Bitcoin, Bull Markets, and the Winds of Change – Letter #13

“Satoshi is equivalent to Prometheus. Prometheus gave us FIRE. Satoshi gave us MONEY… Bitcoin is the first perfect money.” – Michael Saylor

In April 2019, I was in Paris when flames took hold of the Notre Dame Cathedral. The world watched in horror as the spire crumbled and centuries of craftsmanship were reduced to embers and smoke. For me, it felt personal—I spent my formative years in Paris, attending the American School of Paris in St. Cloud, a western suburb. Seeing the skeletal remains of such an iconic symbol hit close to home.

This weekend, the cathedral’s doors reopened, a testament to what humanity can rebuild. The very fire that nearly destroyed it also forged its renewal. It’s a reminder that destruction and rebirth are often two sides of the same coin.

In ancient myth, Prometheus stole fire from the gods and gifted it to humanity, sparking progress and technology. This week, Michael Saylor echoed that myth, comparing Satoshi Nakamoto to Prometheus. Satoshi’s gift, Bitcoin, is a modern spark—a tool that challenges traditional constraints on money and lights the path for financial innovation.

Bitcoin—a form of “perfect money”—has the potential to reshape economies. This week, it surged past $100,000, driven by growing support from policymakers and institutions.

The question is: are we witnessing a Notre Dame moment for the global monetary system? One where old structures are tested by fire, and what emerges is stronger, more resilient, and future-proof?

This week’s Bitcoin milestones suggest we just might be. Let’s dive in.

Winds of Change

As Bitcoin crossed the six-figure threshold this week, it reflects shifting tides in power, policy, and perception. After years of regulatory skepticism, a new chapter for crypto appears to be taking shape.

Leading this shift is Donald Trump’s nomination of Paul Atkins to head the SEC. Atkins, known for his balanced and forward-thinking stance on digital assets, represents a sharp departure from the enforcement-heavy era of Gary Gensler. His appointment hints at a future where crypto innovation is fostered rather than restrained.

Adding to the momentum, Trump also announced David Sacks as the new “AI & Crypto Czar”. Sacks, a co-host of the All-In Podcast and a member of the original PayPal Mafia, has been an early advocate of tokenisation and blockchain. His deep involvement in the tech and investment world positions him well to ensure that crypto policy doesn’t get sidelined in the shuffle of priorities. His appointment signals that crypto’s path to mainstream legitimacy now has dedicated leadership and clear direction.

Meanwhile, in the halls of power, the winds are blowing in Bitcoin’s favor. Fed Chair Jerome Powell publicly likened Bitcoin to gold, acknowledging its legitimacy as an asset class. On the international stage, even Vladimir Putin admitted that banning Bitcoin is futile, a notable concession from a leader known for controlling narratives. This development points to a larger trend: with the weaponisation of currencies on the rise, crypto is gaining recognition as a means of diversification and securing financial autonomy.

These developments are widening the Overton window of what’s acceptable to discuss in financial policy circles. Bitcoin, once dismissed as speculative fantasy, is now part of mainstream discourse on the future of money.

Crypto isn’t just knocking on the door of legitimacy—it’s stepping through.

Just yesterday, Amazon shareholders submitted a request for the $2.3 trillion company to explore adding Bitcoin to its treasury. Meanwhile, Microsoft shareholders are set to decide on the firm’s Bitcoin investment proposal this Tuesday, December 10th.

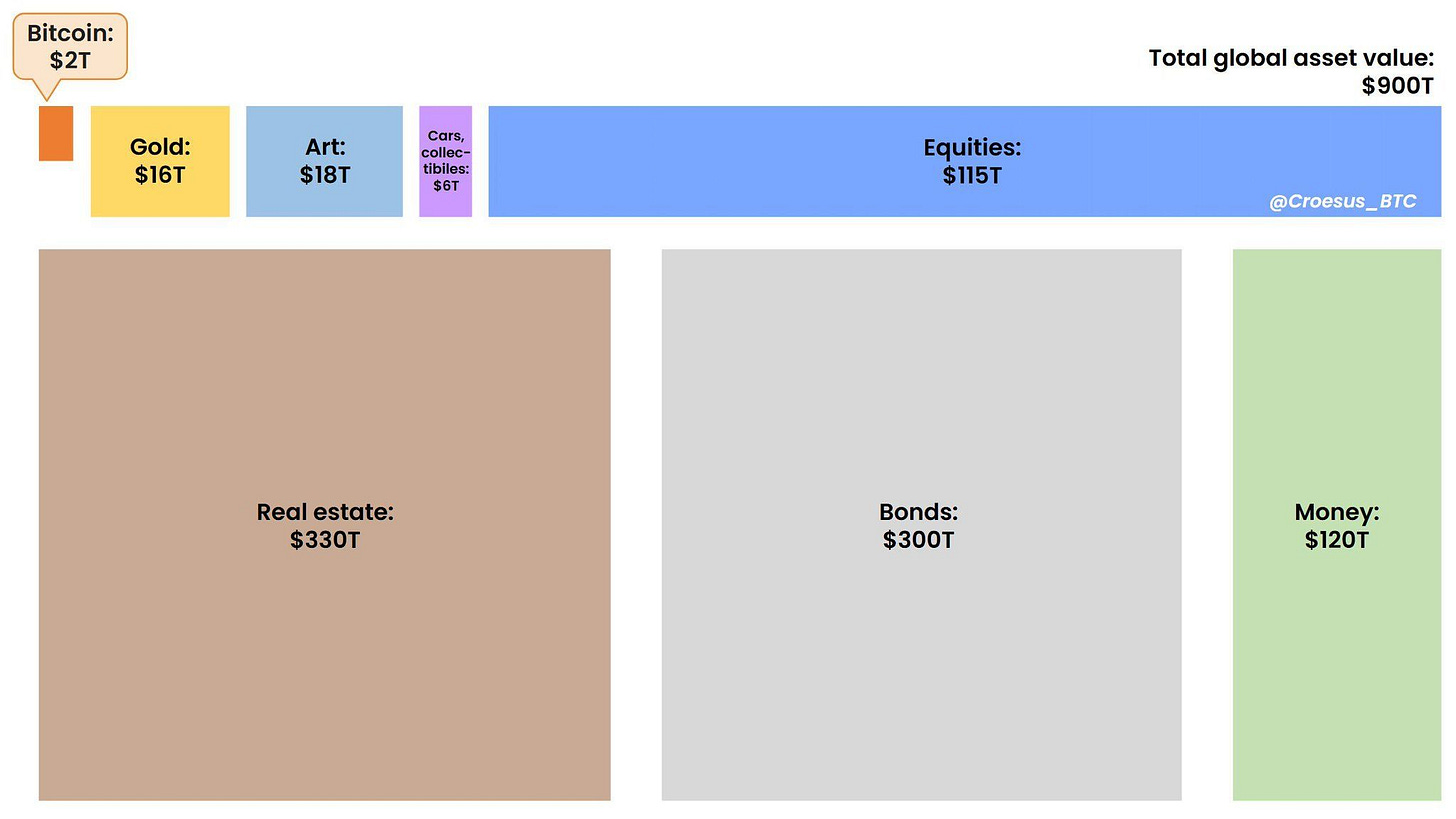

Consider that Bitcoin currently represents just 0.2% of global asset value. Its potential for growth is significant. Imagine a spillover effect where Fortune 500 executives allocate even a tiny fraction of their holdings to Bitcoin. This small shift could drive Bitcoin’s adoption and value to much greater heights.

Bitcoin’s Role as A Hedge

When thinking about Bitcoin’s rise this year, I’m reminded of Lyn Alden’s Broken Money and another book I read much more recently Saifedean Ammous’s The Fiat Standard. In Broken Money, Alden meticulously traces the history of monetary systems, from the days of commodity money to today’s fiat currencies. She highlights how the shift to centrally managed fiat has enabled governments to inflate away value, accumulate unsustainable debt, and make short-term political decisions at the expense of long-term stability. The result is a financial system plagued by centralisation, monetary debasement, and inflationary pressures. Ammous builds on this critique in The Fiat Standard, illustrating how fiat currencies empower governments to overspend and mismanage economies.

Together, these books underscore how Bitcoin emerges as a decentralised hedge—offering financial sovereignty and a shield against political incompetence, monetary mismanagement, and fiscal irresponsibility. In the U.S., where deficit spending is hitting all-time highs—as I’ve covered in a previous Substack—Bitcoin isn’t just a monetary marvel; it’s a response to the growing distrust in systems that seem incapable of reform.

But the breakdown of trust goes beyond financial systems. We’re seeing it in politics, too, where dysfunction has become the norm. Last week, the French government collapsed after Prime Minister Michel Barnier was ousted in a no-confidence vote—the first successful one since 1962. In the UK, Keir Starmer’s attempts at presenting a “plan for change“ have landed with all the impact of a damp squib, underscoring a lack of vision and conviction. Germany’s coalition government collapsed under the weight of budget disputes and political infighting, leaving Europe’s largest economy adrift. Even in South Korea, a brief but shocking declaration of martial law—swiftly overturned by the National Assembly—highlighted how fragile political stability can be. And a Romania’s constitutional court annulled the result of its presidential election first round after a foreign influence operation was uncovered, turning democratic processes into scenes of chaos.

One of the clearest examples of dysfunction with the political class occurred in late November 2024, when violent protests broke out in Montreal, Canada, just as Prime Minister Justin Trudeau was seen dancing at a Taylor Swift concert in Toronto.

In the U.S., astonishingly, it seems we may be turning a corner on dysfunction—at least for now. A counter-elite now occupies the White House, and they have unexpectedly embraced Bitcoin and the broader crypto economy. For them, Bitcoin is more than just a hedge; it symbolises a break from the status quo and an opportunity to reform systems that have long been plagued by mismanagement and stagnation. Viewed as a solution to systemic dysfunction, Bitcoin has proven its resilience, weathering numerous challenges and emerging stronger with each crisis.

Markets Outlook

As we turn our attention to the broader economy, the latest labour market data, monetary policy decisions, and consumer behavior are signaling a path of continued growth and market optimism.

U.S. Equities

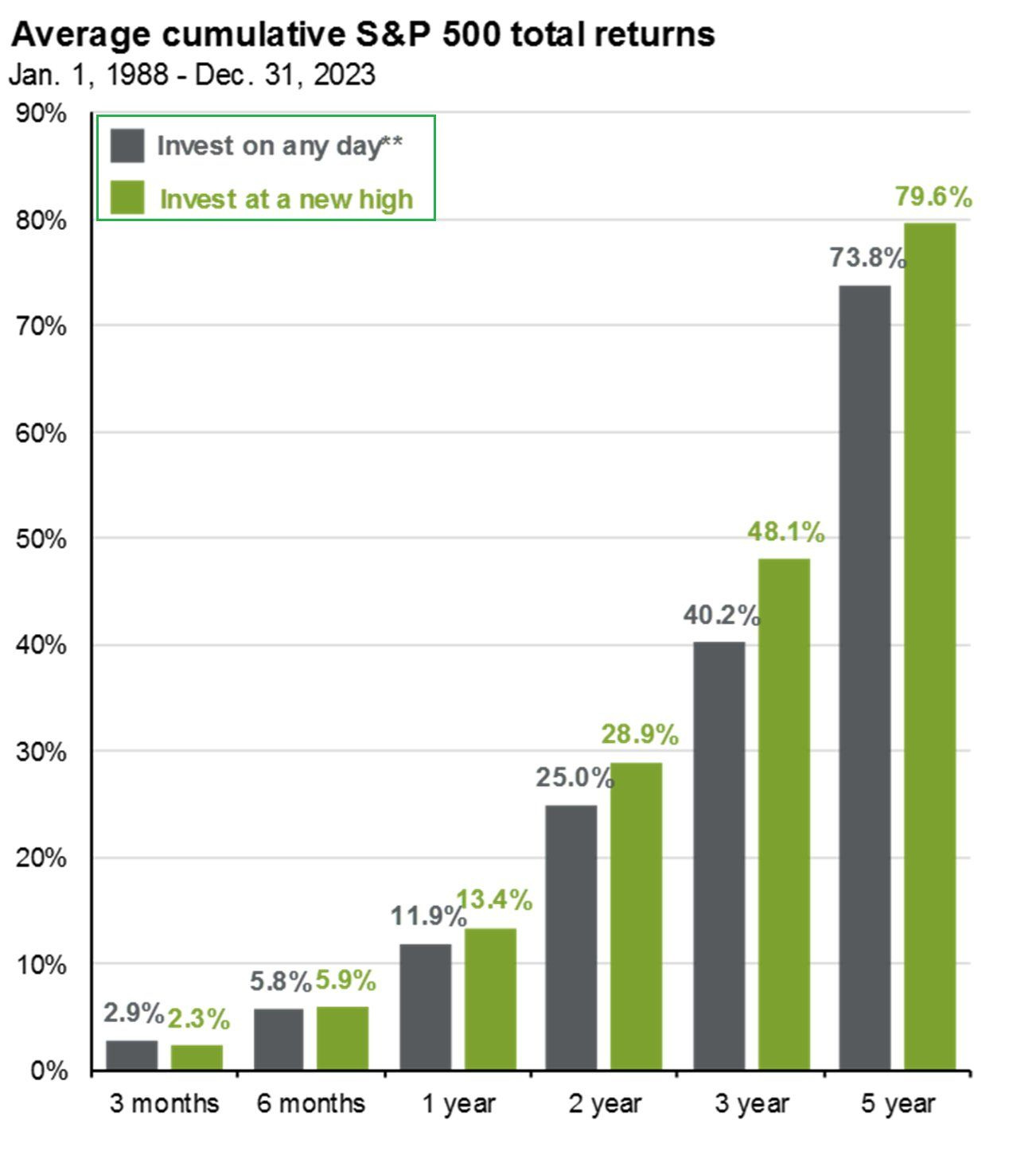

Stocks surged on Friday as investors digested the strong jobs report. The S&P 500 ended the week at another record high, marking its 55th new peak of the year on Thursday. Wells Fargo set a bullish year-end target of $7,007 for the S&P 500 by December 2025, reflecting expectations of continued corporate earnings growth and a favorable U.S. economic environment. It’s worth noting that buying at all-time highs has historically proven to be a more successful strategy than staying on the sidelines.

Labour Market

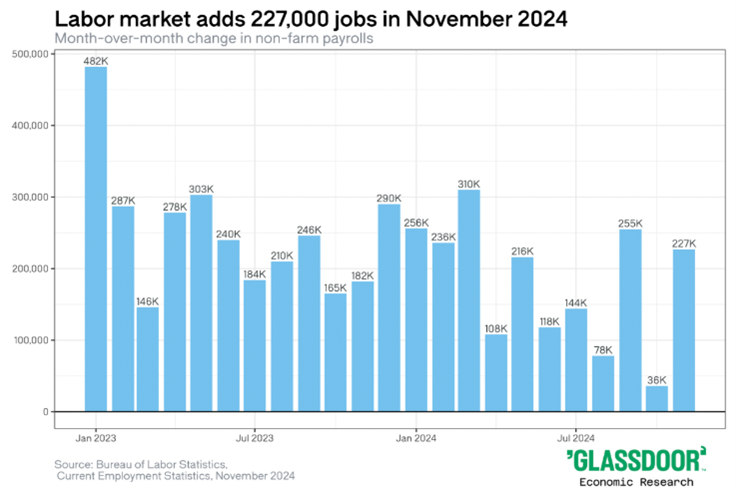

The labour market showed strong recovery with the addition of 227,000 jobs in November, exceeding expectations. This bounce-back followed a slowdown in October, which was impacted by hurricanes and strikes. The data also clarified that the modest 12,000 jobs added in October—later revised to 36,000—were primarily due to these disruptions, rather than signaling a broader weakening trend. Analysts now anticipate that this positive report makes it almost certain the Fed will lower interest rates again later this month.

The Fed

Fed Chair Jerome Powell gave an extensive interview in which he reaffirmed the Fed’s independence, a key factor that has been credited with helping to moderate inflation globally. He indicated that the Fed would respond to, rather than preempt, any consumer taxes that President-elect Trump may impose via tariffs. This stance should allow for continued interest rate cuts in the first half of next year.

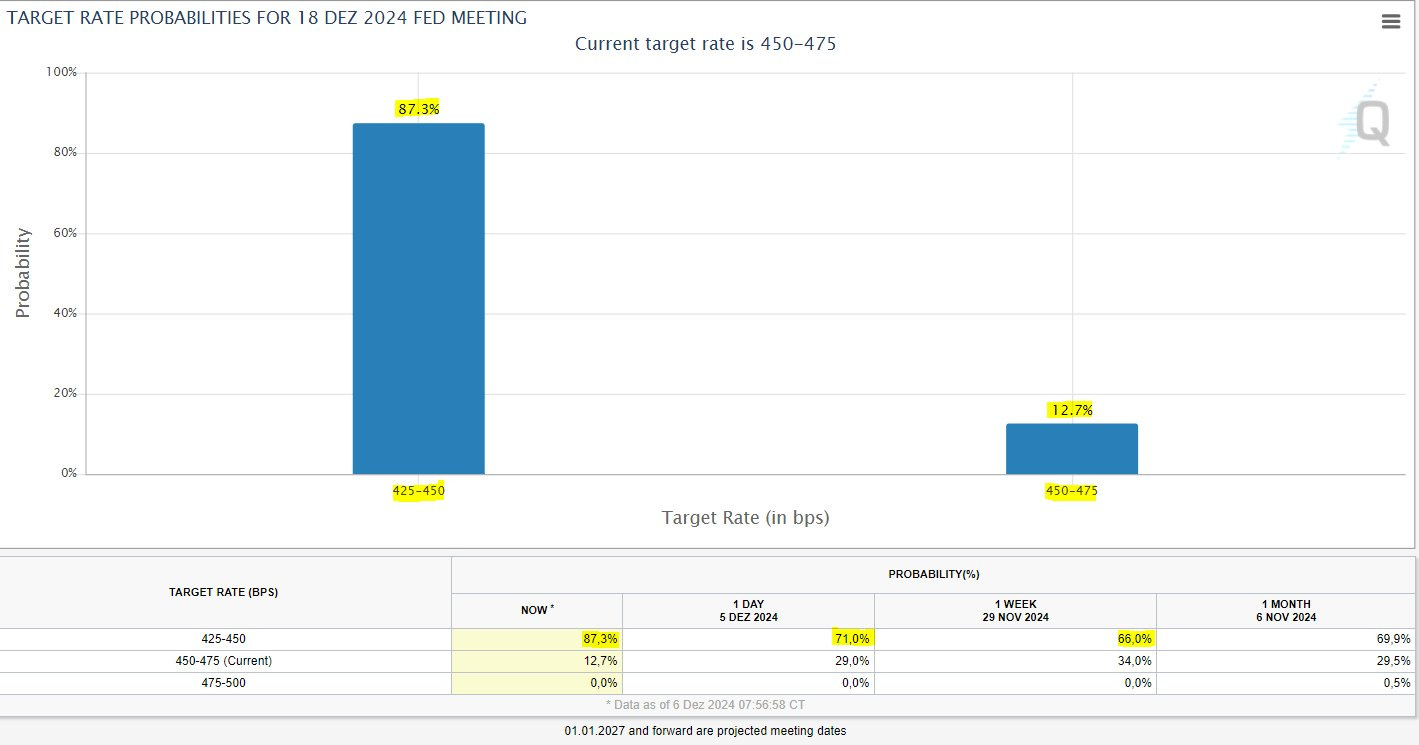

The likelihood of a rate cut at the upcoming Fed meeting in less than two weeks is now at 87%, following the positive jobs report from last Friday. However, the outlook beyond that is more uncertain. March now appears to be the next most likely opportunity for a cut, with the odds at about 65%. Markets are currently pricing in 2-3 rate cuts for next year.

Q4 GDP

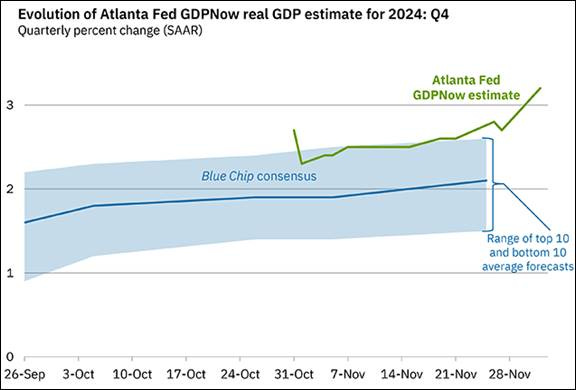

Here’s the Atlanta Fed’s brilliant real-time estimate of U.S. GDP.

The American Consumer

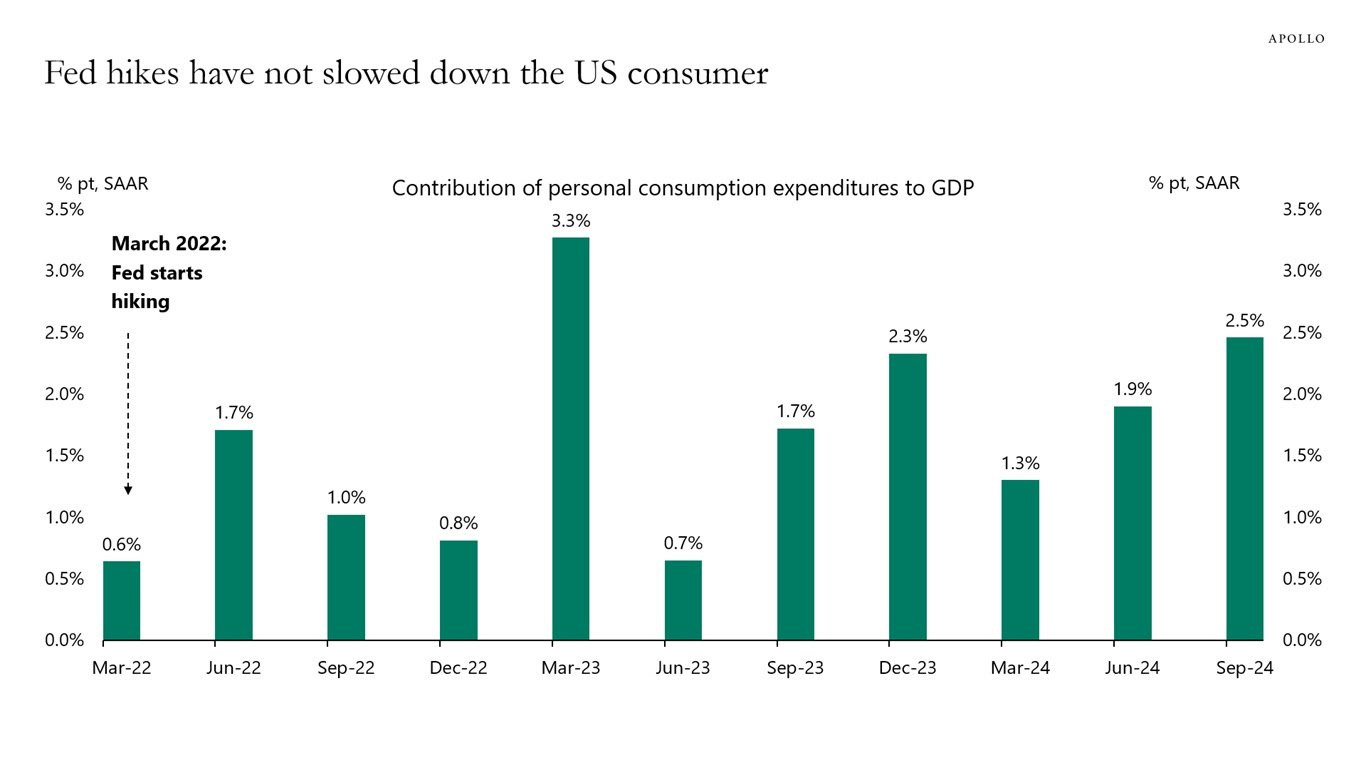

This chart really caught my attention…

We’re now 2.1 years into the current bull market, and history suggests there could be a lot more to come. The chart highlights past bull markets over the last 50 years that made it to their second anniversary, with many showing significant gains in the years that followed. As we approach this milestone, it’s worth considering that previous markets often continued to surge for several more years.

Maybe this bull is the gladiator we’ve all been waiting for.

Feel the pulse, stay ahead.

Rahul Bhushan.