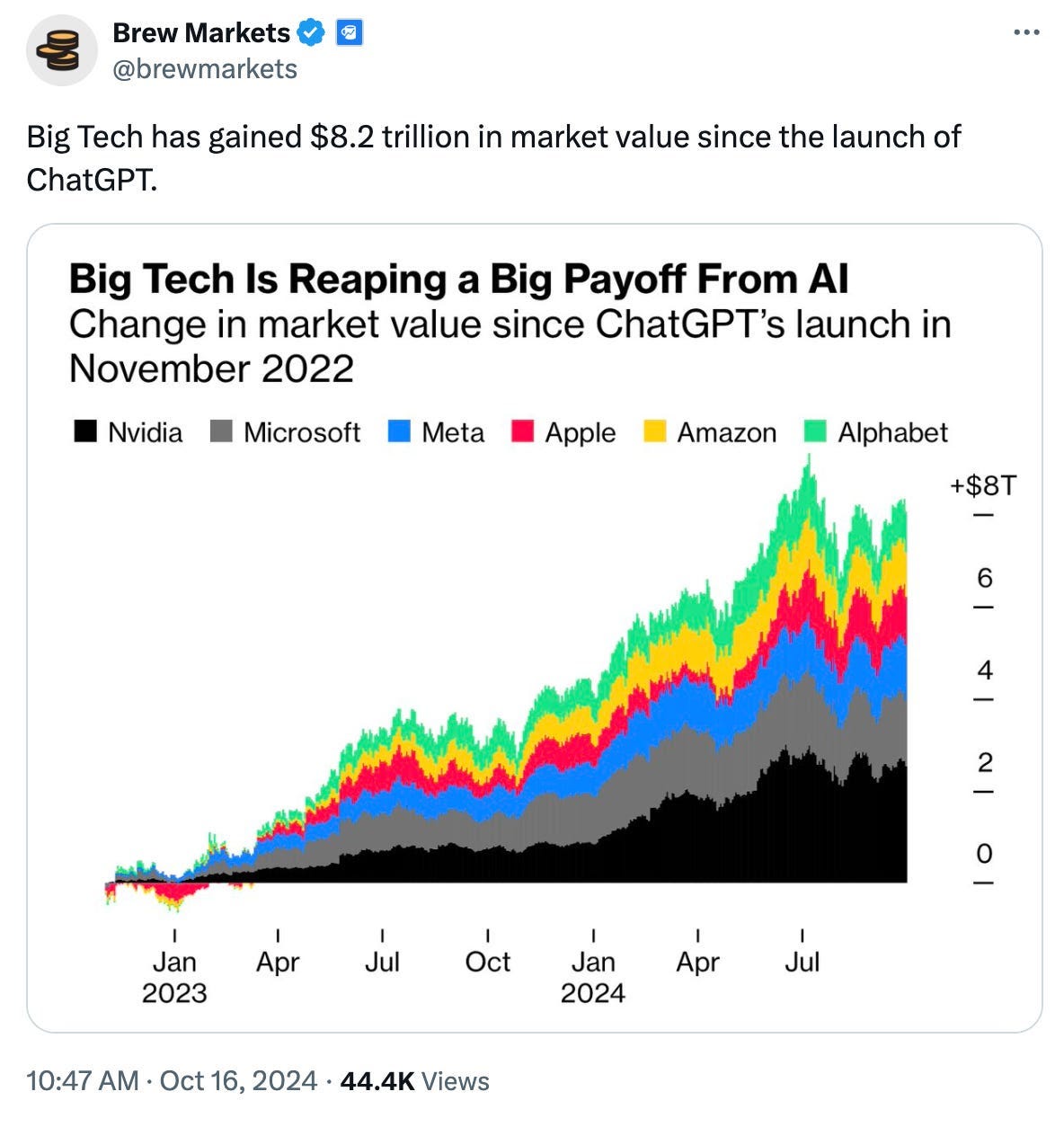

Big Tech’s AI investments are clearly no longer speculative. Google’s record-breaking earnings, Amazon’s intensified focus on cloud and AI and Microsoft’s unmatched demand for AI capacity signal a new era where the improbable becomes possible. For companies valued in the trillions, this level of sustained growth is remarkable. With revenue, earnings and capital investments still climbing, Big Tech is rewriting what’s achievable at this scale. Far from plateauing, these companies appear to be charging forward—at least for now.

Global Markets

Following these strong Big Tech earnings and despite a Halloween dip, the Nasdaq hit a new all-time high on Friday, reflecting the tech sector’s enduring strength, even as the market braces for uncertainty surrounding the upcoming U.S. election.

Investors are beginning to price in scenarios that include a potential Republican sweep, which could bring significant shifts to fiscal policy. U.S. Treasury yields are experiencing the most significant post-election fluctuations in more than three decades, with the 10-year yield climbing by over 70 bps since the Fed’s September rate cut, reaching 4.37% on Friday last week.

This surge in yields reflects concerns over possible policy shifts, including tax cuts, increased government spending and rising deficits. Bond market volatility, as shown by the MOVE Index, has hit a one-year high. The Treasury’s recent announcement to borrow an additional half-trillion dollars in Q4 alone has added to this uncertainty. Given lukewarm demand in recent auctions, further yield increases may be necessary to draw buyers.

Jobs Report

October’s jobs report delivered a mixed message. The U.S. economy added just 12,000 jobs—down sharply from September’s 223,000 gain and marking the slowest monthly growth in two years. Strikes and weather events likely played a role in this drop, with the Boeing strike alone accounting for more than 44,000 lost jobs. Sectors like construction, retail and financial services saw minimal job growth, hinting at a broader hiring slowdown. Additionally, job figures for August and September were revised downward, cutting 112,000 jobs from initial reports. The cooling labour market has bolstered expectations for a quarter-point rate cut at the Fed’s meeting this upcoming Thursday.

U.S. GDP

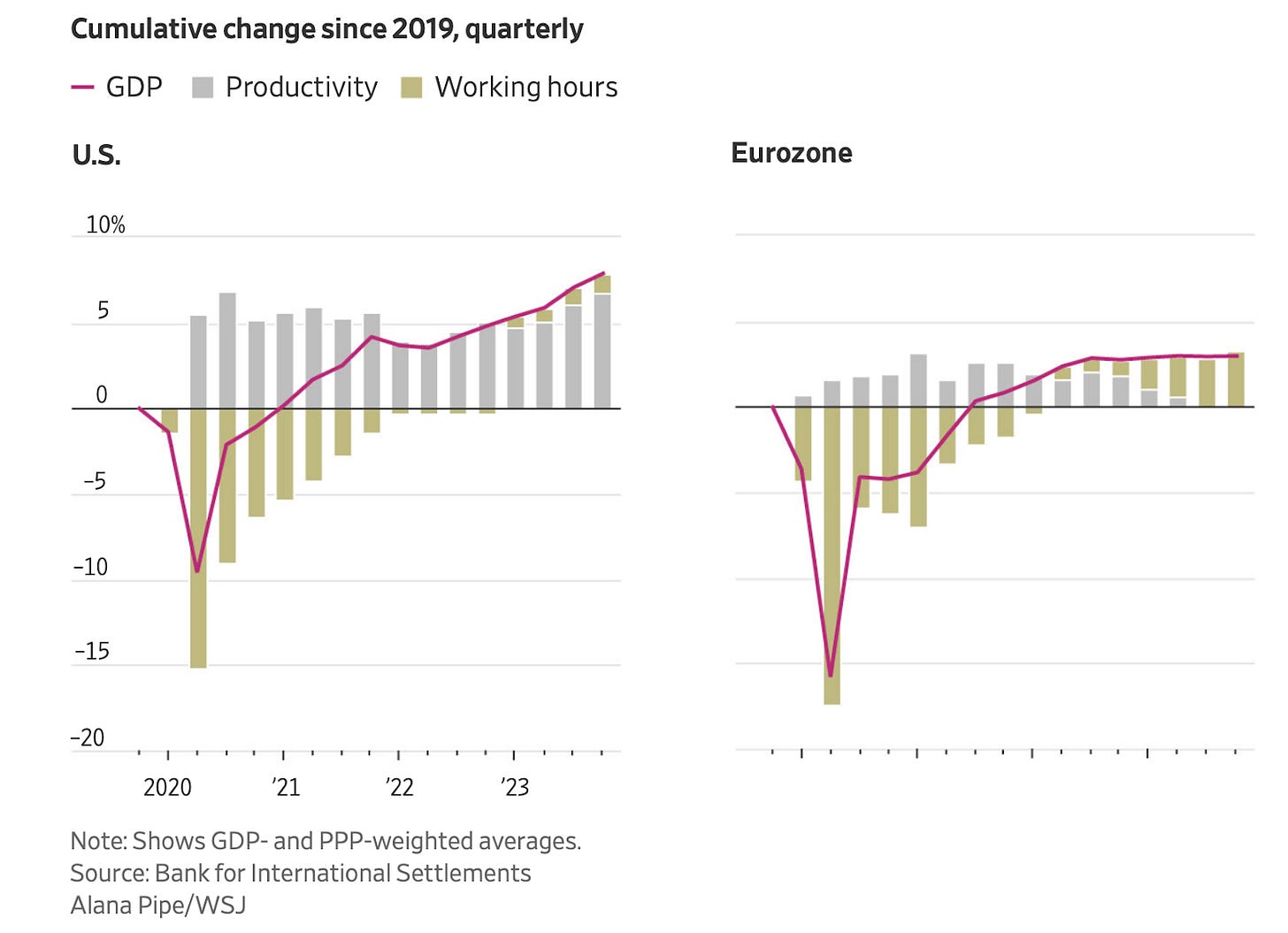

Despite softer labour market data, the U.S. economy as a whole remains resilient. Q3 GDP growth came in at 2.8%, exceeding many forecasts and indicating that the economic recovery has not only reached but surpassed pre-pandemic levels. This post-pandemic boom in productivity and economic output has defied many expectations. For international observers, especially in Europe, this sustained growth feels remarkable. Relative to slower growth in major economies abroad, the U.S. economy has surged ahead, with GDP growing at an annualised rate of 3% in the year’s first half—outpacing all other large advanced economies, none of which grew more than 1%. The following graphic from the Wall Street Journal shows how extraordinary the post-pandemic boom in US growth and productivity has been. As a reminder we also covered this phenomenon last week.

Consumer Confidence

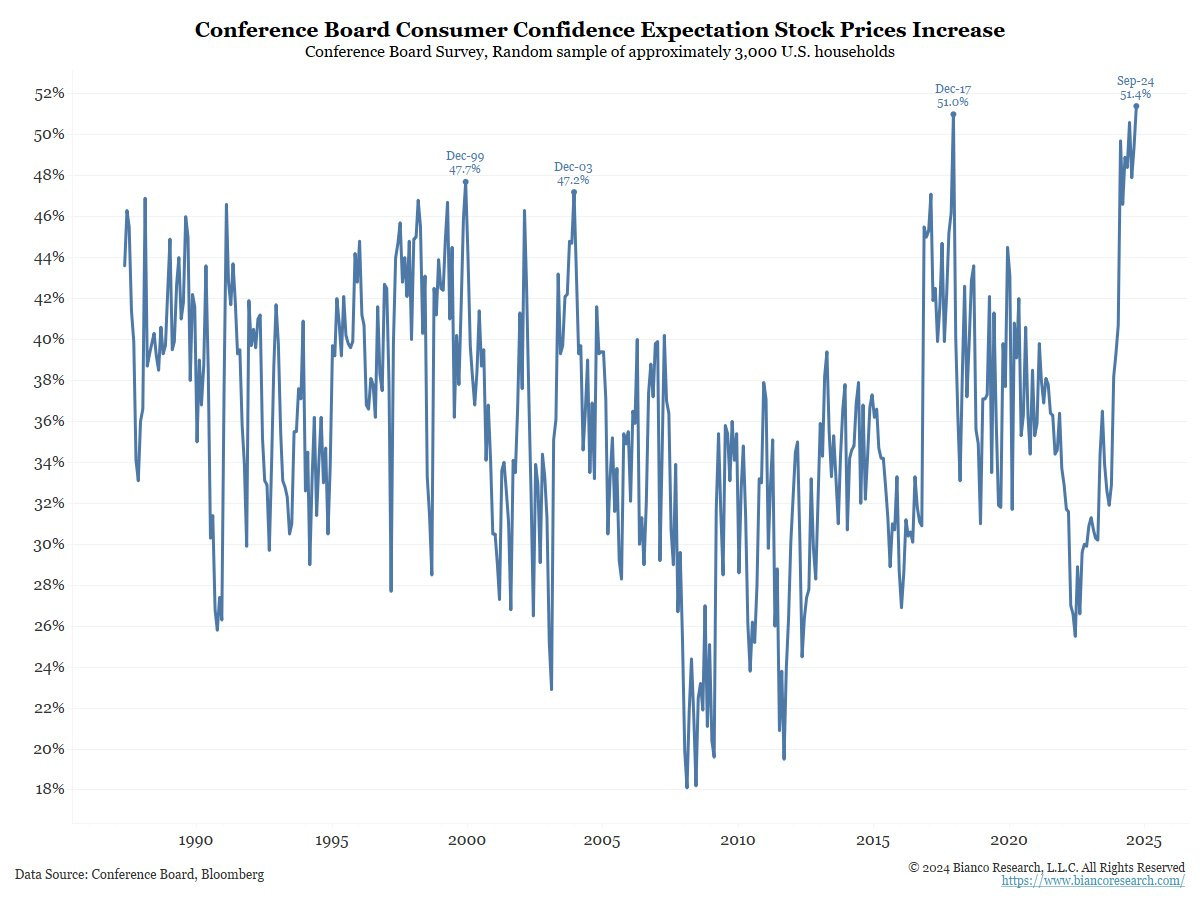

On October 30th, the Conference Board released its latest consumer confidence survey, which revealed record-breaking optimism among U.S. households. For the first time since the survey’s start in 1987, 51.4% of respondents said they expect the stock market to rise. This bullish sentiment among consumers underscores a renewed confidence in the market, despite broader economic uncertainties.

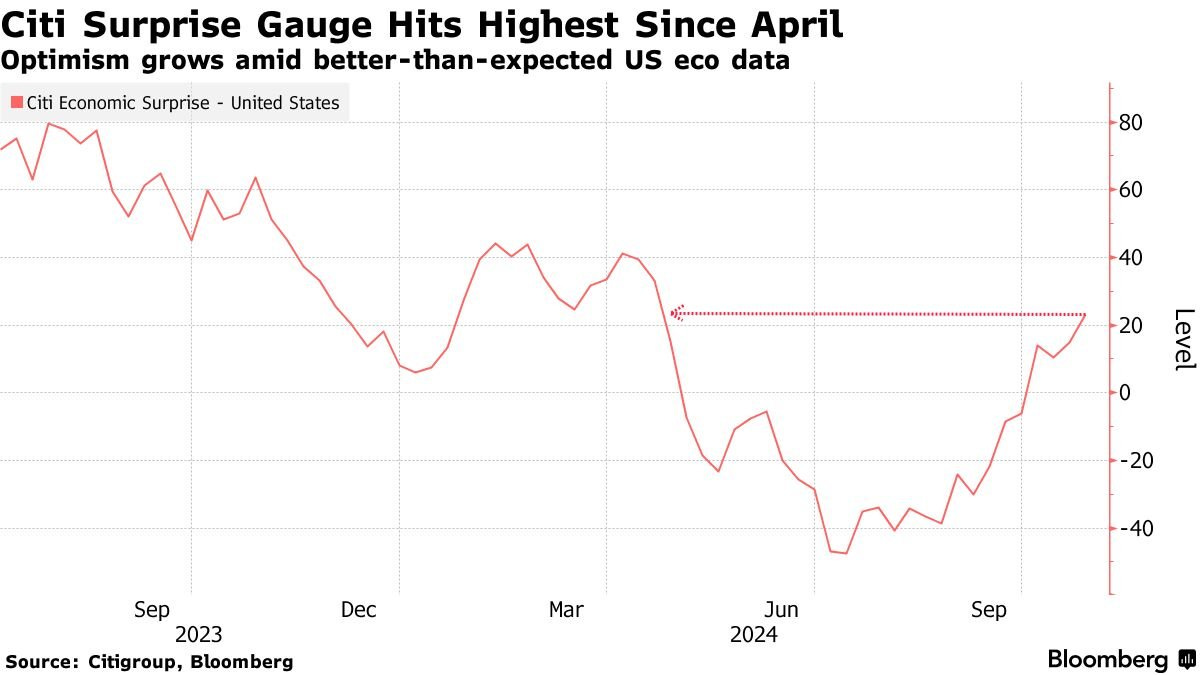

Additionally, the Citi Economic Surprise Index rose to 23.1 points on Friday, its highest level since April, signaling that recent economic data has consistently outperformed analyst forecasts. Key metrics, including Retail Sales, Global Services & Manufacturing PMIs and New Home Sales, have all exceeded expectations over the last two weeks. This stronger-than-expected economic data suggests that consumer resilience and solid economic fundamentals continue to underpin the U.S. economy, even as it faces external challenges.

U.S. Fiscal Deficit

Last week, we examined the looming threat posed by the U.S. federal deficit, now nearly $2 trillion or 7% of GDP. What’s striking is the political landscape’s relatively relaxed approach to addressing this issue. Both sides appear more focused on populist policies to appeal to voters—including enacting additional fiscal spending—rather than seriously considering fiscal austerity. With the U.S. government’s spending outpacing revenue by 40%, debt-to-GDP now sits around 126%.

While many commentators are linking the recent climb in the 10-year yield to inflation expectations tied to potential fiscal expansion, this perspective may capture only part of the picture. As we approach the U.S. election, the potential for pro-growth policies under a Trump presidency—or even a centrist-leaning Harris presidency, though to a lesser extent—could bring sweeping changes. These policies, likely to prioritise an “all-of-the-above” energy approach, pro-AI, pro-crypto and (particularly under Trump) lesser government, deregulation and tax cuts, could create an environment ripe for accelerated economic growth. After all, the best way out of a fiscal deficit is often to grow out of it—a strategy that saw success under Reagan and Clinton. A re-examination of government spending and waste, perhaps with a proposed Department of Government Efficiency (D.O.G.E.), could also free up critical capital and reduce the deficit.

Alongside these policy shifts, disruptive technologies like AI, robotics and genomic sequencing hold immense potential to reshape industries and drive growth. The AI-driven boon we’ve observed in Big Tech’s recent earnings exemplifies the substantial gains AI can bring. If supported by pro-growth policies, these innovations could significantly bolster productivity across sectors, creating the conditions for real economic growth and potentially pushing short-term rates higher.

With the right alignment of pro-growth policies, cutting-edge innovation and resilient consumer spending, the U.S. may be uniquely positioned to capitalise on the confluence of policy and technology to propel its economy forward.

Key Events This Week

The week ahead promises to be the busiest of the year. Tuesday kicks off with the U.S. election and ISM Non-Manufacturing PMI data. Thursday brings Initial Jobless Claims and the Fed’s much-anticipated interest rate decision, while Friday rounds out the week with the MI Consumer Sentiment report. Meanwhile, ~15% of S&P 500 companies are set to report earnings this week. Are you ready for the busiest week of the year?

Feel the pulse, stay ahead.

Rahul Bhushan.