Lewis Hamilton’s Ferrari Leap, German Cars, The Trump Put, The Battle for Panama, and Buying the Dip – Letter #23

“Winning is the most important. Everything is consequence of that.” – Ayrton Senna

I watched Lewis Hamilton debut in Ferrari red this weekend. He finished 10th yesterday in Melbourne. Lando Norris took the win. Not exactly the start Hamilton or Ferrari fans imagined.

But Hamilton’s placement in one race isn’t really the point.

His story began decades ago, in Stevenage, a working-class English town north of London. He wasn’t born into racing royalty. His father built his first go-kart from spare parts, juggling multiple jobs just to keep his son racing. Hamilton was always the underdog, competing on worn-out tires against older, better-funded kids. Talent opened doors, but ambition kicked them wide open.

At 13, he told McLaren’s boss he’d race for him one day—and kept his word. By 22, Hamilton had debuted in Formula 1, nearly winning the championship in his rookie year. A year later, he clinched the title, becoming the youngest champion ever at the time.

Then came Mercedes, where Hamilton spent 12 legendary years, adding six more world titles, and rewriting the sport’s record books.

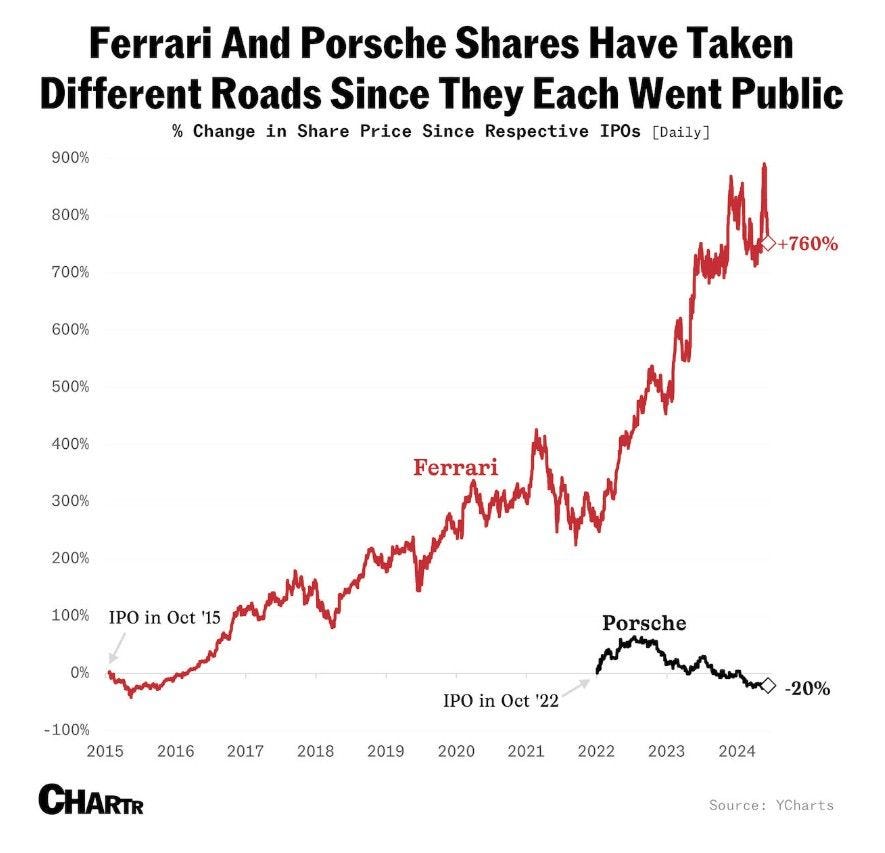

But in February 2024, Hamilton surprised everyone by leaving Mercedes—the very definition of German engineering excellence—to race for Ferrari. Was he inspired by Ferrari’s remarkable stock price rise? (Maybe his new contract includes stock options). Ferrari shares jumped 12% the day Hamilton announced his move, adding billions in market cap. And investors have remained bullish: Ferrari’s disciplined strategy of scarcity and exclusivity has sent shares soaring 760% since its IPO in 2015, dramatically outperforming Porsche, which listed 7 years later.

Hamilton’s move to Ferrari symbolises more than just chasing an 8th championship. It highlights how Ferrari’s prestige and careful branding have left competitors struggling to keep up.

All this raises the question: Are Germany’s automakers losing their grip?

Let’s dive deeper.

Autokalypse Now! Genau?

I came across a telling chart this week: Rheinmetall is now worth more than Volkswagen.

Volkswagen, the iconic symbol of German automotive might, has struggled against mounting pressures—China’s competitive edge in EVs, complicated transitions to electric manufacturing, and slowing global demand. Meanwhile, Rheinmetall has emerged as the prime beneficiary of Germany’s massive new defence spending package, which passed last week.

It’s poetic timing, too. Rheinmetall’s ascent comes precisely as it considers acquiring some of Volkswagen’s production operations. Germany’s proposed defence spending—pitched domestically as a pathway toward reindustrialisation—offers Rheinmetall an unprecedented opportunity, potentially allowing the company to absorb parts of Volkswagen’s declining automotive business.

“Defence plans are likely to increasingly be sold domestically to voters as a pathway to the reindustrialisation of Europe,” Nico Fitzroy, Senior Europe Analyst at Signum Global Advisors, noted recently.

Lock, Stock and Two Smoking Ports

But it’s not just Europe trying to reindustrialise. The U.S., too, is looking for ways to rebuild its industrial base, secure critical supply chains, and regain strategic influence.

Few moves illustrate this ambition better than the recent announcement of a BlackRock-led investor group agreed to buy two Panama Canal ports from Hong Kong’s CK Hutchison for $23 billion. The deal, everyone insists, is “purely commercial”—which is exactly what you’d say if your move was obviously geopolitical.

China certainly isn’t fooled. This week, Beijing expressed its displeasure via a spicy op-ed in state-run newspaper Ta Kung Pao, calling on CK Hutchison to “think twice” about the sale. According to Beijing, the deal is nothing less than the US trying to put the squeeze on Chinese trade. Chinese commentators piled on, accusing CK Hutchison of “spineless groveling” and “selling out all Chinese people.” (Not exactly subtle.)

CK Hutchison’s shares promptly tanked nearly 7%.

Still, the consortium—led by BlackRock—insists with a straight face that this deal is purely business. It doesn’t help, of course, that the deal was praised by President Trump, who has repeatedly accused China of trying to control the Panama Canal. (Maybe next they’ll claim U.S. naval ships are sailing into the canal for a “relaxing cruise” 🤣).

China, Inc.

And of course, I can’t talk about reindustrialisation without also mentioning China. And this week, I came across an incredibly well-researched piece from Dylan Patel’s SemiAnalysis that laid out just how far ahead China is. For anyone not already battling an existential dread about China, this should do the trick.

While Europe is still tangled in industrial policy debates and trying to breathe life into old factories, and while the U.S. is busy cutting deals over Panama’s ports, China has spent the past decade building an industrial base so dominant that it’s now in a league of its own.

It has turned itself into an industrial force multiplier. Nowhere is this more evident than in robotics. In 2020, Chinese firms supplied 30% of their own industrial robot market. Today, that number is 50%—and climbing.

The Unitree G1, China’s first commercially viable humanoid robot—and which I talked about in last week’s newsletter—is now built without a single American component.

And this isn’t some one-off story. We’ve seen this playbook before: Batteries. Solar. EVs. Scale the industry, crush costs, outproduce everyone.

The result? Building an identical robotic arm in the U.S. costs 2.2x more than in China. Even for “American-made” robotics, the supply chain tells a different story—most actuators, motors, and rare earth materials still come from China. The West is up against an industrial flywheel that gets stronger with every iteration.

At Xiaomi’s “lights-out” factory, machines run 24/7 with no human workers. At KUKA’s Guangdong plant, robots are now building robots.

You heard that right: robots are now building robots.

But none of this is happening by accident. Beijing has a plan, and it’s backing it with force.

The Xi Put

The Chinese Communist Party is [apparently] pulling out all the stops.

Since China’s “DeepSeek moment”, Chinese equities have benefitted from a rapid-fire series of AI breakthroughs, almost weekly. Last week, I covered several of these. This week, Baidu unveiled Ernie X1 and Ernie 4.5, a new wave of foundation models that could shift the balance of power in China’s AI landscape.

The Ernie X1 model reportedly matches DeepSeek’s performance but at half the cost. That’s a very big deal. Ever since DeepSeek’s release, every major Chinese company, whether in consumer electronics, EVs, or manufacturing, has been scrambling to integrate version 1 into their processes.

AI has become China’s new industrial catalyst.

And this ties into the broader theme. A “Xi Put” implies that Chinese authorities will do whatever it takes—liquidity easing, stimulus measures, targeted credit expansion—to hit their 5% GDP growth target.

The Trump Put

Across the Atlantic, another question looms: Does a Trump Put exist?

The recent sell-off reflects investor anxiety over Trump’s tariff threats and his broader assault on federal institutions. Some worry that continued uncertainty could tip the U.S. into recession.

The idea of a Trump Put—the notion that Trump sees the stock market as the ultimate scorecard and will step in to prevent a prolonged decline—is widely held. Yet Treasury Secretary Scott Bessent has repeatedly emphasised that Wall Street can fend for itself, and the administration’s priority is Main Street, not stock prices. The administration appears comfortable with short-term market pain, betting that its policies will drive long-term economic gains.

Accordingly, if there is a Trump Put, it likely sits lower than markets previously assumed. But it’s also possible that the Trump Put isn’t too far from the Powell Put.

That’s not to say the market won’t find relief. However, if it comes, it may instead come from the Fed, should economic conditions deteriorate enough to force Powell’s hand.

Markets on a Whiplash Ride

Markets have continued to grapple with volatility.

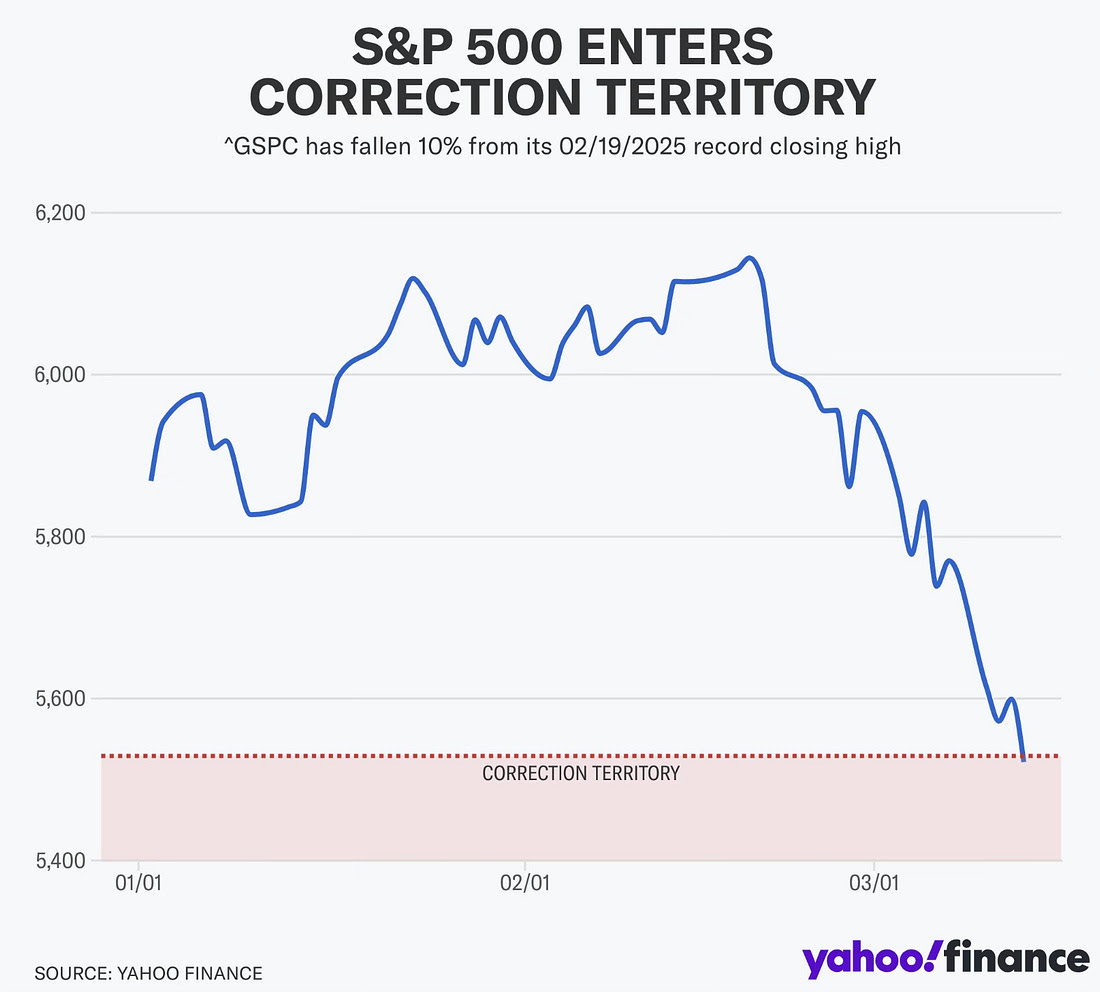

Last week, the S&P 500 tumbled into correction territory, dropping more than 10% from its February high, while the Nasdaq fell 13%, as tech stocks stumbled.

Then came Friday’s dramatic rebound. The S&P 500 and Nasdaq posted their biggest gains of the year, echoing the post-election rally in November.

But a strong finish didn’t change the bigger picture—here’s how stocks ended the week:

Whether this rebound has legs is now the question.

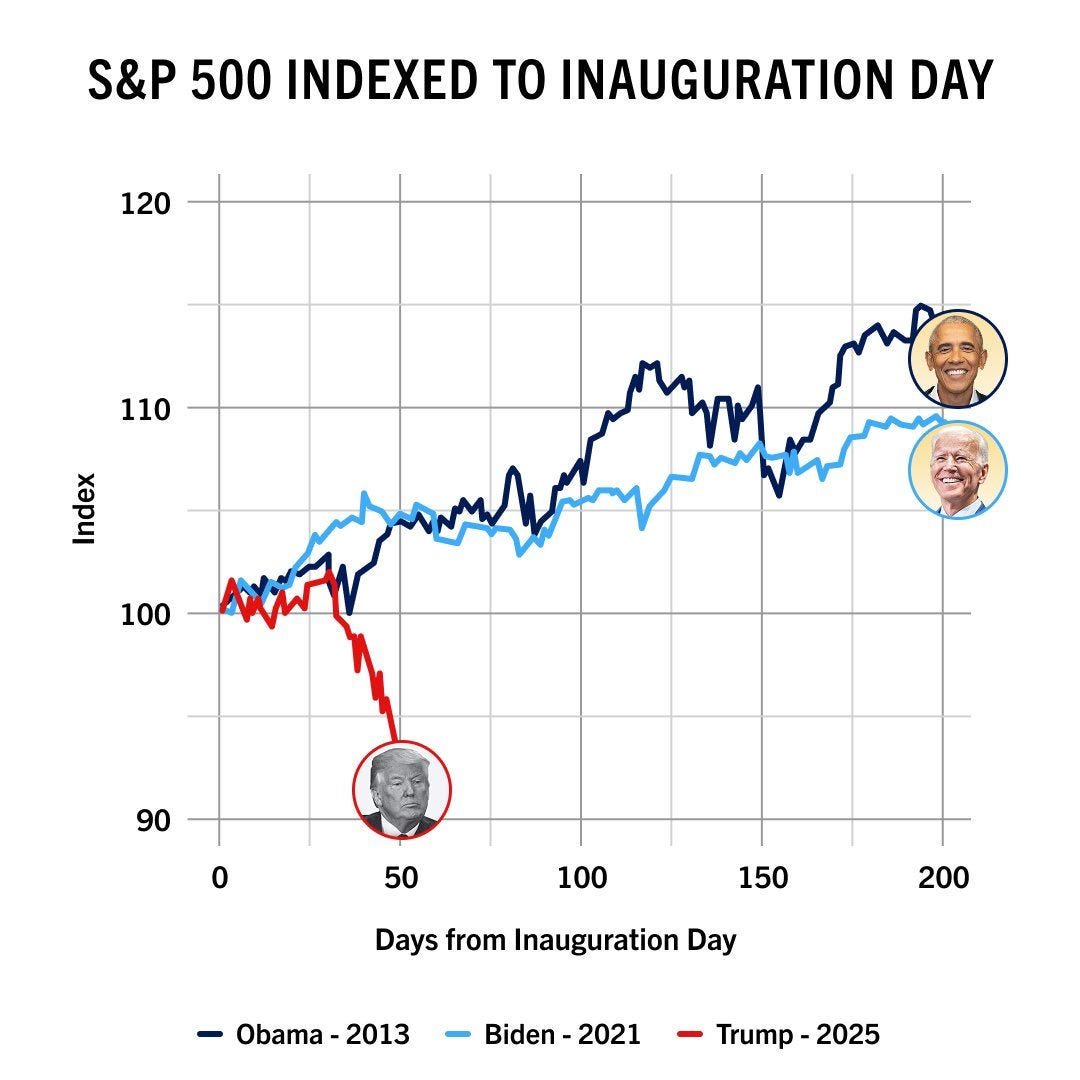

Unsurprisingly, many investors have been highlighting this chart comparing the S&P 500’s performance in the early months of Trump’s first and second terms, hoping it signals an imminent turning point:

Meanwhile, Goldman Sachs strategists estimate that a five-percentage-point increase in U.S. tariffs could shave 1-2% off S&P 500 earnings. Their outlook remains cautiously optimistic, noting that historically, market pullbacks—outside of recessions—have been good buying opportunities. But that optimism assumes Trump will ease off on his tariff agenda.

At the same time, U.S. economic growth is slowing, and equity markets are under pressure. Yet, Trump remains unfazed, dismissing these developments as a temporary dip before a coming economic boom. While that scenario may play out, the risk of a self-reinforcing downturn could become harder to ignore.

The VIX closed the week at 22, showing a clear improvement from earlier in the week, but still not low enough to signal a return to normal conditions. The real test for whether this period of heightened volatility is fading is going to be in watching high-yield spreads, which have climbed from 2.6% to 3.4% in just a month—marking the sharpest and most rapid increase since last August.

U.S. Inflation

Meanwhile, in a welcome shift, last week, February’s CPI report showed inflation cooling more than expected. Consumer prices rose 2.8% year-over-year, below the 3% consensus forecast, while core inflation (excluding food and energy) increased 3.1%, its lowest reading since 2021.

Month-over-month, CPI ticked up just 0.2%, a slowdown from January’s 0.5%. Gasoline prices dropped 3.1%, airfares fell 4%, and shelter costs saw their slowest increase in over two years.

Making breakfast great again:

Breaking the Pattern

Friends of mine sent this excellent chart over the weekend. If we’re in a bear market, this would be the 3rd in five years—something that has never happened before.

It's worth remembering that market pullbacks are a normal part of investing, with history showing that most years experience one to three corrections ranging between 5% and 15%. This chart tracks the frequency of 5%, 10%, 15%, and 20% declines in the S&P 500 per calendar year since 1928. For long-term investors, these corrections often present buying opportunities.

And here are the average S&P 500 returns following the 21 corrections of more than 10% since 1980, broken down over 1-month, 3-month, 6-month, and 12-month periods:

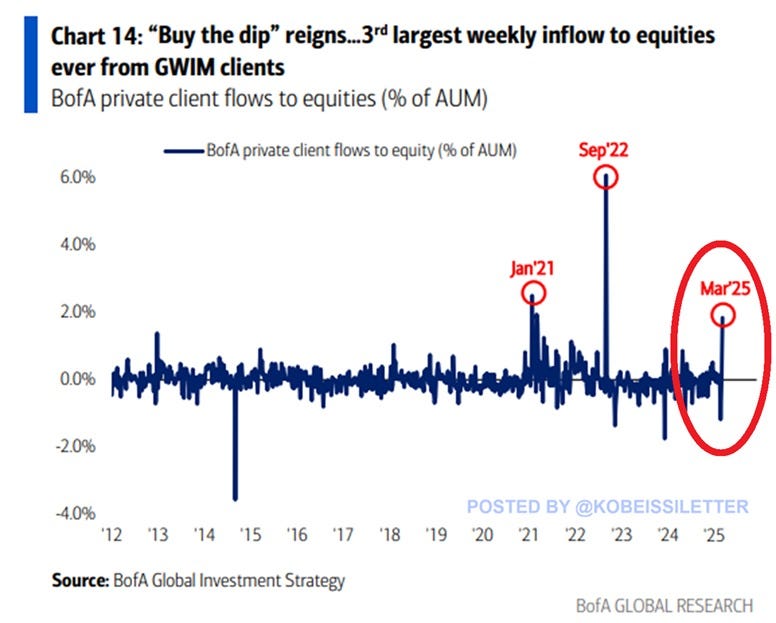

Wealthy investors are piling into U.S. stocks. High-net-worth individuals' equity inflows reached 2% of Bank of America’s AUM last week, marking the third-largest on record. This comes just one week after a notable outflow of ~1% of AUM, the fourth-largest ever. Such a sharp reversal hasn’t been seen in 2.5 years, when inflows surged to 6% of AUM in September 2022, near the bottom of the bear market. The latest buying spree also closely trails the January 2021 spike. As the S&P 500 experiences its fastest three-week drop since 2020, wealthy investors are seizing the opportunity and putting cash to work. The buy-the-dip mentality isn’t dead—at least, not for those with cash on hand.

And no matter the circumstances, markets inevitably reach new all-time highs over time. Stay invested.

Feel the pulse, stay ahead.

Rahul Bhushan.