The Wiener Schnitzel Rally: GameStop Buys Bitcoin, Trade Court Tussles at Mar-a-Taco, JD Vance Heads to the Casino, Powell Ducks the Politics, and Nvidia Dethrones Microsoft – Letter #31

“Optimism sounds like a sales pitch. Pessimism sounds like someone trying to help you.” — Morgan Housel

I’m writing this just after getting back from Lucerne. We’d taken a short trip as a family: part fresh air, part distraction. And, as these things go, we ended up at one of the city’s most iconic landmarks.

Not the Lion Monument. Not the Kapellbrücke.

The Old Swiss House.

Tucked into a red-and-white timbered chalet just behind the lion statue, it’s been around since 1858. Its fame rests not on reinvention, but on ritual: the Wiener Schnitzel, prepared tableside in a well-worn copper pan by a waiter who’s done it hundreds — maybe thousands — of times. Clarified butter is ladled in. Breadcrumbs crackle audibly as they hit the surface.

It’s not flashy. It’s not fusion. It’s performance.

They’ve been doing it this way for over 80 years.

Same dish. Same tableside choreography. Same choreography of indulgence.

Each month, 1,600 plates of breadcrumbed veal are served to grease-craving (mostly) American tourists.

Here’s a photo of me and my son at the table — mid-meal, mid-laugh. I’ve added an emoji over his face (he’s not on the internet yet, thankfully), but you’ll get the idea.

And no, I didn’t film the schnitzel demo. I was busy trying to intercept spoons that had suddenly become airborne.

Fortunately, others have captured it:

As we walked out, the thought arrived — uninvited, but familiar:

There’s more than one kind of Wiener.

The Wiener Schnitzel of our Time

Donald Trump.

This week, the U.S. Court of International Trade ruled that a wide swathe of his tariffs were unlawful. That included the so-called “Liberation Day” duties: blanket tariffs of 10% or more on virtually all foreign goods. The court found that the International Emergency Economic Powers Act — the law Trump used to justify them — did not give him the authority to impose such sweeping measures. The trade deficit, it said, did not constitute a national emergency. Nor could Congress delegate “unbounded tariff power” to the executive.

The ruling held less than two days.

By Thursday, a federal appeals court had paused it. The tariffs remain in place. The case is now likely headed to the Supreme Court.

And so we return to the now-familiar questions: Will the tariffs survive? Will companies and consumers get refunds if they don’t? Are they even being collected today? And what does it mean for firms trying to price, hire, or invest in the middle of all this?

The ingredients change. The recipe doesn’t.

From Trumponomics to Shrugonomics

Perhaps the most telling part of last week wasn’t the ruling itself. It was the market’s reaction to it.

Or rather, the lack of one.

Equity indices stayed within spitting distance of flat. Volatility measures yawned. Even Friday’s announcement of a doubling of steel tariffs from 25% to 50% barely registered.

The market doesn’t seem to be missing the headlines. It just appears to be caring less.

There was a time when a trade-related court ruling would’ve sparked a stampede. Now, the reflex is closer to indifference. Perhaps because the probability of anything sticking is so low. Perhaps because the chance of anything sticking is so slim. Perhaps because everyone knows it’ll all change again by Tuesday. 🤣

It’s possible that markets had already discounted the likelihood of these tariffs sticking, and decided that another round of drama didn’t merit a fresh repricing.

Aptly for a week themed around food, Wall Street, in its infinite creativity, has already coined a name for this rinse-and-repeat cycle: the TACO trade, short for “Trump Always Chickens Out”. First introduced by the FT’s Robert Armstrong, it captures the well-worn rhythm of loud tariff announcements followed by last-minute reversals. The term has gained enough traction to visibly irritate Trump himself, who now finds himself caught between a Mar-a-Lago press conference and a Mar-a-Taco meme. The irony, of course, is that the more fire he breathes, the more markets assume he’ll fold — a pattern that makes each fresh threat feel like it comes with a side of salsa.

In some ways, all this apathy is a risk. It could reflect something deeper. A market that no longer reacts is one that no longer believes.

But it’s also an opportunity.

When no one’s paying attention, risk assets have more room to drift upwards.

Pulse Check

As I flagged back on 7 April and again on 14 April, market pessimism had become too easy — detached from data, overweight narrative. When everyone crowded into defensiveness, it created the very conditions for a relief rally. That was the pulse then. And it’s still beating now.

The Nasdaq soared 9.2% this month, its best month since November 2023.

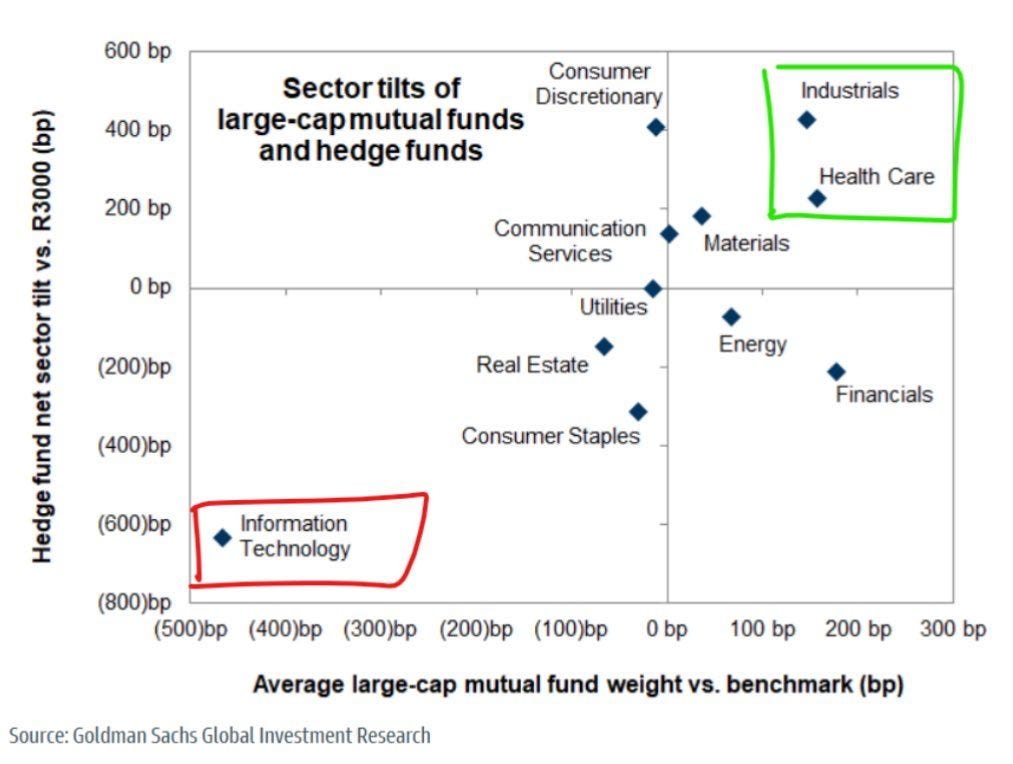

The index is now trading less than 5% below its ATHs, yet both hedge funds and mutual funds remain structurally light on tech exposure. The disbelief rally keeps gaining ground precisely because so few think it can. Maybe that’s the theme of 2025: disbelief as alpha.

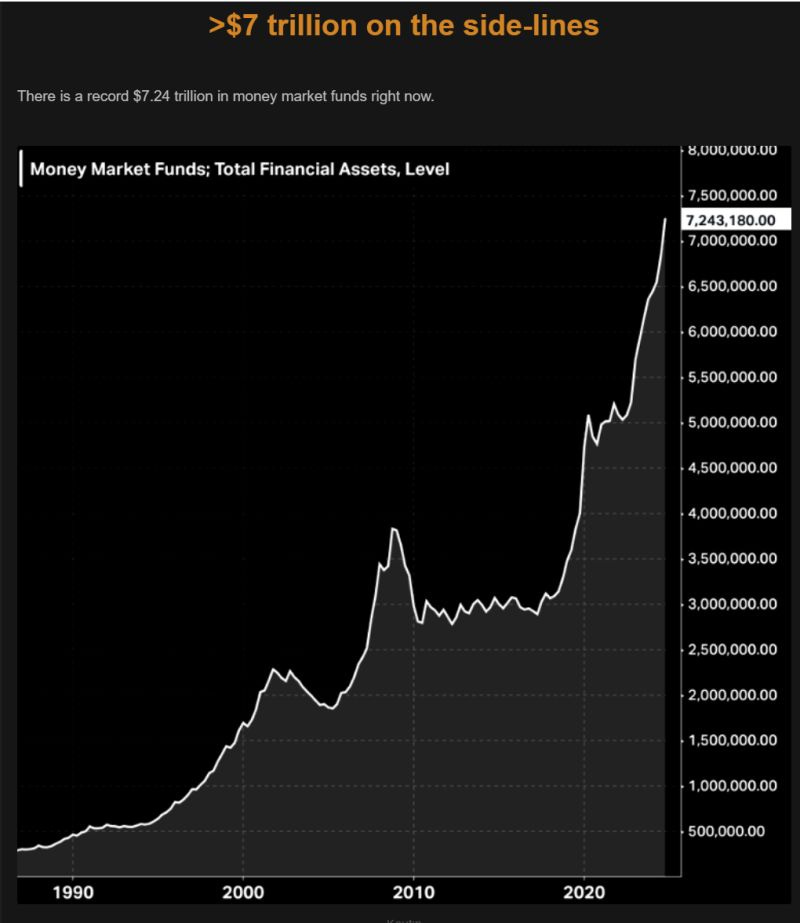

And then, you factor in that $7 trillion in dry powder is sitting on the sidelines at the moment.

May was a good month for stocks too, except for Apple which was busy updating its excuses. 😬

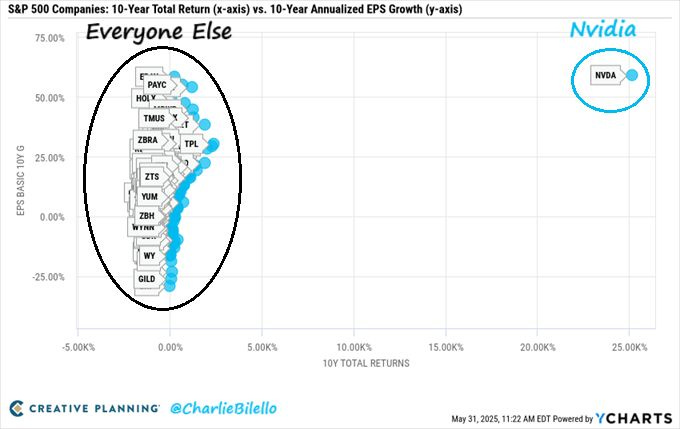

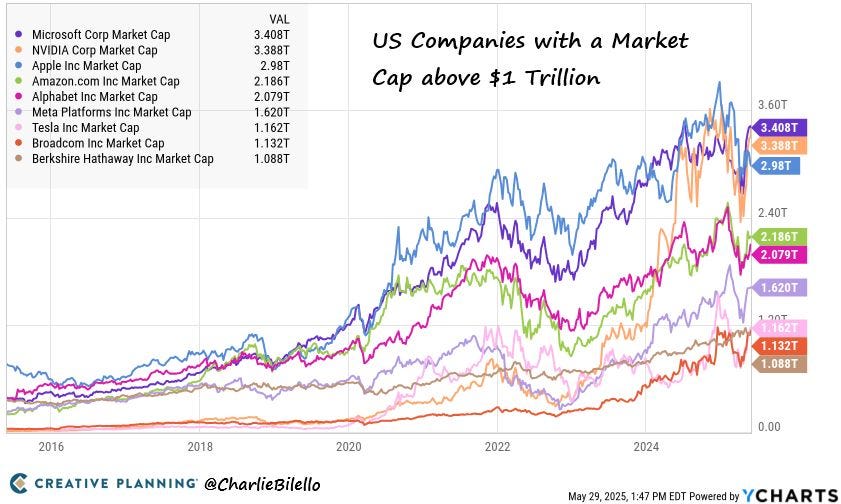

One of the standout stories last week was Nvidia. For Q1 of fiscal 2026, the company reported revenue of $44.1 billion — up 12% from the previous quarter and 69% from a year ago. 🤯 Data centre revenue came in at $39.1 billion, up 10% QoQ and 73% YoY. Unreal. In terms of earnings growth and shareholder returns over the past decade, Nvidia now holds the title as the fastest-growing company in market history.

Nvidia has once again overtaken Microsoft as the world’s largest company. And that milestone has come despite being largely shut out of the Chinese market. CEO Jensen Huang said on the company’s earnings call that demand for its AI chips is still “accelerating”. The company now sees its GPUs not just training AI models, but powering the apps and services that run them in the real world.

Nine U.S. companies have now crossed the $1 trillion market cap threshold: Microsoft, Nvidia, Apple, Amazon, Alphabet, Meta, Tesla, Broadcom, and Berkshire Hathaway.

Highered for Longer?

In markets, a couple of notable developments last week.

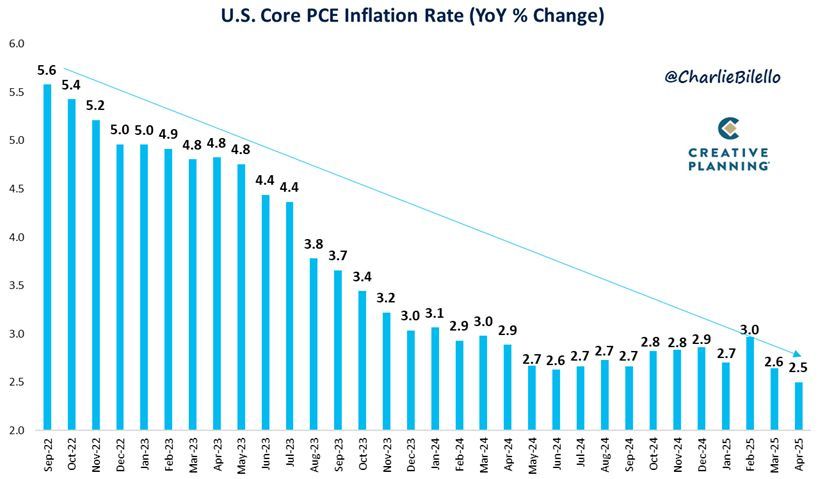

The Fed’s preferred inflation gauge, Core PCE, dipped to 2.5% in April, its lowest reading since March 2021. Markets now expect the Fed to hold rates steady at 4.25-4.50% through the June 18 and July 30 FOMC meetings, before delivering a 25 bps cut on September 17.

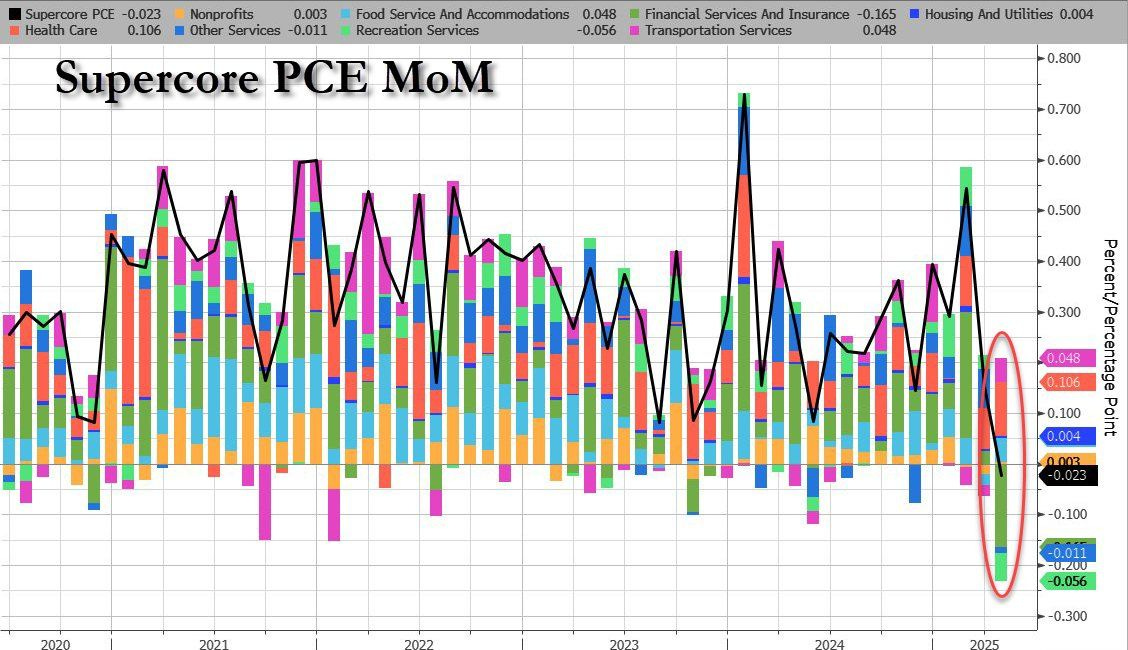

Meanwhile, Supercore PCE posted its first negative reading since the pandemic, making a notable shift.

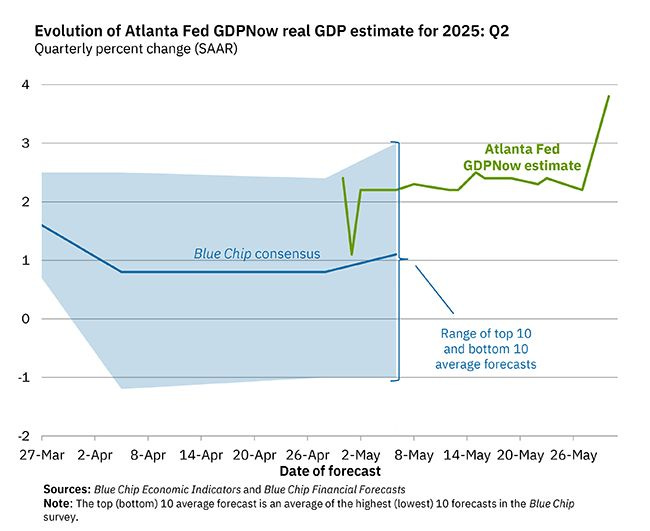

Recession where? 🇺🇸 The Atlanta Fed’s Q2 GDPNow forecast jumped to +3.8% (30 May), up sharply from +2.2%, signaling surprising strength in the U.S. economy.

According to Kalshi, U.S. recession odds have fallen to 31%, the lowest level since early March.

Just two months ago, markets were pricing in a 95% chance of rate cuts in 2025. Today, that probability has fallen to 76%.

The Apprentice Meets the Chair

News emerged last week that Trump summoned Jerome Powell to the White House for their first meeting since returning to office, chastising him over interest rates, while Powell insisted the Federal Reserve would not be drawn into politics.

Officially, Powell offered the standard line: decisions will be guided by the data. The Fed’s statement noted that he “did not discuss his expectations for monetary policy”, beyond reiterating that outcomes would depend entirely on incoming economic information and its implications for the outlook.

The timing of the meeting was no coincidence. Just days earlier, minutes from the Fed’s most recent gathering showed that policymakers are growing increasingly concerned. Still, with economic activity holding firm and the labour market steady, the committee sees little justification to act for now:

“Recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilised at a low level in recent months, and labour market conditions remain solid.”

By late Sunday, however, rumours were swirling that Trump had asked Powell to resign and that he might comply.

Whether that turns into news today is something markets will be watching very closely.

What Really Drives This Market?

But perhaps the more important question is: does even this matter in the short term?

Liquidity may still be the dominant force. As Darius Dale, founder of 42 Macro, argues, the prevailing policy mix now appears to be the highest probability outcome. It’s not austerity. It’s not a long-drawn trade war. It’s a firehose of capital designed to flood the bottom half of the income distribution with income, jobs, and spending power. The goal? Avoid pain, engineer a “Golden Age” for the working class, and stimulate growth by political deadline. The pathway? Spend now, worry later.

Most investors remain underexposed to this possibility. Positioning still reflects confusion: one foot in a defensive world of tariffs and yield spikes, the other in a future of reflation and financial repression. The capital war may already be underway, but markets still seem hesitant to price in the possibility that the U.S. plans to outspend, outgrow, and outlast its rivals. Not back down or slow the pace

The cost of that refusal is beginning to show up in yields. As Michael Howell of CrossBorder Capital has noted, this isn’t so much about credit risk. It’s about rollover risk. The system is now dependent on constant debt refinancing. Around 75% of activity is focused on rolling existing obligations rather than financing new growth. That means there’s growing pressure on long-term Treasuries, which are used as collateral throughout the financial system. As this collateral becomes more volatile, it shakes confidence in the ability to move capital freely and smoothly.

What happens when demand for Treasuries declines just as issuance soars? Foreign buyers pull back. Term premia rise. Bond volatility increases. So, collateral becomes scarcer and more expensive. Howell argues that the real driver of higher long-term rates is the imbalance between the supply and demand.

It’s this feedback loop why the liquidity cycle matters so much. Rising yields reduce the usable collateral pool. Volatile yields lower the multiplier effect of that collateral. And without enough high-quality balance sheet capacity, the system clogs.

As I noted last week, banks are being nudged to hold more Treasuries to keep the system functioning. That may ease near-term pressure, but it’s another sign that liquidity management is perhaps even more important than inflation targeting right now (!)

All said, this summer may feel volatile. But if the past decade has taught us anything, it’s this: liquidity doesn’t vanish, it evolves. And those who can track its shifting flows may find themselves ahead of the next major revaluation.

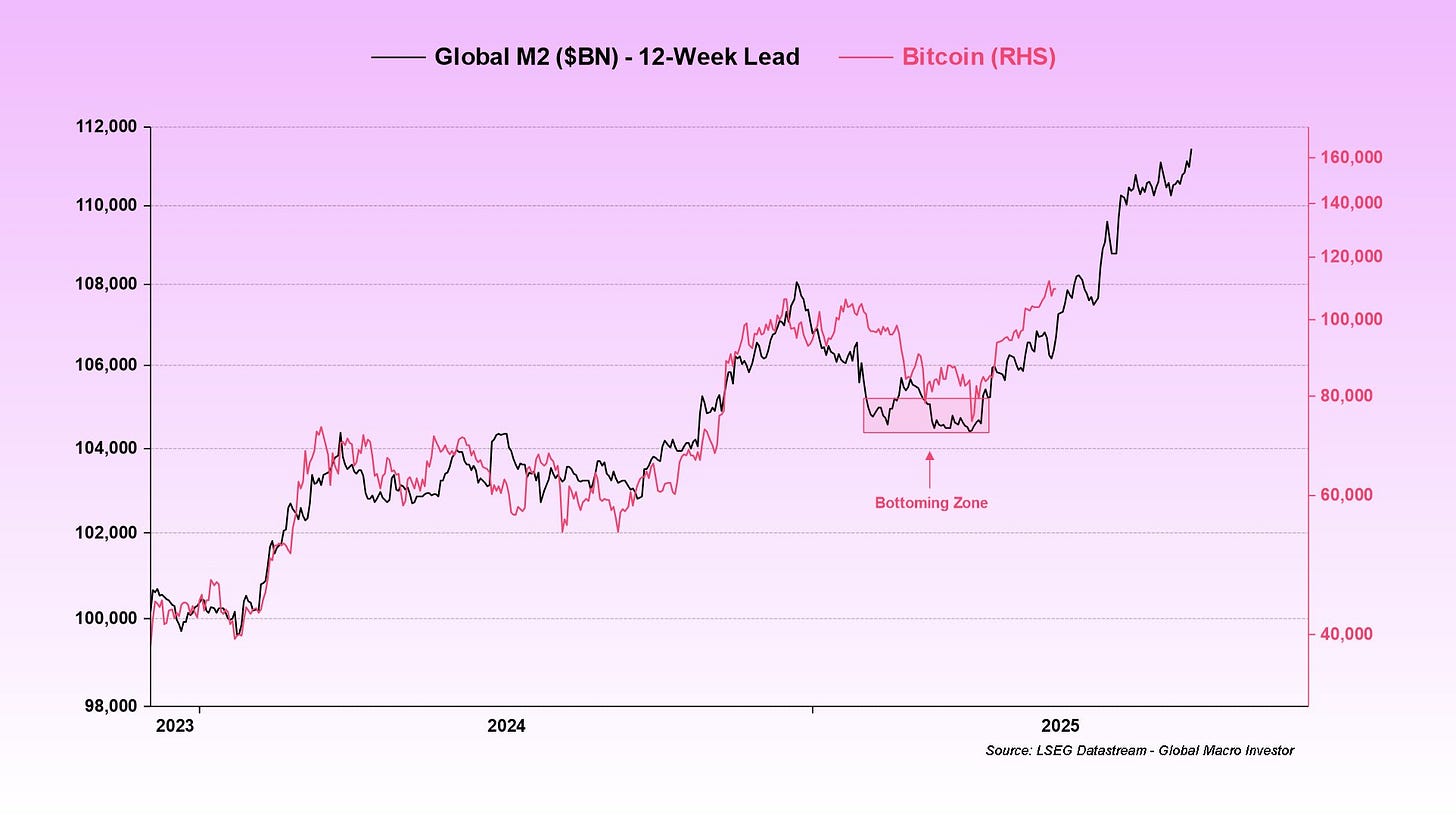

I keep coming back to this.

Big shout out to Julian Bittel, CFA who regularly updates this chart.

Bitcoin’s Corporate Seal of Approval

And a final word on digital gold before we wrap up for the week.

An increasing number of publicly listed companies are now holding Bitcoin on their balance sheets. Not tentatively. GameStop, fresh from its latest meme-fuelled revival, announced its first Bitcoin purchase this week, worth around $500 million. Just a day earlier, Trump Media, the parent company of Truth Social, said it plans to raise $2.5 billion to build a Bitcoin treasury of its own.

They are not alone. According to BitcoinTreasuries.net, 114 public companies now own Bitcoin, up from 89 at the beginning of April. Over roughly the same period, Bitcoin has rallied from around $75,000 to just under $112,000.

At the centre of this surge is Strategy (formerly MicroStrategy), which has evolved from a software firm into what is effectively a Bitcoin holding company. It now holds over 580,000 Bitcoins, worth more than $62 billion.

Furthermore, the political backdrop is shifting. Speaking at Bitcoin Conference 2025 in Las Vegas, Vice President JD Vance said the administration is preparing to roll back federal crypto restrictions and pursue legislation.

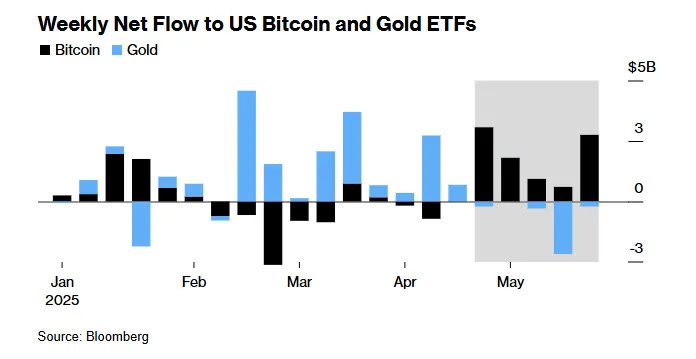

Elsewhere, Bloomberg shared data this week comparing flows into Bitcoin ETFs and Gold ETFs. So far this year, gold has outperformed Bitcoin, rising 25% versus Bitcoin’s 16%. But the gap has narrowed in recent weeks. Bitcoin is up 14% over the past month, while gold has slipped 2%.

This has been reflected in Bitcoin ETF flows, which outstripped Gold ETF flows significantly during the month of May.

This might be one of those moments.

Feel the pulse, stay ahead.

Rahul Bhushan.

Rahul, I enjoy your newsletter and look forward to reading it every week. Loved your photograph with your son. All the best.