The Banana, the Battery, and the Bureaucracy – Letter #11

“The spirit of irony… the whiskey of the mind.” – J.B. Priestley

Last week, I briefly discussed Northvolt, the Scandinavian battery manufacturer that had long been heralded as a cornerstone of Europe’s green tech ambitions. At the time, Northvolt’s story was emblematic of Europe’s struggles with innovation: promising startups often constrained by fragmented markets, regulatory hurdles, and insufficient access to capital. Fittingly—or perhaps ironically—within days of that discussion, Northvolt filed for bankruptcy, and its CEO, Peter Carlsson, announced his resignation.

This isn’t just a coincidence; it feels almost scripted. It’s as if the universe wanted to underscore the themes we explored last week: Europe’s innovation crisis, the fragility of bold ventures in capital-intensive industries, and the systemic obstacles that hinder their survival. The timing almost seems to follow what I’ve started calling the “Irony Law of the Universe”: the most ironic outcome often feels not just possible but inevitable.

But the irony deepens when we look at the backlash against Peter Carlsson himself. Andreas Cervenka, writing in Aftonbladet, ironically frames Carlsson as a symbol of capitalism’s shortcomings. Rather than acknowledging Carlsson’s audacious vision to build Europe’s first gigafactory for batteries—an achievement that inspired an entire wave of green tech projects—Cervenka critiques him in a way that reflects a troubling attitude toward entrepreneurship in Sweden.

As a Swede myself, I find this narrative particularly jarring. At a time when Europe desperately needs entrepreneurs like Carlsson—willing to take bold risks and inspire change—such commentary risks deterring the very audacity Europe requires. Northvolt’s story is a reminder that failure is not the enemy of progress—it’s often its precursor.

This unexpected turn of events opens the door to deeper reflections—not just on Europe’s challenges, but on how irony manifests in markets, politics, and even human behaviour. In many ways, this ties into broader market dynamics we’re observing this week, from unexpected fiscal policies to surprising corporate pivots.

Let’s explore.

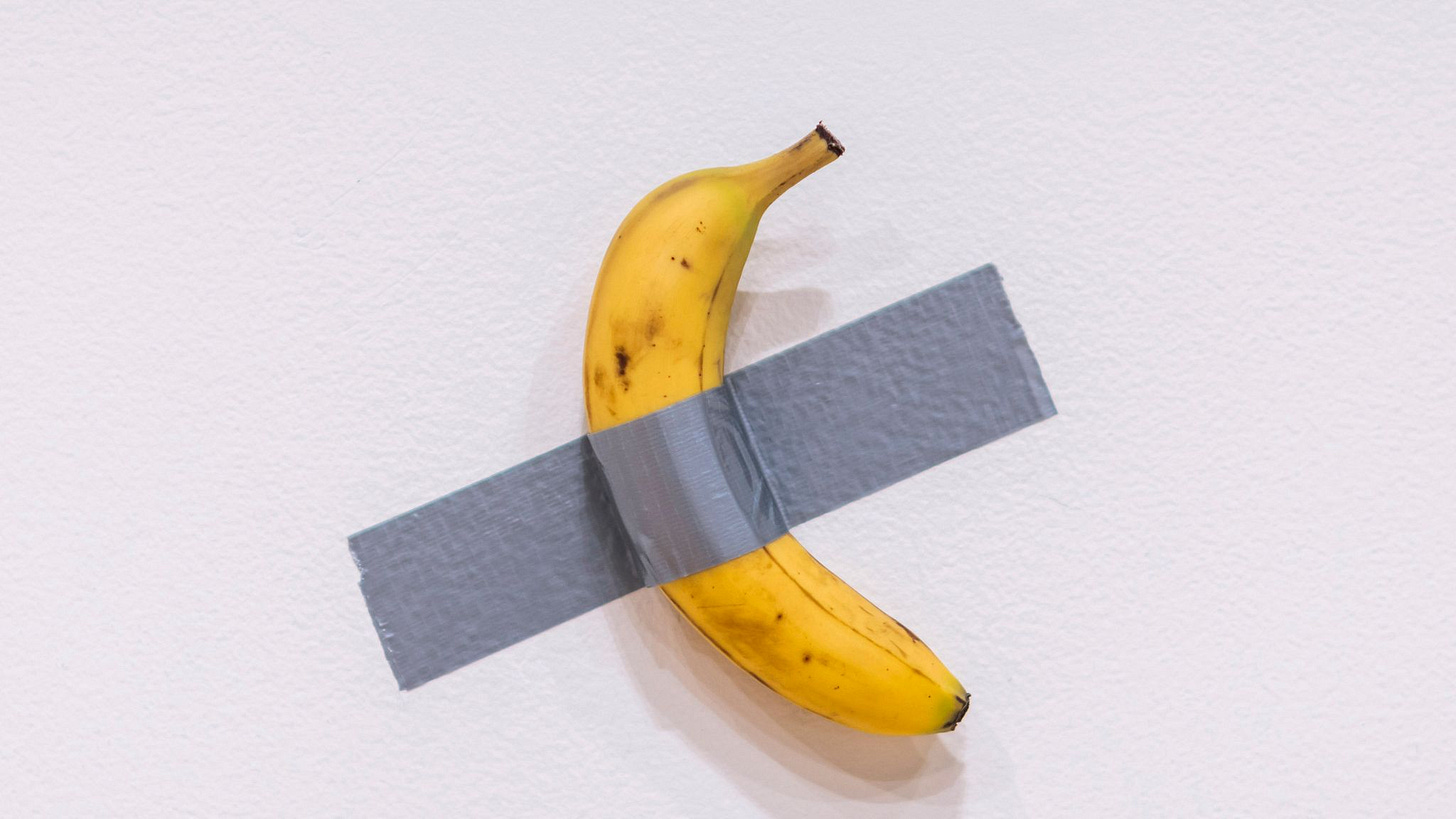

The Story of A Banana

Once upon a time, in a humble grocery store nestled on a quiet street, a banana was born, destined for a simple life. It spent its early days with its bunch, hanging out in a fruit bowl, waiting for the moment it would be peeled, eaten, and forgotten. But fate had other plans. Unlike its peers, this particular banana was never destined for a smoothie or a cereal bowl. It was discovered by a visionary artist, Maurizio Cattelan, who, upon seeing its yellow curve, realised it was no ordinary banana. No, this banana was meant for greatness—artistic greatness. Instead of being devoured in a snack, it was gently duct-taped to a gallery wall, where it would become the star of the show. And so, the banana’s destiny was forever changed: instead of being part of someone’s lunch, it became part of a $6.2 million art sale. The world, it seemed, wasn’t ready for a banana to just be a banana. No, this banana had transcended its humble origins to become a symbol of irony and absurdity, worshipped by art collectors with more money than sense. And thus, the banana lived on, not as a snack, but as a legend.

The Department of Government Efficiency (D.O.G.E.)

On Wednesday, Elon Musk and Vivek Ramaswamy unveiled their vision for the Department of Government Efficiency (D.O.G.E.) in a Wall Street Journal op-ed. Their ambition is bold: to root out inefficiency, fraud, and waste in federal spending, leveraging technology to create a leaner, more accountable government.

One can’t help but chuckle at the unintended irony of D.O.G.E. itself, a name that inevitably brings to mind Dogecoin—the meme cryptocurrency Musk famously championed, even dubbing himself the “Dogefather”. Especially ironic given that Dogecoin was originally created as a satirical homage to a Shiba Inu meme. And speaking of ironic plot twists…

Of course, the federal government already has a watchdog agency dedicated to investigating inefficiency and waste: the Government Accountability Office (GAO). Established in 1921, the GAO audits federal programs, evaluates their effectiveness, and ensures taxpayer money is spent as intended. In essence, it already performs many of the functions D.O.G.E. aspires to. So, the idea of creating a new department to address waste when one already exists has raised some eyebrows.

And then there’s the small matter of two heads. If you're launching a department to eliminate waste, perhaps starting with a two-headed bureaucracy isn’t the most efficient approach. But hey, maybe they’re just being extra thorough in rooting out inefficiency…

A Century of Reform

This isn’t the first time a bold reform effort has been announced to tackle the inefficiency of modern governance. In the early 20th century, Franklin D. Roosevelt’s Keep Commission sought to address government waste, while Ronald Reagan’s Grace Commission in the 1980s aimed to identify and reduce unnecessary spending. Both efforts were ambitious, but history suggests a stubborn trend: government spending as a percentage of GDP has grown relentlessly for a century.

The growth of government spending has been a defining feature of modern economies. Between 1274 and 1691, England’s government raised less than 2% of GDP in tax revenue. By the 1870s, governments in wealthy nations were spending approximately 10% of GDP. This doubled to 20% by 1920, and today, most developed countries allocate 40-60% of GDP to public expenditures—a level that seems difficult, if not impossible, to surpass.

What's notable is that spending spikes often follow crises. For example, Franklin D. Roosevelt’s New Deal saw a surge in government spending as he implemented large-scale programs aimed at economic recovery during the Great Depression. Similar increases occurred after 9/11, the global financial crisis, and COVID-19. Each crisis reset the baseline higher, reinforcing what many see as the “ratchet effect” of government spending: once it expands, it rarely contracts.

Regulatory Compounding

If rising government spending is one half of the problem, regulatory sprawl is the other. Since 1970, the number of federal regulations has more than doubled. While some regulations serve critical purposes, their cumulative weight has created bottlenecks that slow growth and stifle innovation, according to QuantGov.

Consider the broadening scope of occupational licensing. Once limited to fields like law and medicine, in the U.S., licenses are now required for professions such as hairdressing, auctioneering, and even makeup artistry—ironically imposing the greatest burden on lower- and middle-income individuals. Meanwhile, environmental and conservation rules, while important, often make construction projects excessively complex and drawn-out—even for something as simple as extending a home. Many government agencies have also succumbed to “mission creep”, expanding their mandates far beyond their original objectives.

Scott Bessent named U.S. Treasury Secretary

This growing regulatory burden hasn’t gone unnoticed. Indeed, during Trump’s prior presidency, a policy was introduced requiring that for every new federal regulation implemented, two must be eliminated. Though largely symbolic, the initiative underscored a broader frustration with the scale of federal oversight. The appointment of Scott Bessent as U.S. Treasury Secretary on Friday underscores the administration’s renewed focus on deregulation as a cornerstone of its economic strategy.

A seasoned macro investor and founder of Key Square Capital Management, Bessent brings a reputation for incisive analysis and a clear vision for structural reform. His economic approach, encapsulated in what he calls the “3-3-3 Rule”, emphasises three key pillars:

Cut the budget deficit to 3% of GDP by 2028: Bessent argues that fiscal discipline is essential, especially as rising interest rates make ballooning deficits increasingly untenable.

Push GDP growth to 3%: He views targeted deregulation as a catalyst for organic, inclusive growth, aiming to address systemic inequities while unlocking broader economic potential.

Pump an additional 3 million barrels of oil per day: Energy independence, Bessent asserts, is critical for economic stability and geopolitical resilience.

Bessent’s vision aligns with the administration’s broader goals, including a revival of deregulation initiatives. Agencies like the SEC and FTC, which have drawn criticism for hindering innovation and M&A activity, are expected to undergo significant reforms aimed at streamlining processes and boosting economic competitiveness. After all, SEC Chair Gary Gensler has already announced his intention to step down in January.

Beyond deregulation, Bessent’s appointment signals a renewed focus on fostering innovation and addressing fiscal imbalances. Anticipated tax cuts are expected to offset the economic drag from tariffs while stimulating both consumer spending and business investment. His emphasis on energy independence further underscores the administration’s intent to prioritize domestic resource utilization as a driver of economic stability and productivity.

Perhaps most importantly, Bessent’s appointment highlights a strategic alignment between fiscal discipline and technological innovation. For investors, his policies signal a more targeted approach to long-term growth. By prioritizing deregulation and fostering an environment where platforms like AI, robotics, energy storage, genomics, and blockchain can thrive, this administration seeks to unlock transformative opportunities. This rare convergence of market efficiency, structural reform, and technological progress could define the next phase of economic growth.

Could You Imagine the Boom?

The U.S. economy is already an outlier among G7 nations. Nearly 60% of G7 GDP is now accounted for by the U.S., underscoring its sheer scale and dominance. Can you imagine what happens if the current growth trajectory accelerates?

The Atlanta Fed GDPNow model projects Q4 real GDP growth at 2.6%, significantly outpacing the 1.9% consensus. Could this signal another underestimated leg of U.S. growth?

Corporate profits are approaching 12% of GDP, a level that has sparked debate over sustainability. If this profit share persists, does it redefine equity valuations? And are U.S. equities only scratching the surface of a broader rally?

The S&P 500 now represents 46.2% of global market capitalisation. Can this leadership expand further, especially as the U.S. cements its position as the innovation hub of the world?

Nvidia, the AI bellwether, exemplifies this relentless wave of innovation. Its share of the S&P 500 has doubled since the beginning of the year, reflecting the market's recognition of AI’s transformative potential. In its latest results, Nvidia achieved a staggering milestone: earning more in profit this quarter than it generated in revenue during the same quarter last year. If this is what AI can deliver in its infancy, can you imagine the ripple effects as its full productivity potential is unleashed across industries?

As deregulation, tax cuts, and fiscal stimulus converge, the U.S. could achieve growth rates that defy even today’s optimistic projections. Imagine the sonic boom of productivity gains, market expansion, and technological breakthroughs...

Are you positioning for the opportunities these transformations will unlock?

Feel the pulse, stay ahead.

Rahul Bhushan.